With round-the-clock access to reports from financial prognosticators, podcasters, and Wall Street pundits, it takes a discerning eye to identify advantageous investments. Enter Chartered Financial Analyst Jared Hobson, newly hired by Wambolt & Associates as the firm’s Senior Portfolio Manager.

“In this day and age, the amount of information generated about the economy and securities is frankly too much,” said Jared. “You can get caught up in data points and at the end of the day there are only a handful of factors that truly matter. It’s important to know how to cut through the noise.”

Fortunately for clients, Jared’s insight, investment experience, and quest for credible information gives him an advantage when evaluating stock performance, economic trends, and individual company dynamics. Jared’s due diligence also strengthens his ability to make astute portfolio recommendations. His approach aligns well with Wambolt’s focus on an active investment strategy – investigating individual securities that could add value and healthy returns – as opposed to a more passive approach that only gives clients broad exposure to the market.

“I want to structure a diverse portfolio for clients by concentrating on companies that are expected to grow,” he said. “I love digging in and learning about how companies operate and determining if they will continue to be an advantageous investment over time.”

Learning about the culture of Wambolt & Associates and its focus on growth were two of the factors that drew Jared to his position with the firm. “I was looking for a boutique firm with a growth mindset,” he said. “Greg, Cindy, and the team are not only focused on growth, but also on educating and giving opportunities to younger team members. This brings a great level of energy and positivity that distinguishes Wambolt from other firms.”

Jared works closely with his wealth management advisor colleagues to help keep clients apprised of market developments and investment opportunities, and he provides guidance to the team’s traders and analysts. He is most impressed by the firm’s “best in class” service to clients and willingness “to go the extra mile.”

Jared’s professional background includes posts as an equity analyst, investment manager for institutional clients, and a portfolio manager for businesses and high-net-worth clients. Just prior to joining Wambolt & Associates, he managed all public equities and was on the investment committee for a firm that focused on the nonprofit sector. He is a graduate of the University of Wisconsin where he earned a Bachelor of Business Administration – Finance degree, and he earned a Master of Business Administration at Cornell University’s Johnson Graduate School of Management.

Jared enjoys the Colorado lifestyle that provides a healthy balance between work and recreational activities such as skiing and Jeep off-roading. He and his wife of nearly 20 years have two daughters, and two male dogs “for balance.” Jared volunteers as an organizer of a “Dad’s Basketball League,” at his daughter’s high school and he serves as board president of the Rocky Mountain Chapter of the Crohn’s & Colitis Foundation.

Growing up on a family farm in Wisconsin shaped Jared’s values and taught him the importance of a strong work ethic. These attributes along with a distinguished portfolio of experience make him an integral member of the Wambolt team.

