By Cindy Alvarez & Bob Newkirk

“We aren’t addicted to oil, but our cars are.”

– James Woolsey

Roughly 99% of vehicles in the U.S. run on gasoline or diesel fuel. The price of oil used to produce gasoline and other energy products continues to have a significant effect on the U.S. economy, its corporations and your investments. The oil market is truly global, with price changes in Europe and elsewhere directly affecting the market in the United States. While the U.S. has some influence over domestic energy prices, knowledgeable investors pay attention to developments in both the global energy markets and related U.S. policies.

.

Energy Costs, Inflation and Economic Growth

Overall, in part due to higher prices for oil and gas, the amount consumers are spending on

energy has increased by 10% to 30% over last year.

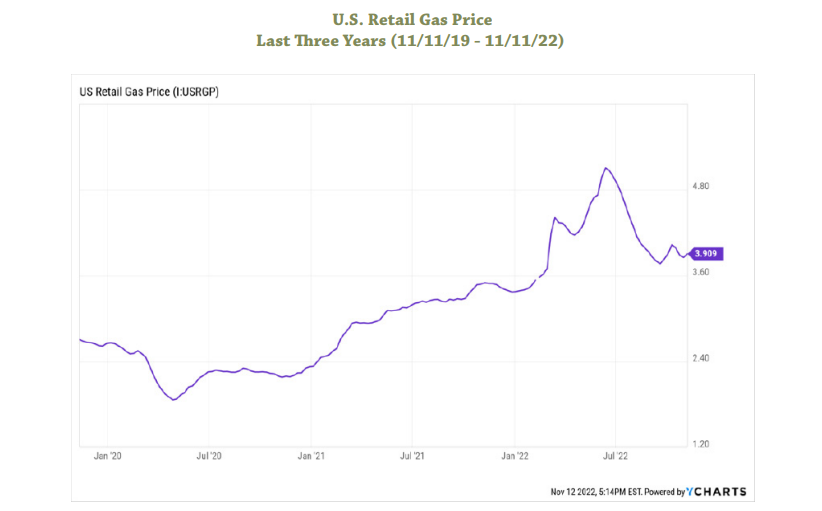

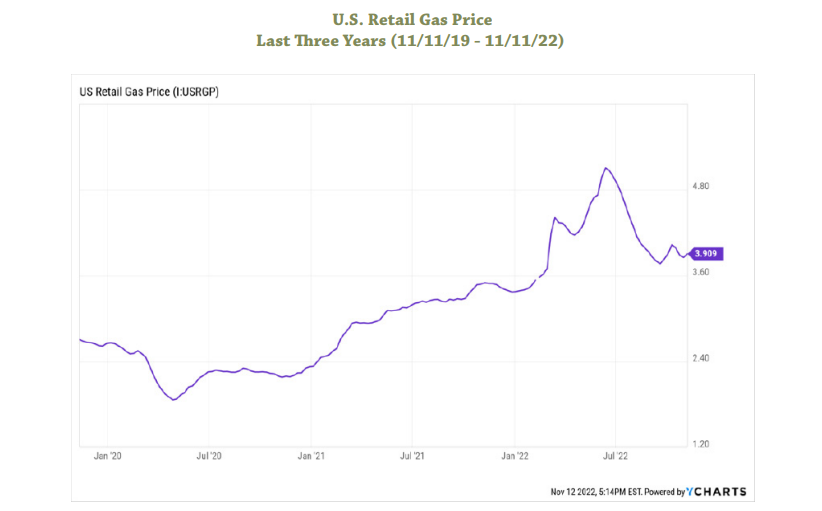

The most obvious effect of higher oil prices is on the price of gasoline. While it has moderated

recently from highs earlier in the year, the price at the pump is still up an average of $1.50 per

gallon, or about 50%, from two years ago.

.

The impact of higher energy prices is more significant for lower-income households. According to a 2011 Minneapolis Federal Reserve Bank study, U.S. households with income in the lowest 20% spend more than 14% of their pre-tax income on energy.

Higher oil prices can hurt overall corporate performance, and the performance of their stock prices. When consumers have to spend more on energy, they have less to spend on other goods or services. J.P. Morgan’s 2015 research report, How Falling Gas Prices Fuel the Consumer, estimated that about 80% of a change in gas spending drives changes in spending on other goods and services.

If that discretionary spending declines due to high gas prices, it hurts the economic growth that contributes to business profits. In addition, higher energy costs can drive higher inflation. In a February 2022 article, Oil Price Surge Threatens U.S. Growth, Josh Mitchell in the Wall Street Journal reported that a sustained price of $100 per barrel for oil in 2022 could shrink U.S. gross domestic product – a measure of the size of the economy – by 0.3%. That higher price could also grow inflation by 0.3%, which can also affect investment performance. (For an explanation of why, see Could Inflation Affect My Investments?)

