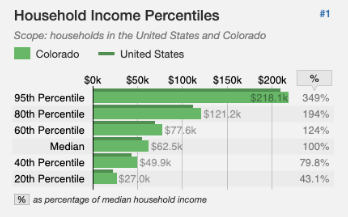

According to the Financial Industry Regulatory Authority (FINRA), there are 19,884 registered financial advisors located in Colorado as of October 2020; this number is six times greater than that of Nevada with only 3,301 advisors.

It comes as no surprise to see this elevated number of advisors residing in Colorado since Colorado is ranked #13 in America for income per capita.

One in every ten people who live in Colorado has a household income of over $100,000 per year. And, in Douglas County, which is located just outside of Denver, ranks #6 in America on FINRA’s wealthiest counties list.

Recognizing this level of household income and overall wealth, it is safe to say there is no shortage of clients for financial advisors, in addition to advisors for clients within the Denver metro area.

With that said, we thought it would bring value to those seeking an advisor to create a list of some of the top questions posed online in search of financial advisory services.

1. What do financial advisors do?

The primary goal of an advisor is to help build wealth and help achieve both short and long-term financial goals all by helping you manage your financial risk.

Financial advisors come with an array of different services, all based on the structure of the financial advisory firm you choose.

Aside from traditional asset management, these services can include an assortment of planning such as: financial, retirement, educational, succession planning for small business owners, proactive tax planning, wealth transfer planning, insurance design, and even estate planning. You will find advisors with more advanced and diverse industry backgrounds as you begin your search.

2. What qualifies as a bad advisor?

It is important to know what to look for when evaluating financial advisors. Most advisors are good people trying to make a difference in the lives of their clients. But, like anything, there are advisors who make decisions with their own best interests in mind, and not that of the client.

You can dial into the show American Greed, to see the dark side of the financial service industry. This dark side accounts for less than 0.01% of this massive sector that represents over $42 trillion dollars in assets under management, as of 2019. This percentage may seem small, but it exists, nonetheless.

Evidence from a Study on Investment Advisors and Brokers, As Required by Section 913 of the Dodd-Frank Wall Street Reform and Consumer Protection Act, suggests this ethical deviance has been at the hands of broker-dealers, and not as much with the investment advisors.

The main difference between broker-dealers and investment advisors is the fiduciary status that brokers are not required to uphold. Instead, brokers are held to a suitability obligation.

As a result, they are more times than not compensated by commissions generated from the transactions they create and by the products they sell. This can be in direct conflict with their client’s best interest.

This is where “churning” often occurs. Churning is a practice whereby a broker will execute an excessive amount of trades in a client’s account for the sole purpose of generating commissions for themselves. The practice of churning is considered stealing from the client, it is also illegal and yet today, it is a practice that is ongoing.

The same study also recommended a “Duty of Loyalty: A uniform standard of conduct that will obligate both investment advisors and broker-dealers to eliminate or disclose conflicts of interest.”

This law would change the way broker-dealers conduct themselves but has yet to be implemented, making it important to understand exactly how advisors are compensated by simply posing the question to any prospective advisor.

3. Are all financial advisors fiduciaries?

Most consumers of financial advisory services have no concept of a fiduciary. However, they do understand the basic idea of what it means to do the right thing.

Registered Investment Advisors (RIAs) who are registered through the state securities regulator or the SEC are, in fact, fiduciaries. They are subject to loyalty and due care when it comes to the care of their client’s assets.

Simply stated, they are required to work in the best interest of their clients and are typically compensated by management fees based on total assets managed. These advisors can be held accountable for malpractice and sued in a court of law.

When it comes to broker-dealers, stockbrokers, insurance agents, and other professionals who provide investment advice, this group of advisors are regulated through (FINRA) Financial Industry Regulatory Authority, a private organization. They are subject to the basic suitability standards of conduct and not to the fiduciary standard.

4. How to choose an advisor?

When it is time to select a financial advisor, there are plenty of online resources to help you find the right advisor, and to help make sure you and your money are safe.

The following talking points will help guide the process when seeking an advisor.

- Are they registered in your state or with the SEC? This can be done by searching your state securities website or the SEC.

- Do they have a physical office location? If so, visit the office to assess the operations and evaluate the culture to determine if it fits with your own. Are they a single advisor operation or do they work in a team environment?

- How do they work with their clients? This could include frequency of portfolio performance meetings, planning, levels of communication, and other services?

- Check online resources for financial service providers, such as:

– Broker Check on FINRA.org

– Investor.com

– Adviserinfo.sec.gov

– Google reviews

- You can check for complaints, conflicts of interest, disciplinary records, years of service in the industry, health of the practice, and client feedback.

