By Cindy Alvarez & Bob Newkirk

“A 10% decline in the market is fairly common—it happens about once a year. Investors who realize this are less likely to sell in a panic, and more likely to remain invested, benefiting from the wealth building power of stocks.”

– Christopher Davis

For most investors, 2022 might seem like a year to forget. Several factors combined to drive down values across nearly every investment class. Yet, remembering years like this can help us understand and adapt to future market declines. Corrections and bear markets are more common than most investors realize. Having a disciplined response is important to achieving expected returns over the long term.

.

The Bear Drives Stock Prices Down

A bit of Wall Street trivia is the origin of the terms “bear market” and “bull market.” Bulls attack by tossing their victims up. A bull turning the tables on a matador uses his horns to throw his tormentor into the air. Bears attack by striking their victims down. A grizzly bear on its hind legs uses its forepaws to drive its prey to the ground.

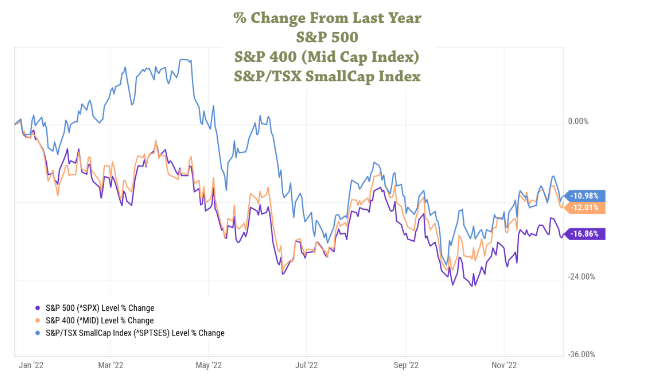

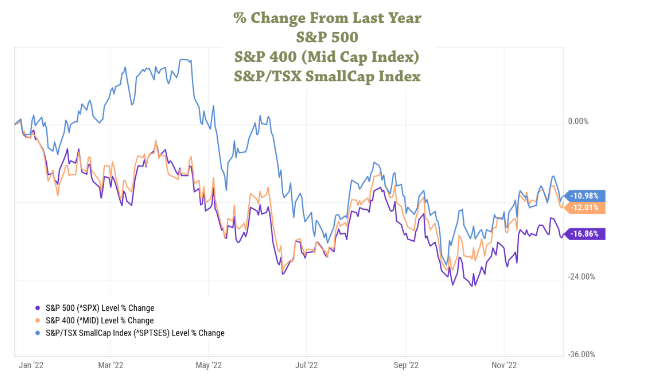

The proverbial bear struck down the stock portfolios of nearly all investors in 2022. Although markets have recovered modestly, the stock indices for large, mid and small capitalization equities all had fallen by more than 20% at one point this year. A 20% decline is a commonly accepted definition of a bear market.

.

What about Bonds?

Investors traditionally have been able to moderate the impact of equity market swings by also holding bonds. The risk and return on bonds is generally lower than for stocks. The equity markets may swing wildly, but the return on bonds is usually relatively steady – and sometimes has even increased in times of falling stock prices. For example, during March of 2020, pandemic effects caused the Dow Jones Industrial Average to fall by 13.74%. Meanwhile, the ICE U.S. Treasury Core Bond Index gained 3.17% – a positive difference of nearly 17%!

While the pandemic was an extraordinary event with extraordinary effects, in general bonds have provided a stable counterweight to equities.

.

Given this history, many investors were surprised that in 2022 bonds did not function as a “safe harbor” from the risk of stocks. Both stocks and bonds declined. In fact, despite the bear market in stocks, by one measure the return on the Dow Jones was better than U.S. Treasury bonds – a 7% loss versus a nearly 11% loss.

Investors who sought refuge in other investment categories also suffered losses: Real estate (down 26%), gold (down 1%) or bitcoin (down 64%).

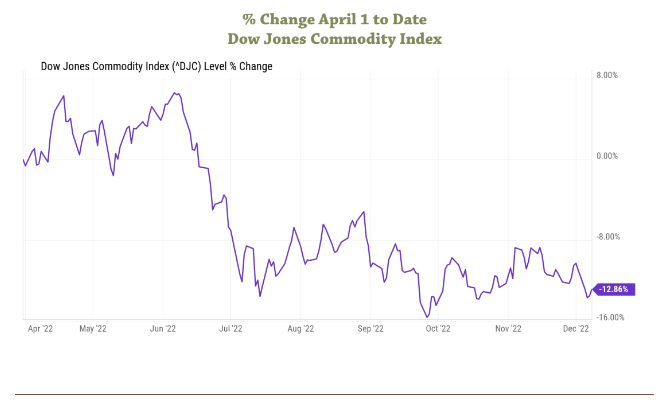

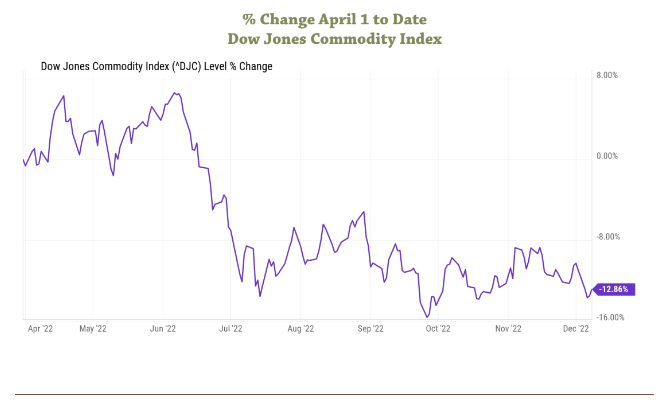

One bright spot on a year-to-date basis was commodities (up 8%). However, only an investor who had money in the commodities sector at the beginning of 2022 was successful. Waiting until the end of March to invest would have meant a loss – approximately 13%.

