By Cindy Alvarez & Bob Newkirk

“Every portfolio benefits from bonds; they provide a cushion when the stock market hits

a rough patch. But avoiding stocks completely could mean your investment won’t grow

any faster than the rate of inflation.”

– Suze Orman

In our first installment of this two-part series, we reviewed basic terminology and historical returns in the bond markets. Using this understanding of fixed income investments, we will now explore examples of how bonds might fit into a well-designed portfolio. These examples will take into account the dynamics and opportunities in today’s market. We will also describe the advantages of buying individual bonds, rather than bond funds.

.

A Quick Recap

A few reminders from our first installment. We will use the term “bonds” as a catch-all phrase for all fixed income, debt-type investments. You can find descriptions of the varying types of fixed income securities, important differences from equity investments, and various terms used to define bonds in our “Part 1” article. (See Bonds are … Hot? Part 1: Yields, History, an Inversion)

When Bonds Make Sense

Bonds can serve three general purposes for investors. First, holding bonds typically reduces risk and volatility, compared to equities. Bondholders are paid before stockholders. Second, bonds commonly generate interest payments and therefore predictable cash income for an investor. Unlike with stock dividends, bondholders have a legal right to payments of interest and principal, when due. Third, bonds diversify a portfolio. Although 2022 was a rare exception, in general when stocks are down, bonds are up, and vice versa.

Current Opportunities

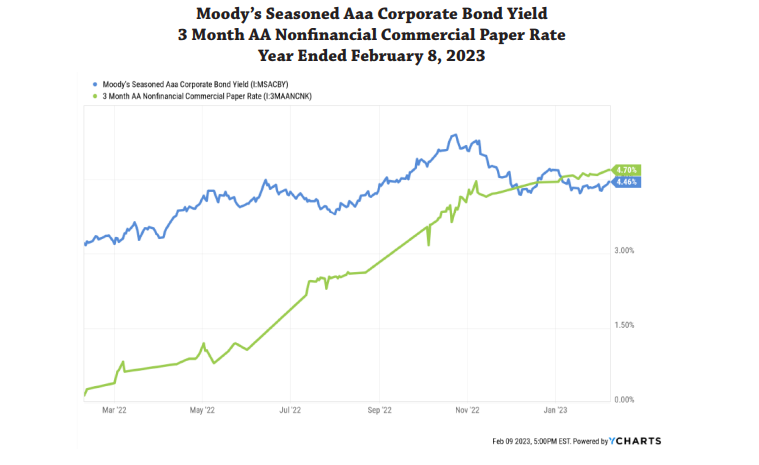

Over the last year, the market for bonds has shifted significantly. Yields on corporate debt have risen, both for short term commercial paper and in the overall market for “safe” corporate debt (rated Aaa).

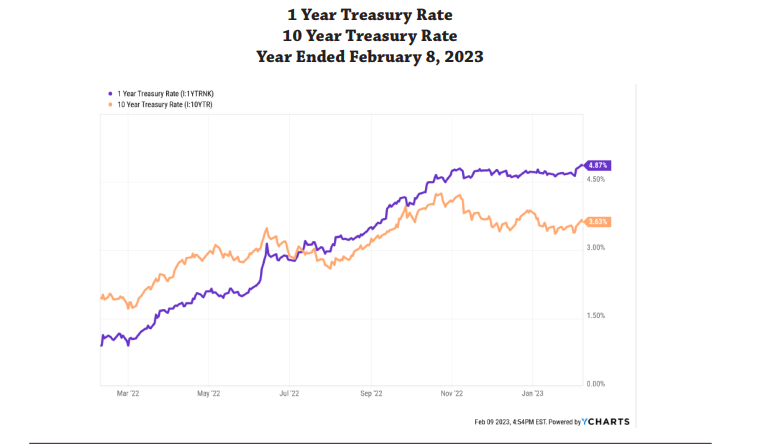

In addition, rates for U.S. Treasury have risen substantially. The 1 Year annual rate is currently 4.87%, up from 0.91%. The 10 Year rate is 3.63%, up from 1.96%.

