Hello Clients, Friends and Family! You’re invited, along with your loved ones, friends and neighbors to join us for a day of entertainment and delicious BBQ at The Conifer Ranch.

The IRS has recently extended relief for certain heirs regarding Required Minimum Distributions (RMDs) from inherited IRAs. The penalties for missed RMDs from inherited IRAs for the years 2020 through 2024 will be waived. This applies to beneficiaries who inherited IRAs from individuals who died after 2019 and were subject to the SECURE Act’s 10-year rule.

Under the SECURE Act of 2019, most non-spouse beneficiaries must deplete inherited IRAs within 10 years of the original account holder’s death. This rule replaced the previous “stretch IRA” strategy, which allowed beneficiaries to extend distributions over their lifetimes.

Initially, there was confusion about whether annual RMDs were required within the 10-year period. The IRS proposed regulations in 2022 that would have required annual RMDs if the original account holder had already started taking distributions. However, this requirement has been waived for 2020 through 2024.

The IRS has indicated that 2024 will be the last year for such relief. Starting in 2025, beneficiaries will need to comply with the final regulations, which will likely require annual RMDs if the original account holder had begun taking them. Failure to comply will result in an excise tax of 25% on the amount that should have been withdrawn, reduced to 10% if corrected within two years.

Beneficiaries should consider the tax implications of delaying RMDs. While the waiver provides temporary relief, it may result in larger withdrawals and higher tax liabilities in the future.

Sources: IRS, www.irs.gov/retirement-plans/required-minimum-distributions-for-ira-beneficiaries

The Beige Book is a report published by the Federal Reserve System that provides information about current economic conditions across the 12 Federal Reserve Districts nationwide. This past month, data revealed that economic activity increased slightly overall, with ten out of twelve Federal Reserve Districts reporting slight or modest growth. The other two Districts reported no change in activity.

A key economic indicator, retail spending, remained flat to slightly up, reflecting weakening discretionary spending and heightened consumer sensitivity to price increases. The manufacturing sector saw a slight decline in activity, as demand for machinery and metals decreased.

Prices continued to rise modestly, with many businesses facing higher expenses. Some companies reported that it has become more difficult to pass along these costs on to consumers, leading to smaller profit margins.

Financial conditions tightened slightly, with business loan demand remaining stable but consumer loan quality edging down with delinquencies increasing with certain loans.

Overall, the latest Beige Book release revealed a cautiously optimistic outlook for the U.S. economy, with modest growth and persistent inflation pressures in place.

Sources: Board of Governors of the Federal Reserve System, www.federalreserve.gov/monetarypolicy/publications/beige-book-default.htm

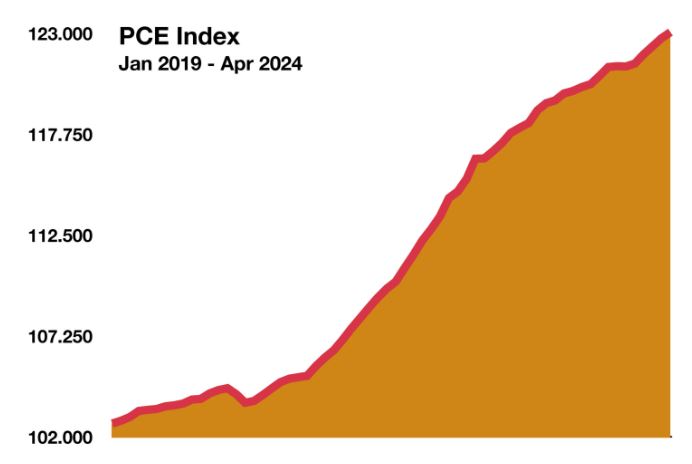

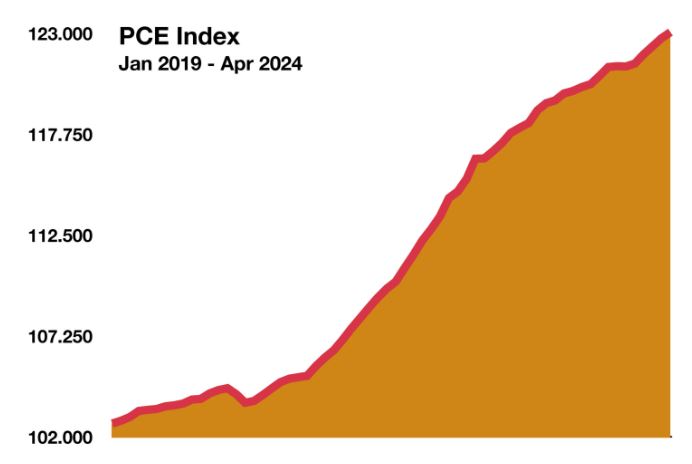

Consumer sentiment and spending have remained fairly consistent in recent months, as noted by the Personal Consumption Expenditures Price Index (PCE). Despite a dip in the summer of 2022, current consumer sentiment is at a similar level as before elevated inflation levels emerged. Inflation has steadily decreased for the past 11 months and reached 4% in May 2023, its lowest level since March 2021.

Even with a slowing economy, consumer spending and outlooks have remained resilient. Business investment and pullbacks in inventories have slowed growth, with investor sentiment remaining fragile. This has resulted in two consecutive quarterly decreases in GDP following the previous two-quarters of negative GDP growth.

Data such as this is extremely important to the Fed, which monitors spending and how it affects inflation. However, with aggressive monetary policies in place, deflationary pressures may also continue to grow, potentially negatively impacting asset prices. Declining asset prices can also impact consumer behavior as devaluing home and stock values lead to lower consumer confidence and expenditures.

Sources: University of Michigan, Bureau of Economic Analysis, Federal Reserve

Mixed data sent equity and bond markets into uncertainty, as economic expansion appears to be cooling, yet inflation remains a burden for consumers nationwide. The labor market also seems to be cooling, as the unemployment rate ticked up to 4%, up from 3.9%, the first time in over 2 years that the rate has reached 4%.

Inflation, as measured by the consumer-price index (CPI) rose 3.4% in April from a year earlier. Closely followed by the Fed, core prices which exclude volatile food and energy items, rose 3.6%. Gross domestic product (GDP) rose 1.3% annualized in the first three months of the year, below estimated projections of 1.6%. Bureau of Economic Analysis (BEA) figures also showed that the economy’s primary growth indicator, consumer expenditures, advanced 2.0%, somewhat less than expected.

An employment index released each month by the Conference Board, is starting to signal a slowdown in the labor market. The Conference Board Employment Trends Index (ETI) fell in April, indicating that employers are hiring less and laying more workers off. Even though companies continue to seek qualified employees and keep certain workers, the level of layoffs is slowly rising at the same time, resulting in what is known as labor hoarding. Economists view a cooling labor market as an indicator of a slowdown in consumer expenditures and economic activity.

Consumers are borrowing more in order to keep spending and to keep up with higher prices. The increase in consumer loan balances is a multifaceted issue driven by higher borrowing costs, inflation, depletion of savings, changes in consumer behavior, economic conditions, and lender requirements. These factors collectively contribute to the rising levels of consumer debt from auto loans to credits cards and lines of credit.

The most recent retail data from the country’s largest retail chains are finding consumer frugality a concern as consumers become more sensitive to how much they’re spending and on what they’re buying. Continued elevated interest rates are keeping consumers from larger big ticket purchases such as cars and appliances.