Every good business, like every good baseball team, has an exceptional utility infielder who covers all the bases and is a go-to for the team. Meet Wambolt’s Director of Operations Regina Franz.

Whether training the administrative and junior associates teams, counseling a client, or assisting a wealth management advisor, Regina is a reliable team player in the Wambolt & Associates line-up. Best of all, she is excited by the many roles she plays for the firm. “I like challenges and finding solutions,” said Regina. “Talking to clients is interesting and rewarding and I am motivated by discovering the best way to serve them.”

Regina’s multi-faceted job includes coordination of day-to-day operations such as onboarding new clients, handling money transfers, and interfacing with financial custodians who partner with the firm. Regina works in tandem with Wambolt advisors and maintains regular contact with clients, to her delight.

Regina enjoys annual check-ins with clients to assist them with their required minimum distributions from their IRAs. “I get to know our clients and their stories,” she says. “We often share a few laughs while getting the job done.” Regina is available to clients during difficult times, too. She gently guides them through the process of merging accounts and handling estate matters because of a death or other major life event.

Making client relationships a priority is one of the reasons Regina chose to join the Wambolt team. She was drawn to Wambolt’s philosophy of putting the needs of the clients first.

“We are a boutique firm and an established Registered Investment Advisor, meaning that we design wealth management plans according to the goals of our clients, independent of any firm interests,” she explains. “All options are on the table – there is no one set strategy. Plus, we review the plan on a regular basis to make sure it is working for the client. It’s never ‘one and done.’”

Regina values playing her position on a cohesive and multi-generational team. “It’s great to be on a respectful team with a generational mix, where we learn from each other,” she says. “The wisdom of experience offered by our seasoned team members and the fresh perspectives and skills coming from a younger group blend well to deliver the best outcomes for our clients.”

Regina loves being part of a team in her spare time, too, as a long-standing player in the Evergreen softball league. Not surprisingly, Regina is an avid baseball fan, first backing the Chicago Cubs and now a loyal Colorado Rockies supporter. She and her husband take advantage of traveling, deep sea fishing, kayaking, golfing and skiing as well.

A first generation American, Regina has a long list of accomplishments which includes raising a family, living internationally, and working in the corporate travel industry. With such a strong, diverse portfolio of life experiences it is no surprise that Regina is a standout on the Wambolt team roster!