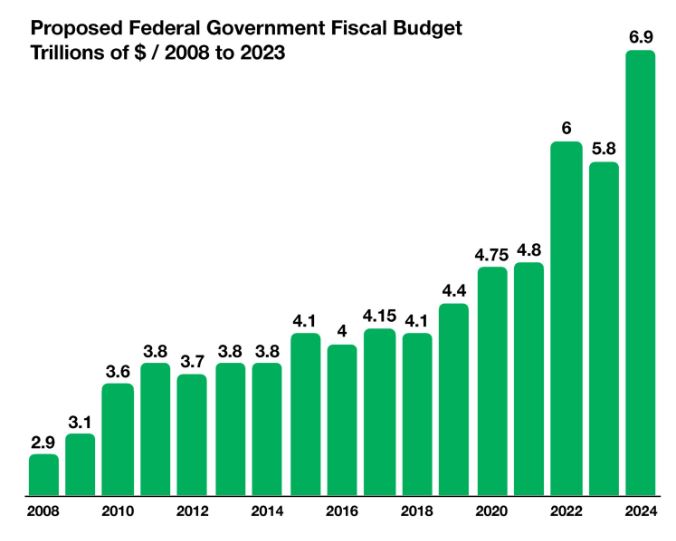

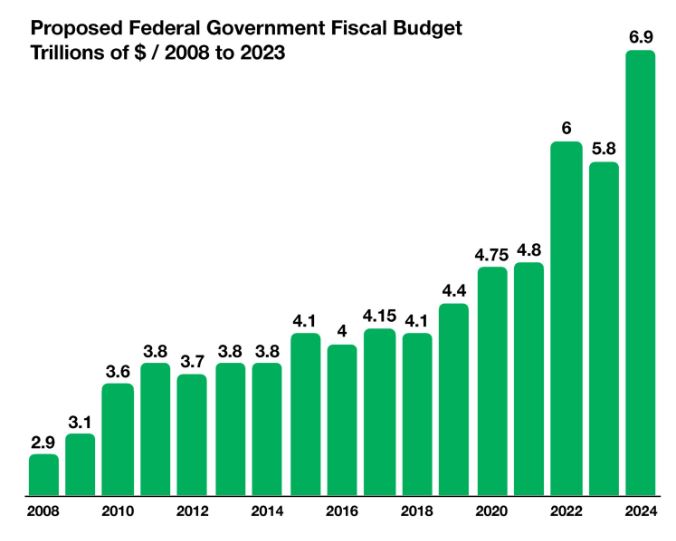

Congress is spending the bulk of September deliberating over the Federal Budget for fiscal year 2024 as a looming deadline on September 30 approaches. Should an agreement not be reached, then a government shutdown could occur. The $6.9 trillion proposed budget encompasses 438 agencies as well as 15 executive branches of the Federal Government.

The most recent Federal Government shutdown lasted 35 days, from December 22, 2018, until January 25, 2019, making it the longest government shutdown in history. Partial government shutdowns have also occurred in the past, shuttering selected federal agencies and programs.

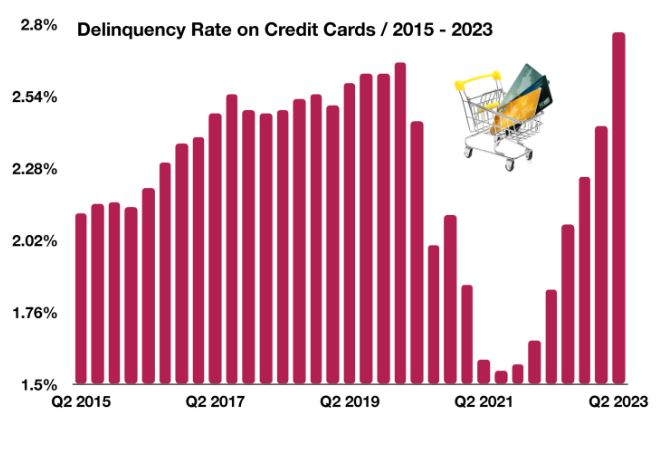

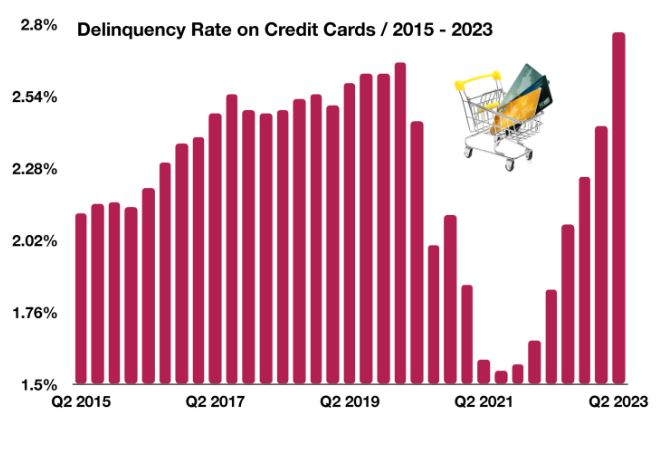

Federal Reserve data is revealing an erosion in consumer credit quality, with a particular increase in retail store credit card delinquencies. Credit card usage has accounted for roughly 20% of consumer spending growth over the past year.

