For Eleni Yeros, wealth management advising is anything but transactional. It’s all about relationships, education, problem solving and collaboration. “I love creating a financial blueprint that brings something fresh to a client’s eyes,” she said.

Eleni has been inspired to help clients reach their financial goals since beginning her Wambolt & Associates career as an intern in 2018. In the years that have followed, her expertise has grown, and her enthusiasm has deepened.

“As we collect data to determine how best to advise our clients, it goes way beyond discovering their risk tolerance and financial situation,” says Yeros. “It’s getting to know how they think, what makes them tick. We dig deeper to learn what goals they have for their family, the lifestyle they seek in retirement, and what truly matters to them at the end of the day.”

In her client-facing role, Eleni helps to navigate the complexities of financial, tax, estate, and investment issues to outline specific, actionable steps they can take to achieve their wealth management goals. She appreciates the firm’s multidisciplinary approach and the ready access to tax, legal and insurance expertise within the firm.

“We are very team oriented, and operate as a family,” said Eleni. “As a boutique firm, we all wear different hats and we’re willing to step up and assist each other so our clients are well served. As a fiduciary, Wambolt is always working in the best interests of their clients without conflicts of interest tied to fee-based financial products.”

Eleni works closely with Senior Wealth Management Advisor Cindy Alvarez whom she met through a friend who attended Cindy’s financial workshop for women on the CU campus. Shortly thereafter, the two women became friends and close colleagues, with Cindy serving as Eleni’s professional mentor.

“In addition to her natural talent for building relationships with our clients, Eleni has elevated our game by introducing us to new technological capabilities and enhancing our operational practices,” said Alvarez. “It’s been a privilege to watch her grow into a leader at our firm.”

Eleni’s affinity for the financial world was cultivated by her studies at the University of Colorado Leads School of Business. She has made education and professional development top priorities, having earned her Series 65 License and Certified Financial Planner™ designation.

In her free moments, Eleni enjoys skiing, spending time with family and friends, exploring the restaurant scene, and travel – having visited more than 20 countries and five continents. With her infectious spirit, loyalty to her team and encouragement of her clients, it is no surprise that Eleni was a CU cheerleader. She roots for her colleagues and clients every day!

Did you know that if you or your spouse were age 65 or older on the last day of 2022, or if you are a Disabled Veteran or Gold Star Spouse, you may qualify for a reduction in the property tax valuation of your primary residence?

For Seniors, general qualifications include owning and occupying the home as the primary residence of the individual(s) for 10 years and turning 65 on or before December 31, 2022.

For those who qualify, 50 percent of the first $200,000 of actual value of the applicant’s primary residence is exempted.

Requirements vary slightly for Disabled Veterans, & Gold Star Spouses and the deadline for this application is July 1, 2023.

Please note that claiming the exemption may cause any Income Qualified Senior Housing Income Tax Credit to be disallowed for those with an Adjusted Gross Income of $75,000 or less. Please see https://tax.colorado.gov/income-qualified-senior-housing-income-tax-credit for important information on this prior to applying for the Senior Property Tax Exemption.

For more information, please refer to https://agingstrategy.colorado.gov/sites/agingstrategy/files/Application%20Form%20Senior%20Property%20Tax%20Exemption.pdf

Or contact Evan Coats, our new Tax Analyst in our office via email (evan.coats@wamboltwealth.com) or via telephone at 720-962-6700.

