Wambolt & Associates Tax Analyst Evan Coats finds true satisfaction in uncovering opportunities for clients to improve their tax situations. Whether working with small businesses, corporate entities or individuals, Evan has a keen ability to understand their tax picture and identify strategies specific to the client.

“My main focus is to understand the complexities of a client’s tax situation and recommend ways to decrease their tax burden,” said Coats. “I enjoy answering client questions, conducting research, and analyzing their tax picture to uncover steps that could minimize their tax impacts and grow their income.”

During the fourth quarter, Evan counsels businesses to take advantage of deductions before the end of the calendar year. Maximizing pre-tax retirement contributions, capitalizing on bonus depreciation for business-related purchases such as machinery, vehicles, and office furniture, and ensuring that businesses are structured appropriately – converting Schedule C entities to S-Corps – are just a few of the strategies he presents. For accredited investors, Coats explores tax-saving Alternative Investments such as conservation easements, and investments in non-public securities including art, alternative energy, the oil and gas industry, and multi-family or institutional real estate ventures.

At the end of the day, each client’s tax complexities and opportunities are unique to them. These challenges are met by Wambolt’s client-centric approach to wealth management, a key part of the firm culture which Evan embraces. “Wambolt & Associates has built a phenomenal culture supported by owners Greg and Cindy,” he said. “We put the client’s interest first because we’re not trying to earn a commission or move forward with an agenda. We are genuinely concerned about the welfare of our clients.”

With the goal of “doing right by our client,” Evan finds the work atmosphere very positive and open. “It is liberating to say things that need to be said, and to offer new ideas because we are all driven by delivering the best results for our client,” he said. “We support each other and strive for continuous improvement, celebrating our wins and learning from our challenges and successes.”

Coats, who has 30 years of business experience, including more than 10 years in the accounting field, is focused on his own professional improvement, completing his Master of Accounting degree at the University of Colorado, Denver. Outside of the office, Evan spends his time renovating an old cabin in Evergreen. He likes to cook and is an active community volunteer. Evan is a graduate of Portland State University with a Bachelor of Science degree in economics.

Evan reflects on becoming a member of the Wambolt team. “At this point in my career, I’m excited to be at a firm that is so forward-looking and so proactive in finding the right answers for our clients.”

