Sector investments perform differently during the various phases of the economic cycle. Successfully rotating – or re-allocating – investments from one economic sector depends on a timely read of future macroeconomic conditions.

“Buy cheap and sell dear.” Benjamin Graham

You may have heard of the “reopening” or “recovery” play in the stock market earlier this year. This sounds exciting and new. However, it’s in large part a variation on the long-standing investment strategy of sector rotation.

In this article, we will describe the eleven sectors of the economy, and key aspects of the economic cycle. Then, we will see how movements through the economic cycle can affect investment opportunities across those economic sectors. “Sector rotation” in simple terms is moving, or “rotating,” investment capital from one sector to another to pursue those opportunities.

The 11 Economic Sectors

Every company in the United States is classified into one of 11 economic sectors, based on the Global Industry Classification Standard. Following is a brief description of each sector:

- Consumer Discretionary: Companies that provide goods or services that are more sensitive to economic cycles, including appliances, sporting goods, hotels and restaurants.

- Consumer Staples: Businesses that are less sensitive to economic cycles, including groceries, tobacco and household and personal items.

- Energy: Consists of companies that play a role in the exploration & production, refining & marketing, and storage & distribution of oil, coal and other consumable fuels.

- Materials: Providers of inputs used in the other economic sectors, including steel, chemicals, paper, and forest products.

- Industrials: This category includes a wide range of manufacturers of capital goods, including defense, aerospace, machinery, and many engineering and research services.

- Healthcare: This sector includes hospitals, physician services, medical supply companies, pharmaceuticals, and other related businesses.

- Financials: Companies involved in banking, investments, and insurance and related services.

- Information Technology: Companies that develop or distribute software, computer hardware, communications equipment, and similar items or services.

- Real Estate: This sector includes developers, property managers, and Real Estate Investment Trusts (REITs).

- Communication Services: This sector includes telecommunications, media and entertainment businesses.

- Utilities: Companies that provide water, natural and propane gas, and generate electricity, including from renewable sources.

Each of these sectors respond differently to changes in the macroeconomic environment. These macroeconomic changes are often described in the context of the economic cycle.

The Economic Cycle

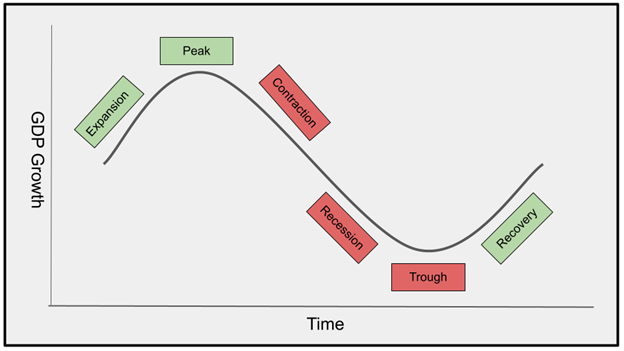

Historically, the overall, aggregate economy changes through cycles of increasing and decreasing production. The four stages of this economic cycle – sometimes known as the business cycle – can be described as follows:

- Expansion or Recovery

- Peak

- Recession or Contraction

- Trough

Economists use changes in Gross Domestic Product (GDP) to measure the economic cycle. The United States GDP is the total value of all finished goods and services the country has produced domestically during a specific time period.

If GDP is growing, the economy is expanding. If GDP hits a high point and then shrinks, this is a peak followed by a contraction. An extended contraction is a recession. When GDP hits a low, followed by an increase, this is the trough, followed by the recovery phase of an expansion. The graphic below illustrates this cycle.

The Stages of the Economic Cycle

Markets Anticipate the Economic Cycle

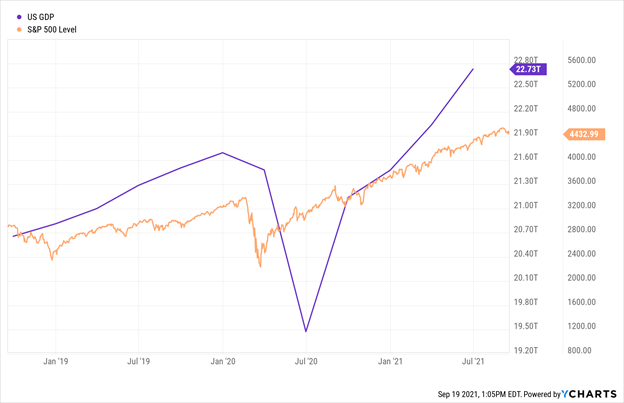

Prices in the stock market are based on expectations about future earnings. In general, if the economy is expanding, the business environment is more favorable and profits are more likely. Reported economic data is historical, i.e., backward-looking, and always lags the actual economic cycle.

