Coaches of winning teams understand that success is not only defined by a strong track record, but also by sustaining a culture that promotes collaboration and innovation. To become a champion in any field, teams need a leader who embraces the evolution of the game and creates a roster ready for the challenge. As coach of Wambolt & Associates, Greg Wambolt is excited to come to work each day with his team to design new plays that will put points on the board for their clients.

Greg’s outstanding leadership earned him the recent honor of being named one of only seven finalists statewide for the Vistage Impact Award. The Impact Award recognizes the remarkable achievement of a business owner who has reached new heights in leadership development resulting in a lasting impact on their company, their Vistage chapter, and the community. Executive Coach and Vistage Group Chair Steve Sager nominated Greg for the award.

“Wealth Management is a dynamic industry. After serving his industry and clients for 35 years, Greg leads with as much passion as ever,” said Sager. “He and his entire team believe they can make for a better world by placing their clients at the center of their organization and developing high performing teams.”

Wambolt’s “Associate” program whereby senior advisors are paired with a right-hand colleague who supports them in all aspects of managing client relationships is an idea that Greg brought to the firm to promote collaboration and teamwork.

“I love the ‘Associate’ mentoring program,” said Sager. “Greg meets with the associates one on one each week to engage and empower them to become leaders in the firm. He’s very driven and extremely fair, a good listener who values learning.”

“Our approach to education was one of the reasons for our award nomination. We are a teaching RIA (Registered Investment Advisor),” said Wambolt. “I’m excited about our next generation of advisors and I’m passionate about their trajectory of growth. I get a lot of energy from the team and the professionalism that they bring.”

Education is a key pillar of Vistage, a 45,000-member, global enterprise dedicated to helping businesses succeed through learning, growing, and adapting to a changing industry climate. Vistage is the world’s largest CEO coaching and peer advisory organization for small and midsize business leaders. It boasts 400 CEO members in Colorado who work together to solve business problems and thereby achieve better results for their clients.

“We share challenges and opportunities and glean wisdom from one another which is helpful in a complicated world where the speed of change can be alarming,” said Wambolt. “In our group there’s a lot of candor, insight, and direction to help each other strategize and navigate through some challenges. I have a lot of admiration for my peers and the adversity they’ve overcome. They are a group of warriors.”

Local peer advisory groups are made up of 12-16 business leaders from non-competing industries with no agenda but to help each other succeed. “Over the last eight months, we’ve had speakers on a wide range of topics from artificial intelligence to emotional intelligence, health topics and technology,” said Wambolt. “The goal is to become the best CEO that you can be by giving you real life wisdom that you can use immediately to change the trajectory of your firm.”

Being open to innovation in a dynamic industry has been a constant motivation for Greg who’s always looking to stay ahead of the curve. “Greg made a conscious and intentional decision to move the company in a new direction,” said Sager. “Greg’s making change ahead of everyone in the industry. He has employed a group of leaders to realize the firm’s vision and has instilled a strong culture that stems from a personal value system.” A winning combination, indeed!

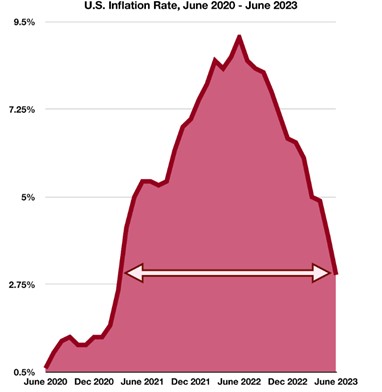

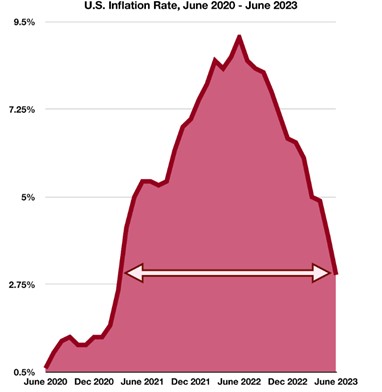

Inflation measured at 3% in June, a two-year low not seen since March 2021. Inflation peaked at a four-decade high of 9.1% in June 2022, more than three times the latest inflation figure. Other factors indirectly affecting inflation include a weakening U.S. dollar and the recent debt rate cut on U.S. government debt.