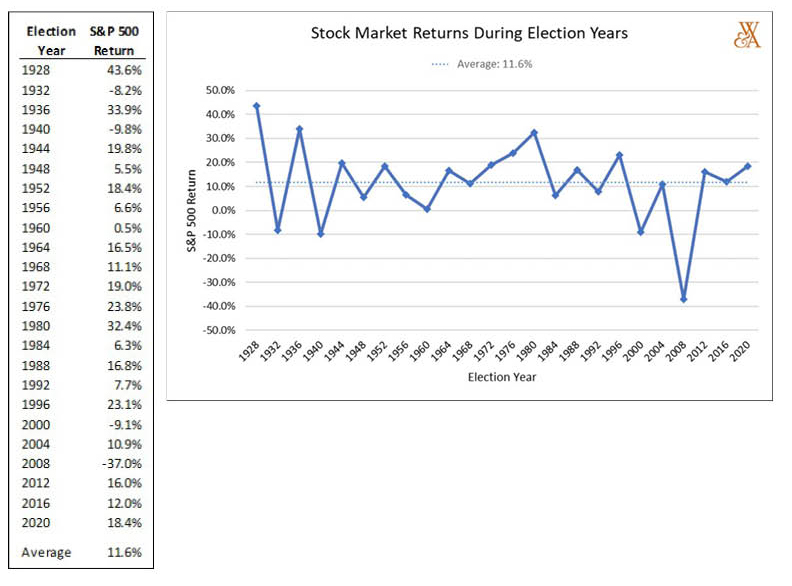

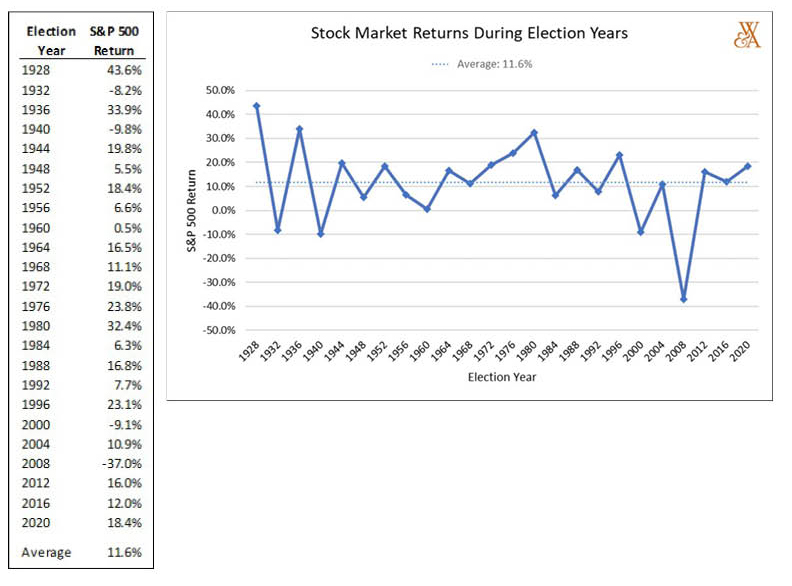

As we inch closer to 2024, it is hard to believe that another presidential election year is approaching. As political rhetoric gets ratcheted up, it would be reasonable to believe that stock market volatility would be elevated during an election year. However, the historical data paints a different story. In fact, the 11.6% average annual return of the S&P 500 over the previous 24 presidential election years going back to 1928 is just slightly above the 11.5% average yearly market return over the entire 95-year period from 1928 to 2022.

Of these prior 24 election years, 20 of them have been positive stock market return years. Of the 20 election years since 1944, 18 have been positive market return years, a 90% hit rate. The only election year going back to 1928 with negative double-digit returns was 2008, when the S&P 500 fell 37% as the U.S. economy was in the midst of the Great Financial Crisis.

So, as it relates to your investment portfolio, try to tune out the election ‘noise’ and focus on the long term.

Source: New York University; Stern School of Business – Historical Returns on Stocks, Bonds and Bills: 1928 – 2022.

