When investing your hard-earned money, it’s natural to have a certain level of anxiety about your decisions. Add to that the proliferation of financial pundits, the constant stream of dramatic digital media headlines known as “clickbait,” and the scare tactics used by the media to grab ratings, and it’s no wonder that investors can easily lose sight of the bigger picture. In a time when we can order nearly anything to arrive at our door within two days or we can ‘Google’ the answer to any question within seconds, our expectations for quick results have grown, making it more challenging to be patient as market dynamics unfold.

Having a wealth management team that will help you remain patient and focused on the objectives in your defined financial plan can save you considerable time and consternation. Equally as important, an experienced advisor can provide facts to aid you in making better informed, less emotionally reactive decisions.

In his book “The Emotional Investor,” Jay Mooreland CFP® cites 10 key behavioral influences that lead many people to consistently poor investment decision-making:

- “We are physiologically hardwired to make hasty decisions without much thought.

- Market volatility can cause us to become emotional and lose our sense of where we are and where we want to go.

- We like instant feedback (gratification), which influences us to act based on short-term outcomes.

- The aversion to uncertainty makes us seek some certainty, even if it is just an illusion—such as with market predictions.

- We tend to micromanage our investments because it makes us feel in control.

- The media often causes us to focus on short-term events and makes it difficult to differentiate important news from noise.

- We believe we are better at investing than we really are.

- Our decisions are often influenced by reference points such as our profit/loss on an investment and past performance.

- We detest loss and may make unwise decisions in an attempt to avoid loss.

- Our perception can be faulty.”

Many investors spend an inordinate amount of their time focusing on issues out of their control – market fluctuations, interest rates and government policy changes. That’s why Wambolt & Associates Owner and Senior Wealth Management Advisor Cindy Alvarez reminds clients of the value of history. “We don’t have a crystal ball to tell us what’s going to happen, but we do have the history of bear market corrections and bull market rallies and we can extract wisdom from these patterns,” said Alvarez. “When a client says, ‘but this time it’s different,’ I reply, ‘it’s always different.’ When some perceive the markets as chaotic, we can view history and see that they’re actually quite predictable.”

How the markets perform in a presidential election year is one example of a situation where the prognosticators can stir restlessness among investors without a basis in history. “Between 1928 and 2020, the stock market closed down only four times,” explains Alvarez. “In all other years, the market closed up an average of 11.6 percent.”

Wambolt advisors often take on the roles of educator and behavioral coach, providing guidance and perspective when markets take a seemingly unexpected turn and a client’s anxiety escalates. “We’re all afraid of something,” said Alvarez. “It’s how we manage fear that can make a difference in our outcomes. I like being a coach – educating our clients and reminding them of the ultimate results they’re trying to achieve.”

The Wambolt approach to advising clients begins by ‘leaning in’ and listening to what priorities drive them. “Before we design an investment plan, we spend time truly getting to know our clients and their financial goals,” said Alvarez. “Every client is different, and each has their own level of risk adversity and bases of fear. That’s why we follow Greg Wambolt’s motto of ‘we guide, and you decide.’”

Alvarez says most savvy investors avoid trying to micromanage their portfolios. “Successful investors don’t look at their portfolios but once or twice a year. They treat their brokerage investments much like their 401(k) plans… and that’s a wise strategy for finding balance.”

Cindy Alvarez, Owner, Senior Wealth Management Advisor, Wambolt & Associates

Election year markets are always a quandary, as candidates propose economic and fiscal plans to boost the nation’s economy. Political parties have had nearly no bearing on market performance during election years as far back as 1928.

Federal Reserve policy during an election year can be construed as politically influenced, even though the Fed’s stated disconnect from the administration and political sway is clearly defined. The Fed has raised interest rates 60% of election years since 1928, with varying political parties in office. The chart below shows the positive S&P500 returns in reference to who won the White House.