As a result, market valuations will anticipate or move in advance of expected changes in the economic cycle. For example, during the COVID-19 pandemic, valuations in the stock market (as measured by the S&P500) moved up in advance of the actual beginning of the recovery (as measured by GDP).

U.S. Gross Domestic Product versus S&P 500: Last 3 Years

How Sectors Respond to the Economic Cycle

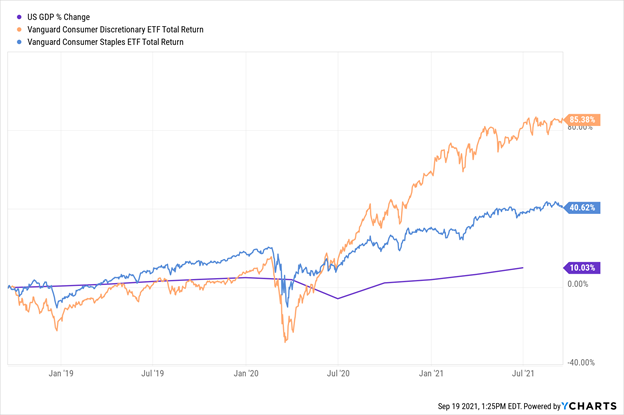

Within the overall market, the individual economic sectors react differently to changes in the economic cycle. For example, the demand for consumer discretionary items – a Louis Vuitton handbag – increases more sharply during an expansion, and falls more rapidly during a recession.

By contrast, the demand for consumer staples – a loaf of bread – does not change nearly as much as an economy moves through a cycle. The chart below illustrates this contrast.

U.S. Gross Domestic Product, Consumer Staples Sector (VDC) & Consumer Discretionary Sector (VCR): Last 3 Years

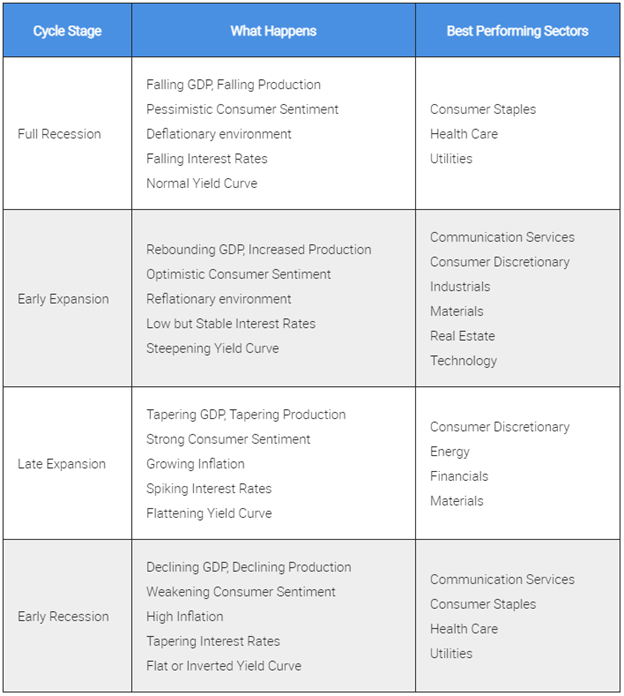

Investment in the 11 sectors perform differently during different phases of the economic cycle. The following chart describes these relationships, using GDP and other measures of macroeconomic performance.

Macroeconomic Cycle Stages, Economic Indicators

& Typical Sector Performance

Sector Rotation is Old Fashioned Re-Allocation

As with many investment allocation decisions, timing is key. Successfully rotating investments from one economic sector based on the economic cycle depends on carefully following macroeconomic conditions, anticipating shifts in return, and shifting sectors quickly. Returns will be affected by how soon, or whether, the anticipated economic cycle change in fact occurs.

In addition, within any sector, other factors may affect returns. During the pandemic-induced recession, certain technology companies did extraordinarily well, due to the emphasis on remote work. For these reasons, rotating just part of your portfolio in or out of a sector, rather than abandoning one and going “all-in” on another, is usually advisable.

“The only constant in life is change.” Heraclitus

Balancing Pursuit of Returns and Diversification

Re-allocating a portfolio based on economic sectors is one form of portfolio diversification. Our last article described another form of diversification, based on growth-oriented and value-oriented investment styles. (See Which Investment Style Works Best with Inflation, Growth or Value?)

Investors can use both approaches, and others, simultaneously. Each requires timely anticipation of likely future events, ranging from overall economic growth to individual company performance – and the ability to apply this foresight in a manner that improves the chance of strong investment returns.

Authored by Cindy Alvarez & Bob Newkirk

Cindy Alvarez – Senior Wealth Management Advisor with Wambolt & Associates.

Bob Newkirk is a registered C.P.A, former investment banker, and prior Fellow in Law and Economics at the University of Chicago.