Reasons behind the causes of inflation vary, such as June 2022’s inflation was abnormally high due to Russia’s invasion of Ukraine. Headline inflation is more volatile to events of this sort because it considers the volatile factors of food and energy. However, the Fed prioritizes core inflation, which even though it has dropped from previous months is still at 4.8%. This remains much higher than the Fed’s 2% target rate, and many Fed officials are focused on ensuring that inflation does not return to higher levels.

A significant concern for the Fed is the strong labor market, where jobs are being added at a robust pace despite employers finding difficulties in recruiting qualified employees. June’s inflation data saw airline fares and used car prices decline. However, increases in housing costs composed 70% of June’s monthly rise in consumer prices.

Sources: Federal Reserve Bank of the United States, Bureau of Labor Statistics, Bloomberg

The rating on U.S. government debt was cut from AAA to AA+ by Fitch, one of the three major credit rating agencies. Standard & Poor’s, another primary rating agency, cut its rating on U.S. government debt to AA+ in 2011, which was the first ever downgrade below AAA. Fitch’s reasoning for the downgrade includes a growing federal debt burden, fiscal deterioration, political gridlock, and eroding governance.

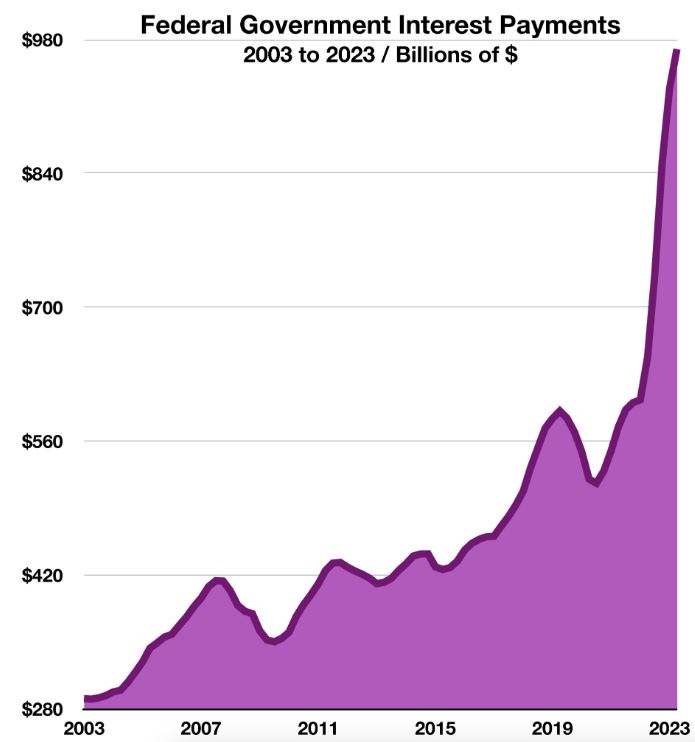

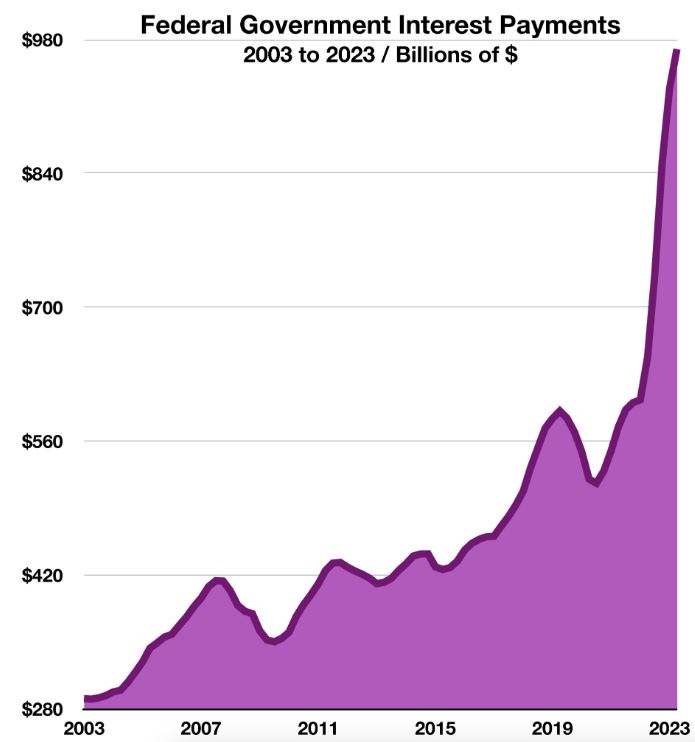

Lower credit ratings make it more costly for the U.S. government to borrow money and issue debt, indirectly raising bond yields on U.S. Treasuries. The recent rise in rates has increased the amount of interest that the government pays, increasing from roughly $520 billion quarterly in 2020 to over $900 billion quarterly in 2023.

U.S. banks are also coming under closer scrutiny by rating agencies as their exposure to commercial real estate loans continues to evolve as a concern. Rising rates on commercial real estate loans along with weaker demand for office and industrial space have intensified the risk of defaults and liquidity constraints.

Inflation and the U.S. dollar trended lower in July as evolving economic conditions altered the dynamics of consumer prices and sentiment. Inflation stood at 3 percent in July, the lowest in two years.