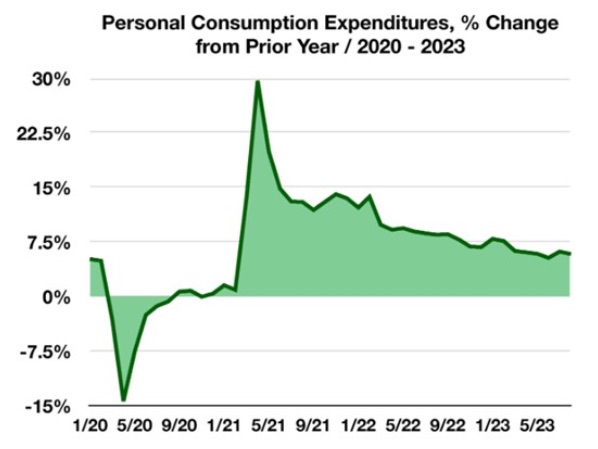

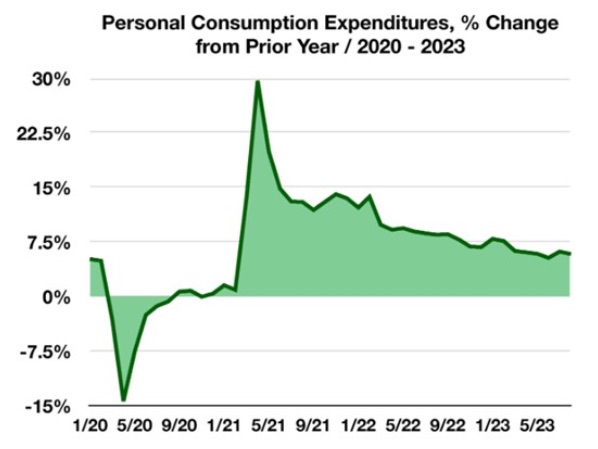

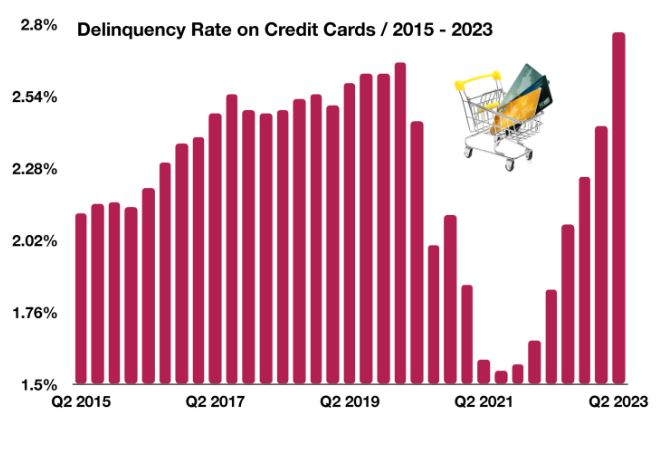

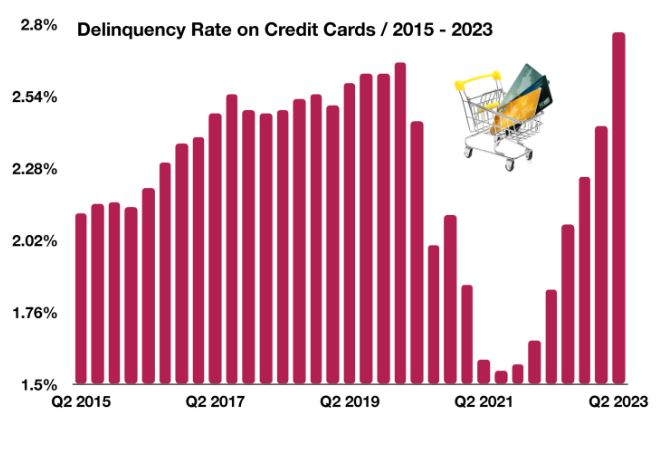

Over 65% of the country’s economic growth, as measured by Gross Domestic Production (GDP) is driven by consumers. Sentiment and confidence are critical components to consumer spending behavior, influencing spending patterns and habits. Recently released data from the Bureau of Economic Analysis reveals that consumers are spending less than they have been.

Factors affecting consumer spending include income, sentiment, job status, and confidence. Once consumers realize a change in their status, they will modify spending in order to accommodate what they need.

As retail stores and restaurants began to reopen in 2021, consumers were ready to spend funds that had been sitting idle for nearly a year. Consumer consumption fell dramatically in April 2020, as stay-at-home mandates and retail closures were in effect, only to elevate to new highs in April 2021 as consumers were able to spend freely again. The most recent data trends validate that consumers are spending less and perhaps with greater caution as economic uncertainty takes hold.

Sources: Labor Dept., Bureau of Economic Analysis

A federal government shutdown was averted on September 30, when Congress voted to fund government operations until mid-November. Volatility in the financial markets increased during September, as uncertainty surrounding a resolution persisted. The possibility of a shutdown will evolve again in November, as Congress once again deliberates on the passage of the federal budget. Should a shutdown occur, the impact on the economy would initially be mild as previous shutdowns, and possibly expanding as millions of government workers go without salary. Private sector contractors would also be impacted with delayed payments, while consumer uncertainty hinders spending.

The federal government shutdown dilemma has increased the possibility of a credit downgrade by Moody’s, the last agency with a AAA rating on government debt. Credit agencies S&P and Fitch have already lowered their ratings on U.S. government debt to AA+, down from the top tier rating of AAA. Another downgrade is expected to make it more costly for the government to borrow funds and maintain already excessive debt levels. The last downgrade was on August 1 when Fitch lowered its rating to AA+ from AAA.

A shutdown of the federal government is expected to affect only government operations and payments that are not funded by permanent appropriations. Those funded by permanent appropriations such as the Postal Service, entitlement programs such as Social Security and Medicare, will not be affected. Other essential and critical departments and agencies of the government would also continue operations, such as the Defense Department and the Treasury Department. Scheduled debt payments such as on Treasury bills, notes and bonds would also continue to be made.

Relentless rising oil prices are hindering portions of the economy, inflicting rising costs on transportation, manufacturing, and food distribution. Equity analysts believe that some companies may see compressed earnings as lofty fuel costs continue to wear on operating expenses. Higher costs can eventually be passed on to consumers in the form of higher prices.

Wages have grown less than the inflation rate over the past two years, dampening consumer expenditures and spending confidence. Recent labor strikes involve wage negotiations to enhance pay that hasn’t kept up with rising prices and inflationary pressures.

