Cindy Alvarez starts each workday with purpose: to help clients access the wealth management resources they need and to support the next generation of the Wambolt & Associate’s team. In her ownership role, Cindy ensures cohesion among team members and clients, aligning priorities and goals and promoting innovative approaches to delivering sound results.

“Clients may come in the door thinking we solely focus on managing their assets,” said Alvarez. “They soon realize that we have an investment in them.” As Cindy explains, Wambolt devotes time to developing relationships with clients to best understand how to translate their life goals into wealth management planning scenarios. Whether helping grandparents secure the future for their grandchildren, presenting tax-wise investment alternatives to high income earners, or translating Wall Street’s impact on an individual’s stock portfolio, the bottom line is the same: adding value to each client’s unique and dynamic financial situation.

“Client communication is a hallmark of our firm,” says Cindy who brought a deep background in marketing and communications to the firm along with her investment savvy. “From our early on-boarding meetings to our quarterly reviews and periodic check-ins, we want to make sure we are on track with what the client needs, pivoting our strategies as their life circumstances evolve.”

Vital to sustaining superior service to clients is recruiting and mentoring an exceptional team. Cindy provides strategic direction to the advisors and plays a large role in fostering the firm’s professional development. She strongly believes there is great benefit to working with a multi-generational team.

“From the start, our younger team members are paired with our more experienced advisors, giving them a front row seat to observing their interaction with clients and gleaning valuable insight,” she said. “Our senior leaders benefit from the fresh ideas and application of current technologies that our younger team members contribute. Overall, it’s a winning combination that’s been proven to produce amazing results.”

Cindy also feels fortunate to have firm founder Greg Wambolt as her mentor and business partner. “It has been such an honor to meet Greg, embark upon this journey with him and then to have him trust me with ownership in the firm,” said Cindy. “The firm culture and family office model Greg established has enabled us to make a difference in people’s lives.”

Family is a priority for Cindy as she spends as much time as possible with her two children who each live on a different coast. A devoted mom, she loves traveling with them and sharing time outdoors hiking, camping, and exploring the beauty of the mountains.

Update IRS limits and rates for tax year 2024 apply to income tax returns filed in 2025. Tax items for tax year 2024 affecting most taxpayers include the following:

Standard Deduction: for married couples filing jointly for tax year 2024 rises to $29,200, an increase of $1,500 from tax year 2023. For single taxpayers and married individuals filing separately, the standard deduction rises to $14,600 for 2024, an increase of $750 from 2023; and for heads of households, the standard deduction will be $21,900 for tax year 2024, an increase of $1,100 from the amount for tax year 2023.

Marginal Rates: For tax year 2024, the top tax rate remains 37% for individual single taxpayers with incomes greater than $609,350 ($731,200 for married couples filing jointly). The other rates are:

35% for incomes over $243,725 ($487,450 for married couples filing jointly)

32% for incomes over $191,950 ($383,900 for married couples filing jointly)

24% for incomes over $100,525 ($201,050 for married couples filing jointly)

22% for incomes over $47,150 ($94,300 for married couples filing jointly)

12% for incomes over $11,600 ($23,200 for married couples filing jointly)

The lowest rate is 10% for incomes of single individuals with incomes of $11,600 or less ($23,200 for married couples filing jointly).

The Alternative Minimum Tax (AMT) exemption amount for tax year 2024 is $85,700 and begins to phase out at $609,350 ($133,300 for married couples filing jointly for whom the exemption begins to phase out at $1,218,700). For comparison, the 2023 exemption amount was $81,300 and began to phase out at $578,150 ($126,500 for married couples filing jointly for whom the exemption began to phase out at $1,156,300).

Estates of decedents who die during 2024 have a basic exclusion amount of $13,610,000, increased from $12,920,000 for estates of decedents who died in 2023.

The annual exclusion for gifts increases to $18,000 for calendar year 2024, increased from $17,000 for calendar year 2023.

