Will the Economic War with Russia Cause a U.S. Recession?

“In the 20th century, the United States endured two world wars and other traumatic and expensive military conflicts, the Depression, a dozen or so recessions and financial panics, oil shocks, a flu epidemic, and the resignation of a disgraced president. Yet the Dow rose from 66 to 11,497.”

– Warren Buffett

Most of the world has been inspired by Ukraine’s willingness and ability to resist military action by

Russia. The suffering of the Ukrainian people is tragic. The reaction has been a broad set of sanctions

against Russia imposed by countries across the globe, with the Russians attempting to respond in

kind. The economic sanctions as a result of the Russian invasion of the Ukraine may create short-term

challenges to the United States economy, but appear unlikely to create a serious recession or to have a

substantial effect on the U.S. economy in the long-run.

The Russian Economy is Small Potatoes

As a result of Russia’s invasion of Ukraine, the U.S., along with the European Union and other countries

have implemented extensive economic sanctions. In response, Russia plans to restrict exports of 200 or

more commodities, including, presumably, to the U.S.. The U.S. has proposed removing Russia’s “most

favored nation” trade status. Trade and other economic relationships between the U.S. and Russia will

contract dramatically this year.

The effects will likely be smaller than you might expect – because the Russian economy is smaller than most realize. Though the landmass of Russia is almost twice that of the U.S., its economy is modest in size. Measured by gross domestic product (GDP) – the total value of finished goods and services produced domestically – the Russian economy is more like that of South Korea, Australia, Brazil or Canada. In fact, the U.S. economy is about 14.5 times the size of Russia’s.

Ratio of U.S. Gross Domestic Product ÷ Russia Gross Domestic Product

Remarkably, that gap has almost doubled within the last decade. The U.S. economy is growing

much faster than Russia’s.

