The rising cost of healthcare has led to an increased focus on the need for both short- and long-term savings to fund these expenses. Employers, benefit consultants, and financial advisors are seeking additional tools to help employees plan for the healthcare costs they will face throughout their lifetime, particularly during retirement years, when healthcare costs can range from $10,000 to $20,000 per year.(1)

Health Savings Accounts (HSAs) are gaining recognition as one such tool for retirement savings due to their triple tax advantage, ability to cover Medicare premiums and out-of-pocket expenses after age 65, and investment capabilities. This white paper explores the benefits of HSAs for employers and employees and explains how HSAs can be an integral part of a holistic retirement strategy.

Health Savings Accounts (HSAs) are gaining recognition as

one such tool for retirement savings due to their triple tax advantage, ability to cover Medicare premiums and

out-of-pocket expenses after age 65, and investment capabilities.

1 Sawyer, Bradley. “While health spending increases throughout adulthood for both men and women, spending varies by age.” Peterson-Kaiser Health System Tracker. May 4, 2017. Peterson-Kaiser Health System Tracker. 18 July 2017. https://www.healthsystemtracker.org/?sfid=4356&_sft_category=access-affordability,health-well-being,spending,quality-of-care#item-start

The Retirement Savings Gap

According to a 2015 U.S. Government Accountability Office study, 29 percent of Americans 55 and older do not have a retirement nest egg.(2) Those who do have retirement funds don’t have enough money to cover essential living expenses– 55- to 64-year-olds have an average of $104,000, and 65- to 74-year-olds have an average of $148,000 in savings.(3) A recent study by Health View Services estimates that a healthy 65-year-old couple retiring today can expect to pay over $400,000 (not adjusted for inflation) in healthcare expenses alone during retirement when taking into account Medicare Parts B and D, supplemental insurance, dental and vision insurance, deductibles, copays, and other out- of-pocket healthcare costs. And it’s expected that these expenses will increase by an average of 5.5 percent per year during retirement, twice the U.S. inflation rate.(4)

The retirement savings gap is a significant hurdle for many Americans, especially with thousands of baby boomers approaching retirement age each day. Increased discussion of retirement savings has improved Americans’ awareness of the financial shortfall many of them will face when it comes to saving sufficient retirement funds

According to the Employee Benefit Research Institute’s (EBRI) 2017 Retirement Confidence Survey, 45 percent of workers are ‘not too confident’ or ‘not confident at all’ that they will have enough money to cover medical expenses in retirement.(5) With awareness levels improving, there are many viable options available that allow individuals to save for retirement, including the 401(k) (Pre-tax and Roth), Traditional and Roth IRAs, Annuities, and even taxable brokerage account solutions. However, none of these options provide the triple tax advantage of the HSA.

The HSA Advantage

HSAs offer unique benefits to employers and their employees. Even though the accounts are not new (first offered in 2004), statistics show they are not fully leveraged or optimized as originally intended. With $2,506 as the average balance, 56 percent of accountholders considered spenders rather than savers, and only 3.8 percent of accountholders using investment capabilities, there are plenty of opportunities to move the needle in the right direction.(6)

Spenders vs. Savers

Not all accountholders use their HSA in the same way. One of the primary differentiators between HSA accountholders is their spending profile: savers or spenders. HSA Bank defines savers as accountholders who spend zero percent of their annual contribution and spenders as accountholders who use a portion (one percent or more) of their annual contribution to pay for medical expenses during the year. The chart shows what percentage of HSA Bank accountholders are savers (39 percent) and spenders (61 percent).

| Type of HSA User | Contributions Spent | Percent of Accountholders |

| Saver | 0% | 39% |

| Spender | 1%-24% 25%-49% 50%-99% 100%-200% Over 200% | 6% 7% 22% 14% 12% |

2 “Most Households Approaching Retirement Have Low Savings.” United States Government Accountability Office. May, 2015. United States Government Accountability Office. 18 July 2017. https://www.gao.gov/assets/680/670153.pdf

3 “Most Households Approaching Retirement Have Low Savings.” United States Government Accountability Office. May, 2015. United States Government Accountability Office. 18 July 2017. https://www.gao.gov/assets/680/670153.pdf

4 “2017 Retirement Health Care Costs Data Report.” Health View Services. June 2017. Health View Services. 18 July 2017. https://www.hvsfinancial.com/PublicFiles/2017_Retirement_Health_Care_Costs_Data_Report_FINAL_6.13_V2.pdf

5 “2017 Retirement Confidence Survey.” Employee Benefit Research Institute. 2017. Employee Benefit Research Institute and Greenwald Associates. 18 July 2017. https://ebri.org/pdf/surveys/rcs/2017/RCS_17.FS-1_Conf.Final.pdf

6 Per HSA Bank’s book of business as of December 31, 2016. The industry average balance per Devenir is $1,845 as of December 31, 2016.

