When she wanted to pursue a career opportunity with a firm that offered a client-driven approach to wealth management, Janelle van Meel did what she does best – she researched the market and found a perfect match – Wambolt & Associates. After reading about the firm and learning that its advisors help clients design customized portfolios without the conflict of interest that comes with commission-based sales of specific financial products, Janelle was convinced that she would thrive on the Wambolt team.

“I wanted to get away from the broker-dealer model of financial advising which was focused on generating revenue for the firm,” said van Meel. “I did my research on Wambolt and loved its business model. Even though there was not a job posted, I submitted a resume and letter, met with the team, and was hired in the middle of the pandemic.”

Janelle brings more than 20 years of experience in the financial services industry having worked at national investment firms focusing on retirement planning, mutual funds, and portfolio management. As a Senior Wealth Management Advisor, she has become a go-to expert on identifying prudent investment strategies. Janelle has an extensive background in researching stocks and bonds that will yield healthy outcomes, and she takes pride in helping to manage client portfolios.

“We buy individual securities and bonds ourselves, unlike other firms that “farm out” portfolio management tasks to Special Manager Accounts (SMAs),” she said. “There is no cookie cutter approach here, and it gives clients the chance to be part of the decision-making process as we customize their investments.”

When engaging with clients, Janelle describes herself as “a realistic salesperson,” who “tells it like it is” – an approach that seems to resonate with clients. “I’ve seen a lot of economic scenarios in my tenure, and I think clients take comfort in knowing that I’ve done the research and I’m providing the best advice I can without sugarcoating the message.”

Janelle appreciates Wambolt’ s team approach to wealth management and credits Greg Wambolt for fostering a culture that puts clients first. “Like the coach of a football team, Greg has players in all positions so he can find the right person to make the right contribution at any given time,” she said. “As a result, clients get better service faster.”

Outside of the office, Janelle has a passion for race cars and can be spotted watching the action at the racetrack. She owns a first-generation U.S., black, Honda Civic Type R which is her ride in the summertime. Janelle’s other devotion is to her family and especially her more than 20 nieces and nephews.

Equity markets reacted to uncertainty in June as major indices saw an increase in volatility. Earnings continue to be a critical focal point as companies struggle to maintain elevated prices while consumer confidence has begun to erode.

The Federal Reserve has essentially signaled that it is more concerned about combating inflation than the negative consequences of continued rising rates on the economy.

A growing discussion among economists is whether the economy will experience a soft landing, meaning that the recent Fed rate increases will not evolve into a recession. Should a recession result, economists view such an environment as a hard landing, which is when job expansion and economic growth are hindered.

Once each year, the Federal Reserve conducts a test to assess how large banks are likely to perform under hypothetical economic conditions. The results of the most recent tests revealed that all the major banking institutions passed this year’s stress test. The tests assumed a hypothetical 10% unemployment rate and a 40% drop in commercial real estate prices.

Yields on short-term bonds rose in June as the Fed indicated that it intends to raise rates at least two more instances this year. Longer-term bond yields remained below shorter-term bond yields as confidence in future economic growth faltered.

Inflation expectations among consumers continue to dissipate worldwide, as inflation expectations throughout European and Pacific Rim countries head downward. The Federal Reserve Bank of Atlanta projects a decrease in GDP growth in the U.S. as domestic economic growth recedes.

