TAKING CONTROL OF YOUR FINANCIAL FUTURE THROUGH THE GENERATIONS

Empowering Women: Taking Control of Your Financial Future Through the Generations

INTRODUCTION

The increase of women in the workplace and as heads of their households has created a paradigm shift from the days where men-controlled family financial affairs. Now more than ever, women are decision-makers in the halls of businesses, governments, and households. This means women are beginning to take on growing responsibility for the long-term financial health of themselves and their families.

Women investors face a unique set of challenges that can make financial literacy and advanced planning especially critical. It’s important to not only acknowledge these challenges, but to explore them with your family and a trusted financial professional. Determining the right solutions for your financial situation is critical to developing a long-term strategy and ensuring a comfortable, secure retirement.

Please consider using this guide as a resource for women like you who are seeking guidance on how to take control of your financial lives.

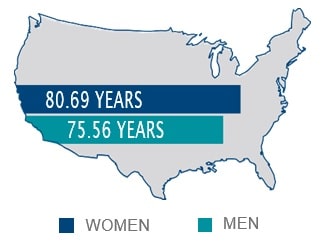

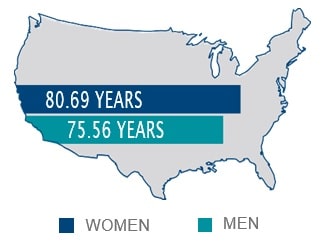

Women Often Outlive Their Husbands

On average, women outlive men by about five years. Losing a spouse is heart wrenching and, in a family, where the husband handled long-term plans, a widow may suddenly find herself in control of family finances with little guidance.

As you and your partner age, it’s important to plan for life- changing transitions to avoid costly errors that could arise during already stressful situations.

Families should prepare for these momentous changes through open dialogue and constant communication between both spouses. Research shows that many women are not as involved in their financial planning as they should be. A 2011 report released by HSBC showed that many women are not as prepared for retirement as men, with just 24% of women in their fifties claiming to have a financial plan in place.(1)

THE SAME REPORT FOUND THE FOLLOWING:

- 65% of men make all or most of their household’s financial decisions without input from wives or other family members.

- 4 in 10 men claim sole decision-making responsibility in retirement planning, compared to 25% of women.(2)

Women often put other priorities ahead of their own financial security later in life. This disconnect between a woman’s need for financial security and her actual planning must be bridged. Women who are not involved in financial affairs run the risk of being left in a confusing, vulnerable position should anything happen to their spouse.

LIFE EXPECTANCY

DO YOU KNOW

- Globally, over 1 billion women participate in the workforce. Of these, 70 million are American.

- In the U.S., approximately 33% of working married women make more money than their husbands.

- Women are the sole heads of 32% of U.S. households.

- More women are inheriting wealth because of longevity and demographic patterns.

Sources: U.S. Census Bureau, CIA World Factbook 2011

Empowering Women: Taking Control of Your Financial Future Through the Generations

Earnings And Savings Cap

Now more than ever, women are taking giant strides in the workforce. Future generations of women can and will achieve great wealth and success in the business world.

However, women still earn less and save less than men, due to smaller paychecks and time spent away from the workforce.

2010 census data show that despite the leaps working women have taken in the last 60 years, they still earn only 77 cents for every dollar earned by a man. This wage gap can add up to a lifetime loss of over $300,000.(3)

Women earn less than men in virtually every occupational category, making it more challenging for women to build wealth.

ONE OF THE MOST COURAGEOUS THINGS YOU CAN DO IS IDENTIFY YOURSELF, KNOW WHO YOU ARE, WHAT YOU BELIEVE IN AND WHERE YOU WANT TO GO.

— Sheila Murray Bethel, PhD

Research also shows that women are much more likely to be caregivers to their family members. This reduces their time spent in the workforce earning a living, which results in lower lifetime earnings, less retirement savings and less pension savings, compared to their male counterparts.(5)

It’s important to keep this in mind as you prepare your long-term goals, because you may have fewer financial options available to you.

“WE HAVE TO HELP EACH OTHER PREPARE SO THAT YOU, YOUR MOTHER,YOUR SISTER, YOUR DAUGHTER, YOUR BEST FRIEND [ARE READY.] WE MUST TAKE CHARGE AND HAVE FAITH THAT … IN KNOWLEDGE THERE IS POWER, AND

IN OUR ACTION THERE IS

A FUTURE.

