By Cindy Alvarez & Bob Newkirk

“The trend is your friend … until the end when it bends.”

– Ed Seykota

Day trading by individual investors grew substantially during the pandemic. People stayed at home, spent more time online, and, in some cases, had additional funds to spend. These effects encouraged day trading, as did the market rally that started in March 2020. However, this year’s bear market has exposed the challenges of day trading. For casual investors, day trading is a volatile form of investing that can increase the emotional stress of trying to preserve net worth. A more traditional, long-term approach may be a better fit.

Day Trading, Defined

In common usage, a day trader is an investor who actively trades stocks, options and related financial instruments on a regular, short-term basis. More technically, the Financial Industry Regulatory Authority (FINRA) defines “day trading” as the purchasing and selling of the same security on the same day in a margin account. A brokerage customer who executes four or more day trades within five business days is generally a “pattern day trader.” Day traders range from individuals casually engaging in the activity, to professionals in hedge funds executing sophisticated trading strategies.

The Rise of Day Trading

Day trading has been around for decades. Day trading took off during the Internet market frenzy of the late 1990s. Commissions on trades dropped sharply, investors could easily buy and sell securities through new Internet-based applications, and the tech-heavy Nasdaq market was in the midst of a strong bull market. Some individuals quit their regular jobs to focus on stock investing.

History sometimes repeats itself. In the past few years, commissions on stock transactions have continued to drop, sometimes to zero. Mobile applications, such as Robinhood, have arguably “gamified” stock trading while making it very easy for small investors to order trades. Starting in March of 2020, the stock market rallied strongly from a pandemic-induced correction. The pandemic also resulted in economic impact payments and increased time at home and online. This combination, now as in the late 1990s, contributed to a dramatic jump in “retail” investment, i.e., individual stock trading.

Rising Markets, Greater Fools & High Tech Competition

Causal investors should be expected to start and continue day trading when they are making money by day trading. One reason day trading can appear attractive is the effect of a rising, “bull” market. In rising markets, it is easier to make profitable trades – which may mislead certain individuals into thinking that they are good at picking specific stocks. For example, consider the performance of the tech-heavy Nasdaq composite index during 2021, as illustrated in the following chart.

During 2021, this Nasdaq index rose 21.4%. If you picked any random Nasdaq stock and bought it at the beginning of the trading day, and then sold it at the end of the trading day, the odds were good that the stock price went up and you made money. Of course, some individual stocks did better than others, and some lost value during 2021. Overall, though, it was easy for day traders to make profits. “A rising tide lifts all boats.”