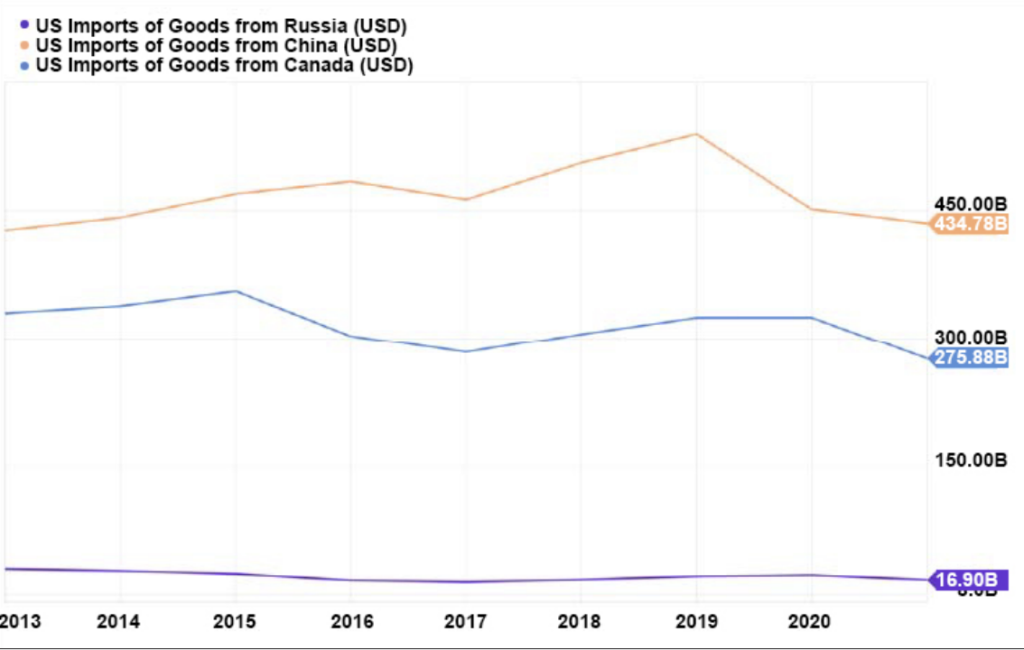

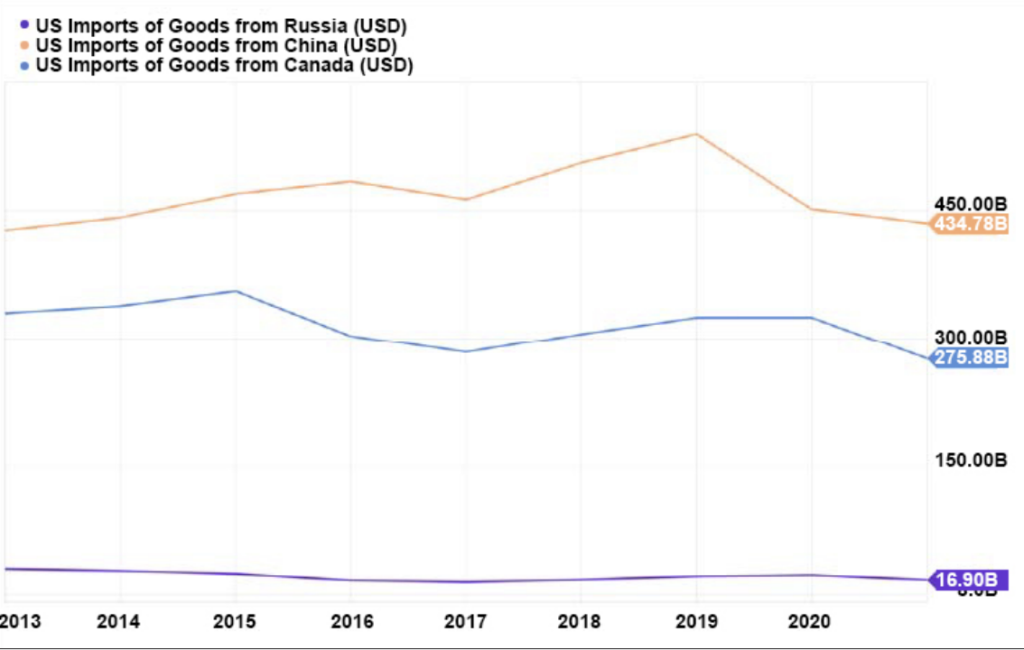

In addition, trade between the U.S. and Russia is not significant – at least to the U.S. Imports

from Russia in 2021 were about $16.9 billion – which represents less than 1% of the U.S. 2021

GDP. By comparison, the U.S. imports $435 billion of goods and services from China. Even

Canada – with an overall economy about the size of Russia’s – is a far more important trading

partner. U.S. imports were about $276 billion from Canada in 2021.

U.S. Imports

Russia, Canada and China

Put another way, Canadian imports by the U.S. were 16.3 times those from Russia. Chinese

imports were 25.7 times higher.

Overall, the economic impact on the U.S. of cutting off trade with Russia does not appear to be

significant. We can live without Russian caviar and nesting dolls, and the Poles make very good

vodka. More substantively, the commodities and other goods and services that Russia sends to

the U.S., while valuable and in some cases problematic to replace in the short-run, in the longrun are replaceable.

The U.S. Doesn’t Need Russian Oil

The most significant commodities Russia produces are crude oil and natural gas. The Russian

attack on Ukraine has also prompted a world-wide reaction in these specific markets. The U.S. has

moved to ban all imports of Russian oil and gas. The United Kingdom has done the same with oil.

13976 W. Bowles Avenue, Suite 200 • Littleton, CO 80127 • (720) 962-6700 • www.wamboltwealth.com

The European Union, which Vladimir Putin may have thought was beholden to Russian supplies,

has committed to reducing its imports of Russian natural gas by two-thirds by the end of this year.

In the short run, these disruptions to the oil market have caused prices to rise. Brent crude

oil spiked to over $125 per barrel, from the mid-$90s, though it has fallen back toward $100

per barrel recently. As a result, gasoline prices at the pump have also risen, hurting American

pocketbooks. Over time, however, the U.S. is well-positioned to minimize the effect of a ban on

Russian oil imports.