Small businesses have seen an increase in bankruptcy filings in 2023, an indicator to analysts of probable slowing economic conditions. According to the Small Business Administration, there are 33.2 million small businesses in America, which account for approximately 99% of all U.S. firms.

Atlanta Federal Reserve Bank President Raphael Bostic said that there is a risk of over-tightening of rates by the Fed. Financial markets are concerned that the Fed may have continued to raise rates to the point that it may have become counterproductive.

A weakening U.S. dollar is becoming an inflationary concern for consumers and the Fed. A weak dollar is inflationary becuse a weaker dollar makes imported goods more expensive for consumers, lowering their purchasing power. This is because the U.S. heavily relies on imported goods, such as clothing, autos, phones, computers, and televisions.

The month of July was Earth’s hottest on record, according to data from the Copernicus Climate Change Service, a European Union-funded scientific agency. July’s temperatures surpassed the global monthly average temperature record set in July 2019. Warmer temperatures increase the use of electricity and energy nationwide.

Sources: Bloomberg, Federal Reserve Bank of Atlanta, Fitch, Bureau of Labor Statistics, Standard & Poor’s, Copernicus Climate Change Service

Credit scores are a vital piece in determining whether an individual is qualified for a plethora of life-changing purchases, from mortgages to auto loans. However, even consumers with a pristine history of on-time payments and proper debt management can see that their credit scores decline in retirement.

Data shows that credit scores tend to peak for consumers in their 70s, while tending to decline going into one’s 80s and beyond. Retirees of these ages typically enter retirement with long credit histories, but when they close decades-old accounts they can inadvertently cause swift declines to their credit scores. Additionally, at older ages, many individuals have already finished paying off mortgage loans, whereas credit scores reward individuals for paying current loan payments on time.