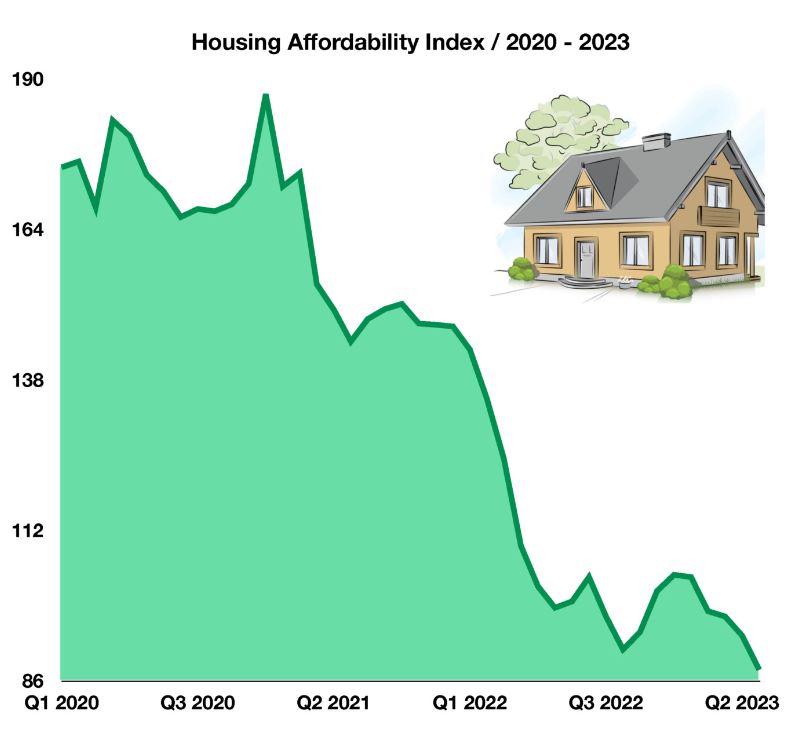

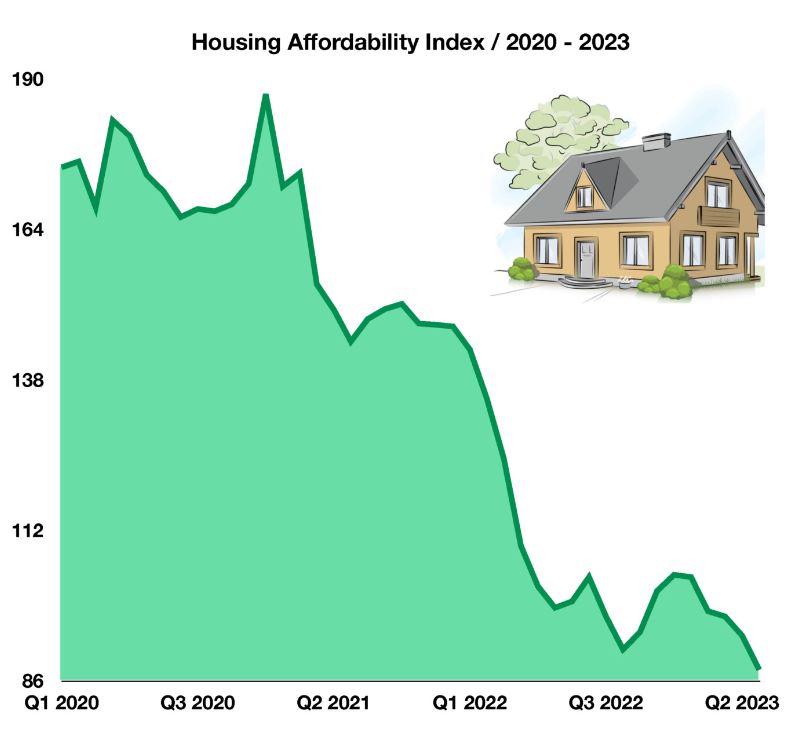

The rate on a 30-year fixed conforming mortgage fell to 7.18% in August, after reaching a 23-year high of 7.23%. The resilience of the housing market has become questionable by many analysts and economists, as elevated home prices continue to make purchases unaffordable for millions of Americans. The cost of apartment and residential rentals are starting to decrease in various areas of the country, as an additional inventory of rentals has been coming onto the market.

