As a sergeant in the U.S. Marine Corps Reserves, Brady Jones has learned the value of teamwork. As a wealth management planner at Wambolt & Associates, Brady appreciates being part of a collaborative team of specialists who go the extra mile for their clients.

“If you’re a Wambolt client, you can leverage the experience of our entire team,” said Brady. “Whether you need expertise in financial planning, tax strategy, investments, or estate matters, we will collaborate to help you reach your unique goals and objectives.”

Brady plays a pivotal role in onboarding new clients and creating profiles that reflect their financial and personal goals in a holistic manner. In addition to gathering details on their accounts and investments, Brady works with the advisor teams to learn about their clients’ vision, values, and life goals.

“Finances are scary – what people worry about the most,” said Brady. “We try to be right by their side to cover all aspects of their wealth management picture – not just their finances.”

As a fiduciary, Wambolt is 100% accountable to their clients. Unlike a broker/dealer, the firm is not restricted by a commission-based framework that encourages the sale of a limited number of financial products. Instead, the Wambolt team has the freedom to identify effective strategies that best meet client needs. “Our process is very dynamic so we can make customized recommendations to clients,” Brady emphasized. “We understand each client’s risk tolerance and we align their portfolio with their priorities.”

Brady appreciates the opportunity to walk beside clients along their financial journey. In addition to conducting a Q&A, he assists them with opening accounts, transferring funds, tracking their portfolio progress, and maintaining regular content to ensure that the firm is responding to their changing needs.

“We like to provide our clients with the ‘white glove’ treatment, taking the burden off their shoulders,” said Brady. “We do the leg work to identify opportunities they never considered and leave them with a gem of knowledge from each meeting.”

Acquiring knowledge is a prime focus for Brady. He is grateful for the mentoring and cross-generational learning that takes place within the firm. “I learn something new every day,” he said. “We have team members with 30-40 years of robust experience working alongside our younger colleagues who bring a fresh energy and eagerness to learn, putting their best foot forward.”

Outside of his work environment, Brady enjoys “everything outdoors,” from fishing and hunting to camping and snowboarding, and exploring nature with his dog. The Denver native values time with his family and his girlfriend who is completing her doctorate in physical therapy in Arizona.

At the end of the day, the platoon leader and wealth management planner finds purpose in a single goal. “I really enjoy helping people – making a difference for them and bringing value to their lives.”