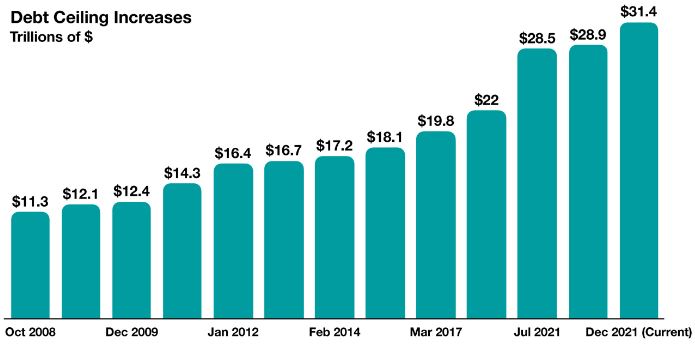

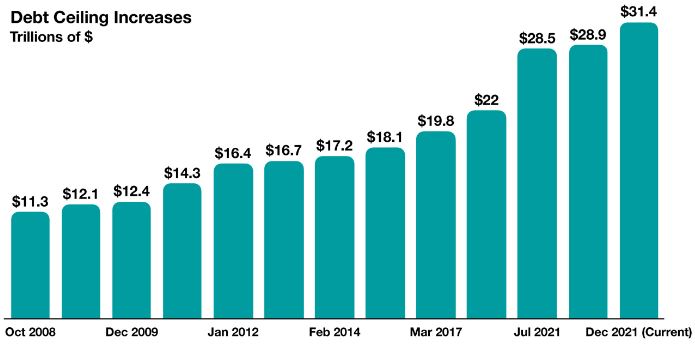

Congress passed legislation during last-minute negotiations to avert a default on the nation’s debt. The suspension on the U.S. government’s $31.4 trillion debt ceiling is temporary until lawmakers finalize legislation to fund ongoing federal obligations.

The impasse on the debt ceiling added strain to bond and equity markets in May. Treasury bond yields rose as increasing debt level concerns triggered increased trading in government bonds. Debt ceiling concerns in addition to the uncertainty surrounding regional banks’ exposure to commercial real estate contributed to a volatile environment throughout the month.

The Treasury Department plans to issue additional short-term debt to fund immediate federal expenses, with $61 billion in 6-month bills and $68 billion in three-month bills already issued as of the first of June. Treasury issuances, also known as auctions, are part of the government’s ongoing cash management process.

The 49th summit of the G7 was held in Hiroshima, Japan in late May. The G7, which includes leaders from developed countries, gathered to discuss the Russian invasion of Ukraine, the climate crisis, the pandemic, and global geopolitical tensions. The G7 also conveyed concern surrounding China’s economic coercion and its stance on Taiwan.

The Fed’s most recent Beige Book survey found that demand for domestic transportation services such as trucking, and railroad has been decreasing. The survey also found that commercial construction and real estate activity has also been decreasing overall.

