It may seem counterintuitive for a trained interior designer to pursue a job in the wealth management arena. For Art Institute-educated Brianna Harris, this plan makes total sense, and the transition has been seamless.

“I’ve always wanted to increase my knowledge of the financial world,” she says. “I have friends who’ve owned businesses and invested in the stock market, so I became curious. The wealth management industry has always been on my radar.”

A year ago, Brianna’s radar detected an opportunity to join Wambolt & Associates as an administrative assistant. Her experience in project management, budgeting, and attention to detail created the blueprint for Brianna’s role on the team. A desire to deliver excellent customer service is her top priority.

“I am motivated by getting to know our clients and creating relationships with them so I can be most helpful,” Brianna explains. “I bring a calm demeaner and empathy to my job. I am a positive person and I try to make our clients as comfortable as possible, especially if they are a bit guarded about seeking help with their finances.”

Brianna often makes the firm’s first impression. She greets new clients, fields initial inquiries, corresponds with outside vendors, and sends communications to prospective clients. Behind the scenes, she manages documentation for clients, coordinates team calendars, and produces the firm’s monthly newsletter.

Her team members consider Brianna a valuable contributor who helps them work more efficiently. “Brianna provides great support to all of us, definitely making our jobs easier,” says one of the firm’s owners and Senior Wealth Management Advisor Cindy Alvarez. “She keeps us organized and does a wonderful job making our clients feel at home. We are grateful for her positive attitude, creativity, and initiative.”

Brianna has been proactive in learning about estates, investments, stocks, trading, and portfolio management from advisors in their meetings with clients. She has witnessed the wisdom and impact of helping clients prepare for the future. “I’ve seen how people can take steps to be more financially secure in their older years,” she said. “I’m also impressed by our clients who make plans for the younger members of their family, like setting up a trust for grandchildren when they are only two years old. All that is awesome!”

Outside of the office, Brianna applies her artistic creativity to designing custom earrings and to writing. She stays in daily contact with her family in Maryland and enjoys spending time with friends she’s made since moving to Colorado in 2017. Hiking, enjoying a swim and taking in nature are among her favorite activities.

Geopolitical tensions in the Middle East along with the ongoing invasion of Ukraine in Europe, is escalating defensive positioning in the markets as funds are being diverted to less volatile asset classes. Domestic and international equity indices retracted in April, as markets reacted to the tensive environment.

Irans’ attack on Israel prompted a recalibration among financial markets worldwide as the demand for government bonds, gold, the dollar, and cash all rose. Shipping and transportation routes may become broadly affected as conflict in the region spreads to other geographic areas.

Many analysts believe that inflation is being kept elevated not by consumer demand, but by price increases as companies struggle to maintain margins. Consumers meanwhile are finding it more difficult to identify less expensive substitutes. The Fed has nearly no influence on easing non consumer driven inflation since its main policy tools, such as the Fed Funds rate which affects short term interest rates, targets consumer expenditures. Three areas are seeing the most inflationary pressures: auto insurance, rents, and health care premiums.

Stronger than expected employment data has led the Federal Reserve to wait on cutting rates until data proves otherwise. Economists view resilient labor conditions as inflationary because it allows consumers to continue to spend throughout the economy. A slowdown in hiring and employment gains is signaling a cooling labor market, which is what the Fed is ideally seeking to start cutting rates.

The Federal Reserve carefully tracks lending activity and releases its findings via the Loan Officer Opinion Survey each month. April’s release revealed that banks and lenders continue to tighten credit lending, making it more difficult for consumers to borrow on mortgages, credit cards, automobiles, and lines of credit. The tighter lending environment is also affecting small and mid-size businesses that require credit for ongoing operations.

Of all the developed country central banks worldwide, the Federal Reserve is the only one yet to embark on lowering rates. Japan, Germany, the U.K and the European Union, have all initiated rate reduction policies. Many analysts believe that the Fed is very close to starting to reduce rates, especially as other central banks have already done so.

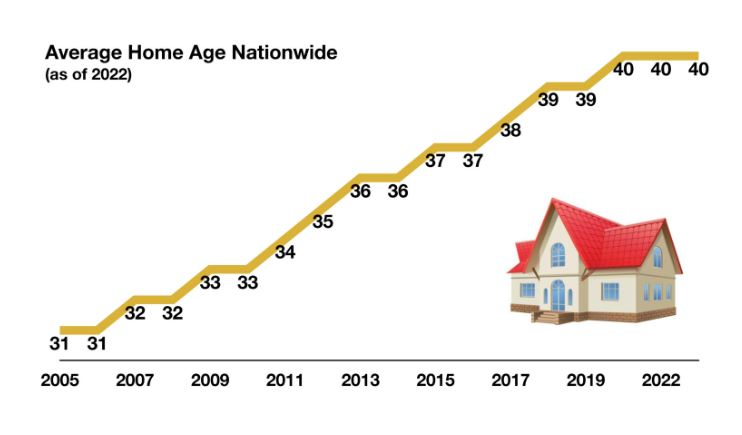

The lack of supply of new homes across the country along with ongoing demand for existing homes has contributed to the average age of a residential home in the U.S. to be 40 years old. Home buyers are spending more on updating and modernizing older homes as newer homes have become increasingly difficult to find. A lack of supply along with elevated home prices continues to make it challenging for younger families.