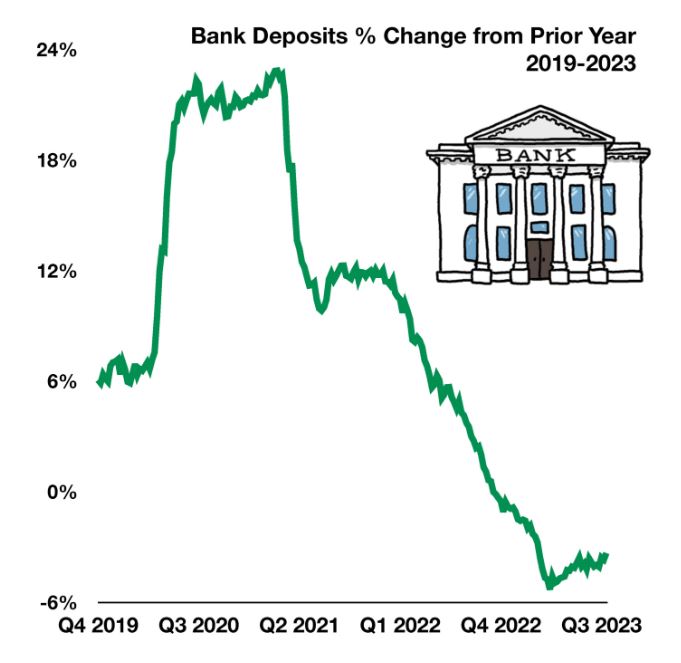

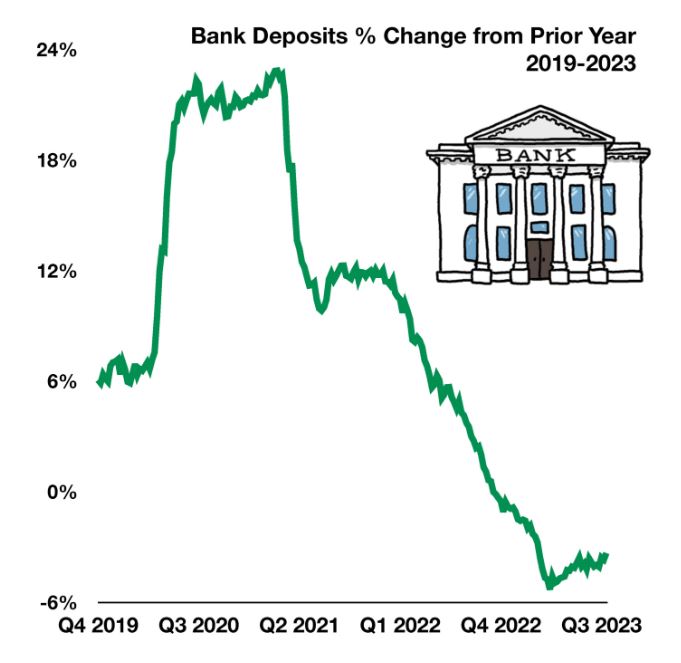

Consumers have been slowly depositing less money into their bank accounts over the past three years. As the pandemic shuttered restaurants and retail stores in 2020, bank deposits increased as consumers spent less and instead saved their cash. Generous government stimulus programs also led to consumers saving more as unused cash landed in bank deposits.

As businesses reopened and consumers began spending again in 2021, bank deposits fell as consumers decided to spend rather than save. Inflation also contributed to less savings and falling bank deposits as consumers found themselves spending more as the post-pandemic recovery drove prices higher.

Recent higher interest rates offered by banks did entice some to deposit more, yet deposits remain much lower than they were even before the pandemic. Banks struggled for years to capture deposits as rates stood at multi-decade lows up until 2022 when the Fed commenced its rate hike strategy. Some bond analysts believe that rates may start to decline as the Fed reacts to slowing economic data signaling dissipating inflation and consumer confidence.

Source: Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series

A gradual devaluation or decline in overall asset prices is known as deflation, which leads to lower prices on most goods and services. This eventually creates an unfavorable environment for companies to raise prices and maintain already elevated profit margins. Ironically, what has led to this environment are the lingering effects of inflation. As the pandemic diminished and consumers spent more, companies raised prices as demand increased, eventually bringing about inflation. Now, as demand dissipates and consumers spend less, prices head lower.

Economists suggest that long-term yields can directly portray deflation. As the 10-year Treasury bond yield has fallen since its peak in October, nominal GDP along with inflation has slowly fallen. Real wages have also contracted, leading consumers to refuse to pay higher prices but demand more lower-priced goods. Retail stores have resorted to discounting in order to increase sales and reduce unwanted inventories.

Commodities across the globe are also reflecting deflationary characteristics as prices have pulled back from the highs of 2021 and 2022, including lumber, natural gas, aluminum, copper, and wheat. The International Energy Association (IEA) for the first time predicted that global demand for oil will reach a peak this decade, indicative of possibly lower oil and gasoline prices in the future.

Fed Chair Jerome Powell mentioned that elevated long-term bond yields lessen the pressure for tighter monetary policy, meaning that the Fed may not need to raise rates further, thus allowing rising bond yields to slow economic activity.

