By Cindy Alvarez & Bob Newkirk

“In Globalization 1.0, which began around 1492, the world went from size large to size medium.

In Globalization 2.0, the era that introduced us to multinational companies, it went from

size medium to size small. And then around 2000 came Globalization 3.0, in which the world

went from being small to tiny.”

– Thomas L. Friedman

Investors are understandably often focused on domestic events. Inflation in the U.S., the Fed’s response, and the risk of a recession are all important topics. (See Will the Fed’s Inflation Fight Cause a Recession?) However, the financial prospects of many firms based in the U.S. are significantly affected by international developments. A savvy investor tracks global events in order to understand their potential effects on foreign investments but also, importantly, U.S. firms as well.

It’s a Tiny World After All

If you are invested in the U.S. stock market, you likely have a significant stake in the global market. A large chunk of the income for many U.S. companies is from overseas sales. According to Goldman Sachs, 29% of the aggregate revenue of the S&P 500 is from foreign sales. That figure is higher for a number of prominent corporations, based on reporting by CNBC. For Netflix and Meta (i.e., Facebook), foreign sales are 59% of their revenue. Semiconductor businesses have even more exposure, at 78%. Some of the businesses with substantial international sales may be surprising, e.g., 70% of the sales of the disability insurer Aflac are foreign.

.

Currency Exchange Rates Matter

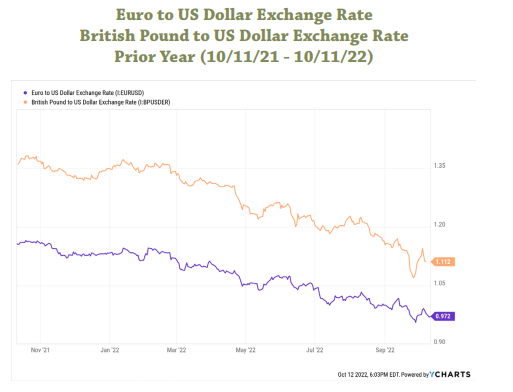

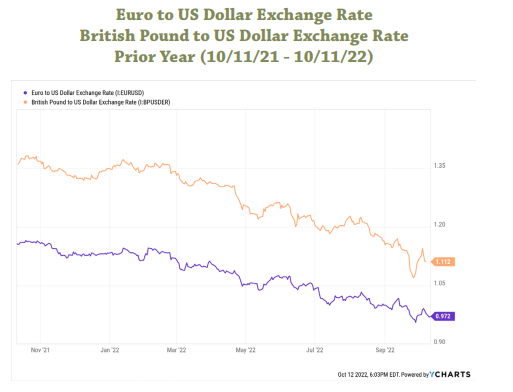

One type of international development that can affect overseas sales is foreign currency exchange rates. Those rates can have broad effects on the U.S. economy. Lately, the U.S. dollar has been strengthening versus two primary currencies in Europe, the Euro and the British Pound. As the dollar strengthens, the dollars a foreign currency buys drops.

A strong dollar can hurt the bottom line of U.S.-based corporations. Businesses often bill and collect in the local, foreign currency. As a result, if the dollar is strong, the business has a difficult choice to make. The business can either raise prices in the local currency, or accept fewer dollars in exchange for its sales. As an example, say Netflix sells a monthly subscription in France for €8.99, or €107.88 per year. Netflix decides to keep its prices the same. Last year, one euro was worth about $1.16, so that €107.88 meant $125.14 in revenue for Netflix. Today, the exchange rate for a euro is about 97¢. The same revenue in euros is worth only $104.64, a drop of 16%. This phenomenon puts additional pressure on U.S. companies that may be struggling to meet earnings projections.

Why is the Dollar Strengthening?

