A former starting lineman for the Colorado State University Rams, Scott Brooks values a winning game plan. Whether charting the financial plays for clients in the wealth management field or seeing the open routes to help his Wambolt & Associates teammates succeed, Scott optimizes opportunities to excel. As his Wealth Management Advisor role continues to grow, Scott remains focused on creating an optimal client experience.

“I love working with our clients, from facilitating their introduction to the firm to researching strategies that can help them achieve their financial goals,” Scott says. “I have the chance to work with so many smart, accomplished clients and provide value as they make wealth management decisions.”

To enhance the client experience and support the firm’s commitment to innovation, Scott investigates and integrates recent technologies. “By using cutting edge, customized, financial planning software, we can save time and devote even more attention to our clients,” Scott explains. “We also can provide state of the art presentations to our clients so that their financial picture and options are easier to understand.”

Taking a proactive approach to client service is a Wambolt & Associates priority that Scott embraces. “Each client household is different and that’s why it’s so important for us to do our homework, have good instincts and be proactive,” he says. “This is especially true during challenging economic times. When there’s turbulence, it’s so much better to have a pilot talking you through it than a pilot whose silence creates anxiety.”

Scott has stayed on top of his game through continued professional education, including the attainment of his Series 65 and Certified Financial Planner® designation. He also emphasizes the crucial mentoring he has received from his firm colleagues. “I appreciate and trust our entire team for their talents and leadership,” he says. “Our focus is on collaboration and making every team member better and more confident. I’ve certainly benefited from the wisdom of our senior advisors and the examples they’ve set.”

As he looks at the field in front of him, Scott sees exciting potential on both the professional and personal fronts. With his growing day-to-day responsibilities, Scott hopes to be part of the team to “carry the ball and run with it,” as the firm moves into the future. On the personal front, he is happily anticipating his upcoming marriage to Paige. They look forward to spending time with both families in addition to enjoying an active Colorado lifestyle of travel, being outdoors and skiing.

Financial markets started the year off with an eye on earnings, the upcoming election, and developments in the Middle East and Ukraine. Markets are eagerly waiting for the Fed to finally commence its rate reduction trajectory. Analysts vary on when it will happen but are expecting that decreases will start before the middle of the year.

Stock performance was mixed in January, as some sectors lagged while others excelled. Sectors including consumer discretionary, real estate, and utilities lagged in January, while financials, healthcare, and communication stocks rose. Analysts deem such a disparity among sectors as “sector rotation”, which is indicative of a possible change in the economic direction of the nation’s economy.

Gross Domestic Production (GDP) for the 4th quarter of 2023 came in at 3.3%, stronger than expected by economists. Concurrently, consumers are contributing less to economic growth as measured by Personal Consumption Expenditures (PCE), representing roughly 67.6% of GDP. Consumers contributed 69% to GDP nearly two years ago, when consumer expenditures were higher. Economists track this dynamic closely since two-thirds of GDP is driven by consumer expenditures.

Companies are carefully tracking their labor costs and how best to maintain existing margins. The Labor Department reported this past month that labor productivity increased 3.2% in the fourth quarter of 2023, meaning that workers are producing more with the amount of hours worked. Companies sometimes need to impose wage increases to keep the most productive workers.

The Federal Reserve continues to struggle with the threat of lingering inflation. Fed officials are mixed about when the Fed will begin to reduce rates and how much the initial reductions will be. For now, the Federal Reserve has held rates steady but may change course should economic data and the economy prove otherwise.

Federal government bank regulators, such as the FDIC, the Office of the Comptroller of the Currency and the Federal Financial Institutions Examination Council have been increasingly focused on the liquidity of smaller banking institutions. Last year’s bank failures prompted an increase in surveillance on various banking institutions and their financial integrity.

The Baltic Dry Index, which measures the cost of transporting commodities and essential goods globally, has fallen back to pre-pandemic levels. Shipping costs and transportation rates rose sharply during the pandemic, causing price increases from commodities to finish products worldwide. Many economists believe that the drop in shipping and commodity prices is indicative of lower inflation and a possible global slowdown of commerce activity.

Sources: Federal Reserve, Labor Dept., FDIC, OCC, FFIEC, Baltic Dry Index

A properly drafted will or trust is essential for anyone that has assets to leave to heirs. Either a will or a trust allows you to designate anyone you wish as beneficiaries. Both a will and a “revocable living trust” allow you to identify who the heirs to your assets will be.

The main difference between the two is that assets held in a trust will avoid probate upon one’s passing, which is inhibitive to the heirs and costly. A trust structured as a revocable living trust can help shelter family assets from taxes by properly placing assets within the trust. For 2024, the first $13.61 million (per individual) $27.22 million (per married couple) is excluded from estate taxes with any assets over that amount taxed at the Federal Estate Tax Rate.

If you own property in another state, a living trust eliminates the need to probate that property in that state. A living trust can immediately transfer management of your property if you become incapacitated either physically or mentally. There is no need to go to court to appoint a guardian or conservator.

If you choose to create a living trust, you should also create what is called a pour-over will. It provides for the distribution of any property that is not included in the trust. It will also allow you to name a guardian for any minor children.