The Benefits of Health Savings Accounts

HSAs are triple tax-advantaged. Funds are contributed pre-tax and grow tax-deferred. Withdrawals are made tax-free when funds are used for IRS-qualified medical expenses.

There is no use it or lose it clause with HSAs. Funds roll over year to year and accountholders retain the money if they leave their employer.

HSA funds can be invested in mutual funds, stocks, and other linked investment options as part of a long-term retirement strategy.

At age 65, HSAs can be used to pay for Medicare Parts A (when applicable), B (individuals may reimburse themselves for premiums deducted from Social Security), C (Medicare Advantage), and D (prescription drug coverage), tax-free and penalty-free.

Qualified long-term care insurance premiums can be reimbursed from an HSA tax-free up to federal tax-deductible limits (increases with age).

HSA funds can be used to reimburse medical expenses incurred any time after the HSA is established, even in retirement, many years after an expense has occurred.

Anyone can contribute to the HSA on behalf of the accountholder, including an employer or extended family member.

HSAs vs. FSAs

It is common for employees to confuse HSAs with Flexible Spending Accounts (FSAs), the more tenured health account, or even an employer-offered Health Reimbursement Arrangement (HRA). While FSAs and HRAs can play an important role in helping employees pay for healthcare expenses during employment years, the HSA is the best option for managing long-term healthcare expenses when paired with a high deductible health plan (HDHP). To learn more about the specific differences between HSAs, HRAs, and FSAs, visit: hsabank.com/accountoptions.

HSA Benefits for Employers

Employers are increasingly turning to lower cost, high deductible health plans (HDHPs) with HSAs as part of their benefits offering to attract and retain employees. Of U.S. employers with 5,000 or more employees, 89 percent now offer an HSA-qualified healthcare plan. When taking all employer sizes into account, 70 percent offer this benefit.(7) Additionally, employers are recognizing the significant role HSAs play as a valuable tool for retirement saving. A recent survey showed 75 percent of employers view HSAs as part of a successful retirement benefits strategy.(8)

HSAs help close the retirement savings gap for employees by funding short-term medical expenses not covered by the company-sponsored health plan. They also provide the benefit of corporate tax savings to employers. Due to the pre-tax treatment of employer and employee contributions, HSA funding lowers the employer’s payroll, which in turn reduces FICA, state and federal unemployment, and worker’s compensation contributions.

For a clearer picture of what employers could save, look at the following example based on an employee who uses payroll deduction to make a $100 bi-weekly, pre-tax HSA contribution.1

Employer Savings Potential

| FICA Savings (7.65% employer FICA contribution) | $7.65 |

| Unemployment Contribution (State) | $3.002 |

| Unemployment Contribution (Federal) | $0.803 |

| Workers’ Compensation Savings | $2.004 |

| Total Savings per Pay Period | $13.45 (13.45% of contribution) |

| Total Annual Savings Per Employee | $349.70 ($13.45 x 26) |

1 The cost savings example is not tax advice and is meant for illustrative purposes only. Actual savings may vary.

2 State unemployment contributions vary by state and employer claim experience. 3% is the approximate average starting rate for unemployment contributions.

3 Federal unemployment contributions are 0.8% for the first $7,000 of employee payroll.

4 Workers’ compensation insurance rates vary by state and region and are affected by employee class, type of job, and employee claim experience. 2% was assumed as the approximate average insurance rate for workers’ compensation.

Given the tax treatment of contributions, the potential for lower premiums associated with an HDHP (when compared to the average traditional PPO plan), and the employer’s desire to help close the retirement savings gap, many employers are choosing to make contributions to their employees’ HSAs.

