By The Wambolt & Associates Team

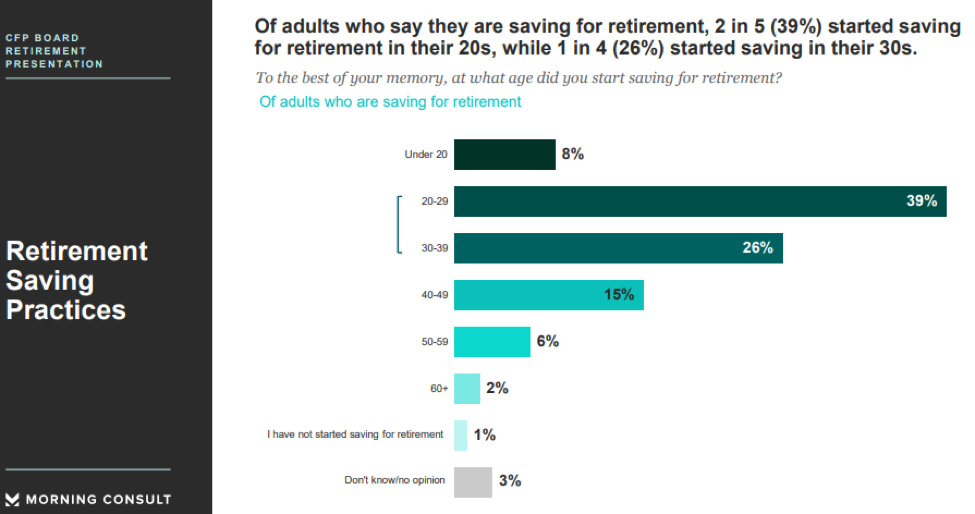

Saving for retirement starts when workers start their career, right? Not so for a significant portion of U.S. adults. Only 4 out of 10 adults started saving for retirement in their 20s, according to a recent report from Morning Consult. Half of adults between 18 and 34 are not saving for retirement at all.

Who started saving when?

The later you start, the less you benefit from compound interest and the greater the chance you won’t have “enough.” Clients want to know how much is enough. The actual dollar amount is different for every client.

At various ages, your nest egg should be many times larger than your household income. Generally, enough means (CNBC):

• Accumulated savings have at least an 80% chance of lasting 30 years after you retire

• Savings averages 6% average annual growth

• Continue to save at least 10% of your income yearly until you retire at age 65

Are you saving enough?

Retirement calculators that take into account three key areas for savings are a good starting point to determine if you are saving enough.

· How much money will you need each year in retirement, including amounts needed to cover medical and long-term health care costs?

· Is the risk and balance of your investment portfolio matched to your saving goals?

· What additional income sources will factor into your retirement savings (social security, pension, etc.)?

Schedule your savings

Use our retirement calculator to visualize your retirement plan and investment schedule. Then, book some time with your Wambolt adviser to modify your plan and stay on track to retirement.

Read more at Wambolt University…

- Women, Wealth & Wisdom: ReWIRE your retirement planning for one

- Save more: IRS increases contribution limits on tax-advantaged retirement plans

- Changing jobs: Retirement funds are for retiring

- Stacking retirement plans accelerates savings and reduces taxes

- Neutralizing the retirement tax

Photo by Jon Eckert on Unsplash

The commentary on this website reflects the personal opinions, viewpoints and analyses of the Wambolt & Associates employees providing such comments, and should not be regarded as a description of advisory services provided by Wambolt & Associates or performance returns of any Wambolt & Associates Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Wambolt & Associates manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Wambolt & Associates provides links for your convenience to websites produced by other providers or industry related material. Accessing websites through links directs you away from our website. Wambolt & Associates is not responsible for errors or omissions in the material on third party websites, and does not necessarily approve of or endorse the information provided. Users who gain access to third party websites may be subject to the copyright and other restrictions on use imposed by those providers and assume responsibility and risk from use of those websites.