For the first time in years, investors can earn meaningful cash interest payments on a variety of bonds.

In addition to increased rates, per the chart above, 1 Year U.S. Treasury rates are currently

higher than 10 Year U.S. Treasury rates. This combination constitutes the “inverted yield curve”

described more fully in Part 1. When short-term rates are higher than long-term rates, there

may be investment opportunities that aren’t typically available.

Advantages of Buying Individual Bonds

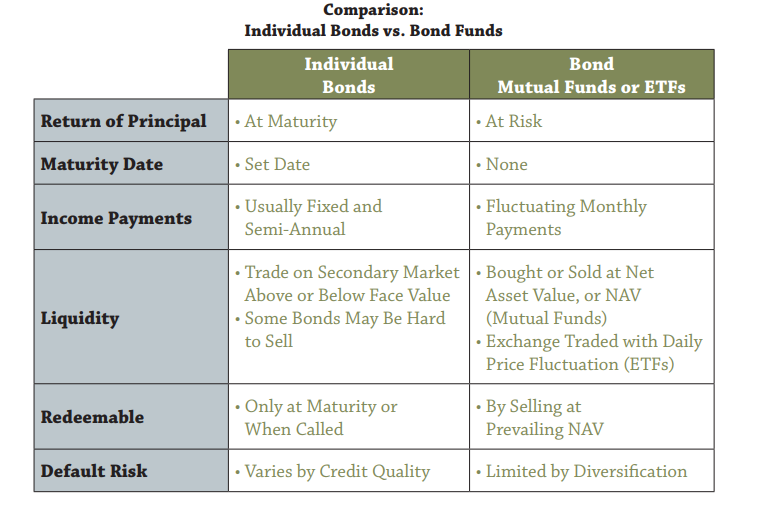

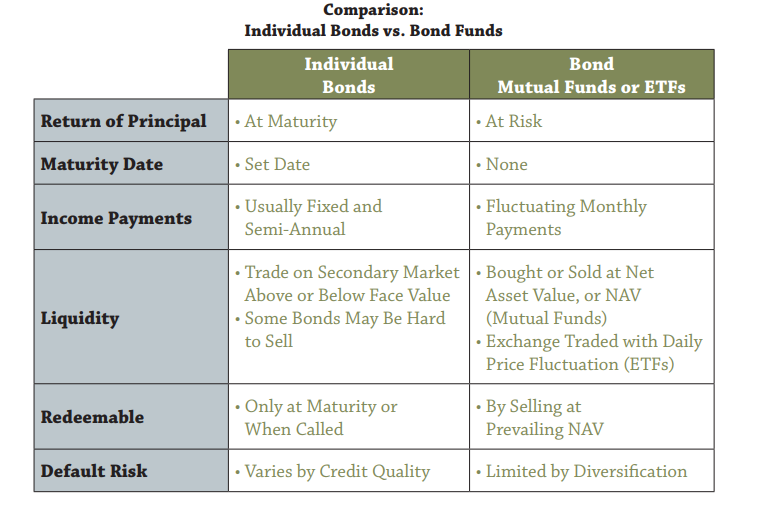

To take full advantage of current fixed income investment opportunities, investors are often

well served to hold individual bonds. Individual bonds have a number of important attributes

that bond funds do not. The differences are illustrated in the following table, which is based on

a chart published by the U.S. Financial Industry Regulatory Authority (FINRA).

Owning individual bonds allows an investor to control maturity dates, the timing and exact amount of interest payments, taxability and specific default risk to a greater extent than holding bond funds.

For example, you might be planning for a large expense in five years, e.g., taking your entire family to Europe for two weeks. The trip is likely to cost $30,000. By investing $30,000 in a Five Year Treasury bond today, the investor can lock in a 3.82% annual return and be highly confident in receiving $30,000 in time for the vacation, with no need to otherwise reserve cash, or sell other investments. Individual bonds can be effective in enabling this type of specific “liability matching” strategy.

