Equities have their best January since 1989. If you missed the rally, did you miss out on the 2019 gains?

January results posted the best beginning of any year since 1989. It’s a dramatic reversal from what was the worst December since 1931. If you missed the rally, did you miss out on the 2019 gains?

The wild ride is a pattern we’ve seen before. Historically following a dramatic downturn there is always an upside. Investors that resist the urge to sell at the bottom are best positioned to ride the rally.

Ride the rally

Stock market plunges like we saw in December 2018 aren’t a reason to worry. December saw markets routed by investor anxieties over signs of slowing global growth, shifting monetary policy, and the U.S. trade war with China. Mounting losses were reflected in the month’s Dow Jones (-5.97%), S&P 500 (-6.24%) and Nasdaq (-4.38%), performance, which were all down (Washington Post). Global stocks also returned -7.0% for the month, closing out 2018 down -8.9%.

Usually the worst months in the markets are then followed by the best months. Coming into 2019, equities had their best January since 1989. Asset classes cleared almost all losses from the previous month. In January alone, we saw:

- The S&P 500 edge up 7.8% and have its best year-opening performance since 1987.

- The DJIA rose 7.17% in January, its largest one-month rise since 2015 and biggest January gain in 30 years.

- Crude oil prices had their best month on record, surging more than 19% after three straight months of losses. Output cuts and the chaos in Venezuela had a lot to do with that performance.

- The U.S. added 304,000 jobs in January, blowing out expectations (of 170,000) despite the government shutdown.

January pattern

While some of this equity euphoria is the result of a bounce back, some may also be due to the cyclical January effect. January tends to be a good month for markets overall, often punctuated with a seasonal increase in stock prices.

This effect can be attributed to an increase in buying, which typically follows a December sell-off as investors deploy tax strategies. Another possible explanation is that investors use year-end cash bonuses to purchase new investments.

A resilient market

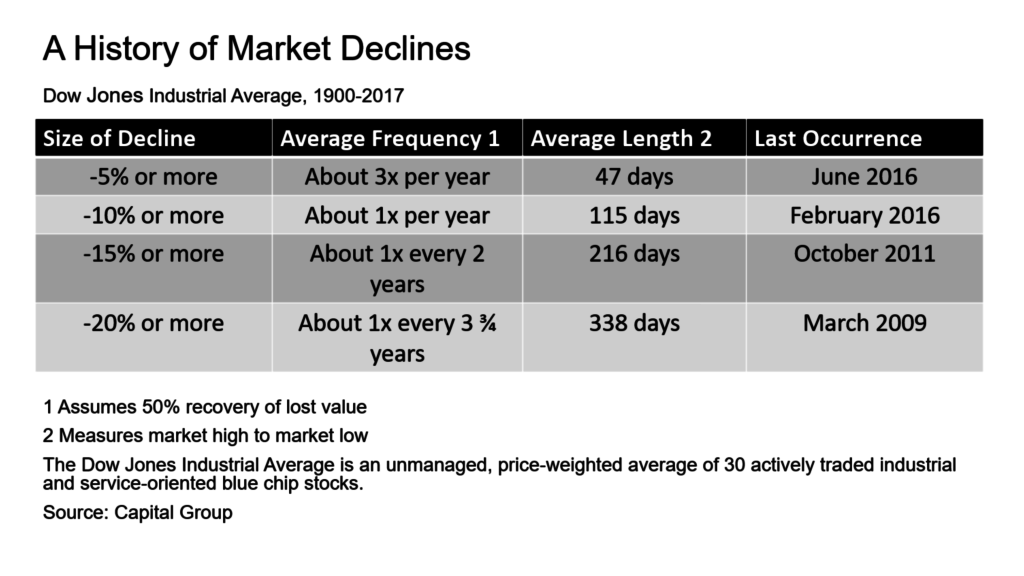

Regardless of the reasons, stock market declines are a normal part of the investment cycle, and often coincide with an economic downturn. While historically temporary, they vary in intensity and frequency.

The market has proven to be remarkably resilient. Every S&P 500 downturn of about 15% or more since the 1930s has been followed by a strong recovery (Capital Group). The S&P 500 saw losses in four of the last 19 years, from 2000-2002 and again in 2008. In each year following the last year of losses, the S&P 500 stormed back with notable market returns: 28% in 2003 and 26% in 2009.

Stay invested

If you back out of the market, you risk missing these unpredictable rallies. Most big stock market gains and drops are concentrated in just a few trading days each year. If you miss those prime days trying to time the market, the impact on your returns can be costly.

Historical data proves time and again that trying to time the market isn’t worth your while. Stay invested and be patient, even when the market is falling, so you’ll be positioned to ride the market back up when the temporary decline reverses course.

You can—and should—take steps now to have a long-term financial plan in place for weathering market turbulence. A well-balanced and diversified portfolio will reduce volatility in your portfolio.

We’re here to talk you through the rough patches and support your decision to stick to your long-term financial plan. It is our fiduciary responsibility to monitor your portfolio and always do what’s right for you. Every step of the way, we’ll be there helping to keep your finances on track and wealth protected.

If you have questions or concerns about your financial plan, please schedule time with your Wambolt Advisor to take a closer look.

Learn more to weather market declines

- Fear less, learn more about what’s streaming through your news feed

- Current market turbulence update

- What does it mean to own a moderately balance portfolio?

- Market volatility could pay off in the long run

- Hedging market volatility with dividend-paying stocks

- Where’s your financial compass pointed?

Follow Us on LinkedIn

Photo by Aditya Vyas on Unsplash

This commentary on this website reflects the personal opinions, viewpoints and analyses of the Wambolt & Associates employees providing such comments, and should not be regarded as a description of advisory services provided by Wambolt & Associates or performance returns of any Wambolt & Associates Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Wambolt & Associates manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Wambolt & Associates provides links for your convenience to websites produced by other providers or industry related material. Accessing websites through links directs you away from our website. Wambolt & Associates is not responsible for errors or omissions in the material on third party websites, and does not necessarily approve of or endorse the information provided. Users who gain access to third party websites may be subject to the copyright and other restrictions on use imposed by those providers and assume responsibility and risk from use of those websites.