While Controller Scott Kirkpatrick is a Wambolt & Associates team member clients rarely see, his leadership of continuous process improvement enables wealth management advisors/planners, and traders to focus intently on delivering positive outcomes for clients. Scott is dedicated to enhancing the firm’s financial, administrative, and compliance arenas and ensuring operations run proficiently.

With more than 20 years of extensive experience in finance and operations from banking and financial institutions, Scott came well prepared to direct Wambolt’s financial and accounting functions. For him, it’s about the numbers and the importance of recognizing how budgetary decisions impact the trajectory of an organization. “I enjoy creating impactful forecasts with sustainable budgets, along with analyzing trends,” he says. “The forecasts that I present to our leaders can assist in determining strategic financial decisions to shape the future of the firm.”

During his tenure at Wambolt, Scott has helped reshape and grow the operations team. “We’ve built a stronger ‘back office’ to assist in multiple aspects of the business” he said. “The advisors can concentrate on what they’re best at knowing the operations team is maintaining a solid foundation to support their work.”

Scott’s responsibilities also include human resources management – overseeing benefits, payroll, and aspects of the hiring process. He appreciates the firm’s collaborative culture and the commitment of his colleagues to foster a positive work environment. “I enjoy working here and the people I work with,” he emphasized. “They have a very high drive to assist clients and they possess a general love for what they do. Providing value to the clients is a shared passion.”

Scott has always had a drive for success. Scott was a swimmer on the Cornell College Swim Team in Iowa, a liberal arts institution, where he majored in business and economics.

Outside of the office, Scott’s favorite pastime is skiing at Vail with his children, a daughter who is a recent University of Colorado graduate and a son who is a CU freshman. He is grateful for his weekend ‘bonding time’ and his children’s continued interest in spending time with their dad.

As for the future of the firm, Scott is excited “to see our organization thriving, and all of us becoming more specialized, growing in the roles where we excel.”

he Federal Reserve decided to leave rates unchanged in February, igniting concerns among the financial markets that interest rates may not fall as soon as many had expected. Larger than anticipated inflation data and resilient employment is deterring the Fed from lowering rates too soon.

The Consumer Price Index (CPI) revealed that inflation was running at 3.1% for the past year as of January, down from 3.9% in December. Some analysts believe that it may be too soon for the Fed to determine as to when it will lower rates, even though inflation seems to be alleviating.

A global recessionary environment is evolving, with recent economic data showing that the U.K. and Japan have both fallen into a technical recession. Global growth forecasts by the International Monetary Fund (IMF) indicate a broad pullback in economic expansion among various countries worldwide.

Interest rates remained stubborn in February as Treasury bond yields rose slightly across all maturities, known as a shift up in the yield curve. Larger than expected inflation data as well as the Fed’s hesitancy to lower rates, drove bond yields higher in February.

Three Federal Reserve officials announced that the pace of rate cuts by the Fed will be contingent on yet to be released economic data. Fed officials differed as to when any rate cuts would materialize, two suggested “later this year” while one estimated this summer. The Fed’s most significant factors when determining any reduction in rates remain inflation, employment, and economic growth.

The growing interest and recent rise in Artificial Intelligence (AI) has reinforced a lingering belief that the domestic economy has begun to shift from an industrial economy to a digital economy. Economists believe that such a transformation, should it ever completely occur, might take decades to evolve.

