By Cindy Alvarez, Senior Wealth Management Advisor

It is a common myth to believe that any sitting President’s fiscal policies can or will manipulate the barometer of the U.S. stock market, while the truth is, over the past 120 years – the long-term performance of the market has shown almost no correlation with government or fiscal policies. It is monetary policy that matters more.

Monetary policy is primarily concerned with the management of interest rates and the total supply of money in circulation, to ultimately achieve stable economic growth. Fiscal policy is primarily concerned with the taxing and spending actions of governments. It is the Federal Reserve that decides monetary policy, and the Congress along with the White House administration that controls the fiscal policy. This is intended to keep our country’s monetary policy free from political influence.

Our current Federal Reserve Chairman, Jerome Powell, took aggressive action to help the economy fortify itself against the coronavirus pandemic by slashing interest rates to zero and implementing a number of different emergency lending practices to keep money flowing freely through the economy. This is the Fed’s role in managing our country’s economic picture based on current events in our country, and not so much on our country’s political environment.

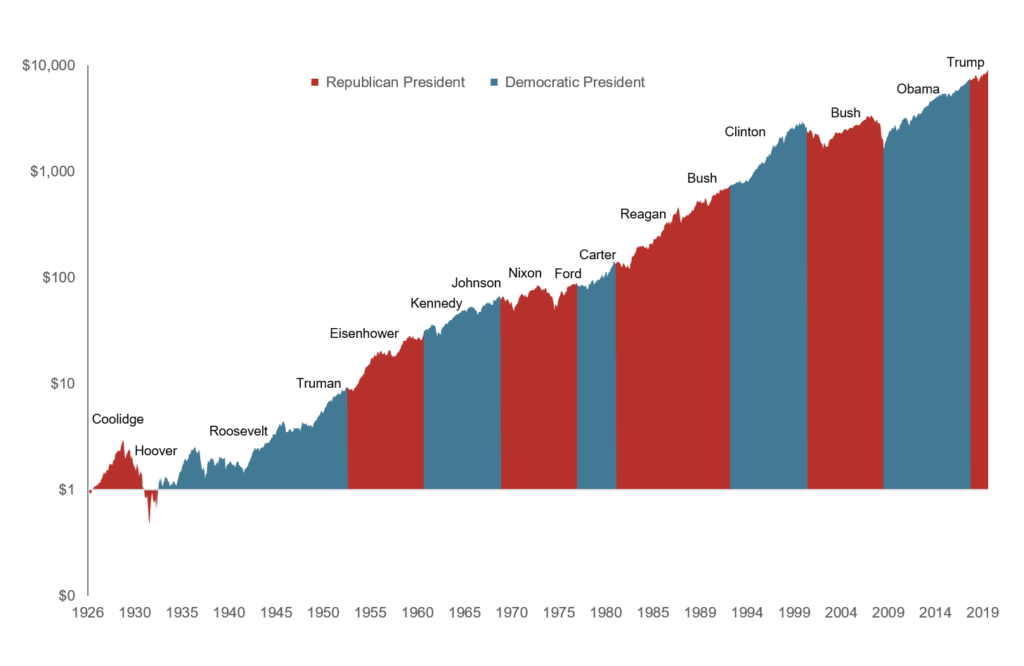

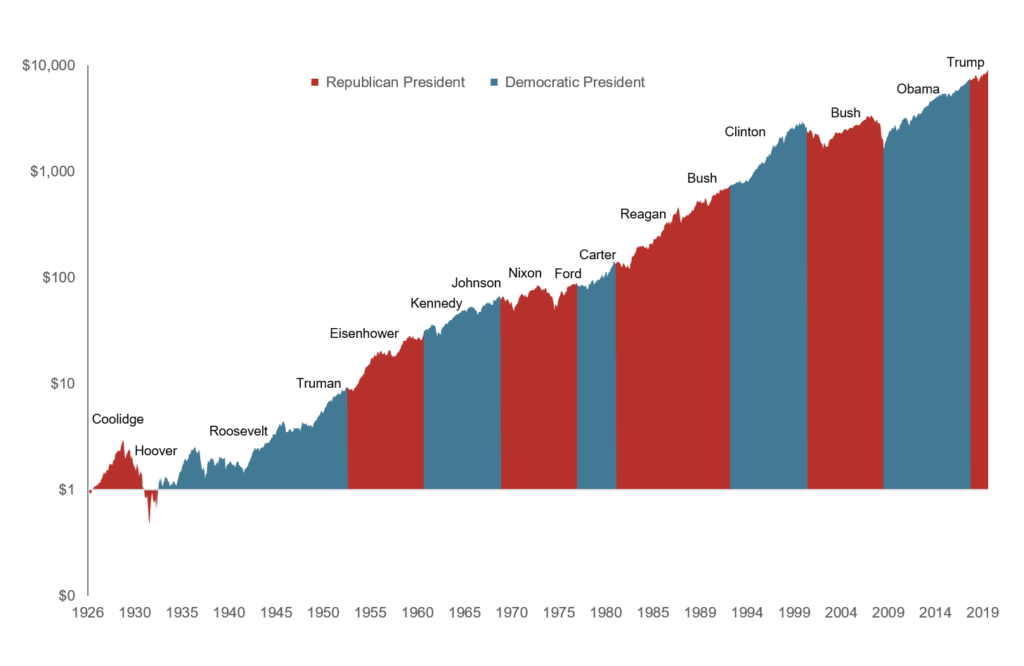

When we look back on history, neither the Republican or Democratic administrations can lay claim to a superior economic or financial market performance. From the inauguration of President Kennedy through the current administration of President Trump, the S&P 500 Index delivered an average annual return of approximately 11% over the past 75 years while our country’s economic growth expanded around 3% during the same period.

It may come as some surprise to learn that the best returns in the stock market have come when the president’s approval rating was between 36% and 50%. This means when at least half the country disapproved of the job performance of any sitting president, the markets experienced some of the best returns. See below figure.

Gallup poll presidential approval ratings and the growth of $100,000

During election cycles, we hear from presidential candidates on newly proposed legislation along with the removal of past legislation, and changes to existing legislation. These legislative changes often do not impact the economy as some like to predict. In fact, these predictions are often far removed from the actual results of new or changed legislation.

For example, it was predicted that the passing of Obamacare in 2010 would destroy small business hiring when in fact, 8.6 million jobs were added in the small business sector since Obamacare was implemented. Similarly, President Trump’s Tax Cut and Jobs Act of 2017 was intended to unlock capital expenditures, but it has thus far failed to bring an acceleration in business investment due to trade uncertainty and, most recently, the coronavirus.

