By Cindy Alvarez & Bob Newkirk

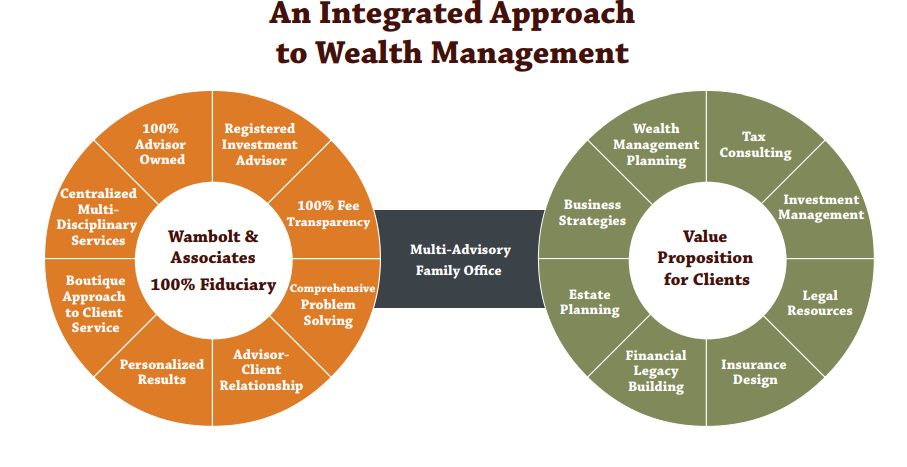

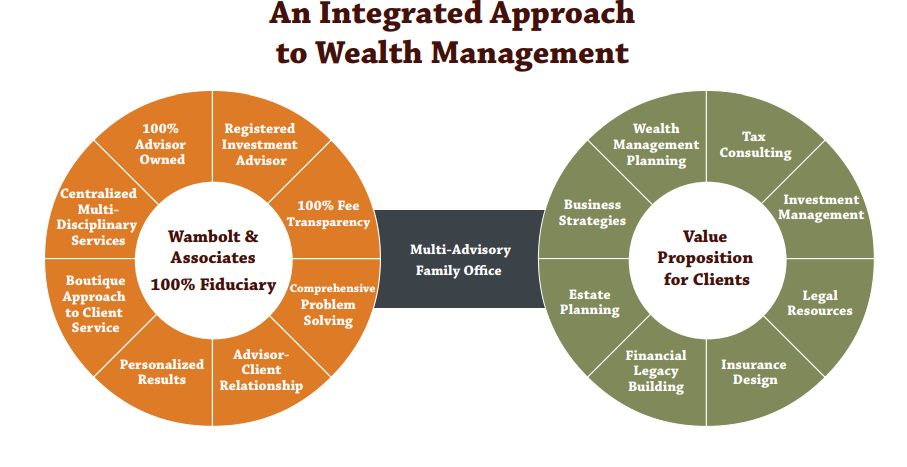

A traditional “family” office provides comprehensive investment, tax, estate and other services to achieve long-term financial goals, including passing on wealth to future generations. Providing all these services is expensive, and to justify an office focused on a single family may require wealth possessed by very few. However, a different model leverages the scale achieved from many clients to create an efficient, cost-effective “multi-family” office for those not in position to create their own dedicated office. Wambolt & Associates uses this approach to integrate multiple professional services into a comprehensive and tailored financial plan, all subject to a fiduciary duty to act in a client’s best interests.

A Brief History of Family Offices

The original family offices were quite literally that. The offices managed the financial affairs for business titans of the late 1800s, for themselves and their kin. One of the largest family offices today, the Bessemer Trust, was founded in 1907 by an officer of Carnegie Steel. Rockefeller Capital Management, unsurprisingly, has its roots in the estate of John D. Rockefeller.

Today, these “offices” are large businesses managing many billions of dollars and the affairs of dozens if not hundreds of clients, using the advantages that such scale can create.

Delivery of Multiple, Integrated Services

To establish an effective family office historically has required a substantial amount of wealth. $100 million or more in assets may be necessary to make creating a dedicated family office a practical exercise. Services delivered by such an office include not just investment, but estate planning and trust formation, tax consulting and return submission, related insurance purchases, business exit strategies, intergenerational wealth transfer and education, and other related matters.

A “multi-family” office uses a different model to provide a range of services through a vetted team of advisors, all coordinated by a single financial consultant with the client’s particular objectives in mind. Wambolt’s goal is to ensure that all of the firm’s clients – those who have built a substantial nest egg and those who have just begun their journey toward financial success – have the advantages of this model.

The model is both effective in the delivery of a variety of services, and also efficient because of the underlying collaboration. Clients making tax decisions access a Certified Public Accountan (CPA) for advice on tax implications. Clients wishing to create a trust consult an estate planning attorney. Clients looking to add an insurance product to their holdings consult a risk management specialist. In each case, a wealth management advisor from Wambolt helps manage the effort, so that there is shared information and consistency across the various experts. Perhaps most importantly, each service is integrated into an overall financial plan tailored to a specific client’s circumstances.

