Your Competitive Edge

Build your business by attracting—and keeping—the best employees

In this Guide

- Introduction

- Why Attract, Retain, and Reward Your Top Performers?

- Executive Compensation Strategies: Compare your Options

- Control and Flexibility: Nonqualified Deferred Compensation (NQDC) Plans

- Simplicity and Deductibility: Executive Bonus Arrangements

- Affordability: Split-Dollar Arrangements

- Conclusion

1. Introduction

Your employees are a huge part of what makes your business successful. However, in today’s fluid employment environment, your competitors are also looking for top talent. Executive(1) compensation strategies that use life insurance allow you to put the proper arrangements in place that can help ensure that key players stay where they belong: with you.

1 “Executive” is defined as a 5% or more shareholder, a director of the business, or a highly compensated employee as defined in either IRS Sec. 416(q) or IRC Sec. 105(h)(5).

2. Why Attract, Retain, and Reward Your Top Performers

Financial security, having enough retirement income, continues to be one of the top concerns of Americans. According to a recent Gallup poll, “Americans continue to be most worried about not having enough money for retirement, with 64% saying they are ‘very worried’ or ‘moderately worried’ about this.”(2) This is especially the case with top income earners. Due to limits on contributions for qualified plans and social security benefits, high-income earners find that these two sources will only cover a diminishing percentage of their current compensation. This leaves a gap in your key employees’ retirement savings that you can fill with an executive compensation strategy—before your competitors do.

| Compensation at Age 45 | $50,000 | $70,000 | $100,000 | $150,000 | $200,000 | $250,000 |

| 401(k) Plan Deposit at age 45 (3) | $5,000 | $7,000 | $10,000 | $15,000 | $18,000 | $18,000 |

| Benefits at Age 67 from 401(k) Plan (4) | $17,148 | $24,012 | $34,307 | $51,467 | $71,208 | $71,208 |

| Benefits at Age 67 from Social Security (5) | $21,252 | $26,940 | $31,188 | $34,836 | $34,968 | $34,968 |

| Total Benefits | $38,400 | $50,952 | $65,495 | $86,303 | $106,176 | $106,176 |

| Percent of Compensation Provided by Age 67 | 76.8% | 72.8% | 65.5% | 57.5% | 53.1% | 42.5% |

3. Executive Compensation Strategies: Compare your Options

This guide describes three designs which may address your executives’ financial concerns. We have highlighted key features of each type of design to distinguish them from one another. The design you choose will depend on your priorities; these may include control, flexibility, simplicity, affordability, or a combination of these features. Some also provide tax benefits to your business.

2 “Americans’ Financial Worries Edge up in 2016”, J. McCarthy, https://www.gallup.com/poll/191174/americans-financial-worries-edge-2016.aspx (April 28, 2016).

3 The maximum contribution for 2017 is $18,000. However, if you will attain age 50 before the close of the plan year, you will also be eligible to defer an additional $6,000 as a catch-up contribution. In order to take advantage of the catch-up contribution election, you must first defer and contribute the full $18,000 of your pay during the plan year. This chart does not reflect the use of the catch-up provision. The maximum annual contribution may differ for other types of qualified plans.

4 Benefits from the 401(k) assume: (1) A n individual age 45; (2) Contributions made for 22 yrs.; (3) Annual contribution increases at a rate of 2%; (4) 401(k) assets accumulate at 8% and payout is based on a single life annuity purchased at age 67.

5 Social Security benefits are based on the 2016 Quick Benefit Calculator at www.ssa.gov. Calculations assume: (1) An individual age 45 in 2016 will receive full Social Security benefits at age 67; (2) A worker’s past earnings are based on the national average wage indexing series with a relative growth factor of 2%; (3) Current earnings stay the same until age 67 and are limited to the 2016 taxable maximum of $118,500.

