With the market entering bear territory in 2018 and a projected economic slowdown in 2019, the new year might bring some unwelcome challenges to freelancers and independent contractors, who rely on project-based work to pay the bills. In a bear market, falling stock prices and pessimism can create fear, causing financial ripples throughout the free market system. Bear markets often coincide with a downturn in the economic cycle.

Luckily, there are proven steps you can take to invest, protect and plan for your financial health, regardless of economic conditions. By exploring available options, you can select those that best fit your value, vision and goals for investing hard-earned wealth. These tools and resources can help get your money working for you, in good economic times and bad.

Let’s face it, there are challenges that freelancers and independent contractors face that W-2 employees may not. Projects may not pay consistently, or work projects may slow to a trickle, leading to inconsistent cash flows. Follow these strategies to build more wealth from what you bring home.

Strategy 1: Manage liquidity

There are two primary ways to structure your portfolio to generate cash when you need it.

- Passive. Increase revenue streams by looking into investments that can generate cash for you. During cash valleys, the dividends and interest generated by these investments are a great additional source of income, without dipping into your principle. When you are flush, the money you don’t use day-to-day is simply reinvested.

- Active. Invest in more liquid assets, such as publicly-traded stocks, bonds, real estate investment trusts, and other assets that can easily be sold. If you buy an individual stock such as Apple or a share in a mutual or exchange traded fund today, you can sell it tomorrow. However, if you buy into a hedge fund or non-public business, cashing out when you are in need may be problematic.

Read more: What does it mean to own a moderately balanced portfolio?

Strategy 2: Fund retirement

As a freelancer or independent contractor, your tax profile differs from W-2 employees. You are required to pay quarterly taxes and have different retirement savings vehicles available to you.

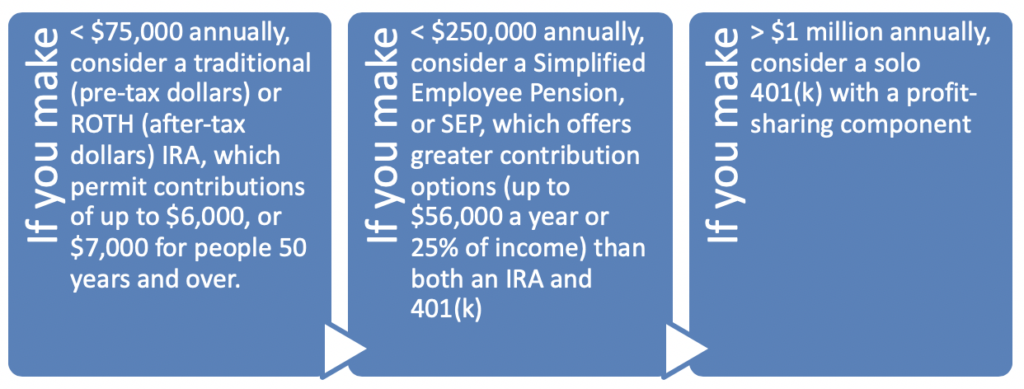

Selecting the right retirement vehicle is largely a function of how much you want to save and your tax bracket. Let’s break it down by income levels.

A freelancer making a maximum of $25,000 a year might prefer to fund retirement with after-tax dollars in a ROTH IRA. A freelancer making more, up to $75,000 a year, may choose to fund retirement with a traditional IRA to take advantage of the tax deduction. Contributions are limited in both IRAs to $6,000 for the under-50 crowd and $7,000 for individuals over the age of 50.

For higher-income earners making up to $250,000 a year, consider another alternative, a Simplified Employee Pension, or SEP. A SEP plan offers greater contribution options than an IRA or individual 401(k).

High-earners might consider a 401(k) profit-sharing plan. This plan lowers an individual’s tax burden immediately and only needs to be in place for three years to reap the greatest rewards.

The profit-sharing component allows you to tax-efficiently take profits out each year, while the 401(k) component allows you to make pre-tax contributions for retirement (up to $19,000 for taxpayers under the age of 50 and $25,000 if 50 and over). Two recent examples from our firm include:

- The two owners of a small, profitable engineering firm took 50% of annual profits out in pre-tax dollars to deposit in their retirement savings. The other 50% was distributed to employees on a vesting schedule, creating loyalty that binds workers to the company.

- A realtor closed a large commercial development, resulting in a $1 million profit on that project alone. The realtor put $200,000 of pre-tax profit into a 401(k), and distributed a portion of the profits to the profit-sharing component of the 401k plan, considerably lowering the tax owed from this project.

Read more: Stacking retirement plans accelerates savings and reduces taxes

Strategy 3: Protect what you own

Wealth needs to be protected. In the wealth management arena, the term “asset protection” has different meanings and uses. Generally, it shores up capital against threats from litigation, market turns, fraud and more.

While there is no way to guarantee asset safety, there are asset protection strategies that can help shield your assets from unauthorized access. This might include insurance binders, trusts and offshore accounts, or investment portfolio strategies, such as bulking up on bonds and non-correlated asset classes to hedge against market risk. Talk to a wealth advisor about how to best minimize risks to your assets.

Read more: Lawsuits, Bears, and Bad Actors: Make Protecting What You Own a Priority

Strategy 4: Integrate tax planning

Every financial decision has tax and legal considerations. Minimize your tax bill by understanding what those consequences will be before making key decisions. This is especially important for high-income earners that have more to lose when taxes are ignored.

Work with an investment advisor that knows your tax situation and works in tandem with a tax specialist so tax considerations are comprehensively integrated into your financial plan.

Read more: Take a bite out of your tax bill with tax-efficient solutions

Strategy 5: Point your financial compass in the right direction

Personal finances are one of the most intimate and emotional conversations we can have with others, which is why so many women find it difficult to talk about their financial affairs. Learn how to talk money with a network of like-minded family, friends, and trusted advisors. These outlets can connect you to resources and solutions that support your financial health for a lifetime. Join the Women, Wealth & Wisdom network to make connections and get additional resources for achieving your long-term financial goals.

The earlier you get the conversation started, the healthier your asset portfolio will be. Start 2019 on the right foot and get your financial compass pointed in the right direction.

Watch now: Where’s your financial compass pointed?

About the Author

Cindy Alvarez is a Senior Wealth Management Advisor at Wambolt & Associates in Colorado, where she has been helping clients achieve their financial goals since 2012. She is also the driving force behind Women, Wealth & Wisdom, a women-only educational series and group mentoring program for building and preserving wealth. Click here to join with other women taking control of their financial future. Cindy can be reached at cindy.alvarez@wamboltwealth.com or 720.962.6700.

Follow Us on LinkedIn

Photo by Andrew Neel on Unsplash

This commentary on this website reflects the personal opinions, viewpoints and analyses of the Wambolt & Associates employees providing such comments, and should not be regarded as a description of advisory services provided by Wambolt & Associates or performance returns of any Wambolt & Associates Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Wambolt & Associates manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Wambolt & Associates provides links for your convenience to websites produced by other providers or industry related material. Accessing websites through links directs you away from our website. Wambolt & Associates is not responsible for errors or omissions in the material on third party websites, and does not necessarily approve of or endorse the information provided. Users who gain access to third party websites may be subject to the copyright and other restrictions on use imposed by those providers and assume responsibility and risk from use of those websites.