.

The Global Oil Market Drives the U.S. Market

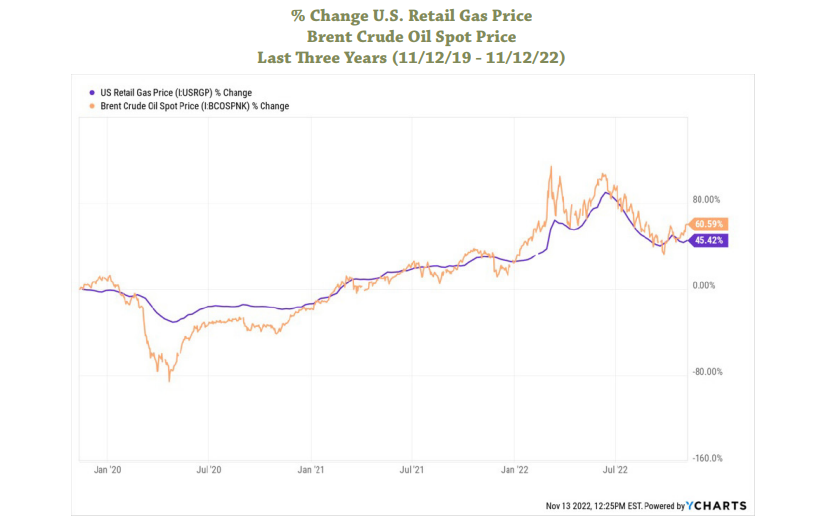

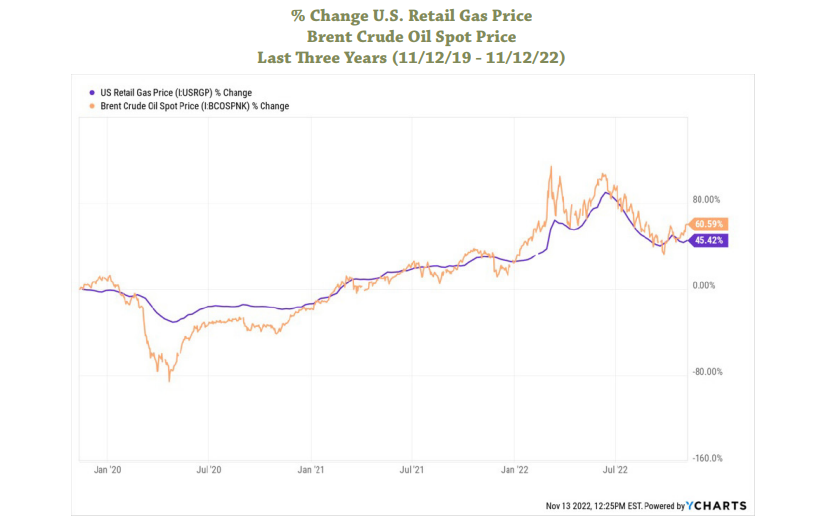

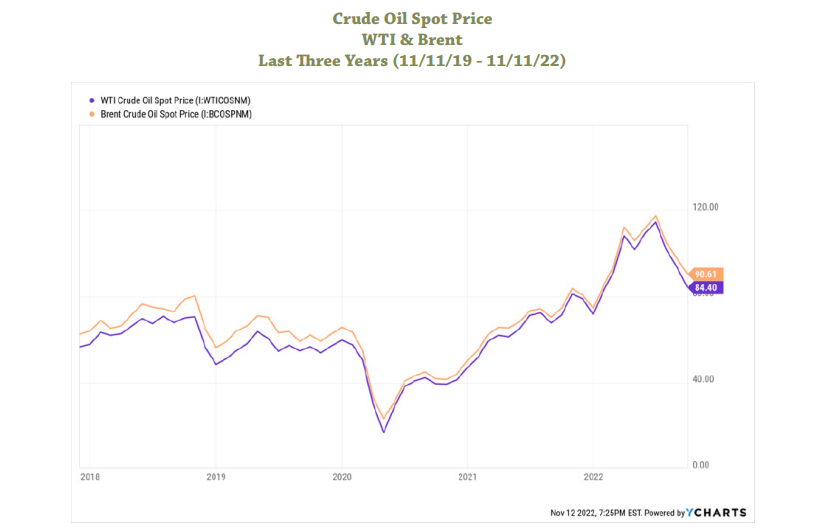

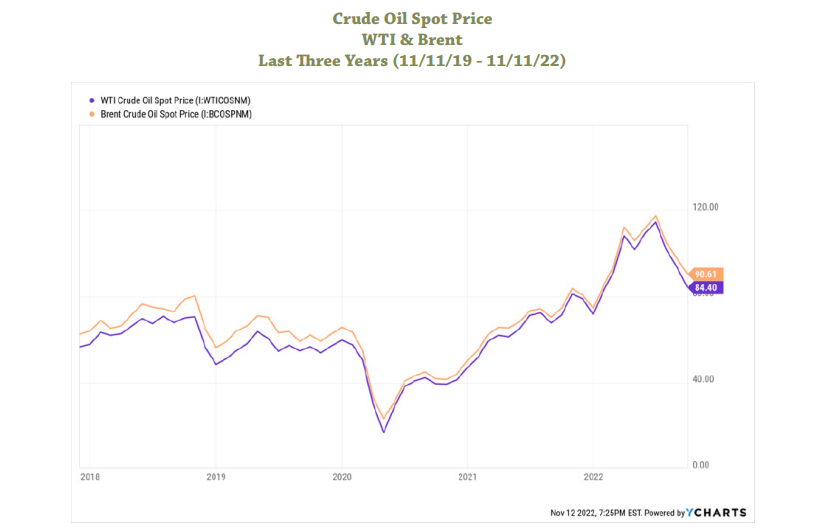

The price for gasoline is largely driven by the global price for the crude oil used by refineries to produce gas and other petroleum-based products. The most common benchmark for global crude oil prices is “Brent” crude oil. Brent crude is “sweet” or easier to refine, and is produced in the North Sea between Great Britain and Norway, which makes it readily available to ship via oil tanker.

The price in the U.S. for gasoline moves up or down as the price of Brent crude oil moves up or down. This is a very tight relationship. The only significant variation was in March 2020, when demand for gasoline temporarily plummeted due to pandemic-related shutdowns.

.

Likewise, the price for a barrel of oil produced anywhere in the world generally changes based on how prices in the global oil market are changing. There are differences in the market value of oil from different regions. For example, crude from Canada’s oil sands is “heavy” and more difficult to refine into consumer products like gasoline. The location of oil fields also makes a difference. Production of “West Texas Intermediate” (WTI) crude oil from the Permian Basin in New Mexico and Texas is well inland, away from seaports. This makes shipping overseas more difficult than for Brent crude, which is produced offshore. Despite the differences between Brent crude and WTI crude, their prices move up and down very closely with each other.

US Has Some Influence

Some are surprised to learn that the United States is the world’s largest oil producer. Sophisticated fracking techniques, though controversial, are the primary reason. U.S. crude oil production represents about 15% of total global production. The U.S. produces over one million barrels of oil per day more than Saudi Arabia or Russia.

The major producers of crude oil, including the U.S., can influence oil prices. The global price for crude oil generally follows the basic economic laws of supply and demand. Prices will tend to decrease when supply increases, or demand lowers. Prices will tend to increase when supply is limited, or demand increases.

