Originally written by Erica York for the Tax Foundation

Lawmakers’ plans to increase taxes on the wealthy range from higher marginal income tax rates to wealth taxes. Erica York for the Tax Foundation demonstrates through historical tax data that neither may work for several reasons, including the higher the tax rate, the greater the tax avoidance.

Key points:

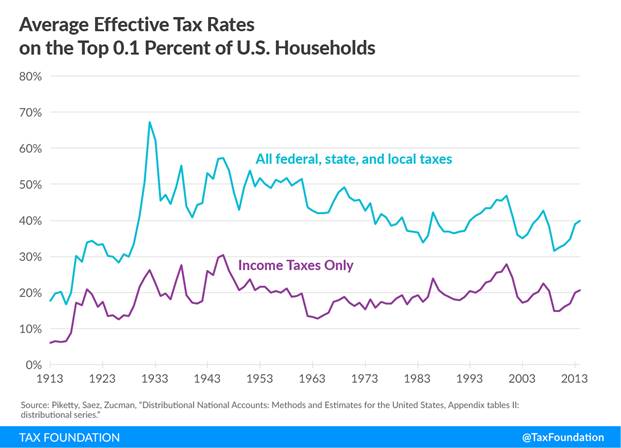

- The top 0.1 percent of taxpayers pay nearly the same average tax rates today as they did in the 1950s because of other changes made to the tax system.

- While marginal income tax rates have come down from their highs of 91 and 92 percent in the 1950s, changes in the tax base (how much and what types of income are subject to the tax) mean the effective rates on the wealthy haven’t changed nearly as much.

- While the average rates for total taxes on the top 0.1 percent have fallen 10.8 percentage points from the 1950s, average income tax rates have remained relatively stable.

- IRS data shows that there is typically a lot of churn among top earners so who is getting taxed at the high-wealth rates fluctuates.

Read the full article at the Tax Foundation.

Follow Us on LinkedIn

Photo by rawpixel on Unsplash

This commentary on this website reflects the personal opinions, viewpoints and analyses of the Wambolt & Associates employees providing such comments, and should not be regarded as a description of advisory services provided by Wambolt & Associates or performance returns of any Wambolt & Associates Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Wambolt & Associates manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Wambolt & Associates provides links for your convenience to websites produced by other providers or industry related material. Accessing websites through links directs you away from our website. Wambolt & Associates is not responsible for errors or omissions in the material on third party websites, and does not necessarily approve of or endorse the information provided. Users who gain access to third party websites may be subject to the copyright and other restrictions on use imposed by those providers and assume responsibility and risk from use of those websites.