Sources: U.S. Congress, Treasury Dept., G7, Federal Reserve

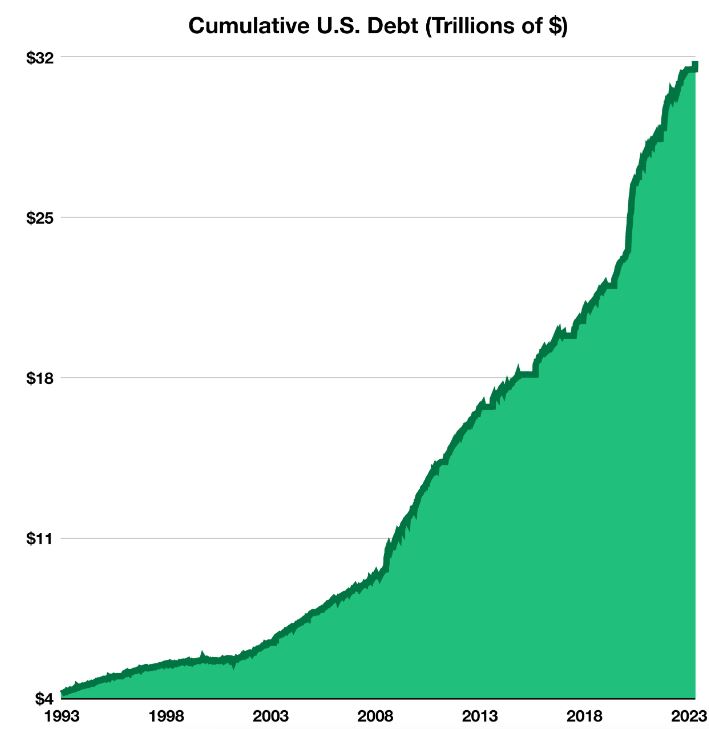

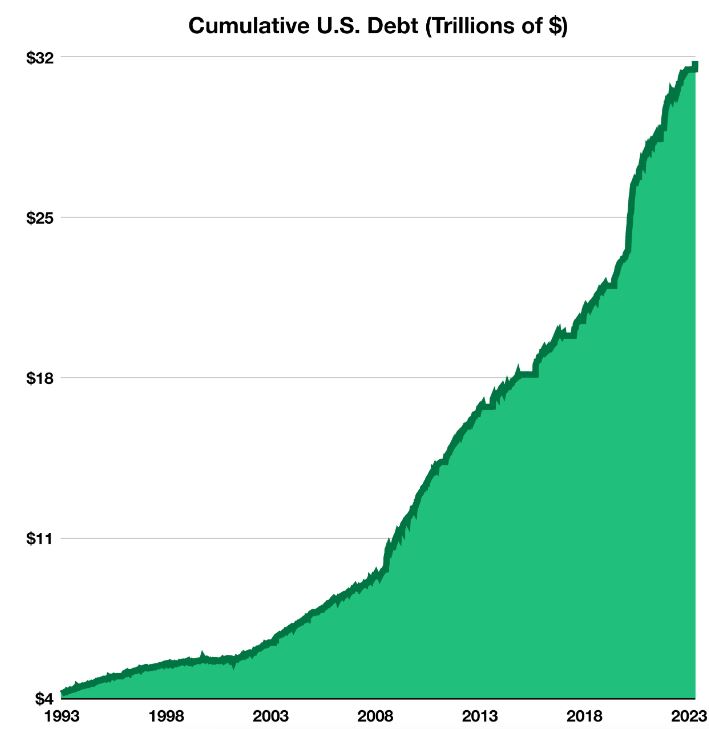

In the decades following World War II, the U.S. has seen its debt level steadily increase as the government has faced growing financial commitments. More recently, however, government debt has been expanding at a more significant pace since the early 2000s. Through these past two decades, there have been several political disputes regarding the debt ceiling, which is the limit of debt the government can issue. In January, the debt ceiling of $31.4 trillion was surpassed, which prompted the U.S. Treasury to implement “extraordinary measures” that will last until early summer to avoid the government defaulting on debt.

There have been several debt ceiling hurdles since the turn of the 20th century. Fortunately, the U.S. has never defaulted on its debt, which means the Treasury would be unable to pay its obligations. However, 2011 saw a point of near default, leading to credit rating agencies’ first downgrade of U.S. debt. In 2013, debates regarding the debt ceiling rose again, with the government experiencing a partial shutdown that led to the furloughing of hundreds of thousands of federal employees until the debt ceiling was suspended. More recently, another government shutdown occurred in 2018 when the debt ceiling yet again failed to be raised. Now, in 2023, the debt ceiling saw a near-default due to political gridlock and differing interests by the main political parties. The resolution to this will delay further debt negotiations until 2025, suspending the debt ceiling and keeping spending largely at its current level.

The risks of default include severe domestic and global economic repercussions, market volatility, and damage to confidence in the U.S. government’s ability to manage its finances. As political gridlock has driven another debt ceiling crisis, it is important to note that extremely similar circumstances have occurred in the past and will likely continue to occur.