It is important to separate myth from reality as we think about elections and the corresponding stock market because history has shown us that predictions tend to be wrong. While there will be short-term market volatility, we continue to believe that investors are better off staying fully invested despite the uncertainty of the election outcome. We encourage clients to remember that monetary policy is more important for markets and has a far greater impact than anything in the political arena.

The chart below shows stock market returns by President.

As you can see, and only with a few exceptions, there is an upward market trajectory in nearly every presidential term. For this reason, we should be diligent in our efforts to keep our fear in-check. Indulging political fears or expectations by making major changes to your investments can be particularly damaging. We continue to express to clients that fear can be the market’s worst enemy, and fear is partly driven by our headline news.

Reflecting on the assassination of President Kennedy, stocks sold off heavily upon hearing the news, yet when the markets re-opened several days later, stocks rose. Similarly, following the assassination attempt on the life of President Reagan, stocks sold off sharply before trading was halted. But, when the markets re-opened several days later, the Dow Jones Industrial Average rose more than 7% in the ensuing days.

The current political unrest in this highly contentious election year has injected more uncertainty into the markets. We should try to recognize that market volatility is what we get when there is policy uncertainty, but we cannot let it shake us as we are experiencing uncertainty against a backdrop of massive monetary policy accommodation. We believe it is important to keep a big-picture outlook, remain well diversified and stay the course – and of course to be on the lookout for market opportunities.

Sources:

1: Haver, Invesco, 6/30/20. Note: President Trump stock market performance data from 1/20/17-6/30/20., real GDP data from 12/31/2016 to 3/31/2020 as GDP is reported with a lag. Stock market performance is defined by the total return of the S&P 500 Index.

2: Bloomberg, L.P., 6/30/20. An investment cannot be made in an index.

3: Bloomberg, L.P., FRED, 3/31/20. Most recent data available.

Photo provided by Markus Winkler on Unsplash.com

This commentary on this website reflects the personal opinions, viewpoints and analyses of the Wambolt & Associates employees providing such comments, and should not be regarded as a description of advisory services provided by Wambolt & Associates or performance returns of any Wambolt & Associates Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Wambolt & Associates manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.