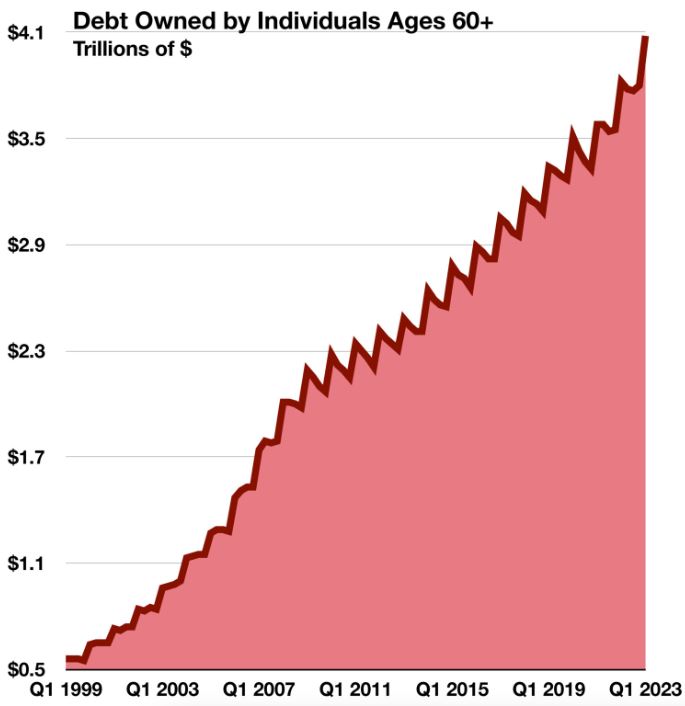

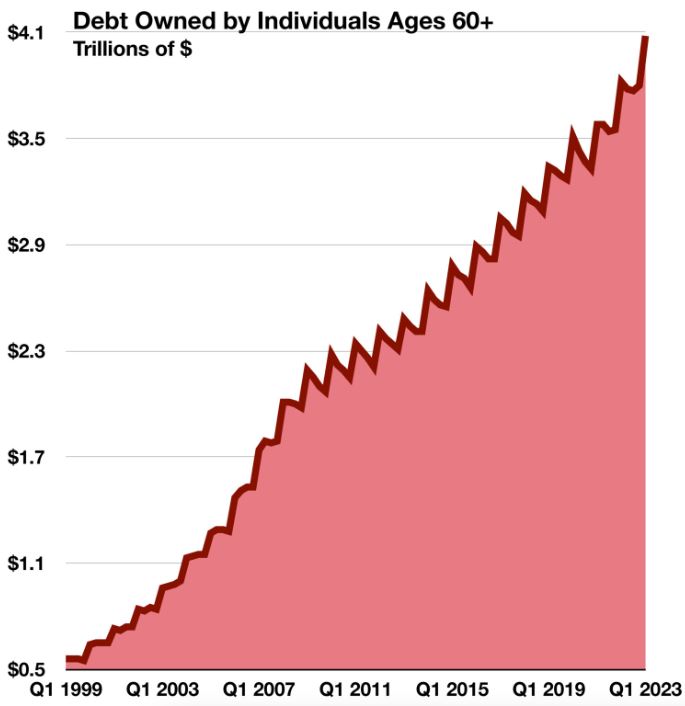

While a greater percentage of retirees have financial freedom and take out fewer loans, credit scores can be crucial in determining insurance premiums and in applications to assisted-living facilities. However, today’s seniors have accumulated debt faster than any other age group over the past 20 years, surpassing $4 trillion in senior debt in 2023.

