By Cindy Alvarez & Bob Newkirk

“There is no Ground Hog Day, when all the economists come out from the tunnel and declare the recession is over. They have a retroactive, seasonally-adjusted Ground Hog Day.”

– Peter Lynch

The recent debate about whether the economy is or is not already in a recession can be a distraction from the important underlying facts. What is generally accepted is that the U.S. economy is weakening. Economic growth, as measured by the domestic production of goods and services, is either slowing or reversing. Markets usually perform less well when economic output falls. However, overall market declines may be starting to reverse, and may also provide attractive opportunities to invest in specific companies.

GDP Explained

To describe what constitutes a recession, a few basic economic terms are helpful. The first is Gross Domestic Product (GDP). GDP measures the total value of all final goods and services produced within a country. GDP is an imperfect but commonly accepted measure of the size of a country’s economy. The U.S. is the largest economy in the world. During 2020 in the U.S., the annualized GDP was $20.9 trillion. By comparison, the GDP of China for 2020 was $17.7 trillion – a smaller GDP despite the Chinese having a population advantage of over one billion people.

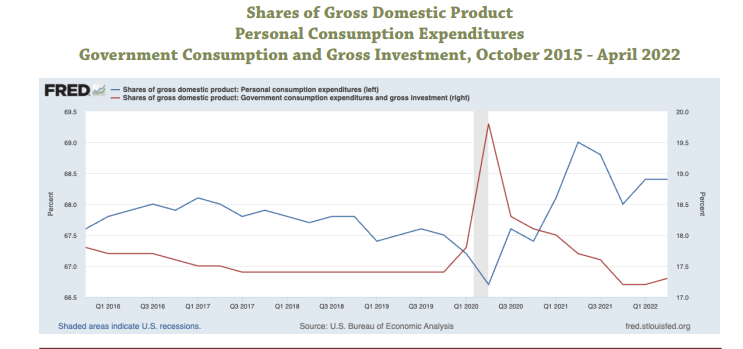

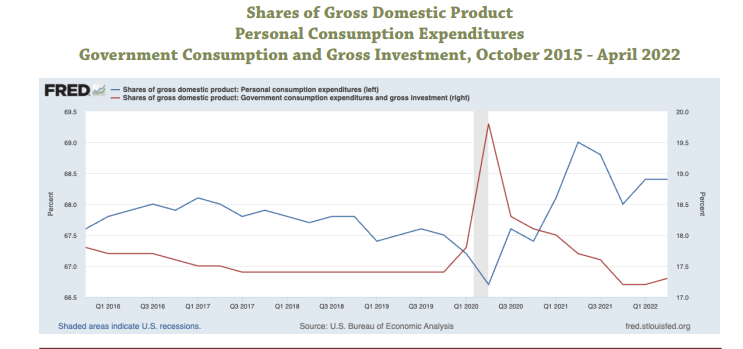

Total GDP is the sum of several aspects of the economy: consumer spending, investment spending, primarily by business, and government spending. GDP is increased by any trade surplus and decreased by any trade deficit. Another key aspect of measuring GDP is to use “real” figures, or dollars adjusted for the effects of inflation. For example, if a (very small) economy has a GDP of $100, and annual inflation of 10%, if the GDP the following year is $110 the “real” GDP has not changed at all. The increase is only the effect of inflation. (See What’s Up With Inflation?)

Recessions Defined

A rule of thumb for when the economy is in a recession is if there are two consecutive quarters, or six months, of a decline in the real GDP. However, the Federal Reserve Board (Fed) relies on a private think tank, the National Bureau of Economic Research (NBER) to define recessions, based on a broader array of economic data. The NBER has not declared whether the U.S. economy has entered a recession in 2022.

A recession is one aspect of the overall economic cycle. That cycle consists of expansion to a peak, then recession to a trough, then back to expansion. Since 1947, per the NBER, the U.S. economy has experienced 12 recessions, each in connection with a full business cycle of expansion, peak, recession and trough.

.

