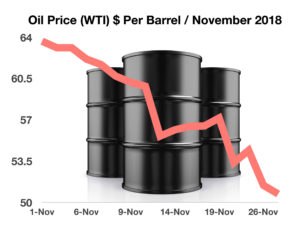

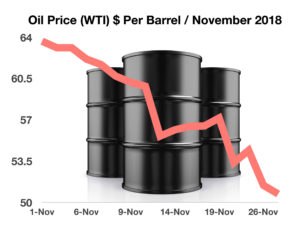

Oil prices dropped fast in recent weeks, driven largely by fears of growing U.S. output and weaker global demand.

The recent price decline is of grave concern to OPEC, Russia, and Saudi Arabia, whose breakeven cost for oil production is estimated to be higher than U.S. production. The rapid expansion U.S. supply has resulted in large amounts of unrefined oil in storage. Construction of new pipelines and transportation infrastructure in the U.S. will speed the shipment of crude oil to refineries for production more efficiently over in upcoming years.

Adding to oil’s pressure is the strong dollar, which lowers oil prices internationally since oil is primarily traded in U.S. dollars worldwide (see Strong U.S. dollar impacts economy unevenly). Sanctions on Iranian oil exports were not as rigid as planned, continuing to allow millions of additional barrels to flood world markets.

The U.S currently exports more oil than it imports, which helps insulate the country from global price swings and adds leverage for U.S. producers competing with foreign producers. U.S. exports of crude oil and petroleum products have more than doubled since 2010 according to the Department of Energy.

Sources: Department of Energy, IEA

Follow Us on LinkedIn

Photo by rawpixel on Unsplash

This commentary on this website reflects the personal opinions, viewpoints and analyses of the Wambolt & Associates employees providing such comments, and should not be regarded as a description of advisory services provided by Wambolt & Associates or performance returns of any Wambolt & Associates Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Wambolt & Associates manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Wambolt & Associates provides links for your convenience to websites produced by other providers or industry related material. Accessing websites through links directs you away from our website. Wambolt & Associates is not responsible for errors or omissions in the material on third party websites, and does not necessarily approve of or endorse the information provided. Users who gain access to third party websites may be subject to the copyright and other restrictions on use imposed by those providers and assume responsibility and risk from use of those websites.