For decades, Americans saved. By 2017, the personal savings rate had dwindled to 2.4% in the United States. With long-term savings in decline, fewer Americans are set to maintain their current standard of living in retirement.

For the Tax Foundation, author Erica York explains one reason is that the tax code favors consumption over savings. Consumption is taxed once, at the point of purchase. Savings are taxed when earned, and any returns on those savings are taxed as well.

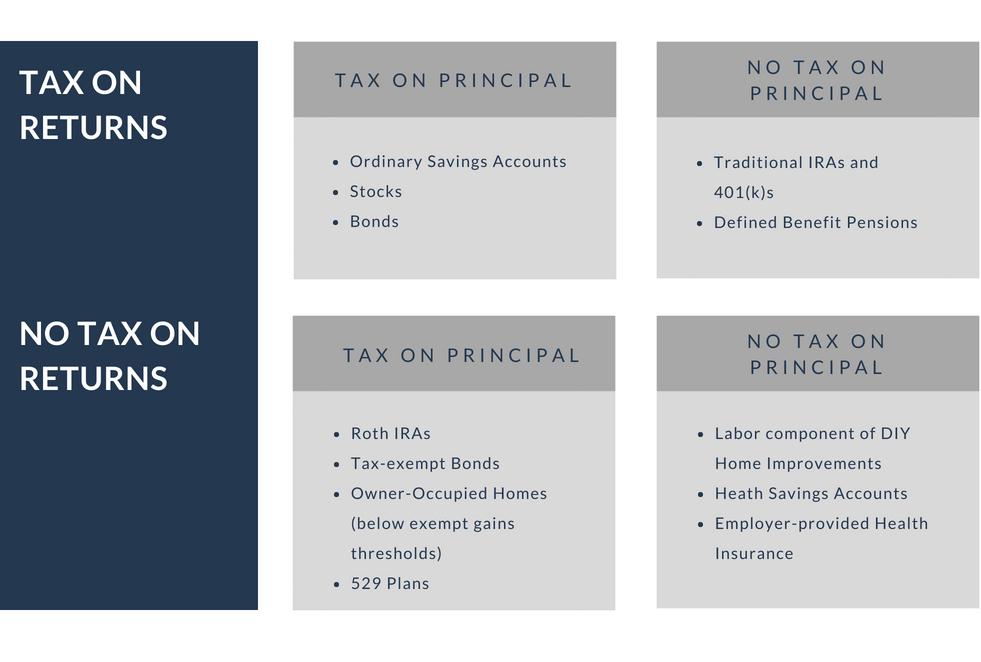

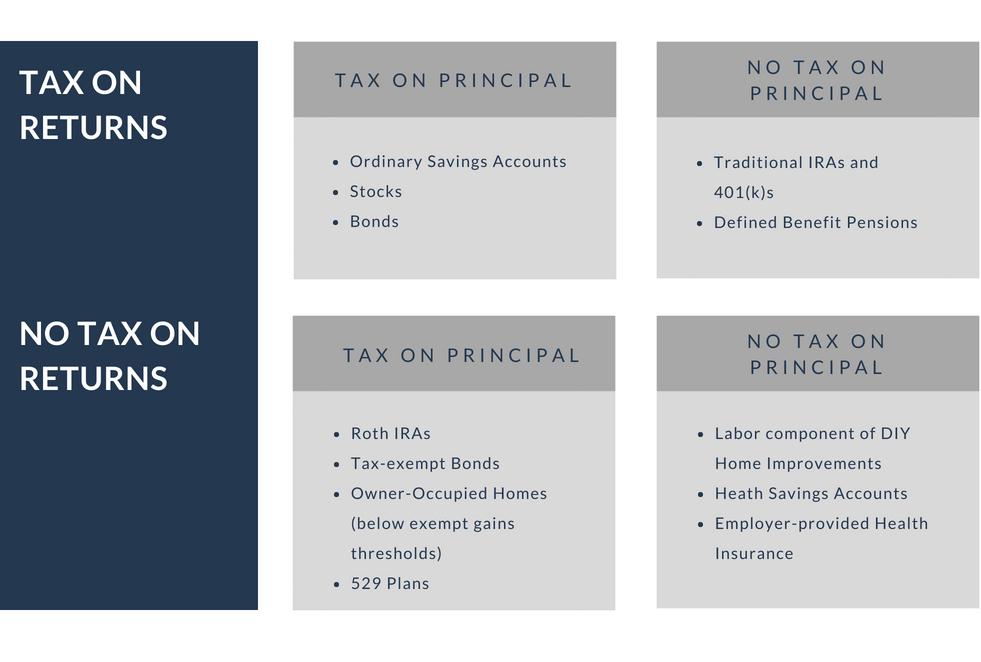

According to the Tax Foundation, there are four ways the tax code applies to savings and investment.

Plan Ahead

Retirement accounts can be used to neutralize some of the impact, within the limitations set by the tax code. The only way to minimize the tax hit to your retirement is to plan ahead. As nearly 80 million baby boomers age into retirement, a sound retirement strategy is critical to building wealth and preserving the quality of life post-retirement.

Get in front of the challenge by understanding the complex structure of retirement savings plans, and the rules and restrictions that apply to each. In general, we can place retirement vehicles into the following account structure based on their tax treatment.

- Taxable accounts – profits from investment sales and interest on savings are taxed

- Tax-deferred accounts and pensions – taxed as ordinary income

- ROTH IRAs – withdrawals are tax-free when accounts are open at least five years and you’re 59 ½ years old or older

- Annuities – if bought with pretax money, entire balance is taxable; if bought with after-tax funds, only earnings are taxed

- Social security – a portion may be taxed

Sit down with a Wambolt advisor to develop a customized plan that optimizes the tax treatment of your retirement dollars. We’ll help you define your financial needs in the next chapter of your life, proactively structure your income sources to meet those needs, and set the order of accounts you want to be tapping now and into the future to better provide for your financial future.

Read the full article by Erica York at The Tax Foundation.