“The four most dangerous words in investing are: this time it’s different.”

– Sir John Templeton

Speculation about a potential recession has been prominent in recent financial reporting. The good

news is that multiple elements of the U.S. economy are healthy and provide an economic tailwind for

the future. The bad news is that actions by the Federal Reserve Board (“Fed”), necessary to prevent longterm inflation, are likely to cause an economic slowdown, if not a recession, within the next two years.

Tailwinds: Labor Markets & Consumer Spending

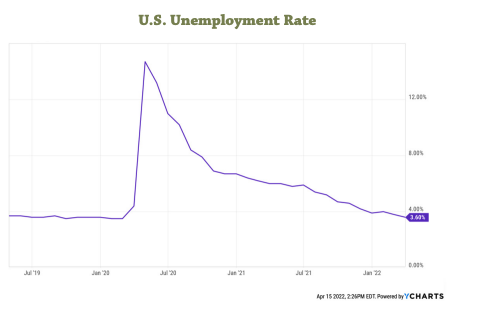

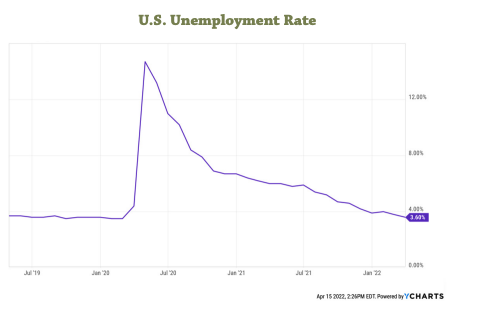

The labor market is strong. The latest reports are that unemployment fell to 3.6% – close to the prepandemic low of 3.5%. The number of workers on payrolls has increased by 431,000, and, importantly, labor force participation of workers aged 25-54 is increasing, from 82.2% to 82.5%. The “Great Resignation” -the concept that many workers decided to leave the job market for good – is turning out not to be the case. These are all good signs for the long-term health and growth of the U.S. economy.

Consumer spending is the largest driver of economic growth in the U.S. Household incomes and spending remained strong in February, but there are signs of change. Personal income increased by 0.5% – a 6%

annual rate. Consumer spending increased by 0.2% – a 2.4% annual rate. However, the rate of increase

was lower than in January, which gives some observers pause.

Headwinds: Inflation, Interest Rates & The Fed

Low interest rates encourage economic growth by making it less expensive to use debt to buy homes,

cars, appliances and other consumer goods. Interest rates have been at historically low levels. However,

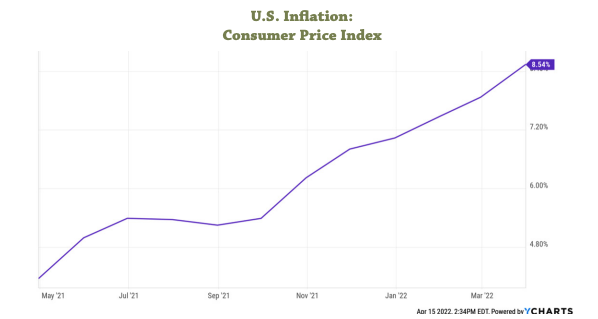

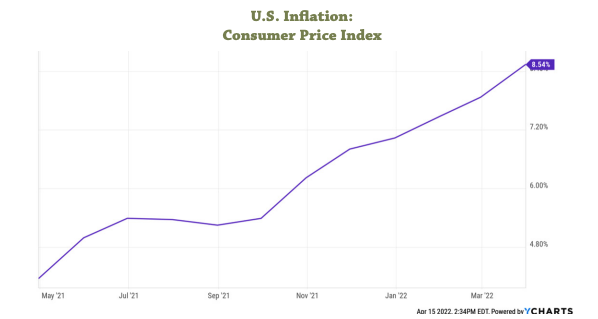

rates are now increasing, largely as a result of increased current and expected inflation rates. Inflation

13976 W. Bowles Avenue, Suite 200 • Littleton, CO 80127 • (720) 962-6700 • www.wamboltwealth.com

has climbed over the past year, and now has reached its highest level in 40 years. (See What’s

Up With Inflation?) The benchmark consumer price index rose at an annualized rate of 8.5%

in March.

In 2022, 30-year mortgage rates have risen from 3.2% to 4.7%. This means monthly payments

for potential new home buyers are increasing. For example, an increase from 3% to 5% in a

30-year mortgage rate increases a monthly payment from about $1070 to about $1300 – an

increase of over $200 per month. That jump creates a real impact on the number of people

willing and able to buy homes, and the amount that home buyers have to spend on other goods

and services. A similar phenomenon applies in the markets for cars, appliances and any other

goods or services consumers might finance.

loans become more expensive, businesses are less likely to take on debt for new spending, and

have to devote more money to financing any debt they do issue. Meaning, again, less money to

spend on capital equipment or other forms of expansion.

The net result across the board is less demand for goods and services in our economy – which

will tend to reduce inflation – but also reduce economic growth.

The Fed has made clear that interest rates will almost certainly continue to increase for a year or

more. Due to the persistence of inflation at or near 8%, the Fed appears to be planning to take

an even more aggressive approach. Half-point (0.5%) increases in the target federal funds rate,

combined with an accelerated sale of securities from the Fed’s $9 trillion dollar asset portfolio

will act to push interest rates higher, faster.

These actions will ripple through the economy and cause yet higher mortgage, car loan, credit

card and other consumer interest rates. (See Who’s Afraid of the Big, Bad Fed? Federal Reserve

Policies Explained.)

Soft Landing?

The goal of Fed policy will be a “soft landing” – raising interest rates to achieve its long-term

target of around 2% inflation while maintaining economic growth. The Fed has been able to

achieve this goal in the past, most recently in 1994 – but in each of the cases the Fed acted

before inflation had increased significantly. When the Fed has acted after inflation achieved

high levels – the situation today – what followed was a recession (two consecutive quarters of a

contracting economy).

Will it be different this time? The best argument is that the current economic situation is driven

primarily by a combination of events not seen in the last 100 years, a global pandemic impacting

supply together with a response of unprecedented government spending driving demand.

As a result, consumer demand for goods and services is currently high relative to supply. So,

higher interest rates that reduce demand could be possible without a major effect on economic

growth. For example, fewer bidders for houses available for sale, or shorter waiting lists for new

cars, might be reasonable developments in those markets.

In the labor market, there are more jobs available than people to fill them. Again, a reduction in

demand for workers might mean only fewer inflationary wage increases, rather than significantly

higher unemployment.

The Virtue of Patience

Given persistently high inflation levels, the Fed intends to “cool” the economy. Whether a fullblown recession results remains to be seen. However, at a minimum, economic growth seems

certain to slow. Investors will need to show patience and portfolio discipline through 2023 to

avoid taking excessive losses, and to position themselves for the gains that typically accompany

a return to an expanding economy.

Cindy Alvarez is a Senior Wealth Management Advisor and owner of Wambolt & Associates. Bob Newkirk is aregistered C.P.A, former investment banker, and prior Fellow in Law and Economics at the University of Chicago.