- Most importantly, how are they compensated? Do they offer proprietary products that pay commissions, do they earn commissions on investments, what is covered under the management fee?

5. Are financial advisors worth the cost?

Depending on your situation, a financial advisor could help you see the bigger picture regarding your financial outlook. They can help you determine your current financial standing, explore where you might be headed, help identify your financial goals by assessing your economic challenges and needs, evaluate your risk tolerance, and then put a plan together to help you achieve your life goals.

Your financial advisor can also help walk you through retirement planning, assessing tax liabilities, investment options and strategies, and so much more. Having the professional support to help manage your financial picture can be an asset that provides long term benefits.

Additionally, some advisors can be a resource for major life events, such as: buying a house, paying for college, having a baby, getting married, inheriting assets, managing healthcare expenses, changing jobs, or retirement.

Research released in October 2019 by the Certified Financial Planner Board of Standards, Inc. (CFP Board) found that 55% of adults believed a recession would occur in the coming year. Those who enlisted the help of a financial advisor, and had a written financial plan, felt more confident that they could weather an economic storm.

This research also indicated that nearly two-thirds (65 percent) of adults working with a financial advisor said they felt more prepared for a potential recession than they did in 2008. When looking specifically at those who work with a CFP professional, 73% of respondents said they felt more prepared now than they did in 2008.

6. What should I expect to pay a financial advisor?

According to an article from July 2020 by SmartAsset, financial advisors charge a flat fee of $1,500 to $2,500 for the one-time creation of a full financial plan, or roughly 1% of assets under management for ongoing portfolio management.

Of course, fee rates and compensation structures differ from advisor to advisor and can be based on the level of services provided.

7. Should I consider a Financial Planner or a Financial Advisor?

Investors considering a Financial Planner versus a Financial Advisor should have a basic understanding of the services provided by each discipline. Some advisors hold a Certified Financial Planning designation but may only be involved with investments, as this is their primary focus when working with clients.

Financial advisors can provide benefit through investing by helping design an asset allocation that fits their client’s unique goals and priorities. They can walk clients through risk tolerance analysis and establish an investment lineup that corresponds with a client’s level of risk.

As the investment portfolio realizes interest, dividends, and/or capital gains, it is relatively easy to demonstrate how the portfolio has performed. With this, the financial advisor has completed their responsibility, however, because the asset allocation was developed with the client’s goals and priorities in mind, the true benchmark should be whether the client is able to achieve their stated goals.

When engaging with a Financial Planner, including those working as a Financial Advisor, benefits are evident through a comprehensive financial planning process to understand what the goals and objectives are for clients, and the ability to provide observations and recommendations to achieve these goals.

Portfolios can be aligned with a financial plan and can be monitored year over year to make certain the portfolio tracks with the financial plan. Other benefits of working with a planner include helping clients minimize their tax liabilities.

Planners tend to be relationship and education based which helps provide clarity around which actions need to be taken to make progress towards savings, debt payoff, or investment goals. Having a place to openly discuss finances with a trusted advisor provides clients clarity about the path forward and it enables planners to educate clients about why a specific recommendation is made.

This increases client confidence, helps relieve stress, and can provide peace of mind about your financial future, all through a trusted relationship.

8. Are financial advisors only for the rich?

Financial advisors are not as costly as they use to be. Financial planning services are more accessible than ever, thanks to fee-based payment models.

Most people feel they do not have or make enough money to use a financial advisor or planner. This is due to industry misimpression by focusing on the high and ultra-high net-worth clients with at least $1 million of investable assets.

The good news is there are a growing number of financial advisory firms out there that provide a fee-based service rather than an asset-based model.

Depending on the benefits, this model can act as a monthly retainer, hourly rate, or flat fee. Fee-based firms have opened the door for people with different financial backgrounds to seek the professional financial services they can afford.

9. Are Robo advisors better than financial advisors?

Robo advisors have been multiplying over the past several years and appealing mainly to younger investors. But does that mean a robo advisor is right for you? If you are looking for a pre-populated portfolio of investments with virtually little to no expense to the client, this model may be a good fit.

However, if you need the personal experience, communication, and customization from a human, then a robot advisor is not the answer. Robo advisors are good for what they are designed for but are still decades away from replacing what a human financial advisor can offer.

We hope this information provides value to you on your journey to be better informed and has equipped you with the tools you need.

This commentary on this website reflects the personal opinions, viewpoints and analyses of the Wambolt & Associates employees providing such comments, and should not be regarded as a description of advisory services provided by Wambolt & Associates or performance returns of any Wambolt & Associates Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Wambolt & Associates manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.