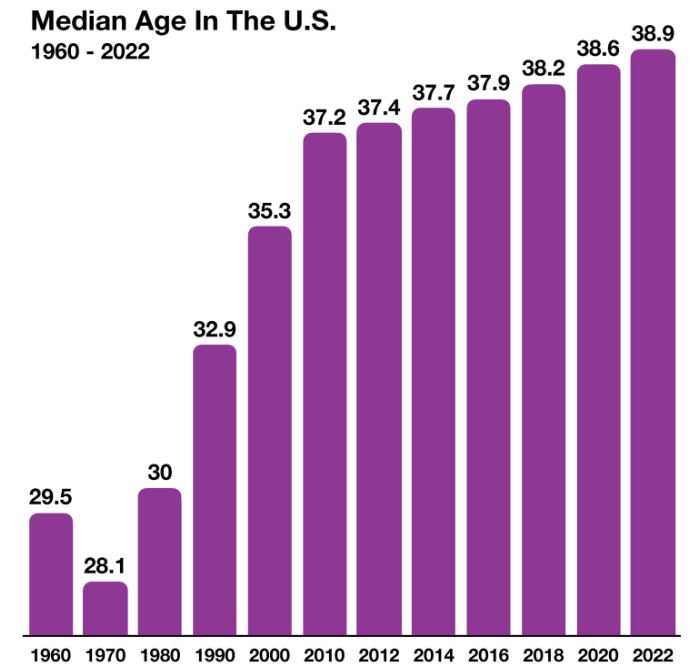

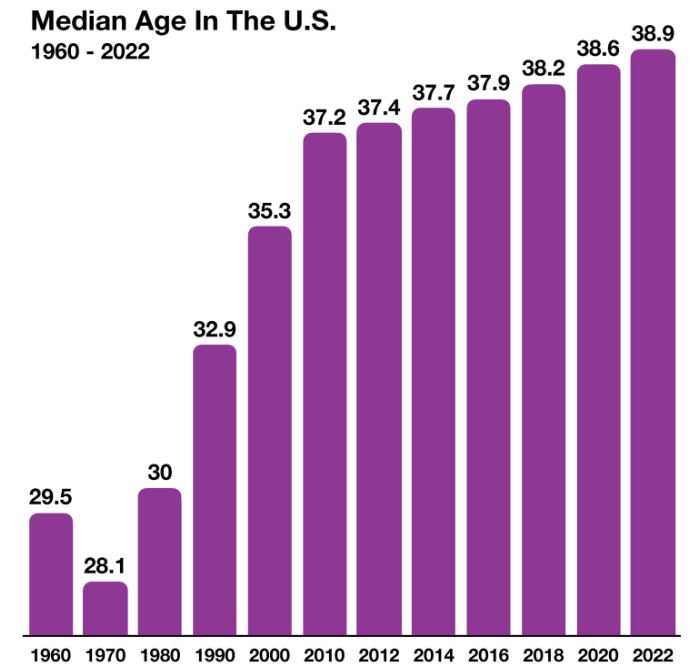

The average age in the U.S. increased to a historic high in 2022, reaching a median age of 38.9 years. The average age has steadily risen over the past decades, primarily due to declining birth rates coupled with longer life spans over the past 20 years.

Sources: Federal Reserve Bank of the United States, Federal Reserve Bank of Atlanta, U.S. Census Bureau