A recent example of a reduction in supply is an action by the Saudi-led Organization of the Petroleum Exporting Countries (OPEC) and certain other oil-producing countries, notably Russia. The combined group is known as “OPEC Plus.” The OPEC Plus cartel can control over half of global oil production. In early October, various media outlets reported that OPEC Plus agreed to reduce crude oil production by around 2 million barrels every day. An immediate increase in oil prices followed.

The Biden Administration has tried to lower oil and gasoline prices through releases from the U.S. Strategic Petroleum reserve. In mid-October, the Administration announced widely reported plans to sell another 15 million barrels of oil from the Reserve. Unfortunately, 15 million barrels represents less than two days worth of U.S. oil production, so the impact on prices from this one-time sale is likely to be more symbolic than significant.

These two examples illustrate the importance of analyzing the effect of both global developments and U.S. policies on crude oil production. (For a discussion of other global markets, see Oceans Do Not Financial Moats Make.) Meaningful price changes for crude oil will more likely result from changes that affect supply or demand for longer time frames or permanently, rather than one-time or temporary supply or demand shifts.

International developments could include increased oil production by Venezuela, a resolution of the war in Ukraine, or a decrease in demand due to slower economic growth in China. Domestic developments could include changes in regulation of methane emissions from oil wells, tax law adjustments, drilling leases on federal lands, or increased incentives to use alternatives to oil, including renewables.

Conclusion

The oil market is an example of how international developments combined with domestic policies can affect both economic growth and inflation. In turn, both growth and inflation affect investment returns. A sophisticated investor stays well informed on both global and U.S. developments that can impact a financial portfolio. A dedicated financial advisor can be a good resource to help you analyze news from around the world.

Cindy Alvarez is a Senior Wealth Management Advisor and an Owner of Wambolt & Associates.

Bob Newkirk is a registered C.P.A, former investment banker, and prior Fellow in Law and Economics

at the University of Chicago. The information in this article is for general informational purposes,

and is not individual financial advice.