— Teresa Heinz Kerry

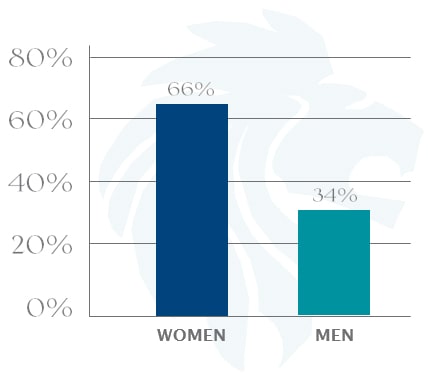

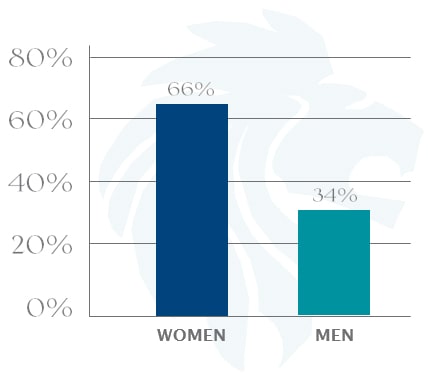

Women Invest More Conservatively

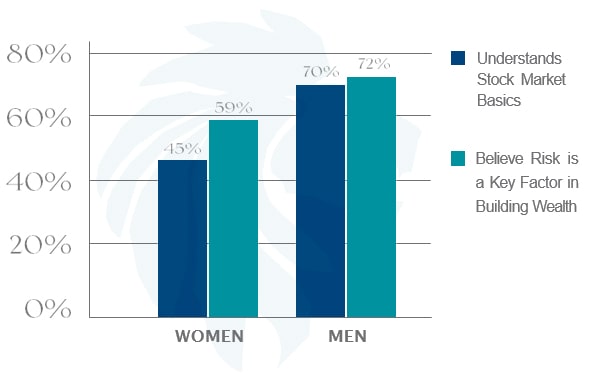

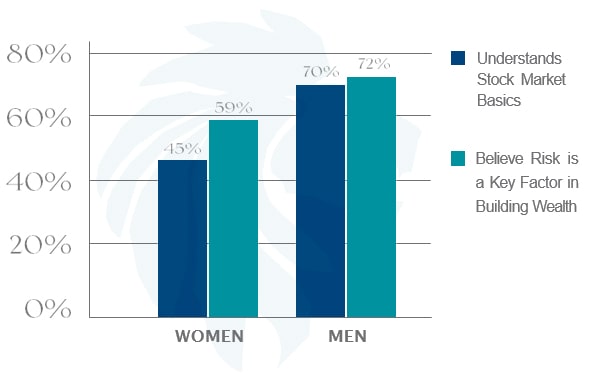

Research finds that women may be more reluctant to accept risk in their investment portfolios, possibly because of lower confidence about investment knowledge.(6) As shown in the chart below, a 2011 survey of high-net-worth investors found that there is a significant difference in (self-assessed) risk appetites and investment knowledge between men and women.(7)

Risk can be a very important part of investing because there is a strong correlation between risk and reward. Typically, investments with more risk offer the potential for higher returns over time.

By working with a qualified financial planner who can properly assess your risk tolerance, you can find the right plan to manage your risk and reward.

How Men & Women Invest

There is no doubt that many WOMEN face unique OBSTACLES to growing their wealth. A realistic perspective and PROPER PLANNING can help overcome these CHALLENGES when building a LONG-TERM financial strategy

Empowering Women: Taking Control of Your Financial Future Through the Generations

Do not rely on your PARTNER, SPOUSE, OR OTHER FAMILY MEMBERS to ensure your FINANCIAL SECURITY; it is critical that you take an active role in your financial FUTURE.

Divorce Effects Women Disproportionately

Divorce is a difficult transition for any family to endure. Switching from a dual- to single-income household can come with many financial challenges, beginning with a significant decrease in income for women.(8) After a divorce, men tend to experience only a 10% drop in income, while women are likely to experience as much as a 27% decline.

Additionally, women may have to assume all responsibility for their finance and retirement planning. You will find success and happiness after a divorce, but it is critical to anticipate and plan for its potential effects on your savings and retirement goals.

WOMEN CONTROL $14 TRILLION IN PERSONAL WEALTH ASSETS. BY 2020, THEY ARE EXPECTED TO CONTROL $22 TRILLION. Source: What Women Want: Understanding the Modern Female Investor.

Thriving Through Transition

During life’s transitions like divorce, retirement or death, it’s important to make a plan to help ensure your financial goals are being met. By building an authentic relationship with a qualified financial advisor, you will be able to set attainable long-term goals to empower you throughout your lifetime and claim your legacy.

It might be practical for one partner to take the lead in financial research or planning, but there should be open communication and all decisions should be made together on a fully informed basis. This will help ensure that families are better prepared for the future and that you are less financially vulnerable. It can be difficult to think about planning for unpleasant events but doing so can help you protect your family and financial future.