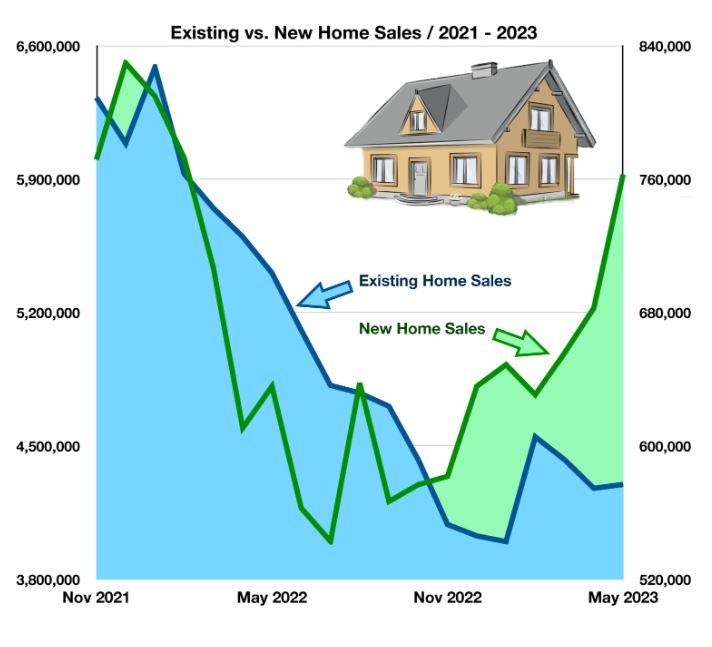

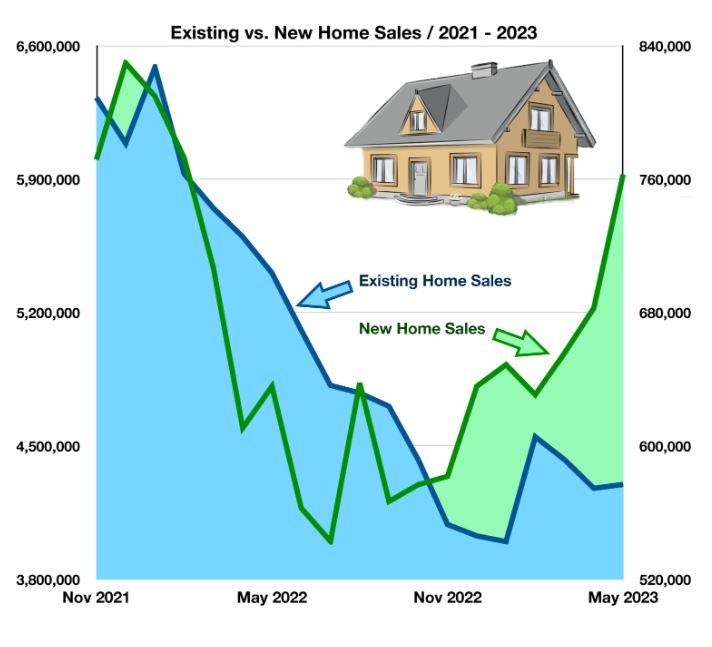

With hiking mortgage rates and historically high home prices, home sales have seen tumultuous recent months as the supply and demand for houses fluctuate. Recent data show that pending home sales are declining, as are existing home sales.

This trend reflects the lack of homeowners who wish to sell their homes, primarily due to not taking on a new mortgage at a higher rate. Many homeowners currently pay mortgages with rates between 2% and 4% due to low mortgage rates between 2019 and 2022. The 30-year fixed mortgage rate did not surpass 4% for 33 months during this period. Mortgage rates surpassed 7% in October 2022 and are currently at 6.8% for a 30-year fixed-conforming loan, scaring away many potential homebuyers who already own a property.

In March alone, pending home sales dropped 5.2%, their largest decrease since last September. These trends can be seen in existing home sales, which have dropped by over 2 million monthly sales since January 2022. With fewer existing homes up for sale, many potential homebuyers are instead looking into new homes. This can be seen in new home sales, which increased by 40% since June 2022, reaching a 14-month high. While sales across the board are still down from the heights of the pandemic, existing homes are seeing stagnant sales and new homes are rising in popularity.

Sources: Federal Reserve Bank of St. Louis, U.S. Census Bureau, National Association of Realtors, Bloomberg

The average age in the U.S. increased to a historic high in 2022, rising 0.2 years between 2021 and 2022 to reach a median of 38.9 years old. The average age has been steadily rising toward 40 years old, primarily due to declining birth rates coupled with people living longer over the past 20 years.

Americans’ median age reached 30 years old in 1980 and rose to 35 years old in 2000. In the past 22 years, the average age has risen by 3.6 years. America has been steadily aging over the past 50 years, with the median age rising 10.8 years since 1970.

In 2022, 17 states had a median age of above 40, while no state experienced a decrease from their 2021 median age. Maine had the highest median age at 44.8, while Utah was the youngest state at 31.9 years. Florida had two of the nation’s six oldest counties, including the oldest county with a median age of 68.1 years old.

Other key populations across Europe and Asia have seen similar trends and steady increases in age. The oldest median ages in nations across the world include Japan at 48.6, Monaco at 55.4, and Germany at 47.8 years. On the flip side, the youngest median ages include Niger at 14.8, Uganda at 15.7, and Angola at 15.9 years. The United States is the 61st oldest nation globally world, with a similar median age to China and Thailand.

Sources: U.S. Census Bureau, CIA World Factbook

Following two consecutive quarters of negative Gross Domestic Production (GDP) growth starting in 2022, the year ended with two consecutive quarters of positive growth. While 2023’s first quarter also displayed positive growth, marginal growth shows a cooling GDP. GDP grew by 1.1% in the first quarter of 2023, down from 2.6% in the fourth quarter of 2022.

Also trending downward is inflation, increasing 4.9 percent from April 2022 to April 2023, the smallest 12-month increase since April 2021. A large driver behind this decline is the mellowing of more volatile factors such as electricity, gasoline, vehicles, and food. Leading this decline is the price of gasoline, which fell 17.4% in March and 12.2% in April from the year prior.

However, core inflation remains resilient. Core inflation excludes more volatile factors which significantly contributed to inflation’s historic rise in 2022. While lower than its September 2022 high of 6.6%, core inflation has remained relatively constant in the past 5 months, measuring in April at 5.5%, just 0.1% lower than in March and the same as in February.

Sources: University of Michigan, Bureau of Economic Analysis, Federal Reserve Bank of the U.S.