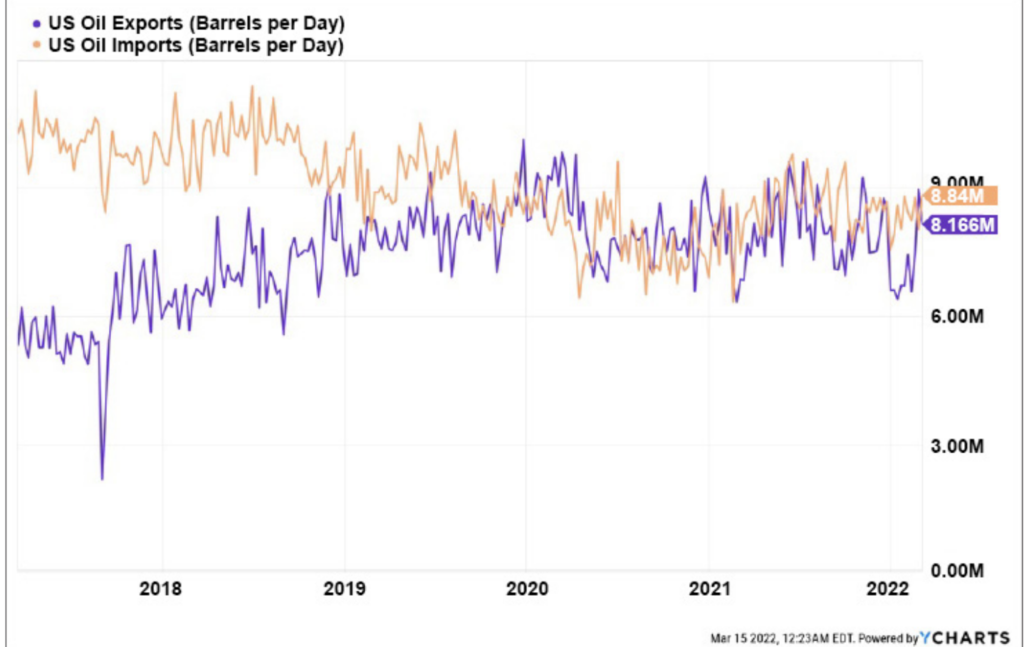

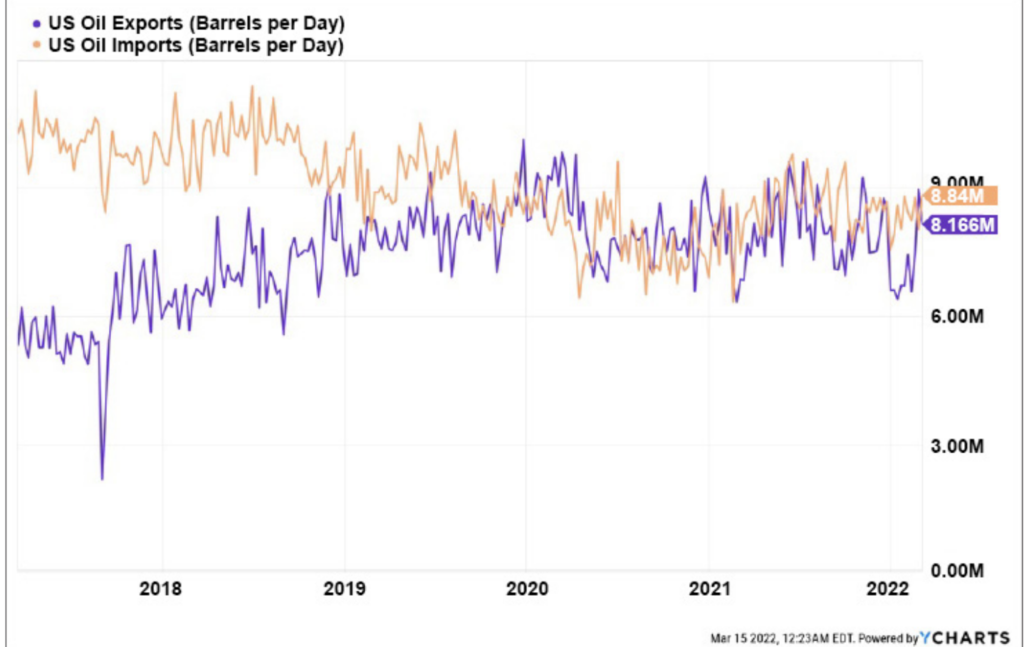

This flexibility is because the U.S. is the world’s largest oil producer. The advent of sophisticated

fracking techniques, though controversial, is the primary reason. The U.S. produces over one

million barrels of oil per day more than both Saudi Arabia and Russia.

Crude Oil Field Production

United States, Russia & Saudi Arabia

U.S. Oil Exports versus U.S. Oil Imports

As a result, the U.S. has recently been, at times, a net exporter of oil. The U.S. is in no immediate danger of running out of this still-valuable resource.

