“The stock investor is neither right nor wrong because others agreed or disagreed; the investor is right because the facts and analysis are right.” ~ Benjamin Graham

Recent increases in wages, prices and inflation are receiving a lot of media coverage. What should you believe, and what is a lot of hot air? What should you consider for your investment portfolio going into the New Year? For 2022, sound analysis of current events and thoughtful application of established investing principles will help you navigate turbulent financial waters.

Fact or Fiction? For Your Next Holiday Party …

Wages rose because government benefits rose!

Part Fact, Part Fiction.

Average hourly earnings have indeed risen significantly over the past year. In November, the annual increase was 4.8%. In some industries, the increase has been even more dramatic. In leisure, the annual increase was 13.7%, and in transportation and warehousing, the increase was 8.9%. If these pay increases are due to increased productivity in the workforce, this is a welcomed development.

Some argue, however, that the increases are a function of excessive government transfer payments, rather than productivity. The benefits include federally-funded increases in unemployment benefits, dependent child payments and lump sum economic impact payments. The argument is that these benefits provide a disincentive to work. Desperate to find workers, employers have been forced to increase pay to compete with these benefits.

As with many economic matters, the truth is more complicated. Wage levels are a function of supply and demand for workers. Government transfer payments, including enhanced unemployment benefits, had an effect on the number of workers available. However, fear of COVID-19 illness, and the pandemic’s shutdown or limitation of childcare, also reduced the number of people willing to work. More specifically, enhanced employment benefits ended in September, and so whatever their effects on the labor market, those are in the economic rear window.

Prices for goods are increasing because corporate taxes are increasing!

Fiction.

Prices are certainly increasing. Producer prices rose by 8.6% in the year ended October 2021. Almost 60% of this increase was for goods, as opposed to services.

However, it is highly unlikely these increases are the result of increased corporate taxes. Federal corporate tax levels decreased due to the Tax Cuts and Jobs Act of 2017. The Biden Administration has proposed increased corporate taxes in its most recent versions of its Build Back Better Act, including a possible minimum 15% corporate income tax rate. However, at this time these increases are not in place.

Although it is possible that businesses have attempted to build in higher prices in anticipation of possible future corporate tax increases, price increases over the past year are far more likely the result of other inflationary pressures – as we describe next.

Inflation is high because government spending is high.

Part Fact, Part Fiction.

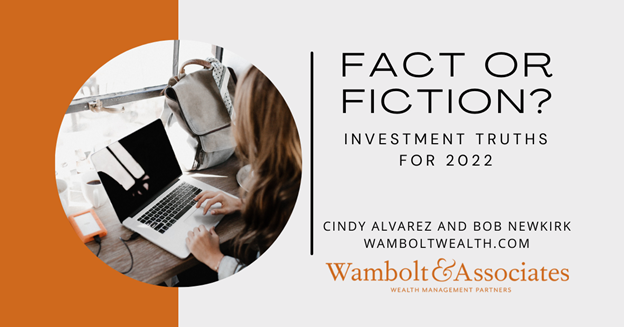

Inflation is currently at the highest level in the past 39 years. The Consumer Price Index rose by 6.8% over the last year in the latest, November report. Broadly speaking, there are two drivers of inflation. One is too much money chasing too few goods, or “demand pull” inflation. The other is increasing costs to produce goods, or “cost push” inflation.

Government spending has been high. Most of the increased federal spending has been in connection with the COVID-19 pandemic. The American Rescue Plan, passed in March 2021, included $1.9 trillion in spending. Another $920 billion of pandemic-related spending became law in December 2020. Earlier in 2020, the CARES Act authorized $2.2 trillion in spending. This surge of spending has almost certainly created “demand pull” inflation.

However, the pandemic has also restricted supply, causing shortages and higher prices for inputs, leading to “cost push” inflation. Examples include shortages of semiconductors, increases in oil prices and supply chain bottlenecks. The increased cost of inputs include the higher labor wages described earlier.

In sum, inflation is rising due to a combination of both government spending and other, largely pandemic-driven factors.

Two Truths for 2022

As with most matters of macroeconomics, there is no simple explanation for the recent increases in wages, prices and inflation. The data suggest multiple underlying causes, and the impact of each individual factor is difficult to specify. So what is an investor to do? Stick to the fundamental truths of investing. Here are two such truths to keep in mind as the calendar turns to 2022.

One truth is that an expectation of higher inflation will in general drive down current stock prices. This is because the present value of the future earnings of a company will decrease. Furthermore, this effect is greater for “growth” companies – with more of their earnings farther into the future – than for established, lower-growth businesses. (For a detailed explanation of why, see Which Investment Style Works Best with Inflation, Growth or Value?)

The following chart describes the movement of an index of smaller, growth stocks versus the S&P 500 since the beginning of November, around the time when concerns about longer-term inflation started increasing. The growth index decreased in value by nearly 8%, while the more staid S&P 500 increased by 2.3%.

Russell 2000 Growth

S&P 500

November 1 – December 10, 2021

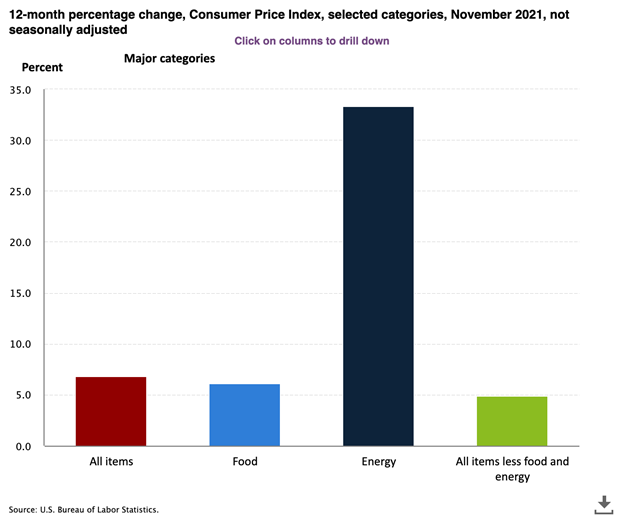

A second truth is that, even in an inflationary environment, stocks will continue to be more volatile than bonds. Yes, corporations can raise prices and make other adjustments to increase earnings in response to inflation. And yes, this pricing power can benefit investors by mitigating the effects of inflation on stock prices. However, stock prices are based on earnings extending far into the future, which means that changes in expected inflation can create large swings in current prices.

Increased inflation also drives bond prices down, since investors require higher yields. On the flip side, the overall “duration” of bonds – or the time over which an investor earns back the price paid – is shorter than for stocks. This means that the shifts in bond prices will, in general, be less dramatic in response to changes in inflation.

The chart below compares the movements of the overall stock and bond markets since the beginning of November. The stock market fluctuated over a range of 5.3%, while the bond market moved within a range of only 1.7%.

Total Bond Market

Total Stock Market

November 1 – December 10, 2021

New Year, Same Principles

As always, investing stocks requires a strong stomach and an ability to understand and avoid irrational responses to price movements. (See Pain vs. Gain: Taming Your Emotions in Uncertain Markets.) This mentality may be even more important in what is shaping up as a tumultuous investing environment in 2022. As you enter the new year, the investment team at Wambolt can help you understand how to separate investing fact from fiction, and apply proven investing principles to evaluating potential improvements to your portfolio.

Cindy Alvarez is a Senior Wealth Management Advisor with Wambolt & Associates. Bob Newkirk is a registered C.P.A, former investment banker, and prior Fellow in Law and Economics at the University of Chicago.