“Far more money has been lost by investors trying to anticipate

corrections, than lost in the corrections themselves.” ~ Peter Lynch

Many investors are concerned that the current uncertainties affecting the markets will cause a “market correction” and losses in their portfolios. Should you be moving into, or staying in, cash?

The market uncertainties are real, and provide a rationale for this impulse. However, behavioral economics teaches us that our pain from losses is greater than our pleasure from gains. As a result, we move too strongly to the side of avoiding risk. While this may feel good, it is an irrational investment strategy. We maximize our long-term financial benefit by maintaining a well-balanced portfolio.

Current Uncertainties

If one likes to worry, in October of 2021 there are plenty of potential concerns about the market.

- Many economists see inflation elevated above 5% throughout 2021, and continuing above the Federal Reserve Bank’s 2% target well into 2022. We have explored previously how higher than expected inflation can reduce stock market valuations. (See What’s Up With Inflation? and Could Inflation Affect My Investments?)

- The Federal Reserve is contemplating reducing its “quantitative easing” program of monetary support for economic growth. Meanwhile, some in Washington are questioning the existing Fed leadership about both a lack of regulatory oversight and potential conflicts of interest.

- In Washington, D.C., Congress continues its debate about a nearly $1 trillion infrastructure bill, an up to $3.5 trillion budget package, and the persistently frustrating debt ceiling topic.

- Some measures of overall market valuation indicate that stocks in general may be overvalued.

- Finally, it is October, traditionally a volatile month in the markets. Remember the market crash of October 1929? Of October 1987? Whether the “October Effect” is real or psychological, investors may be emotionally unnerved.

Stronger Negative Response to Loss

Negative emotions can lead to an irrational response in managing investments, namely, to avoiding loss at the cost of foregoing future gains. Over the last 40 years, economists have developed a set of theories about human behavior that include the concept of “loss aversion.” As a general matter, we may be biologically hard-wired to focus more on losses than gains.

A few examples may help. One study showed that subjects often chose to receive $1,000 rather than a 50% chance of receiving $2,500 – though the rational choice would be the second alternative, which has an average expected outcome of $1,250, or 25% more. Another example is that people will prefer receiving $25, over receiving $50 and returning $25, even though the outcome is the same. In both instances, a simple explanation from behavioral economics is that the subjects generally preferred avoiding the feeling of loss (of $1,000 or $25, respectively).

In an investment context, this common human urge can lead investors to counterproductive behaviors. These behaviors are particularly common when the risk of loss seems higher than average, during times of increasing uncertainty, or during down or bear markets.

Irrational, loss-avoiding investment behaviors can include:

- Panic selling during down markets

- Excessive rotation into overly conservative investments, including money market funds and certificates of deposit, as bull markets continue for many years

- Holding onto cash or very conservative investments (again, money markets and certificates of deposit) rather than investing in suitable higher return, but higher risk, investments like stocks

The same aversion to loss avoidance can also in certain circumstances lead to irrationally risky behaviors – but that is a topic for another day.

The Cost to Returns of Avoiding Losses

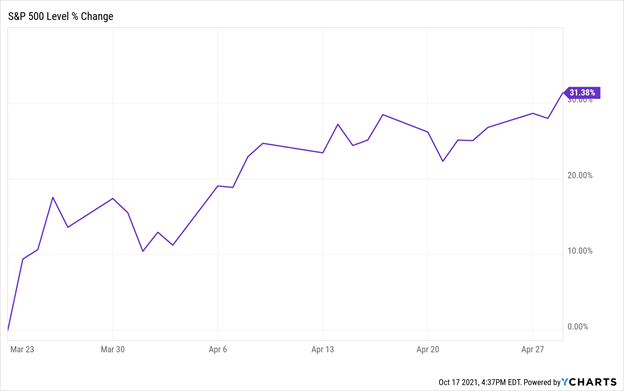

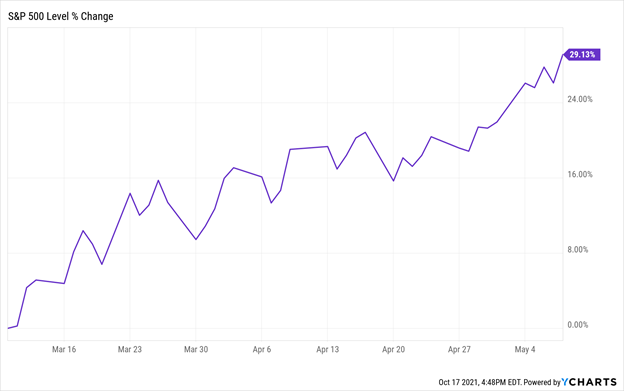

What is the cost of overly conservative investment behaviors in uncertain or down markets? In short, those behaviors can result in investors missing out on critical periods of extraordinarily high returns. Below are two charts demonstrating periods when the S&P 500 increased by roughly 30% in less than two months.

The first example is from the market recovery after the selloff following the onset of the COVID-19 pandemic in the United States.

S&P 500 % Change

Pandemic Rebound: March 23 – April 29, 2020

The second example is from the recovery after the market drop resulting from the Great Recession of 2008.

S&P 500 % Change

Great Recession Rebound: March 10 – May 8, 2009

To get the benefit of these periods of extraordinary return – which are important to an investor’s overall portfolio returns – an investor has to hold stocks! However, the loss avoiding, emotional and overly conservative investment behaviors listed earlier result in a portfolio with no or reduced stock holdings.

The combination of these human behaviors and the unpredictability of the precise timing of any rally make it unlikely that those investors would have miraculously reversed their conservative positions in time to benefit from these and similar market rallies.

How to Protect Yourself from Yourself

If human nature is to avoid pain, including losses in your portfolios, how can you achieve your financial goals based on strong investment returns?

- Commit to a diversified portfolio well-suited to your individual financial circumstances and goals.

- Consult with a financial advisor about your concerns when you become nervous about the economic or political environment, or a market downturn.

- Review your portfolio less frequently. A daily look may only increase anxiety and increase the likelihood of overly conservative investment decisions.

Instead, a disciplined, periodic review of your portfolio with a financial advisor can help you avoid emotional moves and stay the course with a properly diversified set of investments.

Authored by Cindy Alvarez & Bob Newkirk

Cindy Alvarez – Senior Wealth Management Advisor with Wambolt & Associates.

Bob Newkirk is a registered C.P.A, former investment banker, and prior Fellow in Law and Economics at the University of Chicago.