Seventy percent of wealthy families lose their wealth by the second generation, and 90% by the third. It’s time to buck the trend.

Your offspring are likely hungry for information on good money-management skills from you or the financial advisor you use. Yet few teens and adult-children are asking for it, creating a fiscal divide that we can start to bridge, right now.

Only 3 percent of millionaire clients’ children meet regularly with their parents’ financial advisor, despite most (88 percent) reporting that they think regular meetings would be valuable, according to a recent survey by Versta Research.

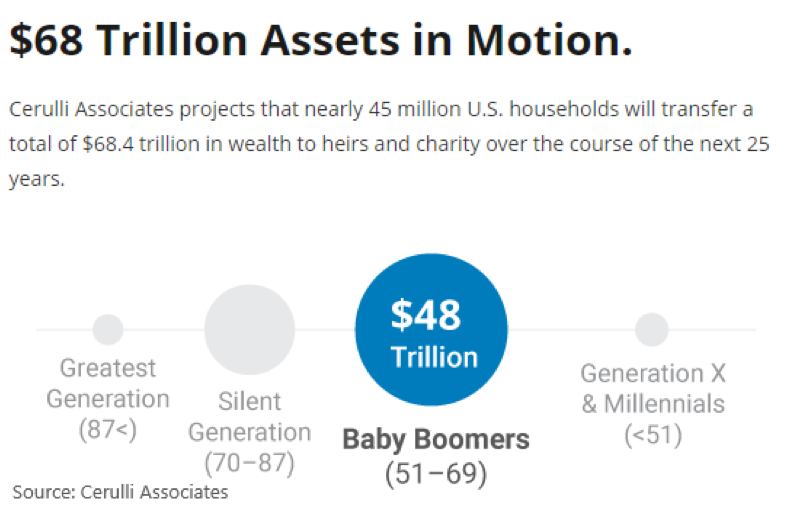

Now’s the time to assess whether your offspring have the tools and resources they’ll need to manage money. We’re on the brink of a multigenerational shift in wealth. Over the next 25 years, nearly 45 million households will transfer a total of $68.4 trillion in wealth to heirs and charity, according to a Cerulli report.

We all can take part in preparing families for this wealth transfer by establishing strong foundations of money management, sharing values about stewardship, and building relationships that can help create lasting financial legacies within families.

Pass along money smarts

The historical data on family inheritance is dismal. Seventy percent of wealthy families lose their wealth by the second generation, and 90% by the third. Bad choices, bad luck, and addictions are the primary culprits for squandered money.

Most Americans aren’t fluent in the language of money, Tara Siegel Bernard wrote for the New York Times. “Yet we’re expected to make big financial decisions as early as our teens – Should I take on thousands of dollars of student debt? Should I buy a car? – even though most of us received no formal instruction on financial matters until it was too late.”

Only 17 states require high school students to take a class in personal finance, according to the 2018 Survey of the States: Economic and Personal Finance Education in Our Nation’s Schools. Teens are graduating from high school with limited understanding of credit cards and student loans, let alone what it means to save for retirement and manage an investment portfolio.

This oversight means financial literacy education begins at home. But it doesn’t necessarily mean you are alone. You can enlist the help of a Wambolt advisor. Together, we can help teach family members how to be financially responsible; live within their means and know how to save, budget, invest, and give. With a strong foundation, they’ll be equipped to manage an inheritance for their own benefit and that of their children.

Lay the foundation

There are a number of ways to lay the foundation for responsible and successful financial stewardship, starting with school age children and growing more sophisticated as children age. Here are just a few:

- Engage in conversations about money. Talk early and often about money matters, making it a natural point of discussion, not a taboo topic.

- Learn together the value of money and how to handle it. There’s value in social learning. Consider taking a course in financial literacy with your son, daughter or grandchildren for a strong footing in financial matters.

- Discuss philanthropy and financial values within your family. Knowing your view of money and its impact on achieving goals and objectives can help younger generations establish strong financial practices and values. Ron Chernow in Titan: The Life of John D. Rockefeller Sr, describes Rockefeller’s commitment to lifelong tithing. Rockefeller’s parents introduced the practice when he was young, instilling strong habits of “thrift, self-denial, and careful budgeting.”

- Grow money smarts. Give youth the responsibility of a bank account at home or at a bank. Form your own Bank, as proposed by David Owen in a 1998 article in the Atlantic. Owen set up accounts for his children at what he called the “First National Bank of Dave,” and offered attractive interest rates—5 percent a month, annualized to more than 70 percent. Owen’s kids were given control of their money and unlimited access to their funds, no questions asked, so they could see how money works in the real world. Spend it and it’s gone; save it and it grows!

- Help teens and young adults develop a portfolio, starting with a budget and savings for retirement. Help teach them the fundamentals of investing in a diversified, balanced portfolio and the eroding effect of investment fees.

- Introduce your son or daughter to your financial advisor at Wambolt. Our advisors can help bring your family members into conversations about the family values you uphold and how those values translate into financial planning.

We’re here to help educate your offspring about the basics of managing money. Set up a time for us to meet your children ages 8 to adulthood for help getting started with important conversations about compound interest, diversification, and more.

And, you won’t want to miss sharing our Christmas tree cutting event with your children, their families, and the Wambolt team. It’s an informal and festive gathering to get to know each other. Watch for invitations later in the year!

Follow Us on LinkedIn

Photo by Element5 Digital on Unsplash

This commentary on this website reflects the personal opinions, viewpoints and analyses of the Wambolt & Associates employees providing such comments, and should not be regarded as a description of advisory services provided by Wambolt & Associates or performance returns of any Wambolt & Associates Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Wambolt & Associates manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Wambolt & Associates provides links for your convenience to websites produced by other providers or industry related material. Accessing websites through links directs you away from our website. Wambolt & Associates is not responsible for errors or omissions in the material on third party websites, and does not necessarily approve of or endorse the information provided. Users who gain access to third party websites may be subject to the copyright and other restrictions on use imposed by those providers and assume responsibility and risk from use of those websites.