Money flowed into growth-oriented technology investments in 2020. 2021 investing has a different look. Here’s a way to think about a rotation from growth to value investing when inflation heats up.

In our last two articles, we described the recent worries about higher inflation, and the effects an increase in inflation has on stock and bond prices. (See What’s Up With Inflation? and Could Inflation Affect My Investments?) When inflation expectations are changing, one important type of asset allocation[1] to consider in a well-diversified portfolio is the mix of stocks reflecting two different investment “styles”: growth and value. In short, a value-based investment style may be more effective when inflation expectations are increasing.

Growth & Value Stocks

A growth stock is a share in a company that is expected to grow at a higher than average market rate. An economic sector that often contains growth stocks is the technology space. A recent example of such a company would be the videoconferencing business, Zoom (ticker symbol ZM).

A value stock is a share in a company with a stock price that appears relatively low – today – compared to its current and near-term expected financial performance. Industries that may contain value stocks are usually populated with long-standing, established business models, such as food or groceries. Some analysts have recently considered as value stocks the grocery chain, Kroger (ticker symbol KR) or the meat processor, Tyson Foods (ticker symbol TSN).

Not every investment professional will agree on how to classify a particular company. Because of differences in opinion about individual companies, the overall economic situation, and inflation expectations, a well-timed, properly-sized shift between these two investment styles may help increase overall returns in relation to risk.

The Inflation Effect on Growth & Value Stocks Differs

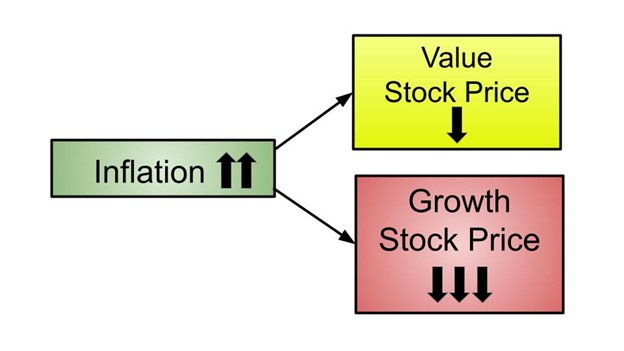

One driver of the choice between growth and value stocks is inflation expectations. Recently, concerns about inflation increasing for an extended period of time have risen. (What’s Up With Inflation? provides those details.) An expectation of higher future inflation will cause prices of stocks to decline, in general. Why? Very briefly, higher expected inflation drives a higher required rate of return on any investment, which drives down the current value of future corporate earnings. The farther into the future those earnings, the greater the negative effect of higher inflation on their current value. The more the current value of the future earnings is driven down, the lower the stock price. (Could Inflation Affect My Investments? provides a more detailed explanation.)

Because of this timing difference, not all stocks are affected equally. The current share price of growth stocks are largely driven by risk-laden expectations of high profits well into the future (e.g., Uber). The current share price of value stocks are driven by fairly predictable current or near-term performance (e.g., Costco). Since inflation has a stronger negative stock price effect the farther in the future that earnings are expected, increased inflation expectations drive growth stock prices down more than prices of value stocks.

Inflation Impact on Value and Growth Stock Prices

Market Shift to Value in 2021

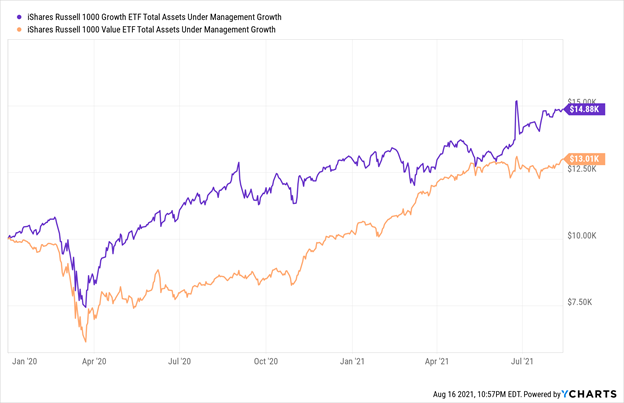

Investors in the stock market are well aware of this effect, and it is almost certainly one reason for the recent shift in overall investment from growth to value. The chart below illustrates the shift toward growth in 2020, and the rotation to value in 2021.

Change in Invested Assets: Growth versus Value

With the onset of the pandemic in Q1 of 2020, inflation expectations were low, and remote working and learning environments drove rapid adoption of technology from growth companies. Money flowed into growth investments accordingly. Then, in Q1 of 2021, the economy began to open more broadly, federal spending bills kicked in, and inflation fears emerged. This helped drive a shift into value-based investments.

Timing is Everything

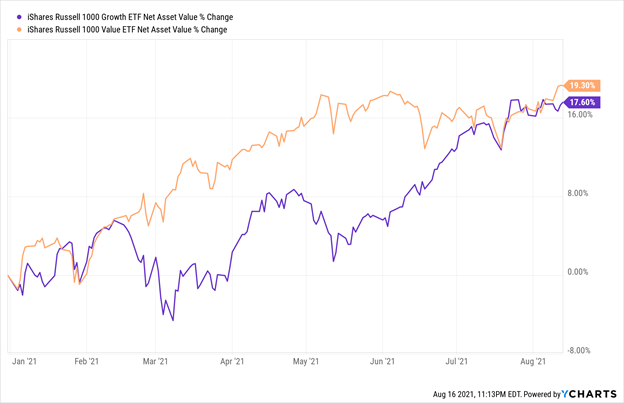

The challenge for any investor in deciding when to re-allocate investments is that timing is critical. A rotation from growth into value stocks in February of this year would pay off nicely. A rotation in May would have yielded disappointing results. See chart below.

Percent Change in ETF Net Asset Value: Growth versus Value

In addition to the timing risk, picking between growth and value stocks has other potential downsides. One reason that a value stock may have an attractively low price is because the company has poor prospects, due to its products, markets or management. In other words, the price is low because, quite simply, the company is bad. On the other hand, with respect to a growth stock, inflation fears may be overblown, in which case the high potential earnings will turn out to be more valuable today than commonly thought, possibly making the current stock price quite reasonable.

Pick Your Style Wisely

“The virtue of justice consists in moderation, as regulated by wisdom.” ~ Aristotle

As in matters of philosophy, moderation in shifting between growth and value stocks, and in making other shifts in asset allocation, is usually wise. Prudent, timely rebalancing toward value stocks in a time of increasing inflation may increase returns. However, this effort requires constant attention to macroeconomic factors, industry trends, specific corporate performance, and individual stock prices, combined with an understanding of how these factors determine when a shift is likely to pay off. A team of focused, experienced investment professionals can help.

Authored by Cindy Alvarez & Bob Newkirk

Cindy Alvarez – Senior Wealth Management Advisor with Wambolt & Associates.

Bob Newkirk is a registered C.P.A, former investment banker, and prior Fellow in Law and Economics at the University of Chicago.

[1] While the focus in this article is on growth and value stocks, the choice of investment style is only one of many forms of portfolio diversification. Other types of diversification include type of investment (stocks, bond, REITS, etc.), size of company (large, middle, or small capitalization), and geography (domestic, developed international, emerging markets). Diversification can also take the form of allocating investments across major economic sectors (e.g., utilities, energy).