Source: IRS

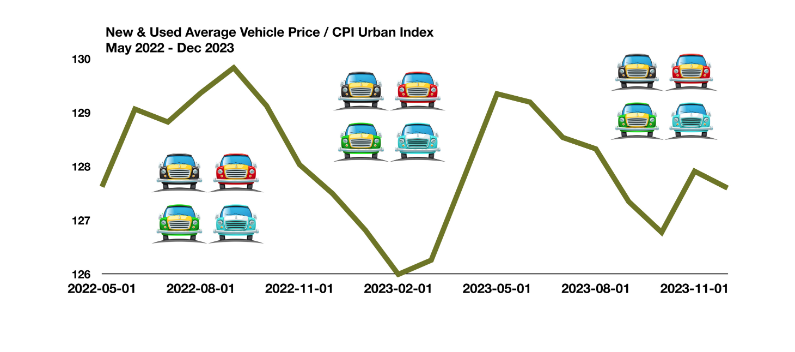

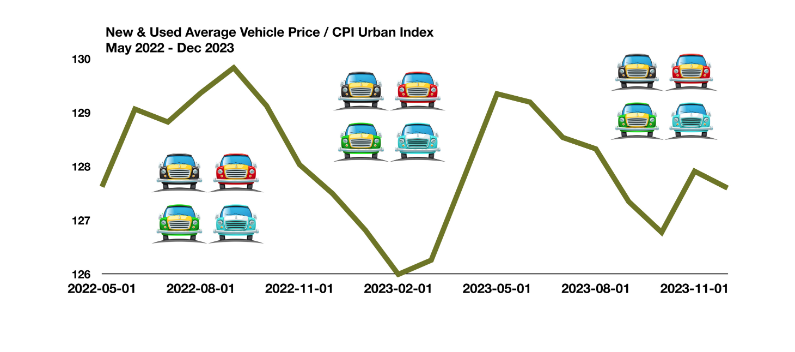

Years of consecutive increases in U.S. auto sales have put a glut of vehicles on U.S. highways. In addition, a significant number of those sales were with a lease, leading to a rising tide of cars flowing back into the market as lease terms expired.

As automakers have added manufacturing capacity, they have also been aggressive in offering larger incentives on new vehicles in order to maintain record sales momentum. That has put downward pressure on the entire market.

Consequently, the number of drivers that owe more on their cars than they are worth is surging. Americans are paying on a record $1.6 trillion of auto loans currently, according to the most recent Federal Reserve data. That represents roughly half of all licensed drivers in the U.S. Among those that carry loan balances, the Federal Reserve estimates that auto loans make up between 10 percent and 23 percent of their total financial obligations.

Auto prices soared as the pandemic took hold in 2020 through 2022, as supply constraints for critical auto components hindered manufacturing and distribution of automobiles globally. Low interest rates on auto loans helped subsidize rising auto prices as consumer demand continued on.

Sources: Federal Reserve Bank of St. Louis

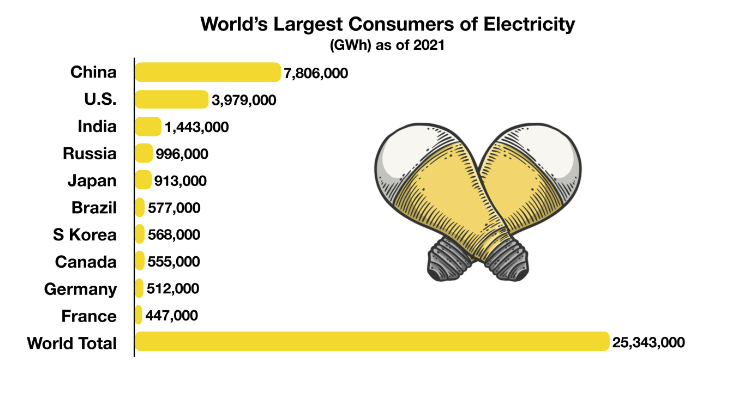

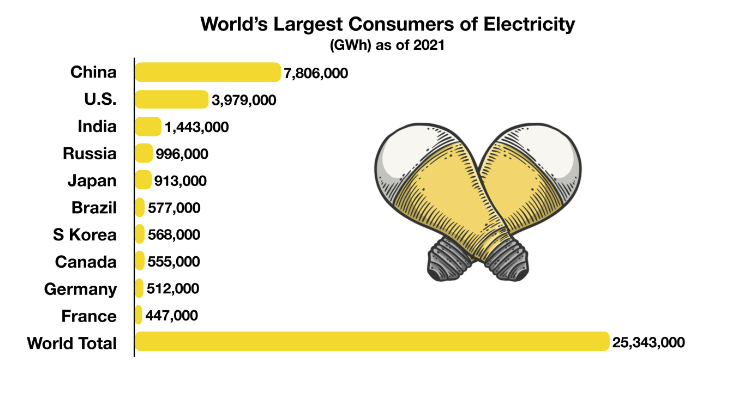

As China and other developing countries continue to grow their middle class and build new cities and roads, the demand for energy such as electricity, continues to increase enormously.

China continues to build and expand its infrastructure to accommodate a population of over 1.4 billion people, while the United States has far less of a population to accommodate with 331.9 million. Optimistically, the U.S. has become more of an energy producer and less of an energy consumer, due in part to technology advances and slower economic expansion.

The abundance of newly extracted oil and natural gas from the United States has been primarily attributable to the advancement of technology. Radical new processes and methods of identifying oil and natural gas reserves have propelled the U.S. to a world leader for energy resources.

As global growth from emerging and developing countries continues, so does the demand for energy. Electricity is a primary energy source for the individual population and for a country’s manufacturing sector and infrastructure. Many market analysts believe that long-term global growth is what has been fueling the steady rise in energy prices, more so than geopolitical events.

Source: U.S. Energy Information Administration (EIA)