“Don’t confuse brains with a bull market” is a famous investing quote credited to Humphrey Neill, the ‘Father of Contrarian Analysis’. We currently find ourselves in a bull market that has been running for more than 8 ½ years, the second longest in the history of the S&P 500. Historically, conditions like this create a level of false self-confidence with investors that often lead to poor decisions and returns that are anything but what they anticipated.

You don’t have to look far to find stocks that have lured in investors based on impressive returns, only to see the performance take a sharp turn in the exact opposite direction. A perfect example over the last several years is Under Armour (UA). This stock was one of the most popular stories on Wall Street as UA posted incredible growth. It was not only taking on many of the big names in athletic apparel, it was winning the battle. Below is a quick snapshot of the last five years and the ugly ride it’s investors have been on…

Under Armour didn’t just beat the S&P 500 from 2012 to 2015, it crushed it! The problem is, many investors that owned UA during that impressive run still own it, and never locked-in any of the profits they enjoyed on paper. Stories like this are all too common. One minute an investor feels like a genius – then suddenly the stock, industry or overall market makes a drastic move, and returns disappear quickly. Currently, there are several stocks that have been dominating the headlines and occupy a significant portion of many portfolios. Could they take investors on a similar ride?

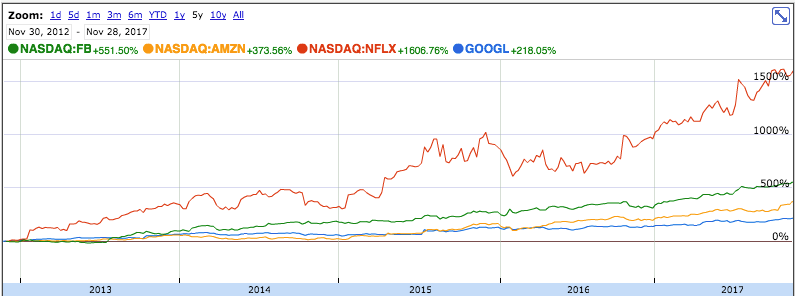

The financial industry loves creating new terms and acronyms. Chances are you’ve heard of the FANG stocks, and you may have some exposure to them in your portfolio. FANG represents four of the most popular technology stocks in today’s market: Facebook (FB), Amazon (AMZN), Netflix (NFLX) and Google, now called Alphabet (GOOGL). Below is a chart illustrating each of these stocks and the performance they have posted over the last five years.

Facebook (FB) • +551%, Amazon (AMZN) • +373%, NetFlix (NFLX) • +1,606%

Alphabet/Google (GOOG) • +218%

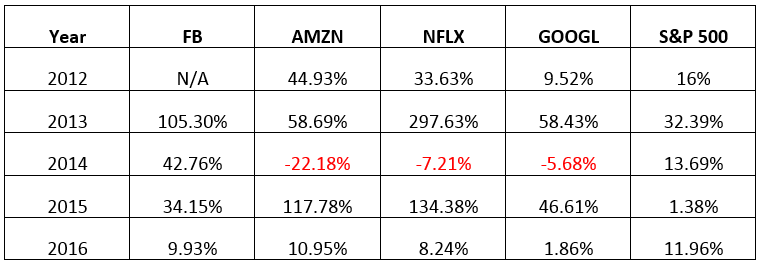

These numbers are certainly impressive, but what many don’t realize is it has not always been an upward trend for these stocks. Below is a breakdown over the last several years, similar to the Under Armour chart we shared earlier.

What many investors don’t realize is the S&P 500 index beat these ‘darlings of Wall Street’ many times over the last five years. Yes, when the FANG stocks outperformed it was by a wide margin, but will this trend continue? Stock momentum and performance can change quickly, particularly in the technology sector. Volatility can create the same scenario we discussed earlier with Under Armour, and impact any or all of the FANG stocks. The Tech Bubble and the market crash of 2008 were not that long ago but many investors have pushed them completely out of their minds and are setting themselves up for another painful experience.

If you purchased $10,000 of Facebook stock at their IPO in 2012, you would have approximately a $38,000 position in the stock today. Definitely an impressive return, but how should you manage that position going forward? Here are a couple key items for you to consider before making a decision:

- What are the tax ramifications? Is the position owned in a taxable or qualified account?

- What is your realistic long-term outlook for the stock?

- How large of a percentage of your overall portfolio does the position or positions add up to?

- Can you handle watching your gains, and possibly a portion of your original investment, disappear?

These are all challenging questions that anyone holding a highly appreciated position (not just FANG stocks) needs to ask themselves. If you need help or would like a second opinion we encourage you to contact us! We started this article with a quote and will end with one of our favorites that share our view on this topic…

“Pigs get fat and hogs get slaughtered”

Which one are you going to be?