A multitude of factors affect presidential elections, including fiscal and tax policies, foreign policy initiatives, social programs, and economic stimulus objectives. Congressional control of the House and Senate are also a factor during elections, as some states strive to either synergize or disconnect from Federal initiatives.

Sources: Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/SP500

The Federal Reserve raised rates eleven times between 2023 and 2022, increasing the Fed Funds rate from 0% at the beginning of 2022 to 5.5% at the end of 2023. Expectations are that the Fed will begin easing rates in 2024, reversing its tightening monetary policy. Lower consumer and mortgage rates are expected to materialize as the Fed eases.

Fed influenced rate reductions among other central banks globally is creating a lower rate scenario in 2024. The European Central Bank (ECB) as well as the central banks of Canada and England signaled a continued easing of rate policy in 2024.

A unique dynamic started to occur in the 4th quarter of 2023, with Treasury yields and commodity prices falling in tandem. Some economists perceive the dynamic as deflationary in nature, adding to an eventual lower rate environment. Deteriorating inflation concerns have also led the Fed to project possible lower rates as the year progresses. The yield on the 10-year Treasury bond ended 2023 at 3.8%, down from 4.95% in October.

Sources: Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/FEDFUNDS

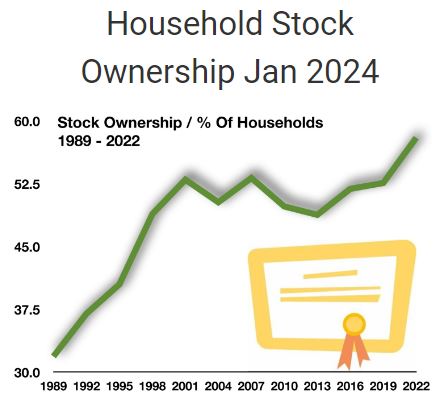

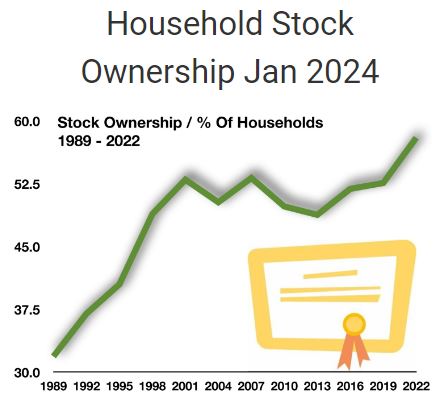

A recent survey conducted by the Federal Reserve, called the Survey of Consumer Finances has identified that 58% of U.S. households own stocks, up from 53% in 2019. The findings released in the fall of 2023, reflect the most available data from 2022. The same survey identified that 52% of households owned stocks in 2019, validating a gradual increase in stock ownership over the past few years.

Equity ownership varies among households, varying by age and income across the country. The survey did find that the bulk of equity holdings remains concentrated with older and higher income households. The survey includes consumer household accounts holding individual stocks, mutual funds, and Exchange Traded Funds (ETFs).

Sources: https://www.federalreserve.gov/publications/files/scf23.pdf

Despite efforts to curtail oil consumption and production of domestic oil, the U.S. achieved another record producing year in 2023. With over 13 million barrels of oil produced per day, the U.S. continues to be the world’s largest producer, eclipsing Russia and Saudi Arabia as a distant second and third. The United States has ranked as the world’s top oil producer since 2018.

The U.S. shale industry, known for its fracking technology to extract oil from shale rock formations, has continued to surprise the world oil markets with its resistance to varying prices. U.S. drillers have thus far been able to beat Saudi Arabia’s “pump and dump” strategy over the past few years to lower oil prices to maintain market share.

Global demand for oil has been steadily increasing for the past two decades, with a slight pullback during the pandemic in 2020. The broadening demand has been from both developed and emerging economies, as the reliance on crude oil and gasoline remains intact worldwide. The United States has become one of the top five exporting oil countries, with over 10 million barrels exported each month, representing two thirds of total U.S. production.

Source: U.S. Energy Information Administration; U.S. Field Production of Crude Oil