Source: Tax Foundation, IRS

Global markets shifted positively in November as the Federal Reserve signaled that further rate hikes were less likely as economic conditions and inflation cooled. Stocks and bonds both advanced in November, following the expectations that the Fed may be on track to finalize its rate increase initiatives. Various fixed-income analysts even project interest rate cuts by the Federal Reserve as early as March 2024.

Numerous economists and analysts are encouraged that the Fed may have decided to ease its fight against inflation due to the most recent Consumer Price Index (CPI) release indicating that inflation is easing. November CPI data revealed that inflation rose at the slowest pace since 2021, with the CPI rising at 3.2%, down from 7.1% a year ago in November.

There is also a growing consensus that the Fed may be able to achieve a soft landing by easing rates slowly and avoiding the risk of recession. The U.S. economy has thus far been incredibly resilient to the Fed’s rate hikes, which have been hawkish over the past year. The Federal Reserve has communicated that it is carefully monitoring the effect of heightened interest rates on consumers and the economy. Some analysts believe that if the economic environment slows more than the Fed expects, then a transition to lowering interest rates might eventually be executed by the Federal Reserve.

Government data disclosed that domestic economic growth, as measured by Gross Domestic Product (GDP) grew at an annual rate of 5.2% in the third quarter of 2023, up from 2.1% in the second quarter of the year, according to the Bureau of Economic Analysis. Since the Federal Reserve tracks GDP growth for inflationary pressures, fourth-quarter data for 2023 will be critical in determining the Fed’s conclusive decisions on the direction of interest rates.

The price of nearly all major commodities has fallen this year, indicative of lessening inflationary pressures as global economies experience slower economic expansion. Commodities including copper, lumber, natural gas, and crude oil have all declined for the year so far, both domestically and internationally.

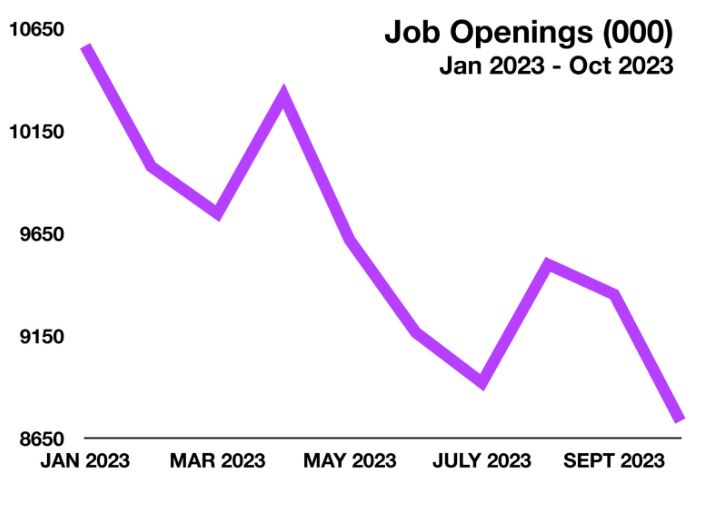

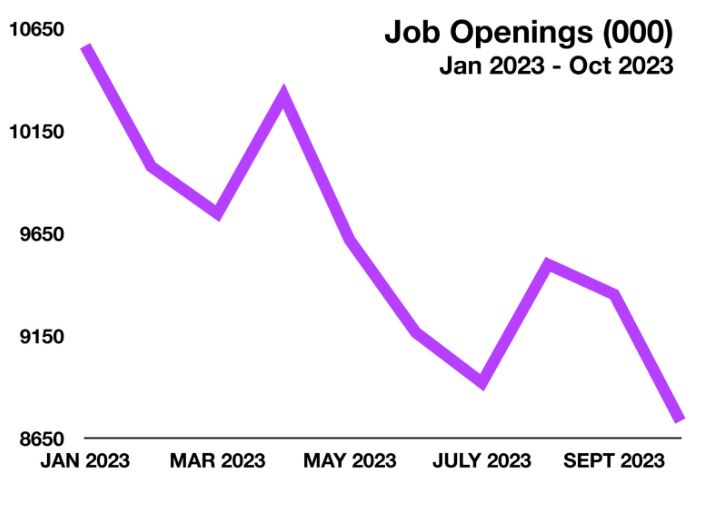

The number of job openings nationwide has been declining all year, with over 11.5 million open positions in January 2023, falling to 8.7 million in October, as revealed by the most recent government data available. Companies in various industries including technology and leisure, have begun scaling back on hiring and some have even implemented layoffs. Economists view a wavering labor environment as an indication of a possible economic slowdown.

