Taxpayers will have the opportunity to save more in 2019 without tax repercussions. In its first increase since 2013, the IRS announced that contribution limits for certain retirement accounts will bump up in tax year 2019.

This is good news for the many Americans (46 percent) who believe financial comfort in retirement may be out of reach, according to a report by Gallup (see Is your investor retirement strategy ready for the summit?). The higher annual contribution limits for tax-advantage retirement accounts allows individuals to put away more money for retirement when contributions are maxed out.

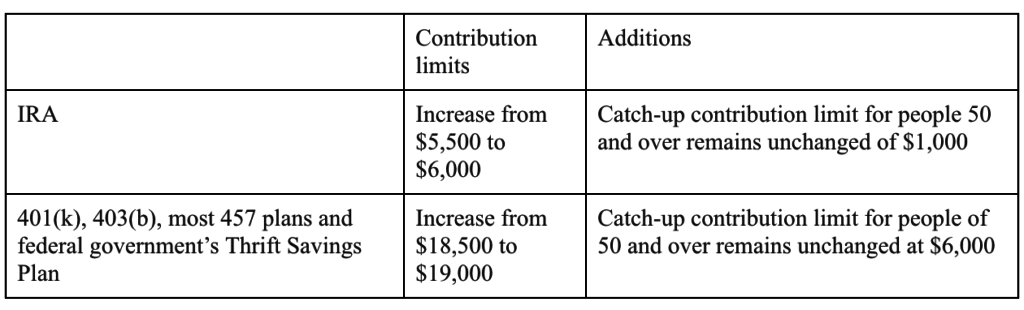

Contribution limit increases

- Rollover contributions

- Qualified reservist repayments

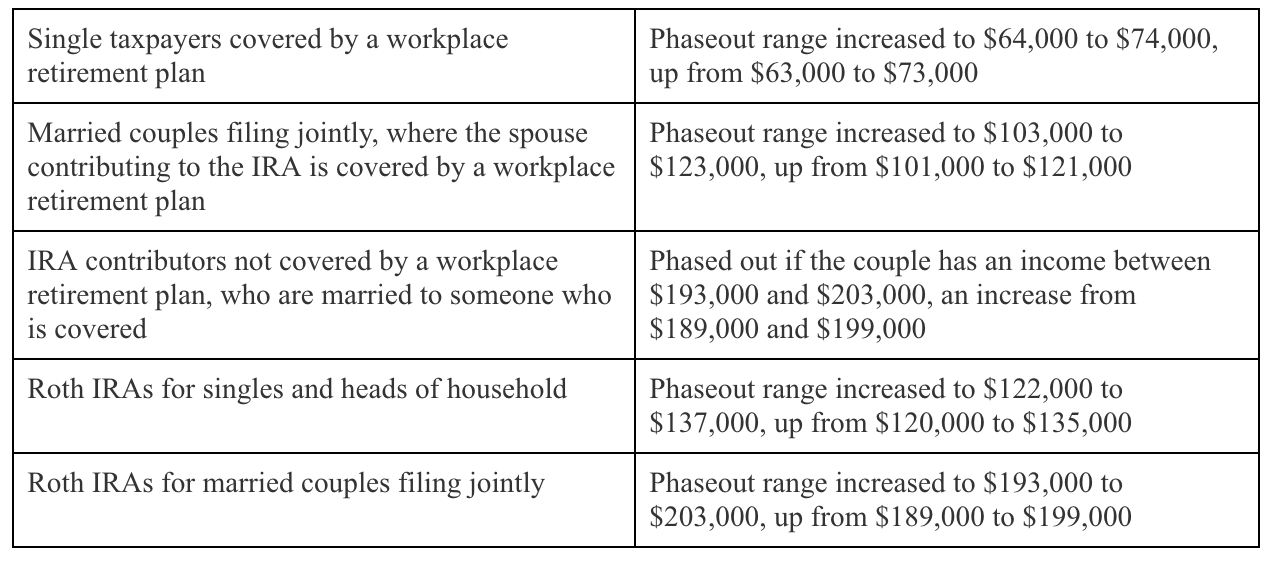

Phaseout ranges increased

Take action

By maximizing contributions in 2019, taxpayers can take advantage of compounding and market growth for longer. Although these changes don’t take effect until next year, get your planning started early.

Step in and talk to us about reviewing your progress to retirement, contribution schedule, and whether additional tax-advantaged retirement savings accounts might be in your best interest, putting you in control of your financial future.

- Neutralizing the retirement tax

- Lessen the tax bit for a fuller retirement

- Is your investor retirement strategy ready for the summit?

- SEP vs. SIMPLE: Which is right for your business?

- Bankruptcies boom, highlighting need to build wealth early

Follow Us on LinkedIn

Photo by Matthew Bennett on Unsplash

This commentary on this website reflects the personal opinions, viewpoints and analyses of the Wambolt & Associates employees providing such comments, and should not be regarded as a description of advisory services provided by Wambolt & Associates or performance returns of any Wambolt & Associates Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Wambolt & Associates manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Wambolt & Associates provides links for your convenience to websites produced by other providers or industry related material. Accessing websites through links directs you away from our website. Wambolt & Associates is not responsible for errors or omissions in the material on third party websites, and does not necessarily approve of or endorse the information provided. Users who gain access to third party websites may be subject to the copyright and other restrictions on use imposed by those providers and assume responsibility and risk from use of those websites.