Equities retracted in August as contentious earnings estimates and lingering inflation risks held stocks back from advancing. Supply constraints that existed a year ago have essentially vanished, yet have led many companies to explore new sourcing locations and facilities. China, the world’s largest exporting country, is showing signs of a possible economic contraction, seen by analysts as a potential hindrance to global expansion.

Petroleum production cuts by OPEC and other oil-producing countries propelled oil and gasoline prices higher in August. Other factors affecting oil prices as fall approaches include seasonality, demand, and supply constraints. Oil ended August at $83.60 per barrel, yet still lower than the recent highs of over $120 per barrel in June 2022.

Sources: GovInfo, U.S. Congress, Federal Reserve Bank of St. Louis, International Monetary Fund, Bureau of Labor Statistics, Freddie Mac.

Measured by the Housing Affordability Index, the affordability of homes has been steadily eroding since early 2021. Factors affecting affordability include home prices, mortgage rates, and household incomes. With historic inflation outpacing income growth, home buyers in the U.S. have been unable to keep up with rising prices and mortgage rates.

When the Fed increases interest rates to combat inflation, mortgage rates are similarly affected. The average 30-year mortgage rate rose to a high of 7.24%, the highest since 2001. This is a significant difference to the lows reached in 2021 when the average 30-year mortgage fell to 2.65% mortgages, the lowest in U.S. history. This creates a less affordable environment for home buyers and harms potential buyers’ abilities to acquire property.

First-time buyers are forced to either buy a home knowing they may not be able to afford it or continue renting until affordability rises. For those who already own a home, remaining in their current house instead of buying a new one has been increasing in popularity as well.

Sources: National Association of Realtors, Federal Reserve Bank of St. Louis, Freddie Mac

Demand for products and services can vary from country to country as consumers have different choices on what they purchase. Supply constraints, transportation costs, and currency exchange rates can also affect prices among various countries and regions.