Federal income tax rates are set to increase slightly in tax year 2024, with increases across most income brackets for both single and married taxpayers. The standard deduction for married couples filing jointly for tax year 2024 rises to $29,200, an increase of $1,500 from tax year 2023. Some increases are indexed for inflation while others are set by legislative reform.

Sources: Federal Reserve, Treasury Dept., BEA, Labor Dept., IRS, St. Louis Fed Bank

With the onslaught of popular electronic payment methods, cash continues to be a primary payment method of choice. The average person still uses cash for transactions every month and in some cases will only use cash for certain purchases, according to an analysis by the San Francisco Federal Reserve Bank.

Various benefits for cash still exist, where credit cards or electronic payment forms just can’t compete. The most compelling reason to use cash is the fact that it is anonymous, meaning that the person spending the money is invisible, relative to making a payment with a credit card or electronic method that can be tracked and identify who’s spending.

The San Francisco Fed study found that the average person pays with cash about 23 times a month, more often than credit cards and electronic payment forms. Most cash transactions are used for purchases of under $25. The study also identified 18 to 24-year-olds prefer cash to other payment forms, maybe due to the lack of credit card access available to younger consumers and students.

Of the various U.S. currency denominations in circulation, the 100-dollar bill is by far the most popular and the single most printed note. For the past two fiscal years (2022 & 2021) the 100 dollar bill has been the most produced note by the U.S. Bureau of Engraving & Printing, with over 2.3 billion individual 100-dollar bills printed in 2021, and over 2.1 billion 100-dollar bills in 2022.

Over 90 percent of currency printed by the U.S. Bureau of Engraving & Printing goes to replacing old and tattered bills already in circulation. Rather than replacing old bills with new electronic payment forms, cash continues to be king.

Sources: San Francisco Fed, U.S. Bureau of Engraving & Printing

Consumers nationwide are frustrated at gasoline pumps as prices have leaped much more quickly than they have dropped. As the drop in gas prices has afforded more discretionary spending for consumers, it now adds to the uncertainty of where fuel prices might be headed.

A study released by the Federal Trade Commission (FTC) showed that gasoline retail prices rise four times faster than they fall after wholesale price changes. The dynamics behind the price conundrum is how much gasoline stations pay for fuel and how long it takes for them to sell that fuel before wholesale prices move higher or lower.

Competition is also a factor as one station may have bought an 8,000-gallon load of gasoline the day before the decline started, in which case they’ll be even slower to drop their price since they paid a higher price. If a station isn’t as willing to be competitive, it stalls other stations from dropping prices further. Stations aren’t in the business of losing money, so they tend to resist dropping prices until another station does. That’s why there may sometimes be four stations on the same corner, yet selling the same grade of gasoline at different prices. Refineries, inventories, and delivery times also impact the price paid at the pump as these factors may vary from station to station.

The FTC study also found that in some places around the country, gasoline retailers sell at a loss when wholesale prices are high and then try to make up for that loss when prices go down. Retailers try keeping prices higher for as long as possible as the only way for them to make a minimal profit, or in some cases break even. Some stations are even willing to sell gasoline at a loss since some of these stations make most of their profit from attached convenience stores. If a sign boasting low prices draws drivers to the station, they’re more likely to spend money in the store.

Interestingly enough, the FTC study identified that when prices are high, buyers search around to find a better deal. Immediately after prices go down though, buyers don’t search as hard. This gives a cushion for the station owners to lower prices in smaller increments.

Sources: EIA. FTC