Sources: Treasury Dept., Federal Reserve, IEA

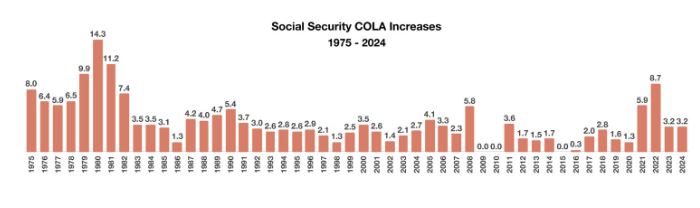

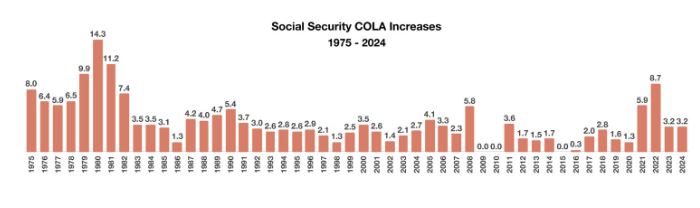

Social Security recipients are due to receive an increase of 3.2% in 2024, the same as last year’s increase. For many recipients, the increase in payments will go towards higher living expenses as well as increased Medicare premiums. The increase in benefit payments is effective in late December 2023 for SSI (Supplemental Security Income) recipients and in January 2024 for Social Security recipients.

Many are concerned that the Social Security benefit increase may not cover expenses that are rising at a faster pace, including essential items such as food, housing, and energy. Medicare Part B premiums are expected to increase 5.9% at the beginning of 2024, nearly double of the 3.2% COLA increase for Social Security.

The establishment of Social Security occurred on August 14, 1935, when President Roosevelt signed the Social Security Act into law. Since then, Social Security has provided millions of Americans with benefit payments. The payments are subject to automatic increases based on inflation, also known as cost-of living adjustment (COLA) which has been in effect since 1975. Over the years, recipients have received varying increases depending on the inflation rate.

Source: Social Security Administration

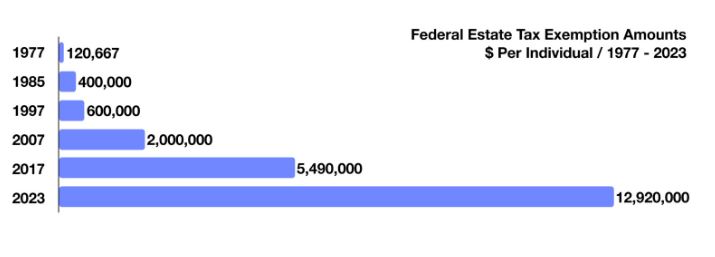

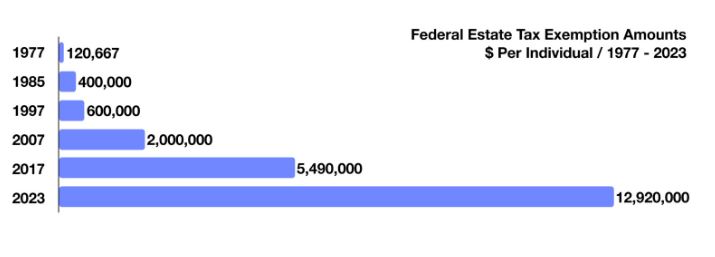

Estate tax exemptions began with the Revenue Act of 1916, which imposed a transfer of wealth tax on the estate of any deceased U.S. citizen valued above a certain amount at the time of death. In 1916, the exemption amount was $50,000, today that amount is $12.92 million. Over the decades, however, the exemption amount has varied, driven primarily by lawmakers and inflation indices. In 1977, the exemption amount was $120,667, then gradually increased over the years to $5.49 million in 2017. The current exemption is expected to revert to $5 million on January 1, 2026, yet may be higher depending on where inflation is at that time. Some estimate the revised exemption amount to reach between $6 to $7 million after adjusting for inflation.

Sources: IRS; https://www.irs.gov/businesses/small-businesses-self-employed/estate-tax