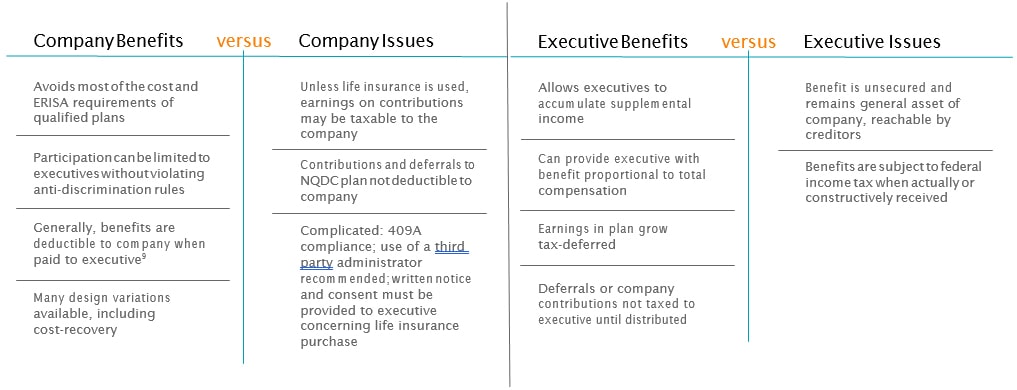

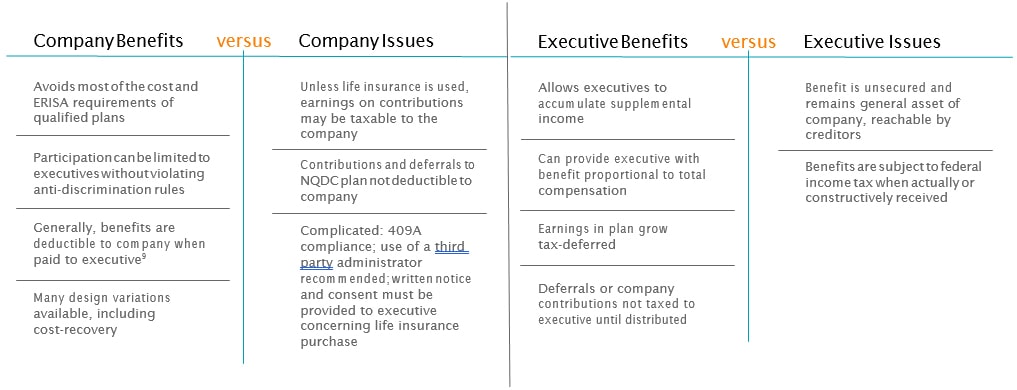

A. Control & Flexibility: Nonqualified Deferred Compensation Plans

A Nonqualified Deferred Compensation (NQDC) plan allows you to customize a compensation plan for key executives. An NQDC plan may allow participants to systematically defer a portion of their compensation until retirement without using a qualified plan. To executives who have already maxed out contributions to their qualified plan, an NQDC plan can be an attractive alternative for accumulating supplemental retirement income. In general, there are three types of NQDC plans:

- Voluntary Deferral Plans offer a method of helping your executives accumulate retirement income. By providing your executives with the option of deferring more of their salaries than is allowed under a qualified plan, a Voluntary Deferral Plan allows you to help your key executives save for retirement without having to make any additional employer contributions.

- Supplemental Executive Retirement Plans (SERPs), on the other hand, allow you to make additional employer contributions to provide your executives with that extra incentive to stay. SERPs also allow you to implement vesting schedules that would require the executives to stay with your organization for a set number of years before they are entitled to any funds – a true “golden handcuffs” scenario.

- 401(k) Mirror Plans combine benefits of both, featuring salary deferrals and employer contributions.

As an employer, you may informally fund the deferrals or promised benefits with any asset that you deem appropriate. Life insurance, however, provides an attractive informal funding option because the policy’s cash value may accumulate without any current taxation to the business.(6) Additionally, you can access the life insurance policy’s available cash value on a tax-free basis in order to help pay the promised benefits to the executive. (7) Finally, the life insurance death benefit proceeds that you receive at the executive’s death will be free from income taxation. (8) You can use these proceeds as a cost-recovery feature to offset the original premium expense.

6 In accordance with existing and pending state insurable interest laws, an employer does not have an insurable interest in an employee unless certain conditions are met. Failure to satisfy state insurable interest requirements may result in disqualification of the policy as “life insurance” under IRC Section 7702, and also may, among other things, void the policy.

