As a business owner, you have options for retirement plans that in most cases, reduce your taxable income. Whether you’re self-employed, or a small business owner with valued employees you want to reward, employer-sponsored IRAs may be a better fit over more complicated 401(k) plans for building nest eggs on a tax-deferred basis.

While there are many options, one of these IRAs might fit your needs.

- Simplified Employee Pension (SEP)

- Savings Incentive Match Plan for Employees (SIMPLE)

Which is right for you?

Regardless of the type of business you have—corporation, partnership, LLC or self-employed individual—you’re likely to benefit from starting a SIMPLE or SEP.

- People will choose a SIMPLE when they want employee participation in a plan. This means employers only contribute if the employee contributes. In addition, as a business owner, you can contribute as an employee and get an employer-match based on annual income.

- With SEP, employers are required to contribute when employees meet eligibility requirements. However, employees do not have to contribute.

Both plans are easy to administer, low-cost and work in almost the same way as a traditional IRA. Funds are fully vested to the employee. There is no IRS reporting and participant loans are not permitted under either plan.

Best of all are the tax advantages. Employer contributions under both plans are tax deductible. Contributions by employees to SIMPLE plans are made on a pre-tax basis and accumulate tax-deferred.

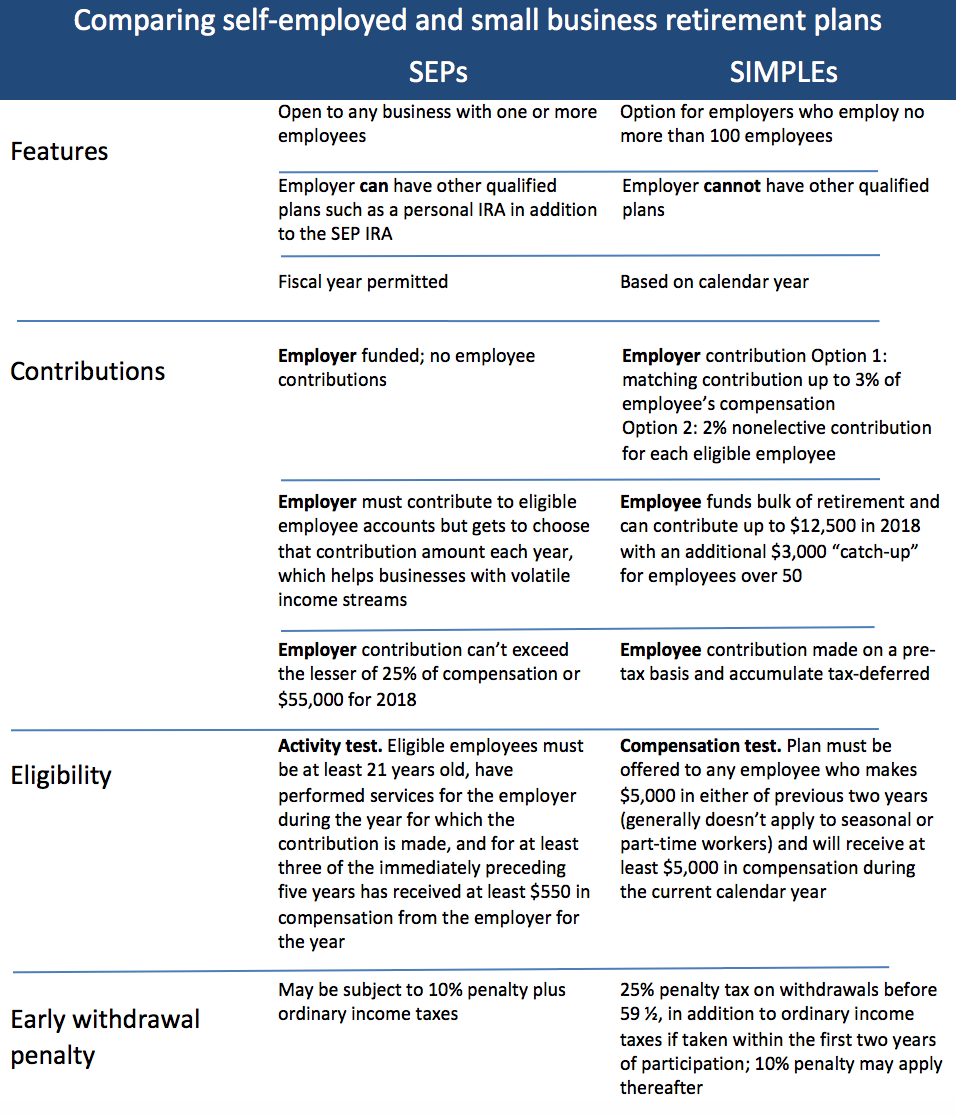

Side-by-side, there are notable differences (see chart below). In short, SIMPLE limits are more restrictive than SEP, but SEP contributions limits are far greater than SIMPLEs.

Which is better for you?

Choose the plan with the highest contribution limit for your situation and a structure that fits. If you are a small business with an unpredictable income stream, SEPs may be a better choice for you because the amount of your contribution can swing with your income. SEPs work well for business owners who prefer to provide a retirement benefit to all employees, and themselves, by making employer contributions. You can also add a personal IRA to bulk up your retirement savings.

SIMPLEs are a great starter plan for encouraging contributions from employees at companies with fewer than 100 employees.

In either case, your business benefits from a lower tax bill, and you and your employees are rewarded for work now when retirement rolls around.

By analyzing the differences in features, eligibility, and contribution limits below, you can determine which option is best for your business. We are here to help you review options and get started. Contact your Wambolt advisor if you would like more guidance.