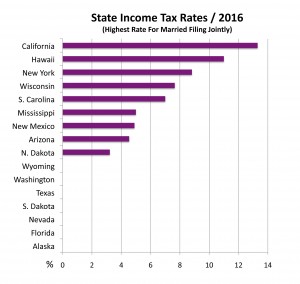

State Income Tax Rates

Individual state income taxes are a major source of revenue for states, accounting for nearly 35% of state tax collections nationwide. Forty-three states currently impose a state income tax, in addition to a Federal income tax, with only seven states imposing no state tax at all.

As state and municipal finances have experienced unforeseen fiscal duress, many states have levied and plan to levy higher tax rates on their residents. The non-partisan, non-profit Tax Foundation founded in 1937 provides unbiased research and data on taxes imposed throughout the United States.

Individual state income tax rates not only affect individuals but also affect companies. As companies grow and hire staff for new locations, state tax rates can deter some companies from hiring in higher rate states. Some companies can pay less since an employee’s take-home pay might be higher should there be no state income tax.

Retirees also consider state tax rates when planning for retirement and reducing expenses. It’s no surprise that the seven states that have no state income tax are also popular living destinations for retirees.

Source: Tax Foundation