7 Tax-free income assumes, among other things (1) withdrawals do not exceed tax basis (generally, premiums paid less prior withdrawals); (2) policy remains in force until death;

(3) withdrawals taken during the first 15 policy years do not occur at the time of, or during the two years prior to, any reduction in benefits; and (4) the policy does not become a modified endowment contract. See IRC Secs. 72, 7702(f)(7)(B), 7702A. Any policy withdrawals, loans and loan interest will reduce policy values and may reduce benefits.

8 For federal income tax purposes, life insurance death benefits generally pay income tax-free to beneficiaries pursuant to IRC Sec. 101(a)(1). In certain situations, however,

life insurance death benefits may be partially or wholly taxable. Situations include, but are not limited to: the transfer of a life insurance policy for valuable consideration unless the transfer qualifies for an exception under IRC Sec. 101(a)(2) (i.e., the “transfer-for-value rule”); arrangements that lack an insurable interest based on state law; and an employer-owned policy unless the policy qualifies for an exception under IRC Sec. 101(j).

9 The deductibility of the distribution is subject to the reasonable compensation limits established by IRC Sec. 162(a).

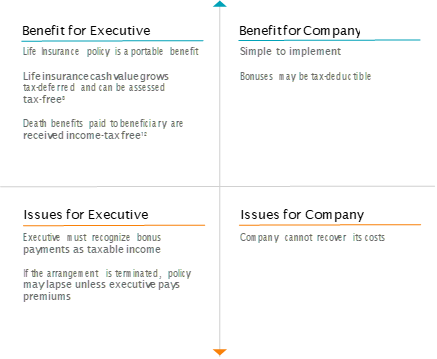

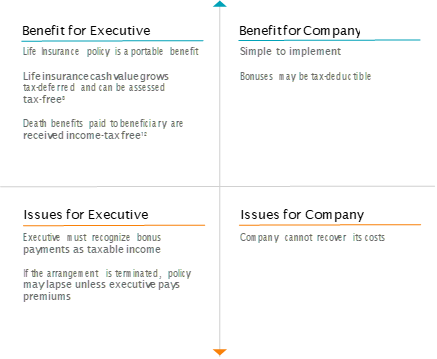

B. Simplicity & Deductibility: Executive Bonus Arrangements

An Executive Bonus arrangement involves paying the premiums, through a series of bonuses, for a personal life insurance policy that is owned by the executive. This simple arrangement allows you to avoid the hassle of complying with IRC Sec. 409A and paying for the cost of a third-party administrator.

A basic Executive Bonus arrangement does not require a separate agreement.(10) You can simply bonus the premiums to the executive or pay them directly to the insurance company. In both cases, however, the premium amounts will be taxable to the executive and tax-deductible for your business.(11) You have the option of grossing up the premium amounts.

If you wish to provide a stronger incentive for your executive to stay, there is the option of using a Restricted Executive Bonus arrangement instead. A Restricted Executive Bonus arrangement allows you to prevent the executive from accessing the cash value of his or her life insurance policy until they have remained with the organization for a set amount of time.

A Restricted Executive Bonus arrangement involves adding two additional documents to a basic Executive Bonus arrangement: an access agreement and a Restricted Executive Bonus form. The access agreement records the terms of the arrangement that you enter into with the executive, and states how long the executive must remain with the organization in order to access the cash value of the life insurance policy. The Restricted Executive Bonus form prevents the executive from accessing the cash value of the policy without your signature.

10 Please consult with your employee benefits legal counsel as to whether this is an employee benefit plan under the Employee Retirement Income Security Act of 1974 (ERISA) and if so, whether any additional requirements are necessary to comply with ERISA.

11 The deductibility of the bonus is subject to the reasonable compensation limits established by IRC Sec. 162(a).

12 For federal income tax purposes, life insurance death benefits generally pay income tax-free to beneficiaries pursuant to IRC Sec. 101(a)(1). In certain situations, however, life insurance death benefits may be partially or wholly taxable. Situations include, but are not limited to: the transfer of a life insurance policy for valuable consideration unless the transfer qualifies for an exception under IRC Sec. 101(a)(2) (i.e. the “transfer-for-value rule”); arrangements that lack an insurable interest based on state law; and an employer-owned policy unless the policy qualifies for an exception under IRC Sec. 101(j).