Don’t forget to engage your partner in these very important conversations—this will set the precedent for building a lifetime of communicative and informed decision-making regarding your financial future. Doing so will strengthen and draw you closer as you align your goals. Children and close relatives also enjoy being involved in conversations about the family legacy and your estate plans. These discussions don’t have to revolve around thinking up worst- case scenarios—it can be fun to set goals and dream about retirement plans.

Empowering Women: Taking Control of Your Financial Future Through the Generations

4 Investments Mistakes You Can Avoid

MISTAKE #1: FAILING TO PLAN FOR LONGER LIFE EXPECTANCY

As previously stated, women generally live longer than men, so it is especially important to use investment strategies that balance a sustainable withdrawal rate with the right measure of risk while factoring inflation. Balancing these factors is critical to help ensure financial stability that lasts a lifetime. It is recommended that you have an articulated income plan, budget and adequate investment and insurance strategies that support your long-term goals.

MISTAKE #2: FAILING TO PLAN FOR HEALTH CARE EXPENSES

Another factor to consider is that your longer life expectancy can mean more expensive long-term care. In 2010, the average cost for assisted living was more than $38,000 a year, according to the annual Genworth Cost of Care Survey. The annual cost of a private room in a nursing home was nearly $75,000, and home health aides averaged

$19 per hour. According to the Center for Retirement Research, retirees can expect to spend 29% of their annual income on health care by 2020.(9)

It is critical to include health care planning in your long-term financial strategy. Major medical expenses can easily wipe out retirement savings; but there are several ways that retirees can help prevent this from happening. By building your retirement plan with Investment Answers, you can make plans to help ensure that your medical needs are addressed without adversely impacting your retirement lifestyle and to help ensure you don’t become a financial burden on your family.

MISTAKE #3: MAKING EMOTIONAL INVESTMENT DECISIONS

Emotional decision-making can wreak havoc on the most carefully designed investment plan. The adage of buy low, sell high is often entangled within market crashes. Many readers remember the dot-com bubble burst of 2001, and still more are recovering from the mortgage-meltdown crash of 2008. When markets swing, many cash out near the bottom, fearing that the markets themselves are collapsing. Many may have opted to have their money sitting stagnant—but safe—on the sidelines rather than taking another hit.

A 2011 study by benefits company Aon Hewitt showed that baby boomers are especially at risk of making emotional investment decisions. Study results showed that those nearing retirements become more averse to risk, and are more prone to bailing on the market during declines.(10) The problem is that these are investors who have the most to lose by making poorly timed investment decisions.

One of the major benefits of working with our firm is that it is our job to act as the voice of reason when emotions run high. When major investment decisions are only a click away, many investors can give in to emotional decision- making and have to pay the price for their short-term thinking. When markets decline, we are available to answer questions, provide reassurance, and show you the opportunities that volatile markets provide.

MISTAKE #4: NOT SEEKING PROFESSIONAL ADVICE

Taking advantage of the services a qualified financial advisor has to offer helps ensure your financial future will meet your long-term goals and needs. Knowing that you have your finances and long-term care plans in order is like sleep insurance—it gives you peace of mind. Too often, people find themselves regretting their decision to put off their financial and long-term care planning. It is never too early to start thinking about your long-term goals and what you want your retirement to look like. We recommend that you leverage time and find a financial advocate who knows the ins and outs of investing and insuring.

As fiduciaries, it is our focus as we represent you to make sure your long-term plan is being reconciled with turbulent markets and ever-shifting economical and legal issues.

PROVIDING FOR FUTURE GENERATIONS

One of the rewards for hard work, effective wealth management, and the prosperity that follows is the ability to provide for your loved ones and the causes close to your heart. In our business, we have found that as couples move into retirement, they begin to think more practically about the legacy they leave behind. Women are increasingly responsible for the final disposition of family assets, so it is important to discuss your family’s estate-planning goals in advance.

Your legacy of financial responsibility can leave a great example for your family. As you take steps toward controlling your financial destiny remember that the women in your life will be looking to you for support in their own financial lives. Let that journey be a part of your legacy as well.

CONCLUSION & MOVING FORWARD

Educate yourself about wealth management, financial planning, and investing. If there is one thing we hope you take with you from this report, it’s that we want you to begin taking control of your financial future. Start now. Have a conversation with your husband, significant other and family. Start preparing for life after retirement.

We are available to help you plan for your future and leverage your present situation to meet your long-term goals. Build a relationship with a qualified financial advocate that is licensed as a fiduciary. Your financial representative should have excellent communication with you, and it is important to work with someone who understands and encourages your goals for your financial future.

We want to be your resource for your questions and concerns regarding both your current financial situation and your long-term goals. Leverage Investment Answers as an asset as you claim your financial independence. We’re here to help.