Sources: New York Fed Consumer Credit Panel/Equifax

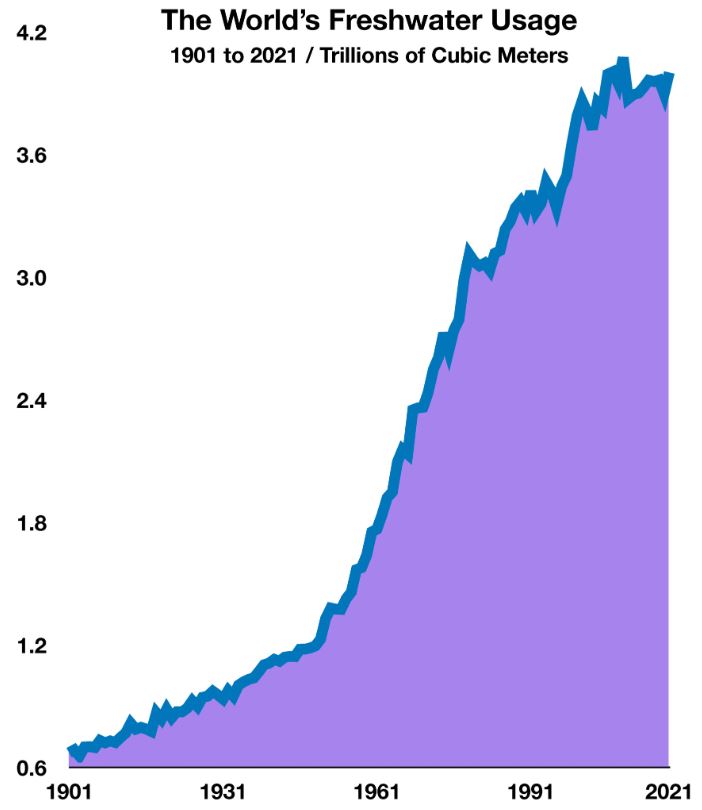

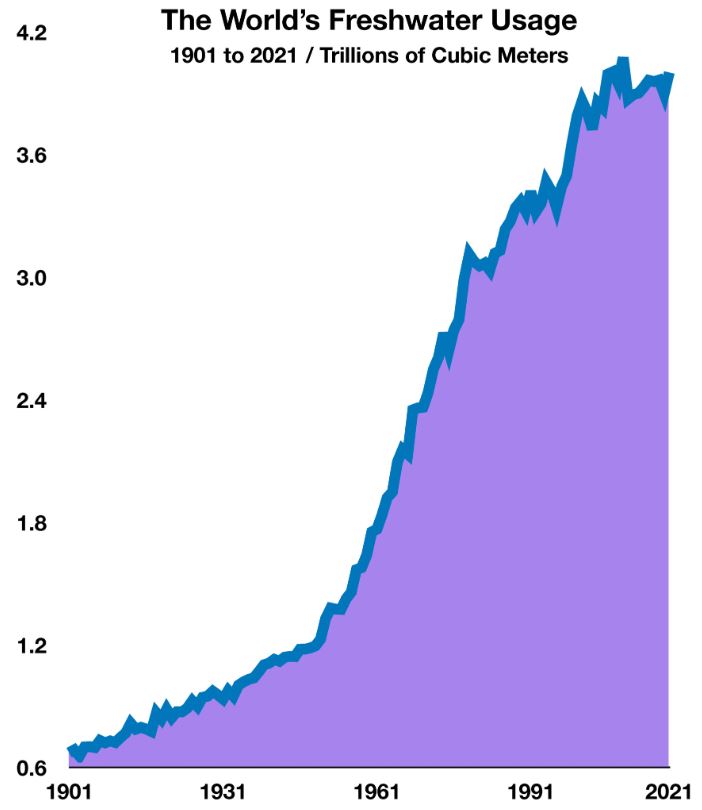

With the global population continuously rising, and water demand greatly outweighing supply, the global water supply has decreased dramatically. However, water treatment innovations may be a growing field that attempts to combat the world’s water crisis by making fresh water more accessible.

Over 4 billion people experience severe water scarcity for at least a month each year, and half of the global population will be living under constant water scarcity as early as 2025. By 2040, around 1 in every 4 children will suffer from severe water stress.

Global freshwater usage is at a historic high, with the annual usage sitting at around 3.88 trillion cubic meters as of 2017. This is a 65% increase in usage from 1970 and over a 400% increase in the past century. Across the world, droughts and water scarcity are shocking populations. The current American Western mega drought, in states from California to Montana between 2000-2022, is considered the driest period in over 1200 years. Further, four days in July were measured as the hottest day on Earth in over 100,000 years.

To combat this, water treatment has become an emerging field of innovation where purification, sanitation, and filtration are all in heightened demand. Purifying previously undrinkable water through methods, like desalination, membrane distillation, and photocatalytic purification has become extremely important. Since 1971, over 400 desalination plants have been opened in the U.S., with over 200 currently operational mostly in California, Texas, and Florida. Over 300 million people across the globe get their water from desalination as of 2019.

Sources: Yale University; UNICEF; A. Park Williams et al.; Our World in Data; Food and Agriculture Organization;

AQUASTAT, World Bank, University of Maine, U.S. National Centers for Environmental Prediction.