The fertility rate in the United States fell to 1.62 births per woman in 2023, a 2% decline from a year earlier, according to data from the U.S. Department of Health and Human Services. The current fertility rate is the lowest rate recorded since the U.S. government began tracking the data in the 1930s. The U.S. fertility average is below the global average of 2.3 births per woman as of 2023 data.

Sources: U.S. Dept. of Health, Federal Reserve, Treasury Dept., S&P, Bloomberg

The limited supply of new homes in addition to a drop in new home construction nationwide has contributed to the average home to be 40 years old. The U.S. Bureau of Economic Analysis tracks and reports new home construction as well as the average age of existing homes. The supply of new homes has been a growing concern as young families continue to demand housing but are being hindered by the lack of supply nationwide. As a result, many home buyers are instead buying older homes and renovating them to meet more modern standards. The most recent data available from the BEA shows that the average age of a U.S. residential home is 40 years old as of the end of 2022.

The challenge with an older home, the Bureau of Economic Analysis (BEA) found, are maintenance and repair expenses, which include plumbing, electrical, roofing, and structural integrity. The data also provided the fact that more than a third of homes throughout the U.S. were built more than 55 years ago, adding even more costly repairs to update homes. The average age of improvements to residential structures is also rising, up from 17 years in 2008 to 19 years in 2022. Some cities and states require upgrades and improvements to be up to code, thus increasing costs. An increase in the cost of materials and labor over the past few years has also added to the strain of improvements and new home construction, thus adding to already elevated housing prices.

Source: Bureau of Economic Analysis

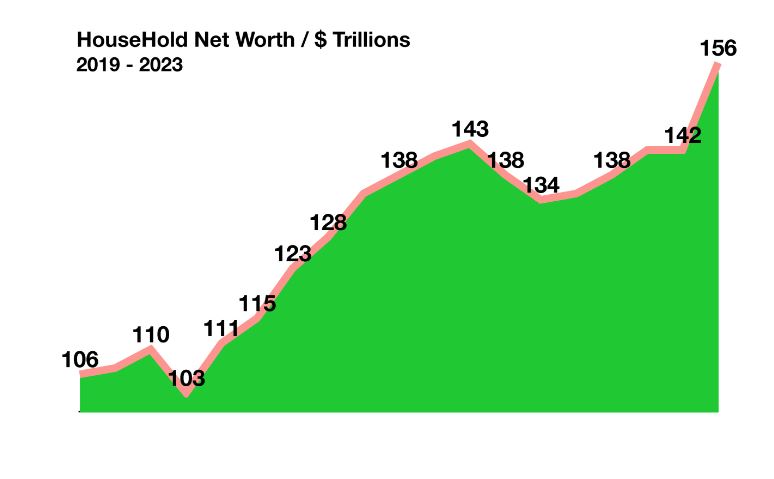

Even as inflation and higher rates have been an ongoing hinderance, consumers remain resilient and continue to spend. The reasoning behind the confidence and tenacity of consumers is believed to be what is known as the wealth effect, which is the change in spending that accompanies a change in perceived wealth.

An increase in the wealth effect has been a result of the increase in real estate and equity values, which has created a sense of wealth thus prompting consumers to spend more. Real estate and equities have pushed the level of household net worth up an astonishing $11.6 trillion over the past year, encouraging consumers to spend more out of their current income. Some analysts and economists relate this scenario to what occurred in the late 1990s.

Economists view the wealth effect as more of a psychological phenomenon where an increase in home and stock values are perceived as a justification to spend more as thought it was an increase in income. In actuality, the increase in asset values may not be sustainable and may even result in a devaluation, erasing confidence and spending motivation for consumers.

Source: Federal Reserve Bank of St. Louis

Homeowners nationwide are grappling with surging insurance costs and worse, coverage cancelations. Insurance companies are becoming much more defensive as claims for property damage have soared over the past few years. Damage resulting from hurricanes, tornadoes, flooding, fires, and other natural disasters have led to dramatic increases in policy premiums nationwide.

Hurricane and severe storm damage in Florida has led to expensive homeowners insurance premiums, while wildfire damage in California has prompted several insurance companies to cancel existing policies and deny coverage to new applicants. Premiums can vary dramatically among different geographic areas and can also change quickly following numerous claims and increased risk factors. According to the Insurance Information Institute, the average homeowners insurance premium nationwide is over $2,000 annually as of the end of 2023. Insurance underwriters are paying closer attention to changing weather patterns and extreme conditions caused by natural phenomena.

Source: Insurance Information Institute

Join us for an afternoon of entertainment and BBQ at the Conifer Ranch. Bring your friends and family along with a blanket and chair. Get ready to soak up some sun, listen to live music and feast on some tasty eats. Don’t forget your dancing shoes!

Saturday, July 27, 2024

12-4 p.m.

Conifer Ranch

12414 US Hwy 285, Conifer

We can’t wait to see you there!