Individual bonds may have advantages in changing market conditions.

• If rates increase, driving bond prices down, an investor can decide to hold the bond, collect the

remaining interest and receive the full face value of the bond at maturity.

• The current inverted yield curve means that investors can buy short-term bonds today with

attractive interest rates. If rates fall, the price of the bond increases. At maturity, the investor

can decide whether to re-invest in bonds or equities, based on market conditions at that time.

Bond Choices Tailored to Individual Profiles

Following are high-level examples of how individual bonds might fit into different portfolios based upon the current 2 year, 3 year, 5 year, 10 year, 20 year and 30 year yields.

The Long-Term Growth Investor

This investor is looking for strong overall growth in the portfolio, with an emphasis on equities. Fixed income investments are to provide diversification and lower volatility. Based upon the current yield curve, a bond strategy might include:

• Moderate percentage of overall portfolio, e.g., 10-20%

• Investment grade corporate bonds with these characteristics:

– 1-6 year maturities

– Companies with finances that indicate a strong ability to pay interest and principal

– Two recent positive credit agency reviews

The Long-Term Growth Investor Who Earns High Income

This investor has high income from any source in a state with a relatively high income tax rate. Fixed income investments are to diversify and reduce the overall risk of the portfolio. A bond strategy might include:

• Moderate percentage of overall portfolio, e.g., 10-20%

• Investment grade corporate bonds from the first example representing half of the overall fixed

income allocation

• The other half of the fixed income allocation in tax-free, high-quality municipal bonds with

these characteristics:

– 10-15 year maturities

– Uses of bond sale proceeds are low risk

– Reliable sources of funds to pay interest and principal

– At least one recent positive credit agency review

The Fiscal Conservative

This investor has a low tolerance for risk, desires stable income and has limited need for growth in the value of the portfolio. Based upon the current yield curve, a bond strategy might include:

- Higher percentage of overall portfolio, e.g., 50-60%

- Diversification of the bonds by including:

– U.S. Treasury bonds

– 1-5 year maturities

– Specific bonds based on yield to maturity

– Maturities matched to expected expenses

Naturally, every situation is different, and so every individual, with the help of a trusted financial advisor, must evaluate what mix of bonds makes sense for their financial situation.

An Informed Approach to Bond Investing

In this second installment on bond investing, we have explored changes in the market for bond investments. Opportunities now exist that have not been available for decades. While stocks will remain an important part of most portfolios, these market shifts should drive investors to consider fixed income investments. Individual bonds may be the best fit. However, evaluating and matching individual bonds within a portfolio can be complex. A financial advisory firm with specific expertise in this area may be helpful in deciding what’s best for you.

Cindy Alvarez is a Senior Wealth Management Advisor and an Owner of Wambolt & Associates. Bob Newkirk is a registered C.P.A, former investment banker, and prior Fellow in Law and Economics at the University of Chicago.

The views expressed in this article reflect the personal opinions, viewpoints and analyses of the Wambolt & Associates, LLC employees or contractors providing such comments, and should not be regarded as a description of advisory services provided by Wambolt & Associates, LLC or performance returns of any Wambolt & Associates, LLC client. The views reflected in this whitepaper are subject to change at any time without notice. This whitepaper is intended to provide education about the financial industry. It is NOT intended to provide investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recom mendation to buy or sell that security. Wambolt & Associates, LLC manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the whitepaper. Past performance is no guarantee of future results. Please remember that all investing involves the possible risk of loss of principal capital. Wambolt & Associates, LLC is a registered investment adviser. Advisory services are only offered to clients or prospective clients where Wambolt & Associates, LLC and its representatives are properly licensed or exempt from licensure. No advice may be rendered by Wambolt & Associates, LLC unless client service agreement is in place.