“What differentiates Wambolt is that we bring an integrated, family-oriented financial management experience to all of society, not just the wealthy.”

A Fiduciary Duty to Each Client

The wealth management advisors at Wambolt operate under the firm’s status as a Registered Investment Adviser (RIA). As an RIA, Wambolt is regulated by the U.S. Securities & Exchange Commission under the Investment Advisers Act of 1940

RIAs always owe a “fiduciary duty” to act in the best interests of their clients. This legal duty encompasses several responsibilities, including that RIAs must:

• Eliminate, limit or disclose conflicts of interest

• Disclose all material facts

• Establish a reasonable basis for investment recommendations

Many investors are familiar with stockbrokers, or “broker-dealers.” Firms such as Raymond James, Edward Jones or Charles Schwab, as well as many banks and other financial firms, operate as broker dealers. While “Regulation BI” has increased the responsibilities of broker-dealers, they do not have the same fiduciary duty to their clients that a RIA firm such as Wambolt has.

A Customized Plan for You

One of the ways in which Wambolt fulfills its fiduciary duty is by establishing long-lasting relationships between specific clients and a single wealth management advisor. Wambolt understands that no two clients are the same, and each client should have a tailored wealth management plan. Each advisor gets to know each client’s individual circumstances – their risk profile, their current assets, their family members, their goals. An initial plan reflects these circumstances and is subject to a client’s approval. That approval is based on a clear explanation of the underlying concepts, no matter how complex. As circumstances change, so does the plan.

The Importance of Unbiased Fees

“What differentiates Wambolt is that we bring an integrated, family-oriented financial management experience to all of society, not just the wealthy.”

“Good advisors make poor decisions for clients when there’s a paycheck attached

to those decisions.”

Wambolt’s compensation is in the form of management fees, based on a percentage of assets under management. As a result, Wambolt’s compensation increases as the wealth of our clients increases. This is in contrast to brokers or other agents who are paid commissions when they sell financial or other products to their clients. In that model, the agent is compensated for the sale, rather than investment performance. The difference in the models is that Wambolt’s recommendations are unbiased by sales commissions.

As Wambolt, we are truly invested in achieving positive results. Here are few important attributes of the Wambolt fee model:

- Wambolt charges its percentage management fee quarterly, with complete transparency. Clients need not read the fine print to understand the charges from Wambolt they are incurring.

- Wambolt’s fees grow only if your portfolio grows, aligning incentives. And if market valuations fall, Wambolt’s fees fall.

- Wambolt does not generally make commissions on the sales of investment products, with the industry-wide exception of insurance policies.

- Wambolt’s investment strategy is to make direct investments in stocks and bonds, or low-cost ETFs. Wambolt’s portfolios avoid mutual funds and other investments that charge high embedded management fees. This methodology lowers a client’s aggregate investment expenses.

- Wambolt’s management fees as a percentage of a portfolio drop as portfolio size grows. As a result, the Wambolt fee grows at a slower overall rate than your portfolio growth rate.

- Wambolt’s fees also decline when the firm manages the assets for an entire set of family members. This approach also encourages estate and tax planning coordination amongst generations

The Wambolt Model

The illustration below helps describe how a Wambolt advisor integrates investments, tax

consulting, insurance, and estate planning into a comprehensive financial plan for each client.

Advisors are Owners

Many financial advisory firms are owned by banks or other financial services firms. Their advisors are employees only; the primary interest of the owners is in the financial success of the firm itself, not necessarily of clients. At Wambolt, the owners are also wealth management advisors. There is a much tighter and more personal link between clients and firm ownership. Delivering value to each client is not just an indirect means to create business value but motivated by a personal relationship. Helping Clients

Build a Legacy

A personalized, boutique-style approach to wealth management has been the norm for the wealthiest families for over 100 years. Wambolt delivers a set of the same services to those who are also seeking to manage their wealth, whether in the near-term or to create a solid financial plan for the future. Wambolt’s fiduciary-based model helps ensure an integrated and comprehensive financial plan today, and a smooth transition to future generations tomorrow.

The views expressed in this whitepaper reflect the personal opinions, viewpoints and analyses of the Wambolt & Associates, LLC employees providing such comments, and should not be regarded as a description of advisory services provided by Wambolt & Associates, LLC or performance returns of any Wambolt & Associates, LLC client. The views reflected in this whitepaper are subject to change at any time without notice. This whitepaper is intended to provide education about the financial industry. It is NOT intended to provide investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Wambolt & Associates, LLC manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the whitepaper. Past performance is no guarantee of future results. Please remember that all investing involves the possible risk of loss of principal capital. Wambolt & Associates, LLC is a registered investment adviser. Advisory services are only offered to clients or prospective clients where Wambolt & Associates, LLC and its representatives are properly licensed or exempt from licensure. No advice may be rendered by Wambolt & Associates, LLC unless client service agreement is in place.