Social media and the online news sites love to publish articles discussing Americans’ reluctance to plan for their retirement. These articles paint a gloomy picture of a future with too little money saved, the possibility of reduced Social Security benefits, and many people feeling they may never be able to retire. While this may be the case for typical Americans, the affluent could have options that might not be appropriate for most people.

You’re likely already paying more in taxes, with a higher marginal tax rate than most. Strategies that reduce your taxes now and during retirement can make the difference between a reduction in your standard of living and financial security. This guide introduces strategies to get you thinking in the right direction and discusses steps you can take to keep more of your money.

1 – Discover Overlooked Assets Which Receive Favorable

The Three Distinct Asset Category

If you’re like most high-income individuals, you’re probably already maximizing your contributions to the first category of retirement assets, those held inside retirement plans, which includes qualified plans such as 401(k)s and traditional IRAs. But those plans have limits on how much you can contribute, and those limits aren’t designed for people who are making a lot of money. So even if you fully fund them, you still may not have enough invested to afford the retirement you dream of, and you also risk outliving your retirement assets. Plus, the proceeds of traditional plans are generally taxed at income tax rates when you receive the distribution. Many people assume they will be in a lower tax bracket when they retire, but if you want to maintain your current standard of living that may not be the case. The taxes you pay in retirement can eat up a substantial portion of your savings.

Your retirement portfolio may also include the second category of retirement assets: those held outside of retirement plans, which includes stocks, mutual funds, and real estate. These assets can provide substantial retirement income, but proceeds are generally taxed at capital gains or ordinary income tax rates. Other commonly-held assets like CDs are also taxable.

The third category of retirement assets, often overlooked, can receive favorable tax treatment. This category includes Roth IRAs, which can have tax-free distributions; municipal bonds, which can pay tax-free interest; and cash value life insurance, which provides tax-deferred growth, tax-free& distributions, and death benefits. While Roth IRAs are useful, many wealthy investors earn too much to take advantage of their favorable tax treatment, and the amount you can contribute is limited. In a low interest rate environment, municipal bonds may not generate the kind of return you desire.