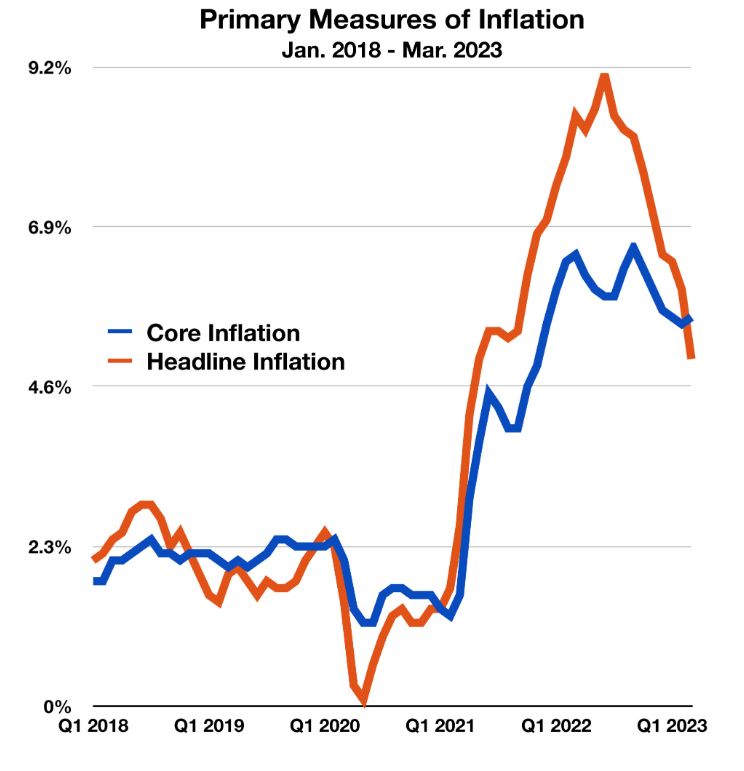

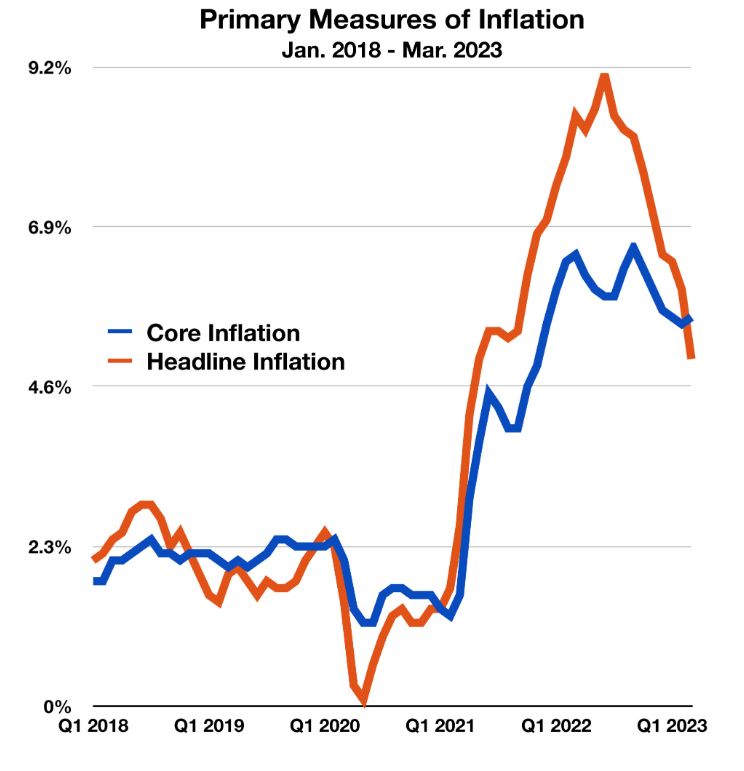

Following historically high inflation throughout 2022, we have now had nine consecutive months of decreases in the Consumer Price Index (CPI), which has driven inflation to its lowest level since May 2021. Inflation in March measured at 5.0%, 1% lower than the month prior and over 4% lower than the highs in 2022. Headline inflation is a broad measure that closely represents the basket of goods and services consumed by most households. Core inflation is the change in the costs of goods and services but does not include those from the food and energy sectors.

Across 2022, volatility in gasoline, food, and housing all played crucial roles in the costs of daily expenses. This drove inflation as high as 9.1% in 2022, a 40-year high last seen in 1981. At its current level, headline inflation is 3.2% greater than core inflation, which does not consider the effects of the more volatile food and energy costs. However, while the headline inflation rate has significantly decreased since 2022, core inflation has proven quite resilient. In March 2023, when headline inflation was 5.0%, core inflation remained at 5.6%, close to its previous highs. March 2023 was also the first occurrence of core inflation being higher than headline inflation since December 2020.

Sources: Bureau of Labor Statistics, Federal Reserve Bank of the U.S.

While fraud, in general, has been significantly increasing in recent years, people ages 60 and above have become major targets of fraud. Amidst changing technological advancements, an increasing number of schemes are being employed to target and defraud elderly people.

In 2022 alone, people over 60 years old lost $3.1 billion due to fraudulent schemes. This represents an 84% surge from 2021 and more than triple the level of fraud reported in 2020. In the past five years alone, elderly fraud has skyrocketed by over 800%. Victims have lost $35,000 on average, yet over 5,400 victims lost more than $100,000.

The single-most disastrous schemes of 2022 were due to call centers and fraudulent customer support calls. Over 17,800 complaints were filed with the FBI concerning these schemes in 2022, affecting victims over the age of 60 and losing more to these scams than all other age groups combined. These scams prey upon elders’ lack of familiarity with new technology to successfully defraud.

An additional category of fraudulent activity includes the non-delivery or nonpayment of items, specifically those advertised on social media where false advertisements are rampant. Many older adults also fall victim to compromised email accounts, which could be used to conduct an unauthorized transfer of funds. Emerging forms of fraud have also included cryptocurrency schemes, which have defrauded elders of over $1 billion in 2022.

To avoid these schemes, the FBI suggests that elders be cautious of unsolicited phone calls and resist callers’ pressure to act immediately. These are both signs of scammers, who create a sense of urgency to produce fear and lure elders to pay.

Sources: Federal Bureau of Investigation, FBI Internet Crime Complaint Center.