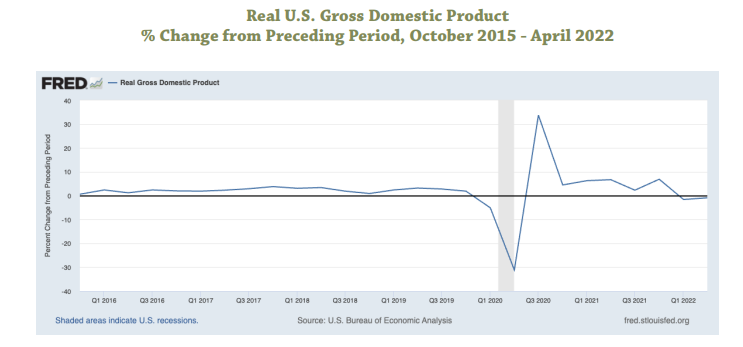

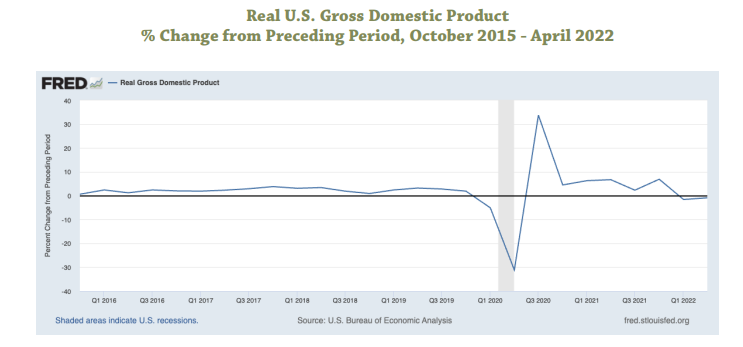

As a result of the pandemic, the U.S. economy experienced a brief but sharp recession in 2020. The economy hit a trough in April 2020 then recovered strongly into an expansionary phase. The current concern is that the U.S. economy may have already entered a recession. This is because annualized, real GDP decreased in each of the first two quarters of 2022, by 1.6% and 0.9%.

.

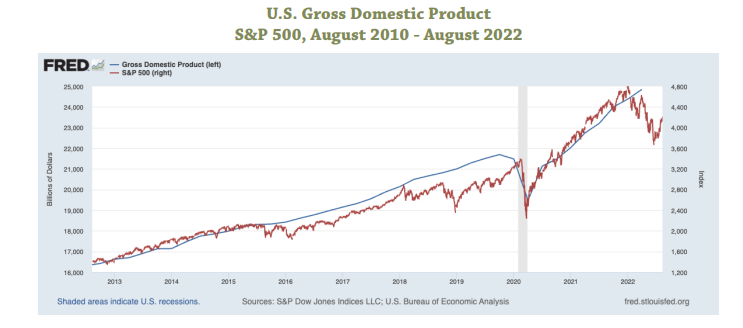

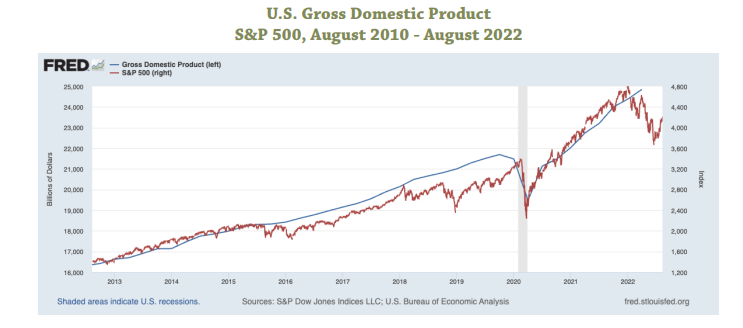

GDP & Investment Returns

Unsurprisingly, there is a strong relationship between overall economic production, measured by GDP, and overall performance of the stock market. When the economy is growing, businesses are selling more goods and services, and in general the valuation of their stocks increases. When sales fall, stock prices fall.

How Bad Could It Get?

Whether we are technically in a recession or not, investors have had reason to be concerned in 2022. In addition to negative GDP growth during the first half of the year, the Fed is in the process of raising interest rates in the U.S. economy to combat inflation. Higher interest rates make credit more expensive, reducing demand for houses, cars and other consumer products, which could further reduce GDP. (See Will the Fed’s Inflation Fight Cause a Recession? and Who’s Afraid of the Big, Bad Fed? Federal Reserve Policies Explained)

In addition to concerns, there are also reasons for cautious optimism. First, the Fed is explicitly seeking a “soft landing” – a reduction of inflation that does not cause a severe recession. Second, the recent declines in GDP are, at least in part, due to the rapid decrease in government spending from a dramatic peak arising from the massive relief bills passed during the pandemic While government spending has fallen off, consumer spending has remained relatively stable. Continued consumer spending would also help prevent a recession.

Current Investment Climate

After falling sharply earlier this year, the S&P 500 index is up about 15% since June. This indicates that many investors may believe that overall economic prospects are not as bad as once feared. In addition, broad stock market declines in connection with recessions may provide opportunities to buy stocks of specific companies at attractive valuations – if their prices were driven down by overall negative market sentiment.

This may be particularly true of businesses with strong cash positions that will allow them to weather weak economic conditions in the near-term. As always, any such investments should be consistent with your overall, long-term financial strategy. A modest shift rather than wholesale repositioning is often the wiser choice.

Cindy Alvarez is a Senior Wealth Management Advisor and an Owner of Wambolt & Associates.

Bob Newkirk is a registered C.P.A, former investment banker, and prior Fellow in Law and Economics

at the University of Chicago.