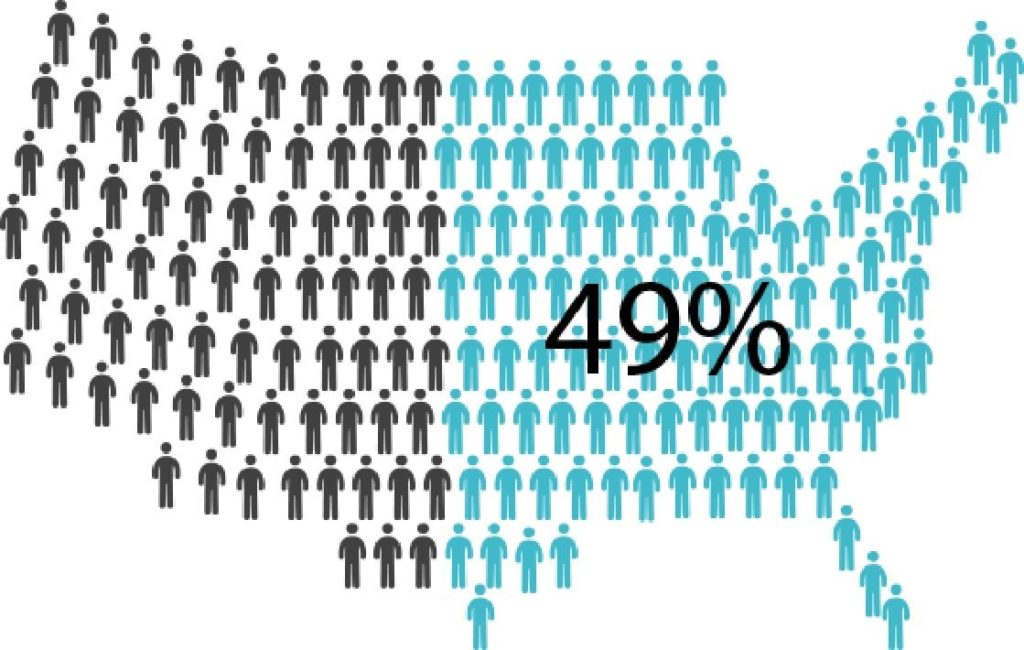

2 – How to Help Supplement Your Existing Retirement Funds

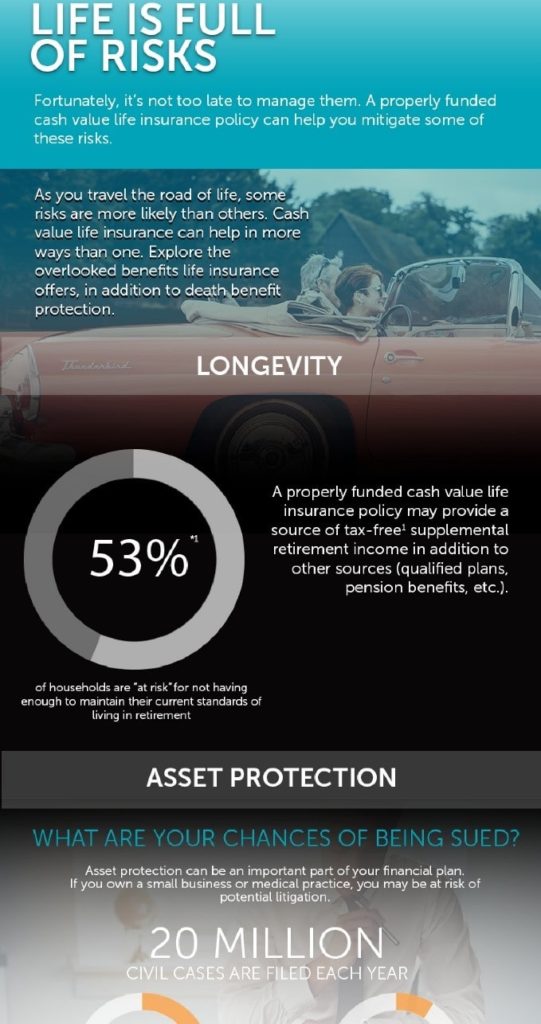

Many people don’t realize that cash value life insurance, in addition to paying your policy beneficiaries a tax-free benefit when you die, can also be used to provide many important benefits while you are alive. These benefits can help supplement the income you receive from traditional retirement accounts, such as 401(k)s and IRAs. You have the lexibility to choose different products which allow options for how the premium can be allocated, and the cash value accumulates tax-deferred. This means that as your money grows, you pay no taxes on the gains.

The tax savings continue when you want to take the money out. At retirement, you can take loans or distributions from the policy which are generally tax-free. Further, your distributions don’t contribute to the income thresholds that trigger taxation of Social Security benefits. This favorable tax treatment is hard to find in any other asset type.

3 – How These Assets Supplement Wealth-Building

Diversify to Help Reduce Tax Risk

As the baby boom generation retires, overall income tax receipts are likely to decrease. How will the government make up the shortfall to fund programs like Social Security? While we don’t know for sure, it’s entirely possible that the tax code may be changed in response to changing demographic realities. This could mean that tax rates may increase, assets which currently provide tax-deferred growth may be limited, or entitlement benefits may be reduced.

These potential changes contribute to tax risk. Because we can’t predict the future, it’s best to include in your planning a variety of different asset types, with different tax treatments, from the three distinct asset categories. By diversifying in this way, you may be able to reduce the negative consequences of a possible change to the tax code on your overall portfolio.

4 – Take Control of a More Flexible Future

We’ve discussed how 401(k)s and other qualified plans have contribution limitations that are fine for most people, but don’t allow high-income-earners the ability to save enough so they can continue their affluent lifestyle in retirement. Let’s look at an example that shows how these limits can negatively impact you.

Let’s say that you are 45 and started saving for retirement at age 35 by contributing $10,000 per year to your 401(k). You are now fully funding your 401(k) with the maximum contribution of $18,000. Let’s assume that 401(k) contribution limits are adjusted upwards each year by 1%, and that you start fully funding the catch-up amount, also adjusted upwards by 1% each year, at age 50. Let’s say that your investment returns in the account are 6%, compounded annually. After 30 years, at age 65, you would have contributed over $600,000 and your account would be worth about $1.4 million.

Medical science is increasing our lifespans, so let’s assume that you live for 30 years in retirement. $1.4 million would allow you to withdraw a little over $46,800 per year from your 401(k). You are likely earning much more than that now, and will be earning even more by the time you retire. Plus, that amount is fully taxable upon withdrawal at your regular tax rate, which means you might only have an after-tax retirement income stream from your 401(k) of about $30,000&,. Is this enough to fund the retirement lifestyle you dream of?

For some affluent individuals, the answer may be no. Of course, you might have other sources of retirement income like savings, Social Security, stocks, and real estate, but earnings from those vehicles are also fully taxable. We’ve learned that Roth IRAs are tax advantaged, but most affluent individuals can’t participate due to the income limits. If you want to keep more of your money for retirement, you should review all of the available options.

Cash value life insurance can also provide the flexibility to fund the policy based on your financial planning needs and access distributions before you retire. So, if you have financial obligations before age 59½ (the age you must be to withdraw from traditional retirement plans without penalty), you have the opportunity to access policy distributions. Or, you can leave the money for potential future accumulation- there is no forced distribution at age 70½ as in qualified plans- to use when you see fit or leave to your designated beneficiaries. This is in addition to the safeguard for your loved ones who you have designated as beneficiaries provided by the tax-free death benefit.

In conclusion, cash value life insurance isn’t something that most people talk about, but for many affluent individuals, it can be overlooked as one of the best ways to help supplement traditional retirement plans. It can help you have the tax advantages and flexibility you want as you create a comprehensive plan for your family’s future.

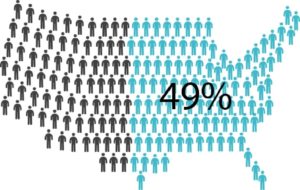

CHRONIC ILLNESS

By 2025, chronic diseases will affect an

estimated 164 million Americans –

nearly half (49%} of the population”3

LEGACY

Resource: https://www.thebalance.com/high-net-worth-tax-planning-strategies-4161014