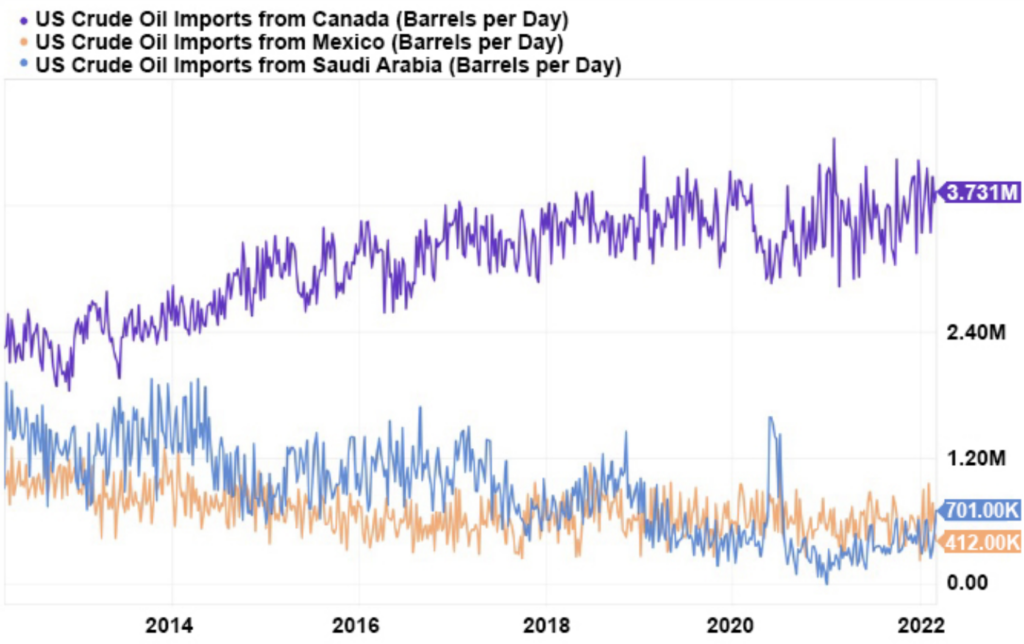

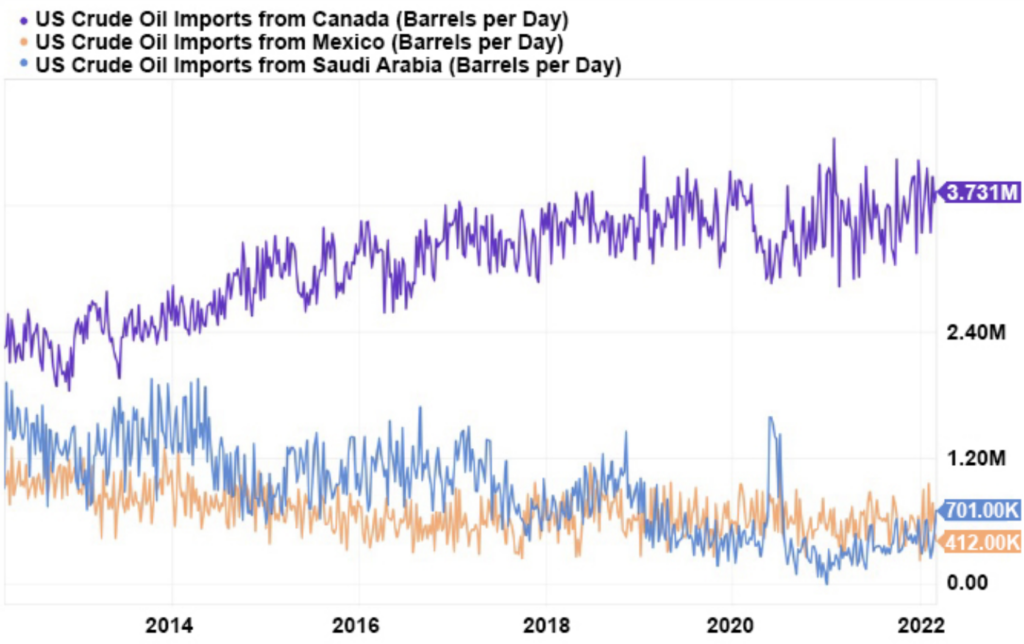

The U.S. does import oil into certain areas of the country for various reasons. However, most of

this oil comes from Canada, Mexico, and Saudi Arabia – not Russia.

U.S. Oil Imports

Canada, Mexico & Saudi Arabia

The Ukraine conflict creates additional uncertainty about the performance of the U.S. economy

and financial markets in 2022. Volatility in commodities markets and stock prices, and the

resulting challenges in setting inflation policies, may continue for several months. (See, e.g.,

Who’s Afraid of the Big, Bad Fed?) However, the U.S. economy dwarfs that of Russia, and the

severing of economic relationships will hurt Russia far more.

These events illustrate the need for investors to set aside in cash – or other liquid, low-risk

investments – funds for use in the near term. Your Wambolt advisor can help you review your

portfolio to make sure your cash allocation fits your current spending plans.