7 “Health Savings Accounts and Retirement Plans.” Plan Sponsor Council of America. 2017. Plan Sponsor Council of America. 18 July 2017. https://www.psca.org/survey_HSA_2017

8 “Health Savings Accounts and Retirement Plans.” Plan Sponsor Council of America. 2017. Plan Sponsor Council of America. 18 July 2017. https://www.psca.org/survey_HSA_2017

HSA vs. 401(k) for Healthcare Saving

The average account balance of HSAs has remained stable over the last five years.(9) The accounts are traditionally viewed as a spending account rather than a long-term savings account like the older and widely accepted 401(k) plan. Additionally, the contribution limits for HSAs are lower than 401(k)s: HSA 2017 IRS contribution limits are

$3,400 for individuals and $6,750 for families with a $1,000 catch-up contribution for those 55 and older. The 401(k) 2017 contribution limit is $18,000 with a $6,000 catchup contribution for those 50 and older. The average benefits enrollee views the HSA as an account to pay for near-term healthcare spending and the 401(k) for retirement savings. This represents a significant opportunity for consultants, employers, and employees who may be struggling to save enough for retirement.

Case Study

Let us take a closer look at these two accounts and the role they play in saving for healthcare expenses during both working years and retirement from the perspective of John Smith. John is 65 years old, has been married to Susan for 40 years, has two children, and now enjoys the company of four grandchildren. John plans to retire this year and has been very diligent with planning and saving for retirement. John feels fortunate he is worked for an employer who offered him a 401(k) plan and an HDHP with an HSA and made contributions to both accounts on his behalf. Due to John’s solid savings habits, he’s accumulated a healthy balance of $250,000 in his 401(k) plan and leveraged his HSA for 13 years as a long-term savings account to save

$100,000, including $19,500 of tax savings because of tax- deferred growth.

This assumes an average annual savings of $5,000 per year for 13 years, a rate of return of 6 percent, federal and state income tax brackets of 25 and 5 percent respectively, and no fund withdrawals.(10) When John retires this year, he’ll need to make decisions about when, how, and where to withdraw money to replace his working-days paycheck.

While there are many factors for John and his financial advisor to consider, because he’s taken advantage of the triple tax advantage of an HSA, John can take money from his HSA tax free when paying for Medicare premiums and out-of-pocket IRS-qualified medical expenses in retirement. And, because John has saved receipts for IRS-qualified medical expenses paid for outside of his HSA before he retired, he can take money tax free from his HSA at any time to pay for any expenses so long as his withdrawals don’t exceed the total amount of the receipts he’s saved.

John can take money from his HSA tax free when paying for Medicare premiums and out-of-pocket IRS-qualified medical expenses in retirement

Additionally, because John takes good care of himself, it’s possible he won’t need all of the money in his HSA for IRS-qualified medical expenses. He can still withdraw the money after age 65, penalty free, with the same tax treatment as a 401(k) distribution (i.e. federal and state tax apply). Additionally, by designating Susan as the beneficiary of his HSA funds, if John dies before Susan, any remaining HSA dollars would be hers to use tax free for IRS- qualified medical expenses.

9 Remjeske and Robb. “2016 Year-End HSA Market Statistics & Trends.” Devenir Research. February 2017.

10 “Health Savings Calculator.” HSA Bank. 2017. HSA Bank. 31 July 2017. https://www.hsabank.com/hsabank/education/hsa-savings-calculator

The 401(k) is an excellent tool for saving for retirement (especially if employer matching is included), but John made a smart decision to leverage the tax benefits of the HSA. When the tax implications are considered for withdrawals from both accounts, the HSA provides a greater benefit when paying for IRS-qualified medical expenses.

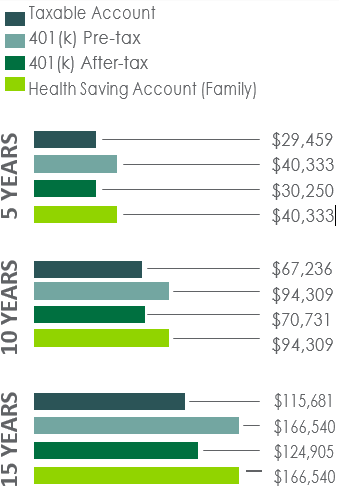

The funds available for healthcare costs from the HSA is 33 percent larger than the 401(k) after taxes and 44 percent larger than the taxable account.

The Schwab Center for Financial Research estimates that the funds available for healthcare costs from the HSA is 33 percent larger than the 401(k) after taxes and 44 percent larger than the taxable account.(11) 11 With this knowledge, employees can leverage the power of both the HSA and the 401(k) plan as two key components of a holistic retirement plan.

