The U.S. and China exchanged $34 billion worth of tariffs on Friday, July 6. An additional list of potential tariffs totaling $200 billion in Chinese goods was announced on July 10 , further escalating tensions between the two countries (CNBC).

China has cried foul, according to the BBC, and lodged a complaint to the World Trade Organization. China has pledged to retaliate against U.S. tariffs in “equal scale and equal strength (WSJ).”

A similar exchange of tariffs is happening with Russia, which announced extra duties on U.S. imports related to earlier U.S. steel tariffs. Mexico, Canada and the European Union have similarly retaliated against Mr. Trump’s steel and aluminum tariffs.

So what gives? Analysts forecast everything from modest escalation to a full-blown trade war based on the rhetoric and the strength of the U.S. economy. Breaking down exactly what the tariffs are, Erica York on behalf of the Tax Foundation said:

“Tariffs on imports from China amount to a tax on American manufacturers, and on global supply chains; U.S. firms will initially pay the import tax to the U.S. government when they bring goods into the country. Firms that can will pass these costs on to the consumers of their products, leaving those consumers less money to spend elsewhere after paying higher prices for the goods affected by tariffs. Firms that cannot pass the costs on will, at best, have less cashflow to invest and expand in the U.S., or, at worst, will become unprofitable, lay off workers, or potentially go out of business. Though firms initially pay the tariffs to the government, it is individual Americans who bear the final burden of these tariffs.”

Ana Swanson and Neil Irwin for the New York Times call the trade war with “allies and adversaries alike” an early volley in an unknown strategy with uncertain objectives. They report, “the current trade measures affect a small portion of the economy and come at a time of economic strength, giving Mr. Trump more latitude to take the type of aggressive measures that, in weaker economic times, would provide a drag on the economy much more quickly.”

One of the biggest casualties of the imposed tariffs are auto manufacturers located in the United States. There are currently 10 foreign auto manufacturers with plants in the U.S. compared to only two U.S.-owned auto manufacturers. According to the U.S. Department of Commerce, these manufacturers rely on components imported from Asia and China whose controlled costs are critical to the profitability of the companies.

What comes next

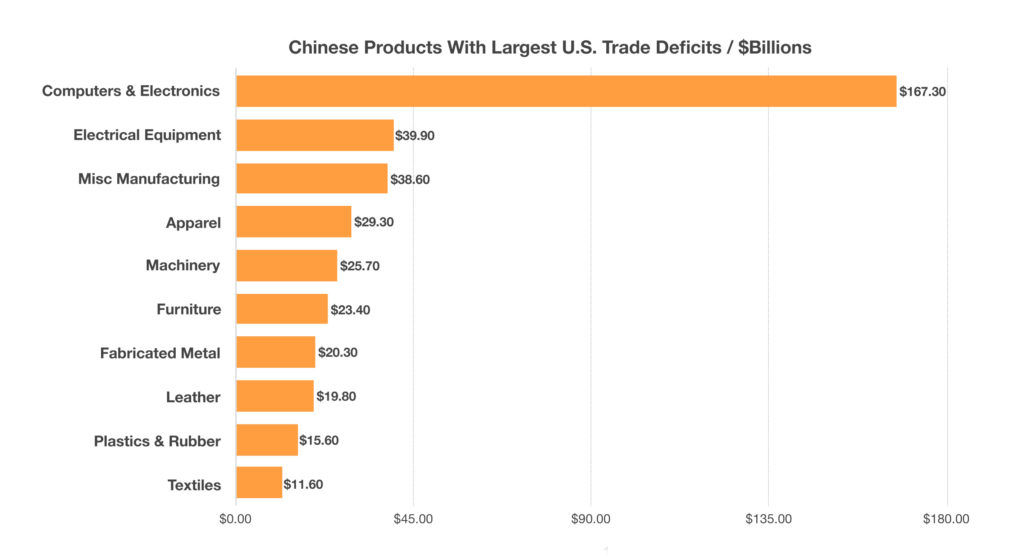

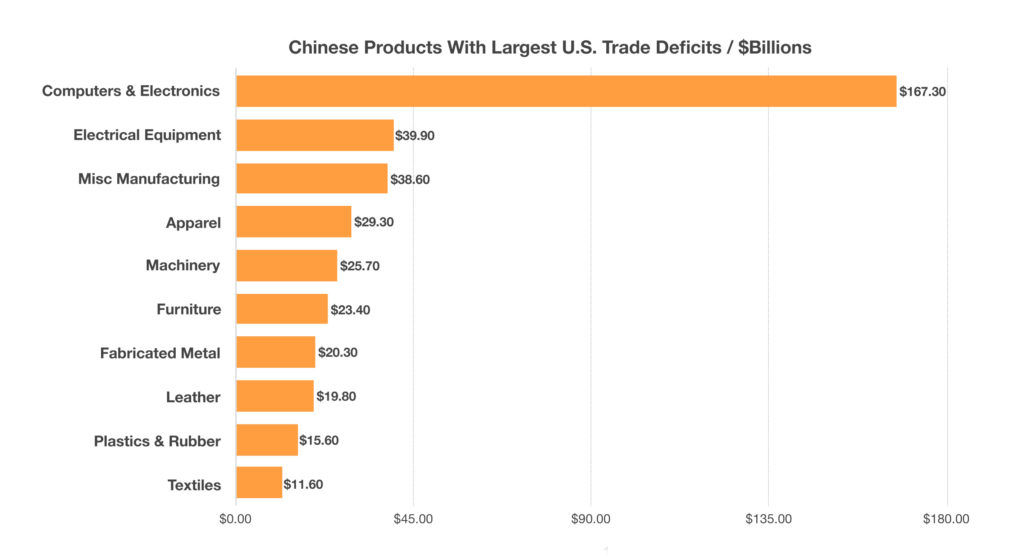

We do know which Chinese products have the largest trade deficits with the U.S. and are on or likely to be focal points for the Trump administration. According to the U.S. Department of Commerce, electronic devices and computers top the list. Over the past few years, American consumers have become accustomed to inexpensive Chinese made products available in every retail and online store across the country. A list of 1300 identified products imported from China are primarily used as components for larger more expensive products. The question is what percentage of these products are comprised of imported components subject to tariffs.

Foreign manufacturers have skirted tariffs and manufacturing rifts over the years by having certain products assembled in the United States, but comprised of imported components. Hence the controversial tag noting “assembled in the USA”, which many consumers and consumer groups have found to be misleading. We’ll keep you posted on developments. And as always, contact us if you have any questions.