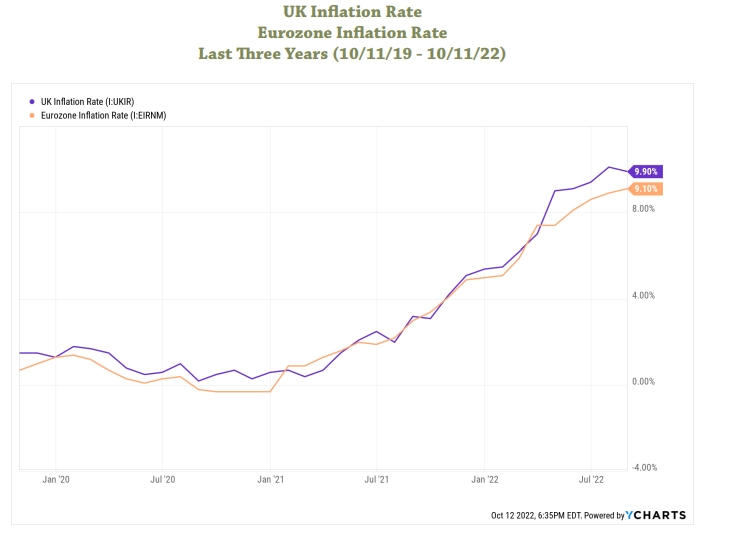

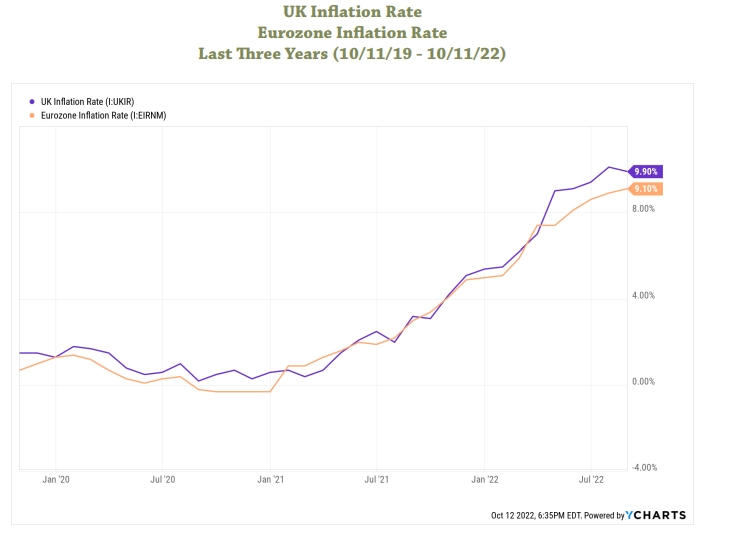

A strong dollar can be a function of several factors, including the “safe haven” attractiveness of the U.S. currency, international trade and financial transfers between countries. Relative interest rates also are a factor, i.e, how do the rates in the U.S. compare to another country? Investors will tend to buy the currency of the country with the higher interest rate. Interest rates usually track with inflation. Like in the United States, European countries have been facing higher inflation rates, starting in early 2021. Most recently, inflation has increased to over a 9% annual rate, from a level near or below zero.

.

In the United States, our Federal Reserve Board (“Fed”) has raised its interest rates relatively quickly in the last year. (See Who’s Afraid of the Big, Bad Fed? Federal Reserve Policies Explained) The European Central Bank has also raised rates to help combat inflation, as has the Bank of England. However, these rates remain below the roughly comparable discount rate the Fed has set in the U.S.

.

.

Bond yields generally, though not always, follow central bank rates. The attractiveness of the dollar, and so its strength and the effect on domestic corporate earnings, appears to have staying power.

It’s Not Just Exchange Rates

A strong dollar has broad economic effects. Other international events may have more specific, and sometimes dramatic, effects on particular industries or companies. The global rivalry between China and the U.S. has been building for several years. Escalating rhetoric and military maneuvers around Taiwan, trade disputes, intellectual property abuses, and the response to the pandemic have all ratcheted up national security concerns in the U.S. about the current Chinese government.