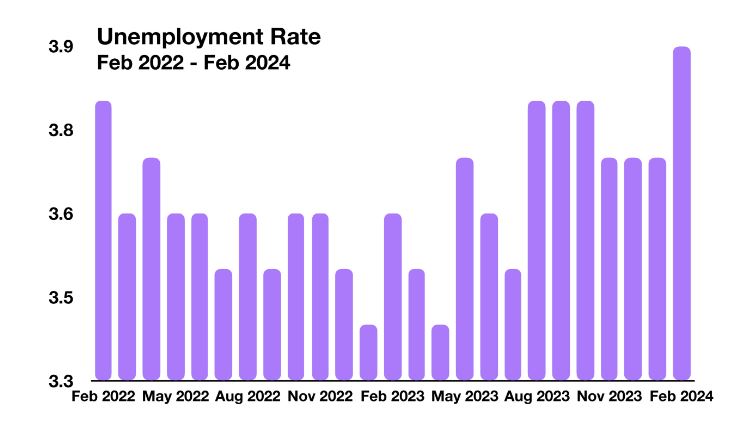

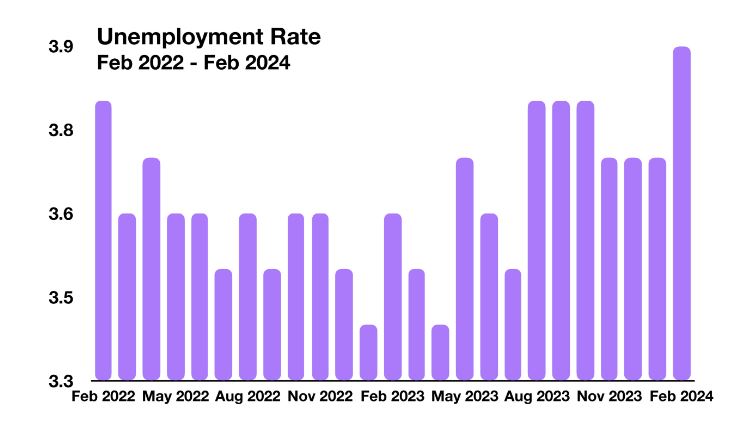

Unemployment rose to the highest level in two years, hitting 3.9% in February, as reported by the Department of Labor. Wage growth also slowed from the previous month, possibly signaling a cooling labor market as perceived by economists.

Requirements for large banks to hold more capital are being proposed by the Federal Reserve. A proposal to boost bank capital by 19% is seen as a preparation for a possible retraction in economic activity as well as defaults among bank holdings. Regulators including the FDIC and the Office of the Comptroller of the Currency support the heightened capital requirements. Banks argue that the additional capital requirements would increase lending costs and tighten loan availability for consumers and businesses.

According to data released by the Bureau of Labor Statics, the past year has seen an increase in the purchase of lottery tickets and an increase in gambling. Some analysts believe that the proliferation of online gambling and lotto purchases is facilitating an increase in speculative consumer behavior.