HSAs and 401(k)s: Better Together

A common misconception is that individuals have a set amount of funds that they can put aside for retirement, and that they will have to choose between the 401(k) and the HSA. A recent study found that people using both a 401(k) and an HSA had a higher savings rate than those using only a 401(k) (10.6 percent of their 2016 salary compared to 8.2 percent). Additionally, 88 percent of people who opened an HSA maintained or increased their 401(k) savings after they enrolled in an HSA.(12)

The effects of taxes on various investment accounts

Schwab Center for Financial Research. For assumptions, visit https://www.schwab.com/insights/retirement/health-savings-accounts-maximizing-your-hsa-retirement-savings

11 Aruldoss and Williams. “Health Savings Accounts: Maximizing Your HSA for Retirement Savings.” Charles Schwab. March 8, 2017. Charles Schwab. 18 July 2017. https://www.schwab.com/insights/retirement/health-savings-accounts-maximizing-your-hsa-retirement-savings

12 “Fidelity Retirement Savings Analysis: Savings Rates, Account Balances Climb to Record Levels in First Quarter.” Fidelity Investments. May 12, 2017. Fidelity Investments. 18 July 2017. https://www.fidelity.com/about-fidelity/employer-services/fidelity-retirement-savings-analysis

Education is an Ongoing Process

There has been progress in terms of individuals saving and investing more HSA funds. However, educating individuals about the benefits of an HSA and how it fits into a holistic retirement strategy is an ongoing process. In the first quarter of 2017, HSA Bank saw a 100 percent increase in HSA dollars moving from the FDIC-insured cash account into self-directed investments when compared to the same quarter a year earlier.

Key factors to consider for a powerful HSA investment offering include the ability to set up recurring transfers to an investment account and a broad set of high-quality and competitively priced investment options with low or no investment minimums to get started.

This is an early indication that more account holders are turning to HSAs to help support their long-term savings goals. According to the most recent Devenir industry report, HSA investments across the industry saw year over year growth of 29 percent, reaching an estimated $5.5 billion in December 2016(13).And those with an investment account have an average total HSA balance (investments and cash account) of nearly $15,000, up from $12,995 only two years earlier.(14)

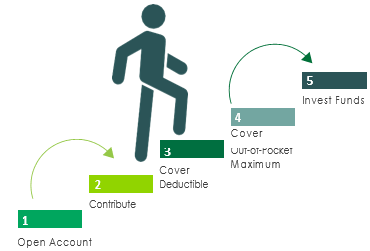

Steps to Maximizing an HSA

Want more tips on communication best practices?Visit our Employer Resource Center at hsabank.com/resourcecenter for marketing and administrative tools and support related to HSA programs.

Although there has been progress in the amount of funds put toward saving and investing, most HSA accountholders (96 percent) do not open an HSA investment account and start saving for retirement immediately upon enrollment. Employers need to leverage their HSA service provider to design and implement a consistent, ongoing, and personalized communication strategy to incrementally educate and ultimately change account utilization behaviors throughout the five phases of HSA ownership.

Using a combination of multimedia tools including video, emails, direct mail, infographics, and online tools, such as savings calculators to appeal to unique learning styles, accountholders should first be educated on the benefits of opening and funding the account.

For the accountholders who have progressed through these two critical steps, the next round of education should focus on accumulating a balance to cover the health plan’s deductible and out-of-pocket costs. Finally, accountholders may be educated on the power of investing to save funds for a healthy retirement. Key factors to consider for a powerful HSA investment offering include the ability to set up recurring transfers to an investment account and a broad set of high-quality and competitively priced investment options with low or no investment minimums to get started. Many financial advisors and their employer clients also value the flexibility of an open-architecture investment solution that gives employees access to thousands of high-quality and low-cost options including exchange-traded funds (ETFs) and individual stocks and bonds.

13 Remjeske and Robb. “2016 Year-End HSA Market Statistics & Trends.” Devenir Research. February 2017.

14 Remjeske and Robb. “2016 Year-End HSA Market Statistics & Trends.” Devenir Research. February 2017.

Conclusion

It is evident that the retirement savings gap facing Americans is a serious problem that needs to be addressed using a collaborative approach involving individuals, employers, benefit consultants, and advisors.