Originally written by Erica York for the Tax Foundation

As 2018 closed earlier this week, many Americans were considering making last minute, end-of-year charitable donations. While the new tax law contains many changes that will impact these decisions, we can look at Internal Revenue Service (IRS) data to gauge how much Americans have deducted for charitable giving in the past.

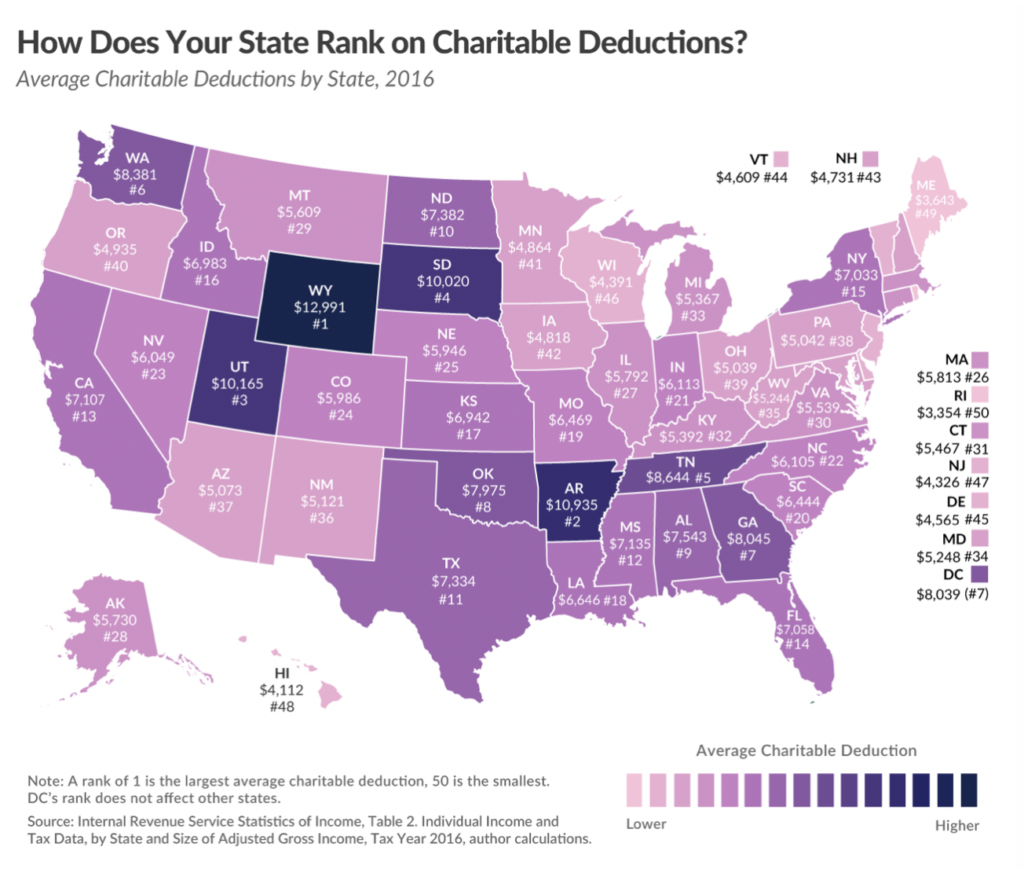

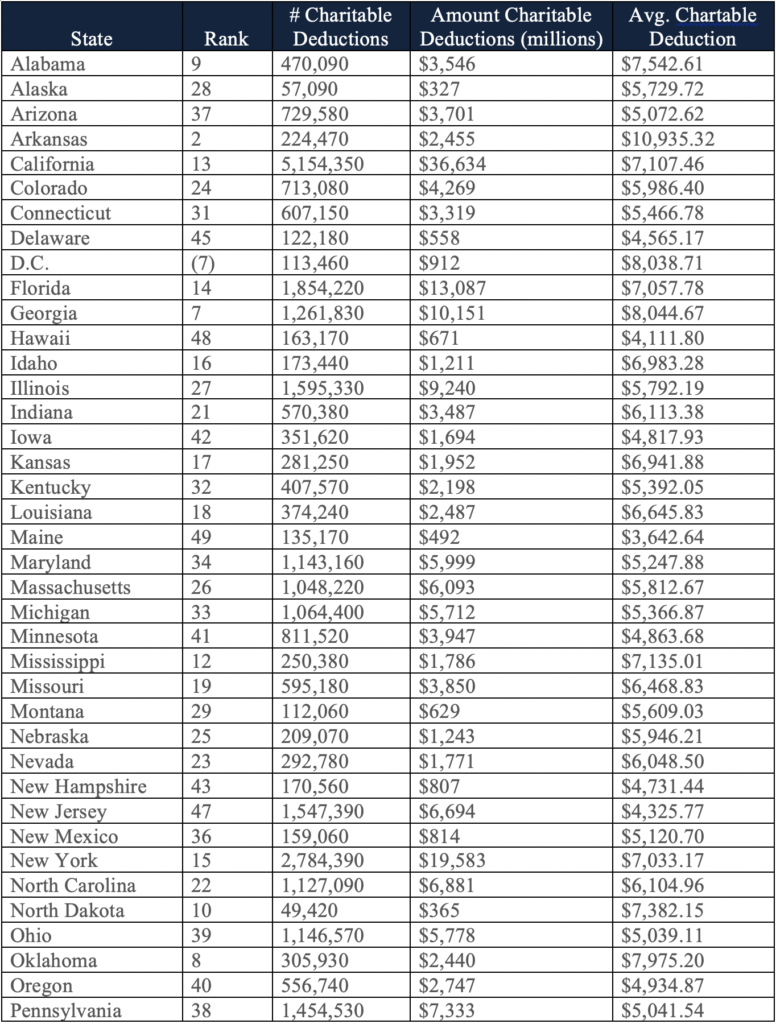

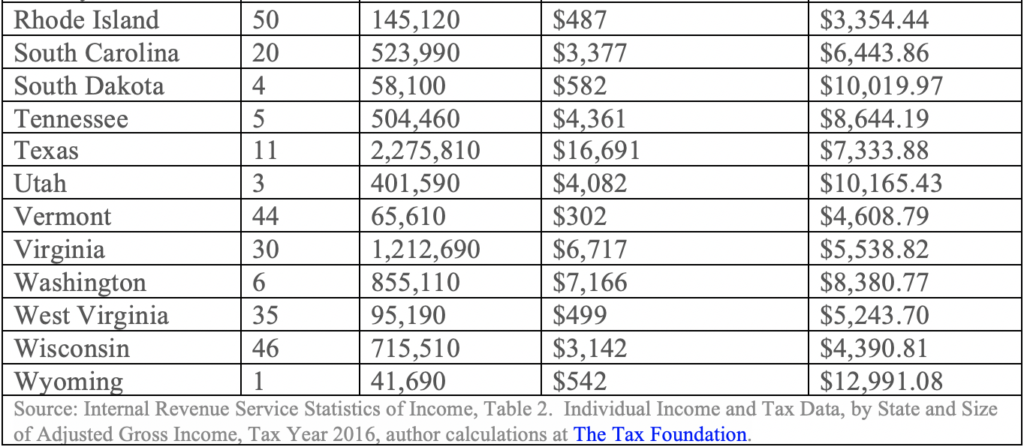

In tax year 2016, just over 37 million taxpayers took an itemized deduction for their charitable giving, deducting a total of $236 billion in charitable contributions for an average of $6,349. Note that this doesn’t represent the total amount of giving in the United States, just the amount that eligible taxpayers deducted on their income tax returns. It’s also worth noting that wealthier Americans disproportionately benefit from the charitable deduction overall, as it is high-income taxpayers who tend to itemize their deductions.

Four states had average charitable deductions greater than $10,000 in 2016: Wyoming ($12,991), Arkansas ($10,935), Utah ($10,165), and South Dakota ($10,019). The state with the smallest average, at $3,354, was Rhode Island.

Because the Tax Cuts and Jobs Act greatly increased the standard deduction, it’s estimated that nearly 30 million households will be better off taking the standard deduction instead of itemizing. While this means tax filing will be simpler, it also means these households will no longer benefit from the charitable contribution deduction.

Lower marginal tax rates under the new law also mean that, for those still taking itemized deductions, their value is lessened. While charitable giving will still be subsidized for these taxpayers, it will be subsidized to a lesser extent.

As fewer households will itemize going forward, we should expect forthcoming IRS data to show fewer charitable contribution deductions. What this means for charitable giving overall, however, is less certain. Though some households may decrease their giving, others may use new strategies, such as bunching their donations, or maintaining their giving by making multiple years’ worth of donations at once to have enough to itemize. Given that the tax subsidy for charitable donations has decreased, it would not be surprising if tax-motivated charitable giving decreases as well. However, households make giving decisions for a variety of reasons, many of which are not tax related.

Source: The Tax Foundation.

Read more about charitable giving on our blog – Subscribe

Follow Us on LinkedIn

Photo by Chang Duong on Unsplash

This commentary on this website reflects the personal opinions, viewpoints and analyses of the Wambolt & Associates employees providing such comments, and should not be regarded as a description of advisory services provided by Wambolt & Associates or performance returns of any Wambolt & Associates Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Wambolt & Associates manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Wambolt & Associates provides links for your convenience to websites produced by other providers or industry related material. Accessing websites through links directs you away from our website. Wambolt & Associates is not responsible for errors or omissions in the material on third party websites, and does not necessarily approve of or endorse the information provided. Users who gain access to third party websites may be subject to the copyright and other restrictions on use imposed by those providers and assume responsibility and risk from use of those websites.