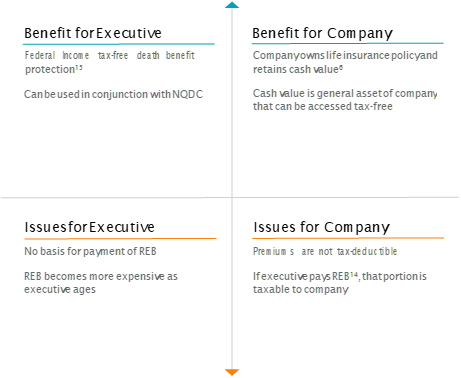

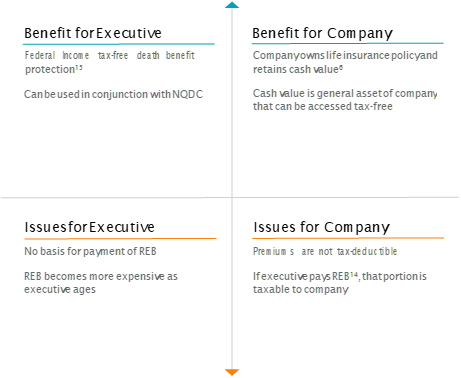

C. Affordability: Split Dollar Arrangements

Is affordability in a benefits arrangement a priority for you? Would you like to provide an attractive benefit for your key employees without committing the set amounts required under an NQDC plan or an Executive Bonus Arrangement?

If you answered yes to these questions, then a split-dollar arrangement may be right for you.(13) A split-dollar arrangement is a method of sharing the benefits of a cash value life insurance policy. If you are an employer who either already owns key-person policies on your executives or are anticipating purchasing those policies, a split-dollar arrangement is a great way of offering death benefit protection to your executives at no extra cost to you.

Typically, in a split-dollar arrangement the employer can pay the entire premium while the executive is taxed on the amount of the REB, which is the term cost of the death benefit coverage.(14)

4. Conclusion

As you look to retain your top performers, remember that these strategies can help provide your business with a compet- itive edge. Whether you’re looking for control and flexibility, simplicity and deductibility, or affordability in a benefit design, these executive compensation strategies which use life insurance may provide the added incentive to keep your key exec- utives with your organization, and keep your organization on top.

13 Split-dollar arrangements may be affected by the Sarbanes-Oxley Act of 2002 which prohibits personal loans by public companies to their directors and executive officers. Additionally, final split-dollar regulations have been adopted by the IRS that may impact the taxation of split-dollar arrangements entered into after September 17, 2003 in many circumstances. Please contact your tax and legal advisors for further guidance.

14 Split-dollar arrangements may be affected by the Sarbanes-Oxley Act of 2002 which prohibits personal loans by public companies to their directors and executive officers. Additionally, final split-dollar regulations have been adopted by the IRS that may impact the taxation of split-dollar arrangements entered into after September 17, 2003 in many circumstances. Please contact your tax and legal advisors for further guidance. Split-dollar arrangements may be affected by the Sarbanes-Oxley Act of 2002 which prohibits personal loans by public companies to their directors and executive officers. Additionally, final split-dollar regulations have been adopted by the IRS that may impact the taxation of split-dollar arrangements entered into after September 17, 2003 in many circumstances. Please contact your tax and legal advisors for further guidance.

15 For federal income tax purposes, life insurance death benefits generally pay income tax-free to beneficiaries pursuant to IRC Sec. 101(a)(1). In certain situations, however, life insurance death benefits may be partially or wholly taxable. Situations include, but are not limited to: the transfer of a life insurance policy for valuable consideration unless the transfer qualifies for an exception under IRC Sec. 101(a)(2) (i.e., the “transfer-for-value rule”); arrangements that lack an insurable interest based on state law; and an employer-owned policy unless the policy qualifies for an exception under IRC Sec. 101(j).