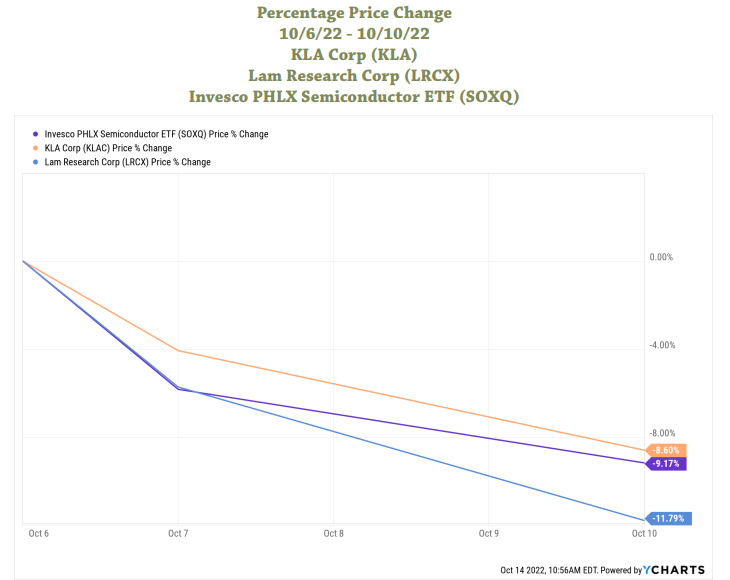

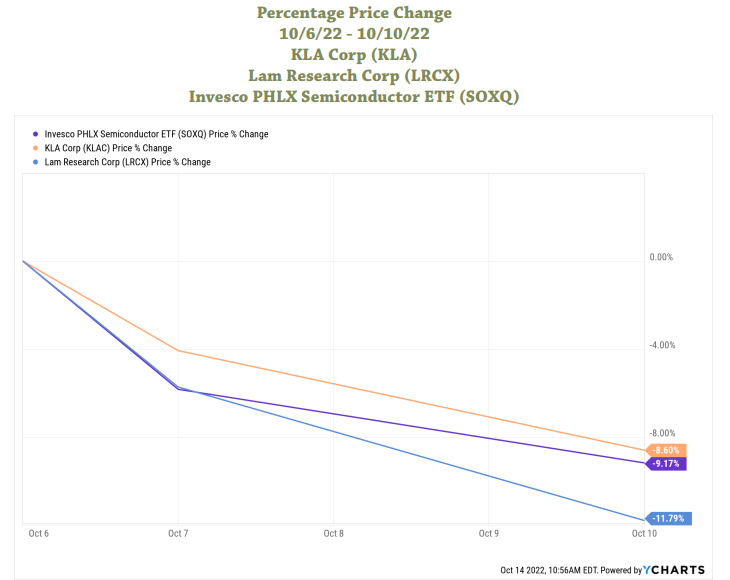

The semiconductor industry is now being rocked by the fallout from this concern. On October 7, the U.S. Bureau of Industry and Security released new export restrictions on advanced semiconductors and chip manufacturing equipment. One reason for the restrictions is to prevent U.S. technology from supporting Chinese military modernization. The effect of the restrictions is to both limit the export of chips and related production gear, but also to prevent U.S. citizens, permanent residents and companies from supporting Chinese chip-making efforts. These restrictions almost certainly contributed to the recent stock price declines of U.S. semiconductor industry companies. Over the period of October 6-10, KLA Corp (KLA) fell 8.6%, and Lam Research Corp. (LRCX) fell 11.8%. For the same period, the price of the Invesco PHLX Semiconductor ETF (SOXQ) fell 9.2%. Decisions by the Chinese government can have significant effects on U.S. companies.

This is but one example of how global affairs can affect U.S. investments. Another recent example is the action taken by the Bank of England to prop up pension funds in the United Kingdom, which negatively affected the market for U.S. collateralized loan obligations (CLOs). Most investors would also readily acknowledge the global nature of energy markets; witness the recent brouhaha over OPEC’s decision to cut oil production.

Conclusion

Whether your investments are in broad market indices or specific securities, paying attention to international developments and considering their implications is an important aspect of being a savvy investor. A strong financial advisor also tracks these developments, and can help you understand whether an adjustment to your portfolio might be beneficial.

Cindy Alvarez is a Senior Wealth Management Advisor and an Owner of Wambolt & Associates.

Bob Newkirk is a registered C.P.A, former investment banker, and prior Fellow in Law and Economics

at the University of Chicago.