The Drivers of Decline

Several factors contributed to the broad-based decline in investment values. One factor is the effect of inflation on the valuations of stocks and bonds (See Could Inflation Affect My Investments?). In addition, concerns about a future recession, in part due to the Federal Reserve Board’s actions to reduce inflation, have negatively impacted markets. (See Will the Fed’s Inflation Fight Cause a Recession?). The war in the Ukraine also disrupted global markets, particularly in energy. (See Will the Economic War with Russia Cause a U.S. Recession?; see also Drilling Into Global Oil Markets)

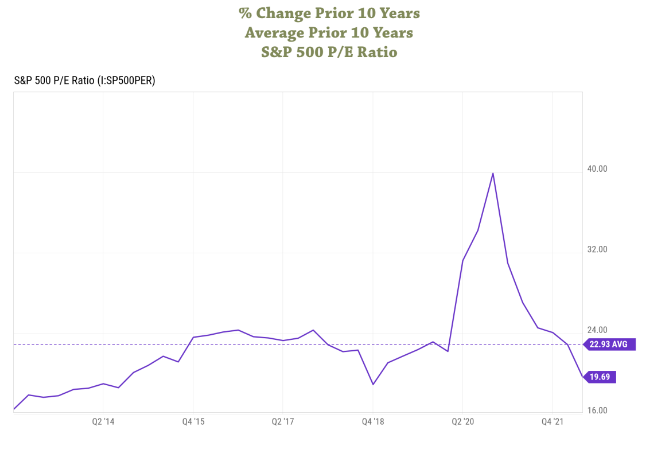

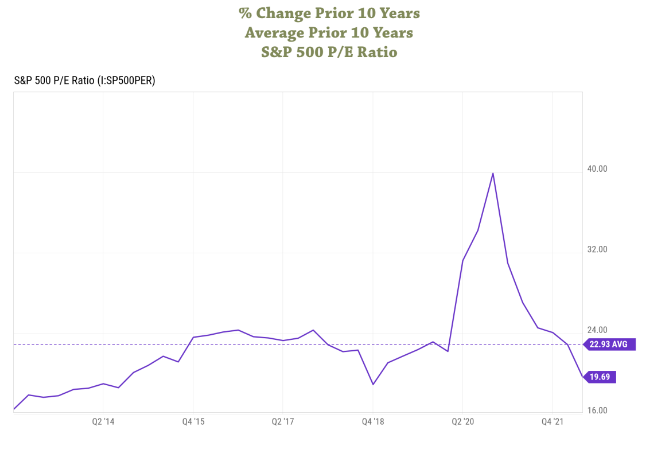

A more technical factor is a return to more typical Price-to-Earnings (PE) ratios in the stock market. A PE ratio is the price per share of a stock, divided by its most recent earnings per share. In rough terms, the PE ratio represents how much an investor is paying for each dollar of recent annual earnings. If the ratio is 20, the price for every $1 of earnings is $20. The PE ratio can be calculated for a specific stock, or for a collection of many stocks, like the S&P 500 index of large U.S. publicly traded companies.

For the last 10 years, the average PE ratio for the S&P 500 was about 23. During 2020, the ratio nearly reached 40 – meaning that investors were paying about $40 for every $1 of earnings. Since then, the ratio has dropped to a more reasonable level of around 20.

Painful as it has been, this drop in the PE ratio bodes well for potential future returns in the stock market.

Down Markets Happen

Although this year’s market was especially challenging, it’s important to remember that bear markets occur regularly – roughly every four to eight years on average. Corrections – a drop of 10% – are even more common. (See Know Thyself in Down Markets: Accepting Losses for Future Gains). Accepting these periodic losses is part of being a sophisticated investor.

Another part is being patient while waiting for markets to recover. Such patience will likely be necessary next year. The Fed is signaling that interest rates will continue to increase. The conventional wisdom is that a recession is lurking in the wings for 2023. The war in the Ukraine continues with no end in sight.

Being invested in the market is necessary to gain the benefit when prices recover and climb. A discussion with a financial advisor can help you understand whether your investment allocations are well-positioned for when that day arrives.

Cindy Alvarez is a Senior Wealth Management Advisor and an Owner of Wambolt & Associates. Bob Newkirk is a registered C.P.A, former investment banker, and prior Fellow in Law and Economics at the University of Chicago.

The views expressed in this article reflect the personal opinions, viewpoints and analyses of the Wambolt & Associates, LLC employees or contractors providing such comments, and should not be regarded as a description of advisory services provided by Wambolt & Associates, LLC or performance returns of any Wambolt & Associates, LLC client. The views reflected in this whitepaper are subject to change at any time without notice. This whitepaper is intended to provide education about the financial industry. It is NOT intended to provide investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recom mendation to buy or sell that security. Wambolt & Associates, LLC manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the whitepaper. Past performance is no guarantee of future results. Please remember that all investing involves the possible risk of loss of principal capital. Wambolt & Associates, LLC is a registered investment adviser. Advisory services are only offered to clients or prospective clients where Wambolt & Associates, LLC and its representatives are properly licensed or exempt from licensure. No advice may be rendered by Wambolt & Associates, LLC unless client service agreement is in place.