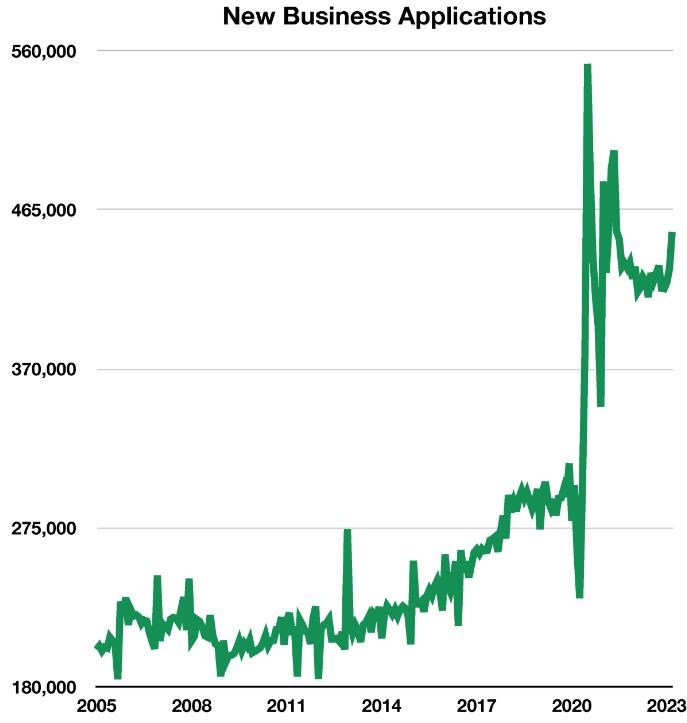

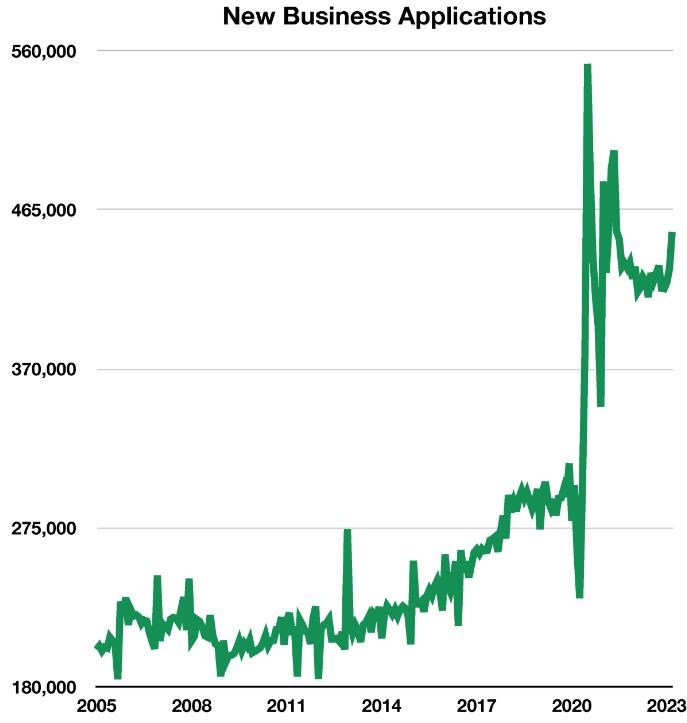

While millions of workers were suddenly faced with unemployment at the spark of the COVID-19 Pandemic, a shift to remote work has shown ripple effects throughout the labor market. One of the primary effects of the ability to work virtually and the need for additional income security has been new business applications, a barometer of the self-employed workforce.

While business applications had been trending upward in the past decade before the pandemic, 2020 saw a historic surge in business applications. Workers, faced with losing their jobs due to the pandemic’s vast disruption, looked to open their own businesses in a mass wave. In the summer of 2020, monthly business applications reached a historic level of 550,000. This was nearly double the level of business applications in late 2019 and early 2020, just months before the pandemic struck.

While the expansion of new businesses has slowed since 2020, business applications are still significantly higher than pre-pandemic levels. March of 2023 saw over 450,000 new business applications, an increase of over 60% from pre-pandemic 2020. There has been no month since the pandemic with a lower level of business applications than before the pandemic. There has been a minimum of 400,000 new business applications each month for the past 27 consecutive months.

Sources: U.S. Census Bureau, Federal Reserve Bank of St. Louis.