By Kelly Fraser – Senior Wealth Management Advisor

As we turn the page on 2019, as well as a decade of economic growth, allow us to reflect on some of the defining features of these interesting times…

Coming off the heels of market volatility in late 2018, that was largely spurred by the Federal Reserve’s focus on tighter U.S. monetary policy (raising interest rates), uncertainty was abundant. Talks of trade wars became the normal accessory to economic news around the world. Global manufacturing and business investment spending were quick to pause, in search of tealeaves that could provide some clarity on the environment to be navigated. Thankfully, service -based sectors of the US economy coupled with looser monetary policy (lower interest rates) buoyed the US economy in 2019, while hopes of trade resolutions persisted. With a phase-one trade deal with China potentially now in the wings, there has been some progress with four of the USA’s top seven trading partners (Japan, South Korea, Mexico and Canada account for about 60% of U.S. trade).

While the United States economy found some resilience in a stronger consumer, thanks to historically low unemployment, overseas markets were still looking for a recovery on the horizon. Several central banks outside the U.S. continued to take interest rates lower, some even delved into negative rates in an effort to provide additional liquidity to spur investment and appetite for risk. Thanks to ‘cheaper’ money via The Federal Reserve, European Central Bank and Bank of Japan, the list of countries focusing on fiscal stimulus via tax cuts, along with stepped up government-spending, is growing. This appears to have ignited some animal spirits in the international equities markets in the last quarter of 2019.

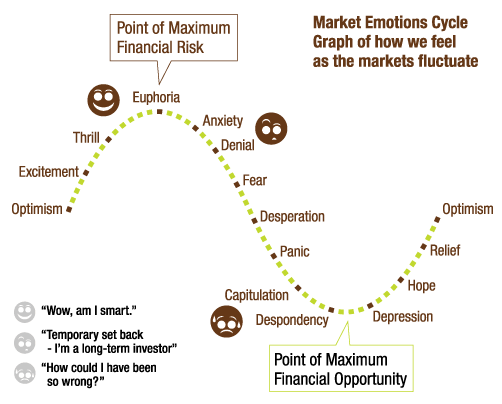

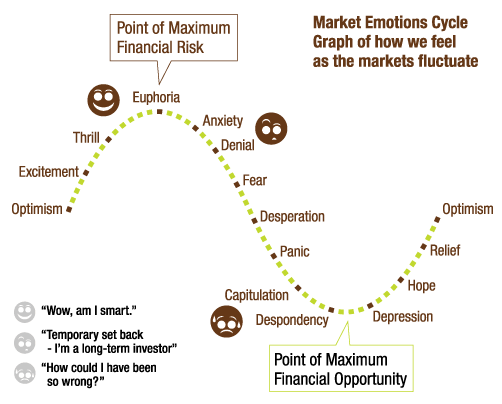

It’s quite unusual to see all sectors and asset classes across markets so highly correlated throughout most of 2019. Although it’s common to see greed during the late stages of a bull market cycle, we’ve observed more concern, skepticism, and fear, and less of the greed. However, it’s often felt more like we are climbing a ‘wall of worry’ while the markets continue to advance in the background (see behavioral finance illustration below). For example, despite U.S. markets hitting multiple record highs this year, individual investors have pulled $135.5 billion from U.S. stock-focused mutual funds and exchange-traded funds in 2019. These are the biggest withdrawals on record, according to data provider Refinitiv Lipper, which tracks money flows. Meanwhile, $85.3 billion has flowed into equity ETFs, but those flows are at an eight-year low.

Looking Forward

As we look forward to 2020, we expect 2019 to be a tough year to follow from an investor’s perspective due to above average returns across the board. This year will most likely not enjoy these ‘tides that raise all ships’. These high correlations across sectors and asset classes will not continue forever, returning us back to an environment where diversification (pairing assets with negative correlation) plays a critical role in mitigating risks to help our clients meet their financial goals – without taking unnecessary risks. The markets often surprise the masses, which is why we are advocates of having a diversified investment strategy that is coordinated with one’s financial plan. This aids in removing the guesswork and temptations to place too much on theories or speculation of what may or may not happen in the future. We have been working hard over the last several months to assess each client’s tolerance for risk while we are enjoying an environment that is rewarding risk-taking in general. We think it’s a great time to have this discussion and welcome having this conversation with you if we haven’t had the opportunity to do so yet.

Read More…

- Your investment strategy: Index funds vs. Individual security selection

- Changing lives: Where’s your financial compass pointed?

Follow Wambolt & Associates on LinkedIn

The commentary on this website reflects the personal opinions, viewpoints and analyses of the Wambolt & Associates employees providing such comments, and should not be regarded as a description of advisory services provided by Wambolt & Associates or performance returns of any Wambolt & Associates Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Wambolt & Associates manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Wambolt & Associates provides links for your convenience to websites produced by other providers or industry related material. Accessing websites through links directs you away from our website. Wambolt & Associates is not responsible for errors or omissions in the material on third party websites, and does not necessarily approve of or endorse the information provided. Users who gain access to third party websites may be subject to the copyright and other restrictions on use imposed by those providers and assume responsibility and risk from use of those websites.