Medicare open enrollment is from October 15 to December 7, allowing changes for existing medicare recipients and enrollments for new members. Any changes and new enrollments are effective January 1, 2024. The Centers for Medicare & Medicaid Services (CMS) reports that there are currently over 65.7 million people enrolled in Medicare.

Sources: Social Security Administration, Medicare.gov, Treasury Dept., Federal Reserve

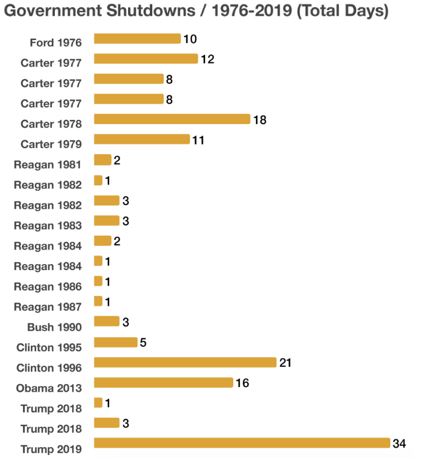

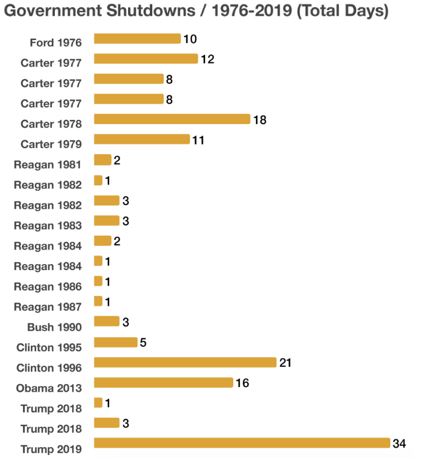

Government shutdowns have been a common occurrence over the years under most every president. The length of the shutdowns has varied from 2 days in 1981 under President Reagan, 21 days in 1995 under President Clinton, and 34 days in 2019 under President Trump. A shutdown occurs when Congress fails to pass or the President refuses to sign legislation funding federal government operations and agencies.

Estimated costs of the most recent government shutdown are still unknown, with lost wages, exports, and government services essential to the operation of private sector businesses being affected. How much the shutdown may have weighed on the economy may not be known until later in the year.

Government shutdowns entail partial closure of certain agencies and departments, not complete closures. Departments affected during the most recent shut down include Homeland Security, Housing & Urban Development, Commerce, FCC, Coast Guard, FEMA, Interior, Transportation, and the Executive Office of the President.

Federal employees deemed as “essential” among the various departments are required to work without pay until a funding bill is passed by Congress. The closures affect numerous private businesses that rely and adhere to regulatory rules imposed by the Federal government, such as mortgage loans and Housing & Urban Development.

Sources: Congressional Records, https://www.congress.gov/congressional-record/2018/12/22

With open enrollment upon us, millions of Americans will be deciding on which, if any, changes to make to their Medicare coverage. The Open Enrollment Period for 2024 coverage is from October 15, 2023 to December 7, 2023. Coverage for any changes or new plans begins January 1, 2024.

Since Medicare doesn’t cover all medical expenses, the decision to buy supplemental insurance coverage or to obtain a Medicare Advantage Plan is important for millions of Medicare recipients.

Medicare Advantage Plans allow a recipient to get both Medicare Part A and Part B coverage. Medicare Advantage Plans are sometimes called Part C or MA Plans and are offered by Medicare-approved private companies.

Medicare Supplemental Insurance or Medigap helps pay for gaps in coverage not paid for by Medicare. Even though Medicare does pay for many procedures and services, some remaining expenses such as copayments, coinsurance, and deductibles are covered by supplemental plans. Some Medigap policies also cover services that are not covered at all by Medicare, such as coverage while traveling abroad. So it’s worth shopping and determining what expenses are covered by the various supplemental insurance policies.

Source: medicare.gov

The Wambolt & Associates team had a ton of fun hosting our firm’s first Summer Jam at the Conifer Ranch. It was a wonderful opportunity to say “thank-you” to our amazing clients by creating a family-friendly experience that included live music from Nashville’s Kory Brunson Band, Brad’s Pit BBQ, Kona Ice, children’s games, and good-natured axe throwing. The beauty of the ranch’s sweeping views, the spirit of community, and plenty of sunshine made for a spectacular day in the mountains. Click here to view photos from the event.