Sources: Congressional Research Service, U.S. Department of the Treasury

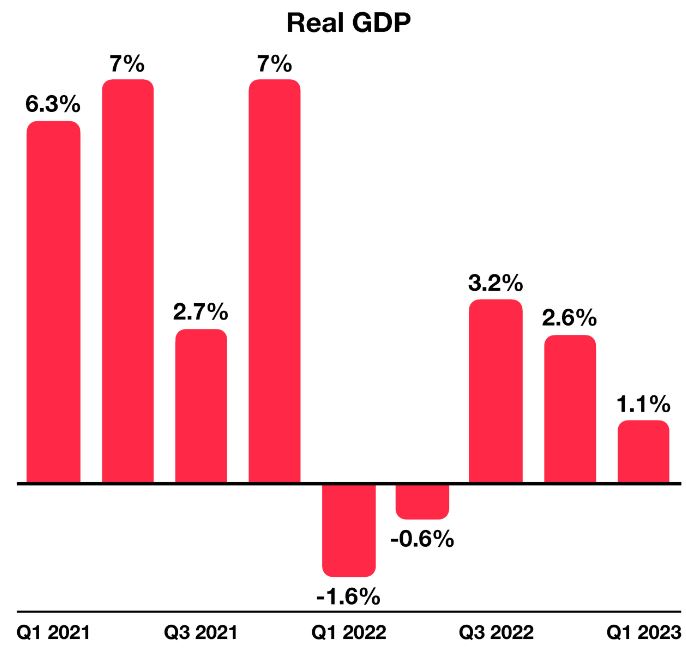

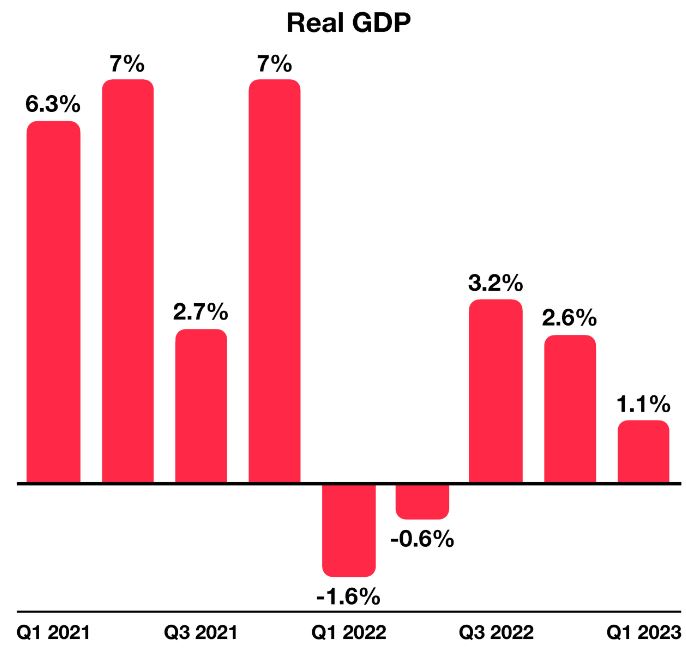

Following two consecutive quarters of negative Gross Domestic Production (GDP) growth starting in 2022, the year ended with two consecutive quarters of positive growth. While 2023’s first quarter also displayed positive growth, marginal growth shows a cooling GDP. GDP grew by 1.1% in the first quarter of 2023, down from 2.6% in the fourth quarter of 2022.

Also trending downward is inflation, increasing 4.9 percent from April 2022 to April 2023, the smallest 12-month increase since April 2021. A large driver behind this decline is the mellowing of more volatile factors such as electricity, gasoline, vehicles, and food. Leading this decline is the price of gasoline, which fell 17.4% in March and 12.2% in April from the year prior.

However, core inflation remains resilient. Core inflation excludes more volatile factors which significantly contributed to inflation’s historic rise in 2022. While lower than its September 2022 high of 6.6%, core inflation has remained relatively constant in the past 5 months, measuring in April at 5.5%, just 0.1% lower than in March and the same as in February.

Sources: Bureau of Labor Statistics, Federal Reserve Bank of St. Louis, Bureau of Economic Analysis