The federal funds rate picked up another quarter point on Wednesday, September 26, as the Federal Open Market Committee unanimously approved its third increase of the year to a range between 2% and 2.25%. In a statement released last Wednesday, data reviewed by the Committee indicates a strengthening labor market and economic activity rising at a strong rate since the last Federal Open Market Committee met in August. Strong job gains, a low jobless rate, and strong household and fixed investment were factors taken into consideration. Inflation remains near 2 percent and indicators of long-term inflation expectations remain steady.

However, it may not be the last rate hike of 2018. Officials indicate one more increase before the end of the year as officials strive to keep the strong economy on course (see What moved the markets).

What they said

Nick Timiraos writing for the Wall Street Journal reported Fed Chairman Jerome Powell said in a news conference following the Committee announcement that, “Our economy is strong,” and “The overall growth outlook remains favorable.”

Each up-tick in the federal funds rates raises borrowing costs for businesses and consumers, which could slow corporate spending and housing demand. However, rates remain low and businesses and consumers continue to benefit from tax reform and a strong labor market.

Projecting forward

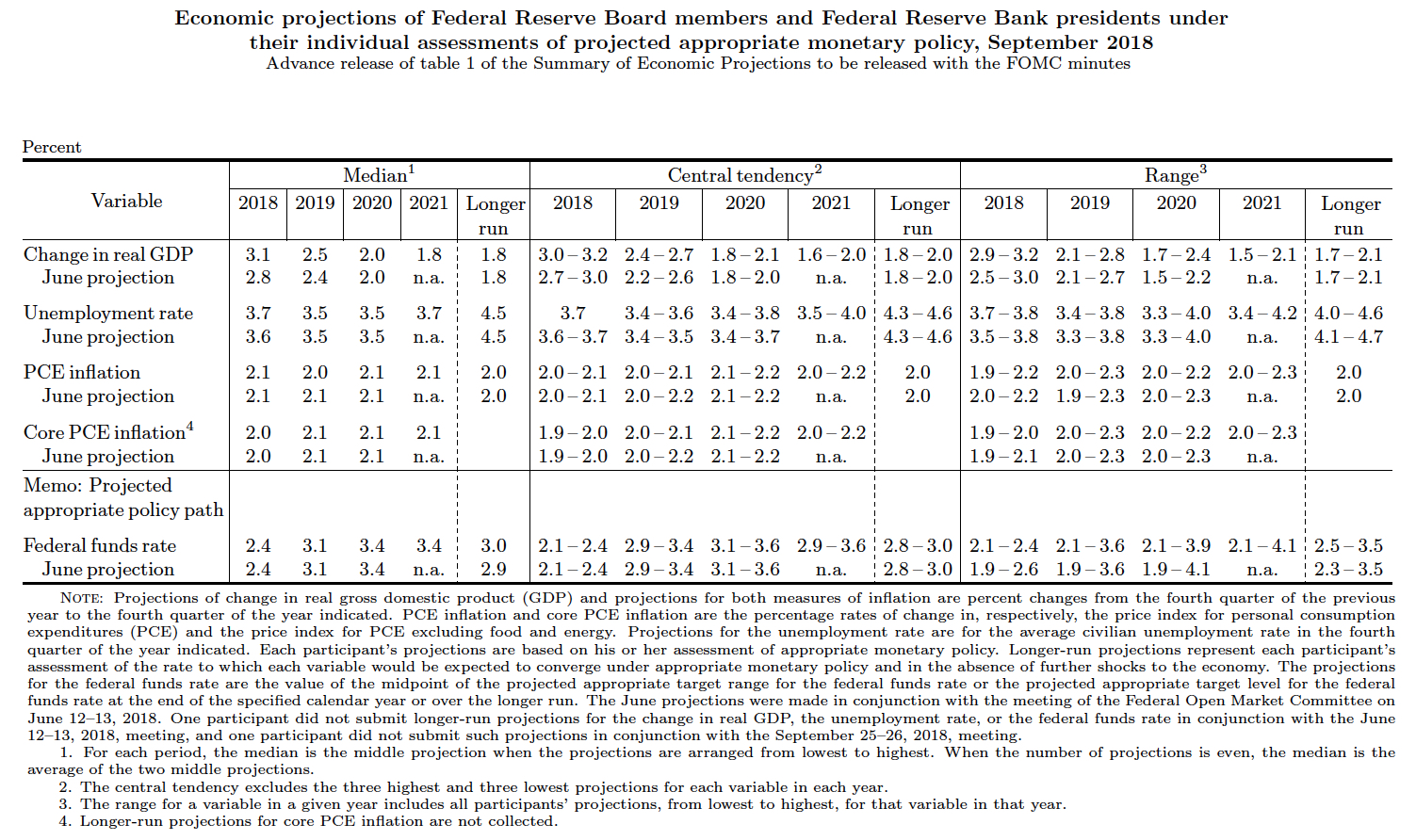

Growth projections overall remain favorable, as seen in the Economic Projections (PDF) issued by the Fed below. Fed officials estimate:

• Gross domestic product to rise 3.1% this year and is forecasted to be 2.5% for 2019

• The jobless rate of 3.7% this year is expected to dip slightly next year to 3.5%

• Inflation of 2.1% this year is expected to settle down to the Fed’s target of 2% in 2019

Labor market conditions, inflation rates, and financial and international developments are impacted whether short-term rates inch higher. But longer-term, CNBC reports that officials see federal funds rates rising three times in 2020 and another in 2021 before settling back down to 3% over the long run. Please contact us if you have any questions. We will keep you posted.

Read More

- Federal funds rate held steady as economic activity is “strong”

- Short-term borrowing rates inch higher

Follow Us on LinkedIn

Photo by Louis Velazquez on Unsplash

This commentary on this website reflects the personal opinions, viewpoints and analyses of the Wambolt & Associates employees providing such comments, and should not be regarded as a description of advisory services provided by Wambolt & Associates or performance returns of any Wambolt & Associates Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Wambolt & Associates manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Wambolt & Associates provides links for your convenience to websites produced by other providers or industry related material. Accessing websites through links directs you away from our website. Wambolt & Associates is not responsible for errors or omissions in the material on third party websites, and does not necessarily approve of or endorse the information provided. Users who gain access to third party websites may be subject to the copyright and other restrictions on use imposed by those providers and assume responsibility and risk from use of those websites.