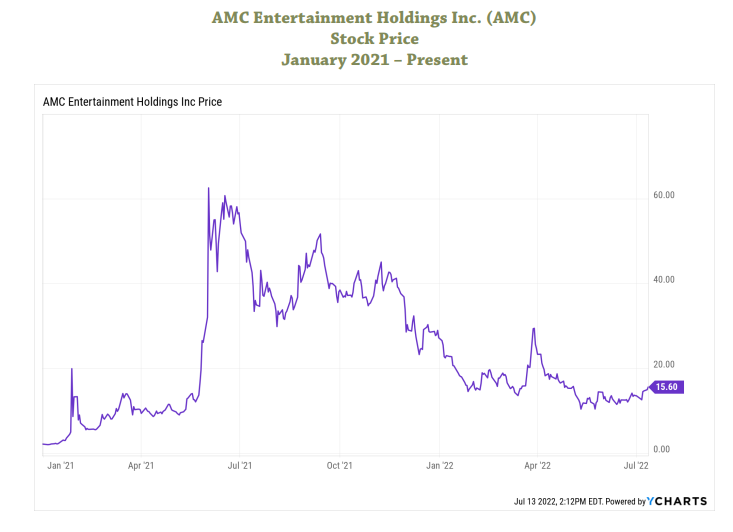

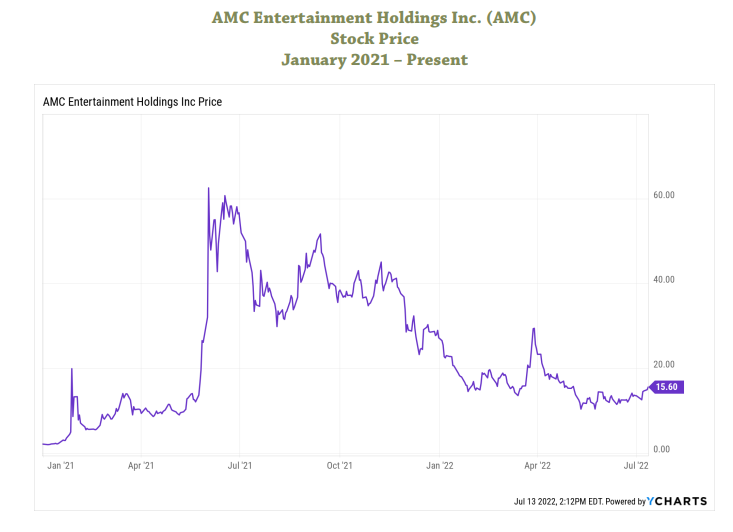

Day traders also could profit from recent investment “bubbles.” A “bubble” occurs when the price of an investment becomes disconnected from its underlying economic value. Although only provable in hindsight, some argue that bubbles occurred over the past two years in certain investment categories, e.g. Special Purpose Acquisition Companies (SPACs) and cryptocurrencies, and in specific “meme” stocks, e.g., GameStop (GME) and AMC Entertainment Holdings (AMC). These bubbles generally started with some reasonable basis for optimism. However, day traders and other investors then piled in, creating momentum that carried prices higher. Buying was often driven by online forums, like Wall Street Bets, where discussions often strayed from traditional, sound financial analysis. As prices rose to levels that were nearly impossible to justify in economic terms, gains could only be secured by sale at a higher price to a “greater fool,” i.e., someone even more optimistic, however irrational, about the prospects for the continued price increases.

As with all such bubbles, eventually the price starts falling, most or all of the fools are frightened away, and the purchasers at the highest price levels are saddled with losses. This phenomenon is illustrated by the stock chart for AMC, on the next page.

.

The siren songs of a rising market and pricing bubbles are certainly challenges. In addition, the casual day trader is often competing with hedge funds that use extensive data, proprietary algorithms and sophisticated, high-speed trading techniques to arbitrage any market pricing inefficiencies. These firms seek to generate extraordinary returns to justify the high fees they charge their clients, which may be 15%, 20% or more. This well-funded, highly-motivated competition adds another challenge for the average day trader.

Emotions & Entertainment

Some day traders, particularly experienced professionals, may experience sustained success. However, many day traders will succumb to falling markets, bursting bubbles and strong competition. Casual day traders are also often fighting their own emotions and psychology, which may subconsciously bias them toward holding on too long to stocks whose prices have fallen, or avoiding sensible long-term investments in down markets. (See Know Thyself in Down Markets: Accepting Losses for Future Gains and Pain vs. Gain: Taming Your Emotions in Uncertain Markets.)

For some, day trading couples the possibility of financial gain with a social outlet and entertainment qualities. This is similar to the experience at a casino. If you are heading to Las Vegas, it’s wise to understand the rules and odds of the games of chance you are playing, and to place limits on your losses. If you are intrigued by day trading, applying similar principles makes sense.

The Long View

While the “tides” of the market rise and fall, the level of the market “ocean” gradually rises over time. If you are enamored of day trading, recognize that there is strong competition in the short-term from sophisticated investors who will likely have a significant informational advantage. Understand the possible “bubbles” associated with stock prices that are sharply rising. Be realistic about the effects of overall market conditions on your successes. Most importantly, day trade only with funds you are comfortable losing. By comparison, for the bulk of your portfolio a “buy-and-hold” strategy typically requires less time and emotional energy, often lowers taxes payable, and likely yields returns that are at least as high.

Cindy Alvarez is a Senior Wealth Management Advisor and an Owner of Wambolt & Associates.

Bob Newkirk is a registered C.P.A, former investment banker, and prior Fellow in Law and Economics

at the University of Chicago. The information in this article is for general informational purposes,

and is not individual financial advice.