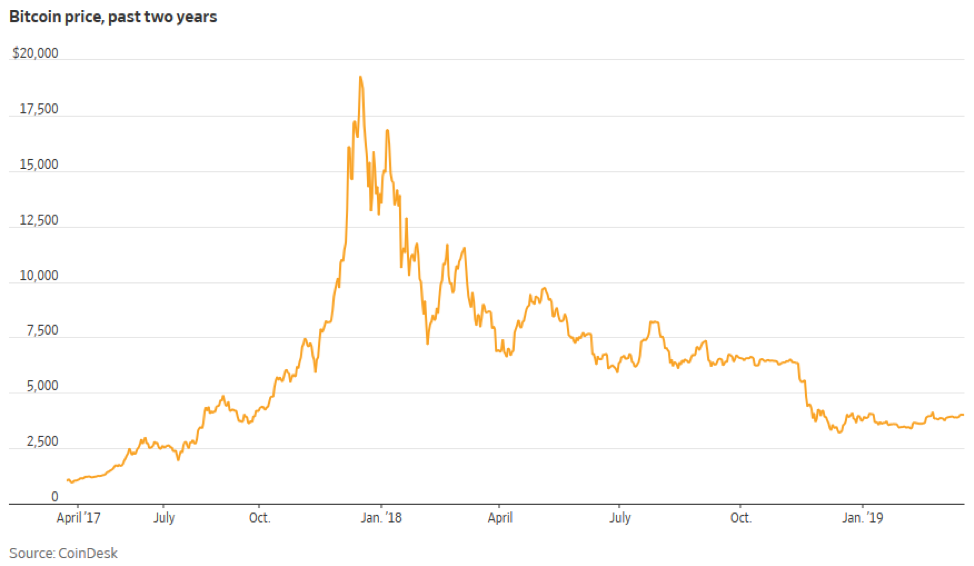

Bitcoin, the most popular cryptocurrency in the world, jumped to a four-month high through April 2, briefly breaching $5,000 on the Bitstamp exchange. The 15% climb puts Bitcoin above its lowest selling price of $3,400 in December of 2018 but a far cry below its trading high of $19,783.06 in December of 2017.

The jump ended Bitcoin’s longest slump in its 10-year history, proving what a difference a few days can make. On March 19, the value of all cryptocurrencies outstanding was down 85% from peak and volumes on U.S. exchanges had been falling. The price that day was just below $4,000 (WSJ).

The Takeaway

The violent mood swings continue as electronic currency exchanges still lack mainstream institutional investors, a regulatory framework, and accurate reporting mechanisms. There is currently no legal or regulatory framework applicable to cryptocurrencies and manipulation in cryptocurrencies is a growing concern for regulators. The Securities and Exchange Commission cited that risk in rejecting several bitcoin-based exchange-traded funds last year.

Nearly 95% of all reported trading in bitcoin is artificially created by unregulated exchanges, a new study concludes, as reported by Paul Vigna for the WSJ. This raises “fresh doubts about the nascent market following a steep decline in prices over the past year.” Research by Bitwise Asset Management found that the actual market for bitcoin is far smaller than previously thought.

No one knows what an appropriate regulatory framework might be, but we’ll keep you posted on developments in this emerging marketplace.

Follow Wambolt & Associates on LinkedIn

Photo by Andre Francois on Unsplash

This commentary on this website reflects the personal opinions, viewpoints and analyses of the Wambolt & Associates employees providing such comments, and should not be regarded as a description of advisory services provided by Wambolt & Associates or performance returns of any Wambolt & Associates Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Wambolt & Associates manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Wambolt & Associates provides links for your convenience to websites produced by other providers or industry related material. Accessing websites through links directs you away from our website. Wambolt & Associates is not responsible for errors or omissions in the material on third party websites, and does not necessarily approve of or endorse the information provided. Users who gain access to third party websites may be subject to the copyright and other restrictions on use imposed by those providers and assume responsibility and risk from use of those websites.