New Year’s Resolutions. Everyone is talking about them. Have you made yours yet? According to data provided by Statista, 50% of all New Year’s resolutions each year are focused on finances. The majority of these resolutions focus on making or saving more money. What if you could do both by making one strategic change?

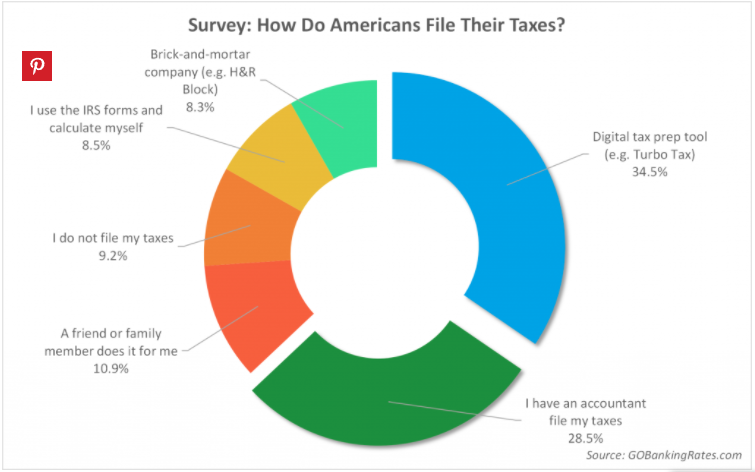

Take a moment to think about your personal finances. What makes the most significant impact to your bottom line every year? Chances are it is taxes. What’s ironic is that while taxes make a huge impact on finances, the trend over the last several years has been individuals searching for the cheapest and quickest option to handle their taxes. The chart below illustrates how taxpayers are currently handling their taxes, often making decisions based on saving them money.

Tax Solutions

If your tax situation is simple, many of the options illustrated in this chart might be a solution you. Unfortunately the driving force for the majority of individuals on how they handle their taxes is the cost. But is this truly the most important aspect? Take a moment to consider whether or not your current solution is reactive or proactive? Will a software product (Turbo Tax), a discount tax reporting service (like H&R Block or Jackson Hewitt) or working with a friend or family member, provide you with recommendations specific to your situation that could possibly reduce your tax liability? In most situations the answer to this question is NO. These ‘solutions’ are primarily reactive; they compile your financial information from the previous year and simply provide you with your tax liability or refund.

While the trend has been to move away from working with a CPA, we often encourage individuals to do the exact opposite and consider at least consulting with one. As individuals accumulate wealth and progress in their careers, their lives become much more complex and require a team of financial professionals to help them make wise and strategic decisions. Below is a list of common life events that warrant working with not only with a CPA, but a qualified Financial Team:

- You own or are starting a business

- You have or are buying rental property

- You are or have in the past been subject to Alternative Minimum Tax (AMT)

- You need to accelerate or postpone income

- You have restricted stock or stock options through your employer

- You inherited taxable and qualified assets

- You experience a life changing event (marriage, divorce, death)

- You are considering buying into a business or partnership

- This list could go on and on with any financial decisions that have tax ramifications…

Your Financial Team – Financial Planner, CPA, Attorney

A proactive CPA is just one of the key players on anyone’s financial team, the other common members are: Financial Planner, Investment Manager, Estate Planning Attorney and Insurance Professional. Your team needs to work for you and with you, providing ongoing proactive communication between each other and you! Your team needs to understand and truly appreciate your vision, values and goals.

We are proud to utilize a multi-advisor approach with our clients. We have a dynamic team in place, but also will work closely with professionals that our clients already have a relationship with. Take a moment to not only consider how you are addressing your taxes but also how you are addressing all of your financial needs and concerns. Working with a ‘Financial Team’ will allow you to know that your complex financial issues are being addressed and that you can focus on what is most important to you. Don’t make decisions simply on the bottom line expense – instead focus on the long-term benefits and the impact they will make for your specific situation. If you have questions or would like to speak about your financial team and specifically your tax solution we encourage you to contact us at your convenience.

Taxes – Are Your Solutions REACTIVE or PROACTIVE?