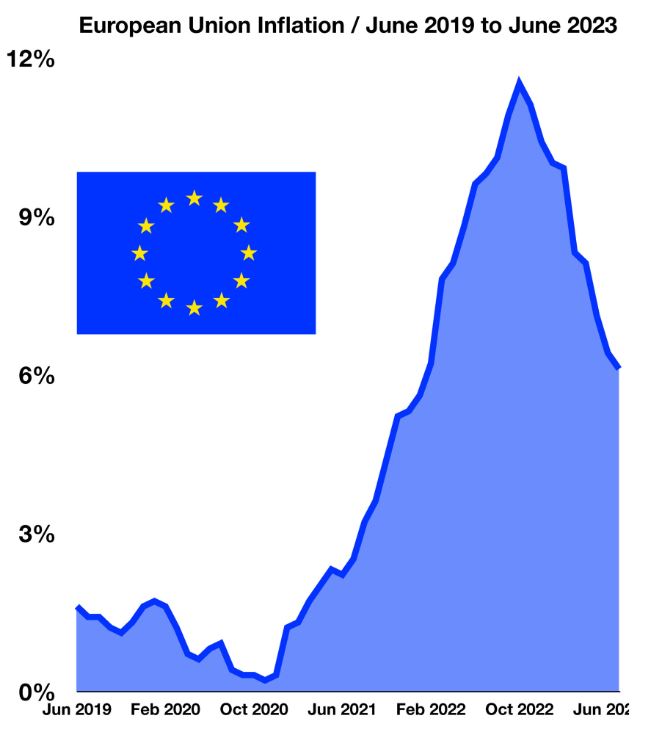

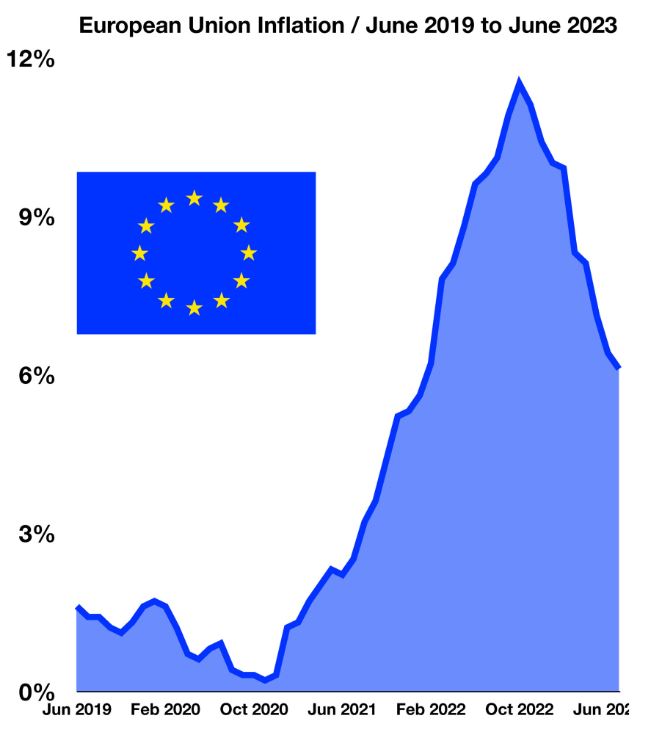

The European Union includes 27 member countries with over 448 million residents encompassing numerous cultures and languages. Similar to the United States, Europe has been experiencing an inflationary environment since 2022, propelled by supply constraints, high service costs, high energy prices, and post-pandemic demand. Inflation in the EU reached 11.5% in October 2022, surpassing the 7.7% rate in the U.S. for the same period. The most recent data available shows that the EU inflation rate had dropped to 6.1% in July 2023, down from 6.4% in June 2023.

Particular countries still have inflation rates above that of the EU, including Hungary at 19.9%, Poland at 11%, and Slovakia at 11.3%. Continued supply issues affecting energy products resulting from the war have resulted in persistent inflation for certain regions.

Sources: Eurostat, Organization for Economic Co-operation and Development

As inflation has taken center stage over the past year, consumers among all demographics have been affected in various ways. Consumers know inflation as the overall increase in the cost of goods and services, from shoes to gasoline. However, products that are essential for everyday life can be more costly for some than others, such as food, healthcare, and toilet paper. These products usually make up a larger portion of expenses for lower-income consumers and less for higher-income earners. In essence, inflation can be much more of a challenge for lower-income earners as less disposable income is left for more desirable items.

Fortunately, consumers can control what they buy when inflation sets in, such as buying hamburgers instead of steak. This is where consumer choice is critical as to where the economy is heading and what companies might benefit more than others.

As the economy slows and lower prices eventually settle in, a deflationary environment evolves pulling certain asset prices down. Historically, lower asset prices affect higher income earners with assets, rather than those with little or no assets. Deflation may affect the prices of assets such as homes, cars, stocks, and commodities.

Sources: U.S. Bureau of Labor Statistics, OneBlueWindow Editorial Staff

A survey released by the Federal Reserve Bank of Dallas found that overall credit and lending activity is deteriorating nationwide. The survey encompasses loan activity among larger banks, regional banks, finance companies, and various lenders.

The primary concern of this report centers around rising delinquency rates on credit cards, which indicates ongoing trends pertaining to consumer behavior. Consumers have become more accustomed to taking on debt, which declined during the pandemic. However, consumers are now financing an increasingly high level of purchases, which has also driven up rates of delinquency.

This is of particular interest to economists, who view this dynamic as a worrying sign for consumer spending. In 2023, credit card delinquency rates reached their highest level in over a decade, surpassing levels last seen in late 2012. When consumers increasingly take on debt which they are unable to pay back, it creates a delinquency cycle that poses financial duress for consumers. Delinquency rates fell substantially in 2021 as pandemic assistance funds helped alleviate the debt burden of millions of credit card holders, yet catapulted back up once those funds were exhausted.

Sources: Board of Governors of the Federal Reserve System, Federal Reserve Bank of St. Louis, Federal Reserve Bank of Dallas.

The Wambolt & Associates team had a ton of fun hosting our firm’s first Summer Jam at the Conifer Ranch. It was a wonderful opportunity to say “thank-you” to our amazing clients by creating a family-friendly experience that included live music from Nashville’s Kory Brunson Band, Brad’s Pit BBQ, Kona Ice, children’s games, and good-natured axe throwing. The beauty of the ranch’s sweeping views, the spirit of community, and plenty of sunshine made for a spectacular day in the mountains. Click here to view photos from the event.