Sources: Federal Reserve, Labor Dept., BLS, IMF

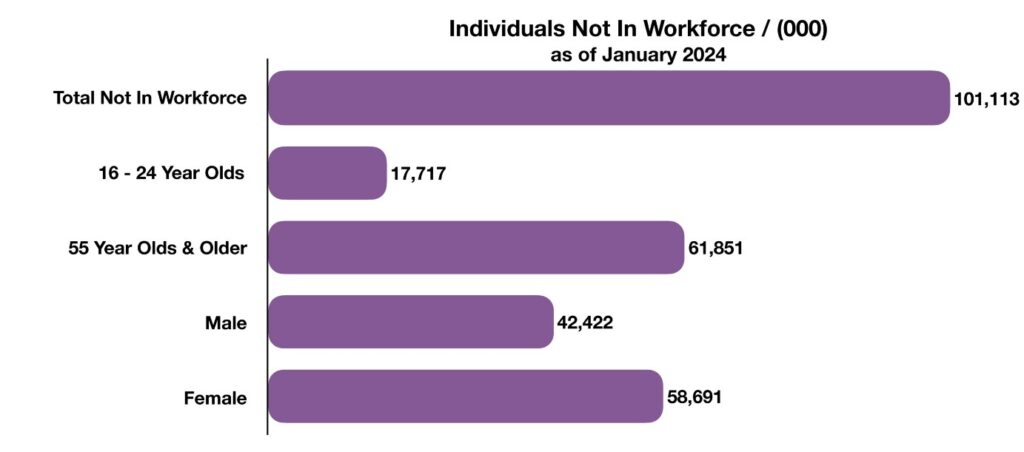

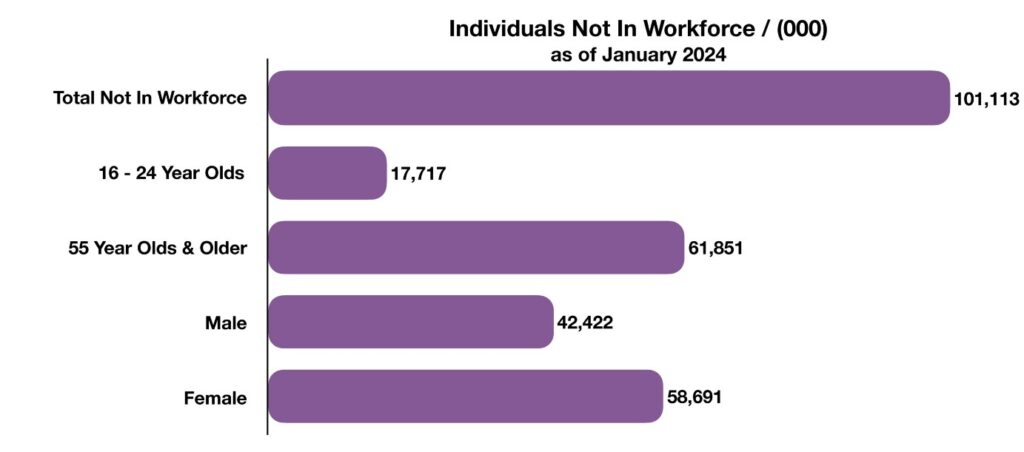

Department of Labor data released this past month reveal that over 100 million people are not in the workforce, either by desire or available for work. Data vary across all age groups and gender yet do show that a large proportion of the U.S. population is not working by choice.

As of January 2024, over 100 million people were not in the workforce, of which 61.85 million were age 55 or older, composing the largest non-working age group. There were 17.7 million age 16 to 24 that were also not in the labor force. Reasons behind not being in the labor force vary, however, factors during the pandemic are believed to have altered workforce availability and desire to work. Government subsidies and work from home requirements during the pandemic shifted work patterns and habits, leading to millions either dropping out of the workforce, or retiring early. An increase in wealth among older workers over the past three years influenced some to retire early, even though they could still find employment if desired.

The lack of qualified workers has been a growing concern among companies looking to hire, as the pool of talented employees has shrunk over the past few years.

Source: U.S. Bureau of Labor Statistics

The unemployment rate rose in February to 3.9%, the highest level in two years. The Department of Labor also reported that wage growth slowed in February from the previous month. The Department made substantial revisions in February to previous data, clarifying the slowdown in wage growth more clearly. Wage growth in February decreased significantly from the beginning of the year in January, surprising various analysts and economists. One of the Labor Department’s substantial revisions included data showing that the economy had added 353,000 positions in January, yet later reported that the number was actually 229,000.

Data tracked by the Labor Department also includes who acquired and lost jobs. The Department identified that native born Americans with a job fell by 881,000 over the past year to 129.3 million, while foreign born workers with a job rose by 1.5 million to 31 million over the same period.

Sectors experiencing employment gains include healthcare, government, and food services. Of concern to some analysts is that employment gains have been primarily concentrated in various lower paying positions. Some argue that the recent employment and wage data may be signaling a slowdown in the job market along with cooling wage gains across multiple industries. Economists perceive these labor market dynamics as indicative of a slowing economic environment.

Source: Department of Labor

All eleven sectors of the S&P 500 Index posted positive results in February, with technology, financial, and healthcare making up the largest sectors of the index. The Dow Jones Industrial Index and the Nasdaq also posted positive gains in February.

The technology sector now accounts for roughly 30% of the S&P 500 Index, a level not seen since the early 2000s. This means that recent gains in the tech sector have elevated valuations thus making up a larger proportion of the index. Some analysts view this dynamic as a disparity and imbalance in the equity markets.

The average price of an individual stock in the S&P 500 is now $204.28, with some 73% of them (or 281 stocks) selling for more than $100 and 9 trading for more than $1,000 as of the end of February. Compared with 40 years ago, when the average price was $39.06 and approximately 4%, or 9 stocks, traded for more than $100, and with no stocks were over $1,000.

Sources: S&P, Reuters, Bloomberg

A recently released study by the Federal Reserve Bank of St. Louis found that the median increase in net worth for those age 65 or older grew by $91,000 from 2019 to 2022. The time period which was predominantly during the pandemic, saw home values and financial assets increase in value the most among seniors. More than half of the wealth increase came from home values, while 48% came from retirement accounts and other financial assets.

Younger age groups also saw an increase in wealth during the same period, but nearly not as much as seniors who have already accumulated real estate and financial assets during their earlier years. Those age 18 to 39 saw a median increase in wealth of $31,600 from 2019 to 2022, both from real estate and financial assets. The intermediate age group of 40-64, also experienced an increase in wealth, which encompasses growing families in the prime of their wealth accumulation years driven by income and asset gathering.

Sources: Federal Reserve Bank of St. Louis